Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 2 by Beatrix Zheng and Version 3 by Beatrix Zheng.

Critical minerals are paramount to the successful deployment of low-carbon technologies in future transportation, defense, agriculture, healthcare, and infrastructure. They have a significant economic importance and their insecure supplies may hinder the development and industrial application of new technologies. An implementation of large quantities of minerals, in particular metals, into the clean energy transition will create new economic opportunities but also bring new challenges to energy security that could lead to unexpected dependencies on raw materials.

- critical minerals

- clean energy

- circular economy

- recycling

- zero-emission vehicles

1. Introduction

The inherent feature of a clean energy strategy is a substantially higher, often multiple times, demand for minerals than that seen in their conventional counterparts. It is frequently quoted from the International Energy Agency (IEA) that the typical electric car requires six times the mineral inputs of a conventional car and an onshore wind plant requires nine times more mineral resources than a gas-fired plant [1]. In another powerful comparison, the photovoltaic energy is portrayed as requiring up to 40 times more copper than the fossil-fuel combustion [2]. According to the IEA prediction, to reach the climate stabilization at a well below 2 °C global temperature rise by 2050, it would require six times more mineral inputs for clean energy technologies in 2040 than today. Thus, while previously the energy sector represented only a small portion of the total minerals demand, it is emerging as the major force in mineral markets and as a result of this transformation, minerals bring new challenges to the energy security. Although the metal-intensive transition to the net-zero economy will reduce dependencies on conventional hydrocarbon resources, it may lead to new and unanticipated interdependencies, including dependencies on raw materials [3].

2. Critical Minerals

A fundamental principle of sustainable economic development and smooth manufacturing cycle, particularly in well-established economies, is the uninterrupted supply chain with raw materials that is free from disturbances and bottlenecks, contributing to the pricing instability and market volatility, thus disrupting the production [4]. This condition is valid for a variety of technologies since raw materials play an important role in defense, the economy, renewable energy development and infrastructure. Growing reliance on raw materials has intensified the competition to identify new resources and establish stable, long-term supply chains. Although the increasing interest in minerals resources, caused by global competition, reached such enormous attention in recent years, the subject is not new and has been considered for decades [5].

The minerals awareness was initiated after World War I as a warranty of sustaining military power. The term “strategic and critical minerals” was used as early as 1938 when emphasizing that the industrial nations should be self-sufficient in regard to certain materials, portrayed as the “materials essential in the promotion of modern warfare” [6]. Similar terminology was used in the “Strategic and Critical Materials Stock Piling Act” of 1939 [7], when political conflicts dominated concerns about the security of raw materials supplies. At present, in the USA and Canada the term “critical minerals” is used while “critical raw materials” (CRM) is used by the European Union. The other terminology includes “strategic minerals” or “advantageous minerals” used by China.

2.1. Defining Minerals Criticality

Minerals criticality is a subjective concept that has been shaped throughout decades. A number of criticality studies were conducted in an effort to define a consensus of currently critical materials, essentially defining the modern criticality paradigm, which allows the interpretation of local perspectives in a global context [8]. The supplies of critical minerals are recognized to be a subject of great societal and environmental risk and uncertainty. It should be emphasized that the scarcity of a mineral in the Earth’s crust alone does not automatically make it critical. A classification of the mineral as critical is derived through its importance to key industry sectors or applications and the overall functioning of the country economy. The criticality criteria may vary across geographical regions, though the essence remains similar. According to [9], material criticality is defined as “economic and technical dependency on a certain material, as well as the probability of supply disruptions, for a defined stakeholder group within a certain time frame”. According to the IEA, the classification of materials as critical is based on [1]:

-

Their significant economic importance for key sectors in the regional economy and/or national security;

-

A high-supply risk due to the very high import dependence and high level of concentration of a set of critical raw materials in particular countries;

-

A lack of viable substitutes, due to the very unique and reliable properties of these materials for existing, as well as future applications.

Due to growing concerns about the supply security of raw materials, the concept termed as “raw material criticality” is at the center of the attention. Over the years since the concept of criticality was formalized, a number of evaluation methods of critical material risks were tested. The potential supply risks come from different sources: depletion due to mineral scarcity, geographical concentration of deposits, political stability of producing countries, geopolitical risks in global raw materials trade as well as low recycling rates.

2.2. Geopolitical Factors and National Lists

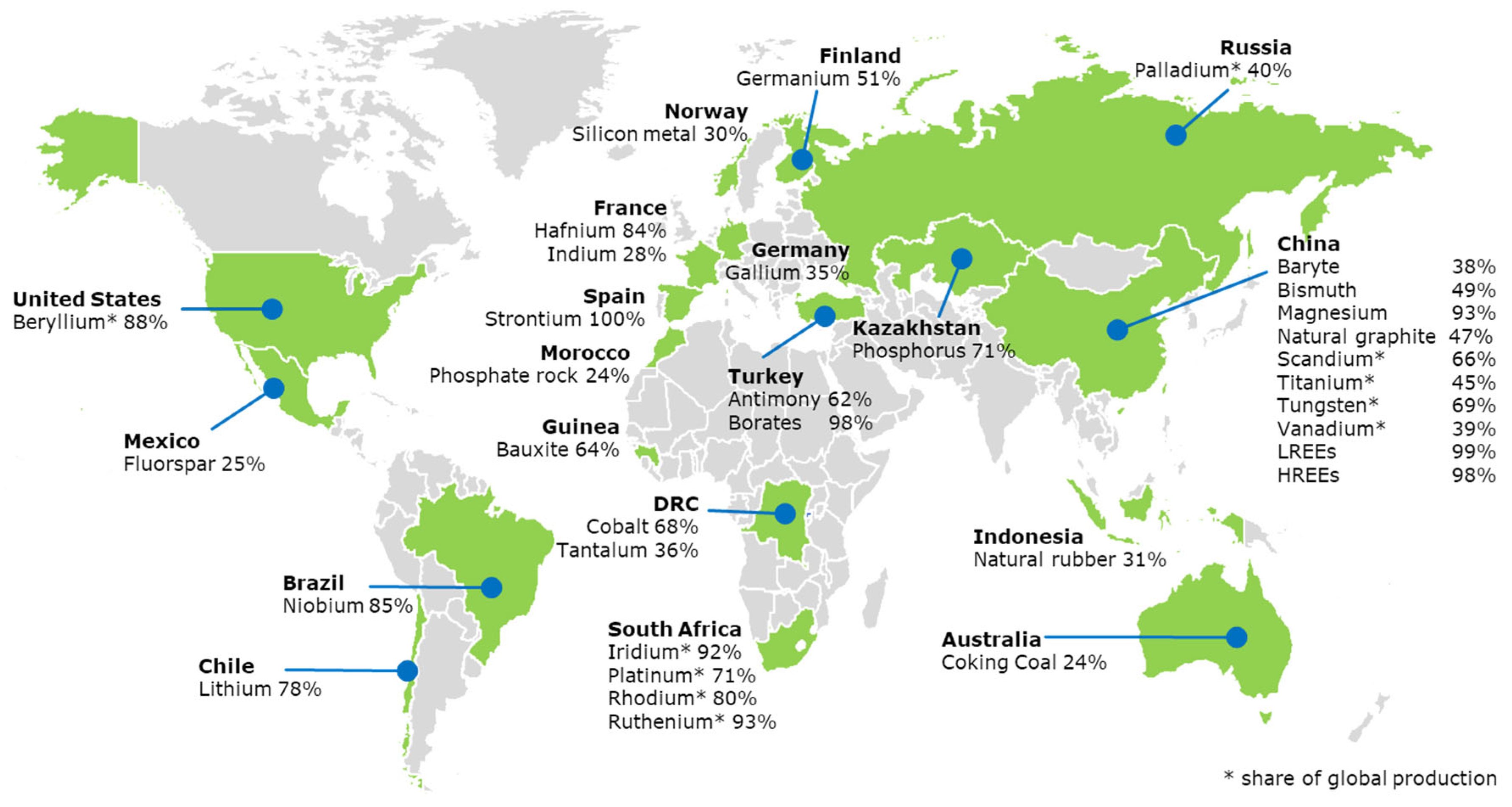

The geographical concentration of minerals creates a major strategic issue: a high global demand versus limited local supply. Since minerals originate from a limited number of mining sites and nations, they are highly vulnerable to supply restrictions [10]. In this respect, the supply risk is always a key factor to determine the criticality in countries that have a high dependency on imported minerals. As a result, there is a potential insecurity in how markets are responding and what roles governments should play to secure the supply chains. An example of critical minerals supply for the European Union is shown in Figure 1.

Figure 1. Global location of critical minerals with specified major supplier countries to the European Union, e.g., China provides 98% of rare earth elements (REE), Turkey provides 98% of borates and South Africa provides 71% of the platinum (2020) [11].

Minerals criticality is commonly evaluated from a regional and geopolitical perspective. In practice, the extraction, refining and use of various materials used in modern transportation vehicles involve complex interactions through associated mining and global trade companies, governments and industrial chains, flowing up to supply chains of then manufactured components for use by vehicle manufacturers. Therefore, the security of supply issues of some minerals is seen through a geographical and political perspective rather than reflecting the actual lack of supply of the mineral in question [12]. Based on resources available, countries can be divided into resource-poor and resource-rich. The resource-poor countries recognized critical mineral supply as a strategic issue, made investments designed to diversify supplies, develop substitutes, improve reuse and recycling and covered them by government policies. In practice, no country is fully self-sufficient in meeting all its mineral resource needs. There are countries, however, where some of the strategic minerals are not subject to a shortage of supply, at least until the near future. In this case, the exploration of critical materials is protected and secured as “strategic” to hold a domestic resource advantage. Having an abundance of critical minerals, a country will act as a powerhouse in supplying the global market. Thus, individual countries have their own lists of critical minerals. It is of interest that as seen in Table 1 and discussed below, the lists of critical minerals specified by individual countries are quite similar with common overlaps.

Table 1. Critical minerals lists, issued by selected countries along with minerals used in key components of zero-emission vehicles.

| Canada | USA | EU | China | Japan | Australia | Electric Vehicles | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2020 | 2016–2020 | 2018 | 2022 | Battery | Fuel Cells | Motor | ||

| 1 | Aluminum/bauxite | × | × | × | × | × | × | |||

| 2 | Antimony, Sb | × | × | × | × | × | × | |||

| 3 | Arsenic, As | × | ||||||||

| 4 | Barite, Barium | × | × | × | ||||||

| 5 | Beryllium, Be | × | × | × | × | |||||

| 6 | Bismuth, Bi | × | × | × | × | × | ||||

| 7 | Borate, Boron | × | × | × | × | |||||

| 8 | Cesium, Cs | × | × | × | ||||||

| 9 | Chromium, Cr | × | × | × | × | × | × | × | ||

| 10 | Coal, Carbon, C | × | × | × | ||||||

| 11 | Cobalt, Co | × | × | × | × | × | × | × | × | |

| 12 | Copper, Cu | × | × | × | × | × | ||||

| 13 | Fluorspar, fluorine | × | × | × | × | × | ||||

| 14 | Gallium, Ga | × | × | × | × | × | ||||

| 15 | Gas-natural | × | ||||||||

| 16 | Gas-shell | × | ||||||||

| 17 | Germanium, Ge | × | × | × | × | × | ||||

| 18 | Gold, Au | × | ||||||||

| 19 | Graphite | × | × | × | × | × | × | × | ||

| 20 | Hafnium, Hf | × | × | × | × | |||||

| 21 | Helium, He | × | × | |||||||

| 22 | Indium, In | × | × | × | × | × | ||||

| 23 | Iron, Fe | × | ||||||||

| 24 | Lithium, Li | × | × | × | × | × | × | × | × | |

| 25 | Magnesium, Mg | × | × | × | × | × | × | |||

| 26 | Manganese, Mn | × | × | × | × | × | × | |||

| 27 | Methane-coalbed | × | ||||||||

| 28 | Molybdenum, Mo | × | × | × | × | |||||

| 29 | Nickel, Ni | × | × | × | × | × | × | |||

| 30 | Niobium, Nb | × | × | × | × | × | ||||

| 31 | Oil | × | ||||||||

| 32 | PGM | × | × (1) | × | × | × | × | |||

| 33 | Phosphate | × | ||||||||

| 34 | Phosphorus, P | × | × | |||||||

| 35 | Potash | × | × | |||||||

| 36 | REE-all | × | × (1) | × (2) | × | × | × | × | × | |

| 37 | Rhenium, Re | × | × | |||||||

| 38 | Rubber nat. | × | ||||||||

| 39 | Rubidium, Rb | × | × | |||||||

| 40 | Scandium, Sc | × | × | × | × | |||||

| 41 | Selenium, Se | × | ||||||||

| 42 | Silicon metal, Si | × | × | × | × | × | × | |||

| 43 | Silver, Ag | × | ||||||||

| 44 | Strontium, Sr | × | × | × | ||||||

| 45 | Tantalum, Ta | × | × | × | × | × | ||||

| 46 | Tellurium, Te | × | × | × | × | |||||

| 47 | Thallium, Tl | × | ||||||||

| 48 | Tin, Sn | × | × | × | ||||||

| 49 | Titanium, Ti | × | × | × | × | × | × | × | ||

| 50 | Tungsten, W | × | × | × | × | × | × | |||

| 51 | Uranium, U | × | × | |||||||

| 52 | Vanadium, V | × | × | × | × | × | × | |||

| 53 | Zinc, Zn | × | × | |||||||

| 54 | Zirconium, Zr | × | × | × | × | × | ||||

| Total | 31 | 50 | 30 | 24 | 34 | 26 | ||||

PGM—platinum group metals (6 elements): iridium, osmium, palladium, platinum, rhodium and ruthenium; REE—rare earth elements (17 elements): lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd), promethium (Pm), samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu), scandium (Sc) and yttrium (Y). (1) Listed individually as above, (2) Split into light REE and heavy REE.

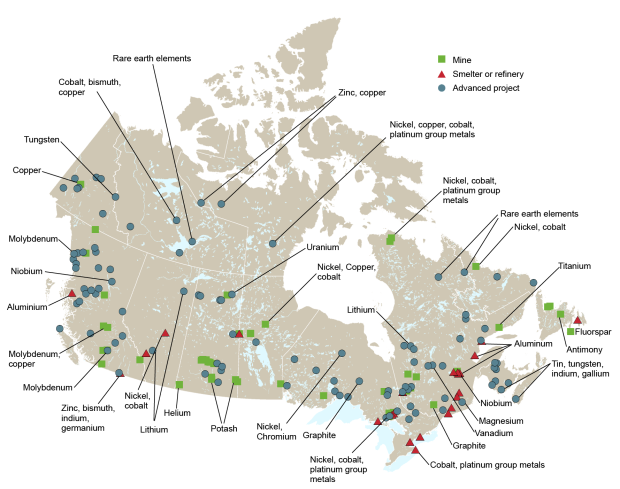

Canada: The Critical Minerals List, unveiled on 11 March 2021 and containing 31 minerals, all of which are available in Canada (Figure 2), is considered integral to the Canadian economy [13]. The list highlights focus areas for future Canadian mining policies and investments and builds on the existing Canadian Minerals and Metals Plan. It was developed by Natural Resources Canada, using a criteria-based approach and in consultation with provinces, territories as well as exploration, mining and manufacturing industries and associations.

Figure 2. Canada as a leading global producer of many critical minerals, including nickel, potash, aluminum, and uranium, having the potential to supply more to both domestic and international markets [14].

USA: The Energy Act of 2020 defines a “critical mineral” as a nonfuel mineral or mineral material essential to the economic or national security of the U.S. and which has a supply chain vulnerable to disruption. The 2022 list of critical minerals, released by The United States Geological Survey after an extensive multiagency assessment contains 50 mineral commodities critical to the U.S. economy and national security [15]. The list contains 15 more commodities compared to the nation’s first list of critical minerals created in 2018, mainly due to splitting the rare earth elements and platinum group elements into individual entries rather than including them as “mineral groups.” In addition, the 2022 list adds nickel and zinc while removing helium, potash, rhenium and strontium.

European Union: The European Commission carried out a criticality assessment at EU level on a wide range of nonenergy and nonagricultural raw materials based on a methodology for establishing the list of critical raw materials [16]. The EU list that contained 14 materials in 2011, was revised to 20 materials in 2014, then to 27 in 2017 and to 30 in 2020. The 2020 criticality assessment was carried out for 66 candidate materials (63 individual materials and 3 material groups: heavy rare earth elements, light rare earth elements, platinum group metals), amounting to 83 materials in total [11]. In addition, the European Commission included borate, coking coal, natural rubber, phosphate rock, phosphorus and silicon metal into the 2020 Critical Raw Materials list.

China: The difference in criticality assessments in China is caused by the consideration of the factor of supply risk. China’s dominance in the critical minerals space suggests that some raw materials are considered “strategic” for reasons unrelated to supply risk because China has them in abundance. China’s first official policy and catalogue of “strategic minerals” was established in 2016 by the Ministry of Land and Resources [17]. The metallic minerals list was refined in 2018 to include four subgroups: (1) the noble metals of Li, Be, Rb, Cs, Nb, Ta, Zr, Hf and W; (2) the rare earth metals of La, Ce, Pr, Nd, Sm, Eu, Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu, Sc and Y; (3) the companion metals of Ga, Ge, Se, Cd, In, Te, Re and Tl; and (4) the precious metals of PGMs, Cr and Co [18][19].

Japan: As a resource-scarce country, Japan has widely been considered as particularly vulnerable to resource restriction since it is heavily reliant on imported raw materials and needs a strategy to secure its supply chain [20]. Japan’s 2018 list comprises 34 critical minerals, 4 up from 30 in 2012. Since 2016, the Ministry of Economy, Trade and Industry (METI) has started criticality assessments of metals used in the Japanese industry by applying the approaches employed in the US and the EU, preparing guidelines to support criticality assessments conducted by companies. The supply-chain management of critical minerals at the corporate level is seen increasingly important, and the guidelines are designed to promote more companies to evaluate the raw materials criticality.

Australia: The focus of the Critical Minerals Association of Australia has historically been on minerals that are deemed critical by other sovereign entities, and on Australia’s potential to contribute to the global supply chain of these critical minerals. Given that Australia is known to export much greater quantities of minerals than it imports, this focus on an increased export potential seems obvious. The 2022 updated strategy builds on the first Critical Minerals Strategy, published in 2019 [21]. It has a vision to put Australia at the center of meeting the growing demand for critical minerals. Australia’s current list of 26 critical minerals highlights its priority critical minerals and is based on global technology needs, particularly around electrification, advanced manufacturing and defense.

2.3. Assessment of Critical Materials Supply Risks

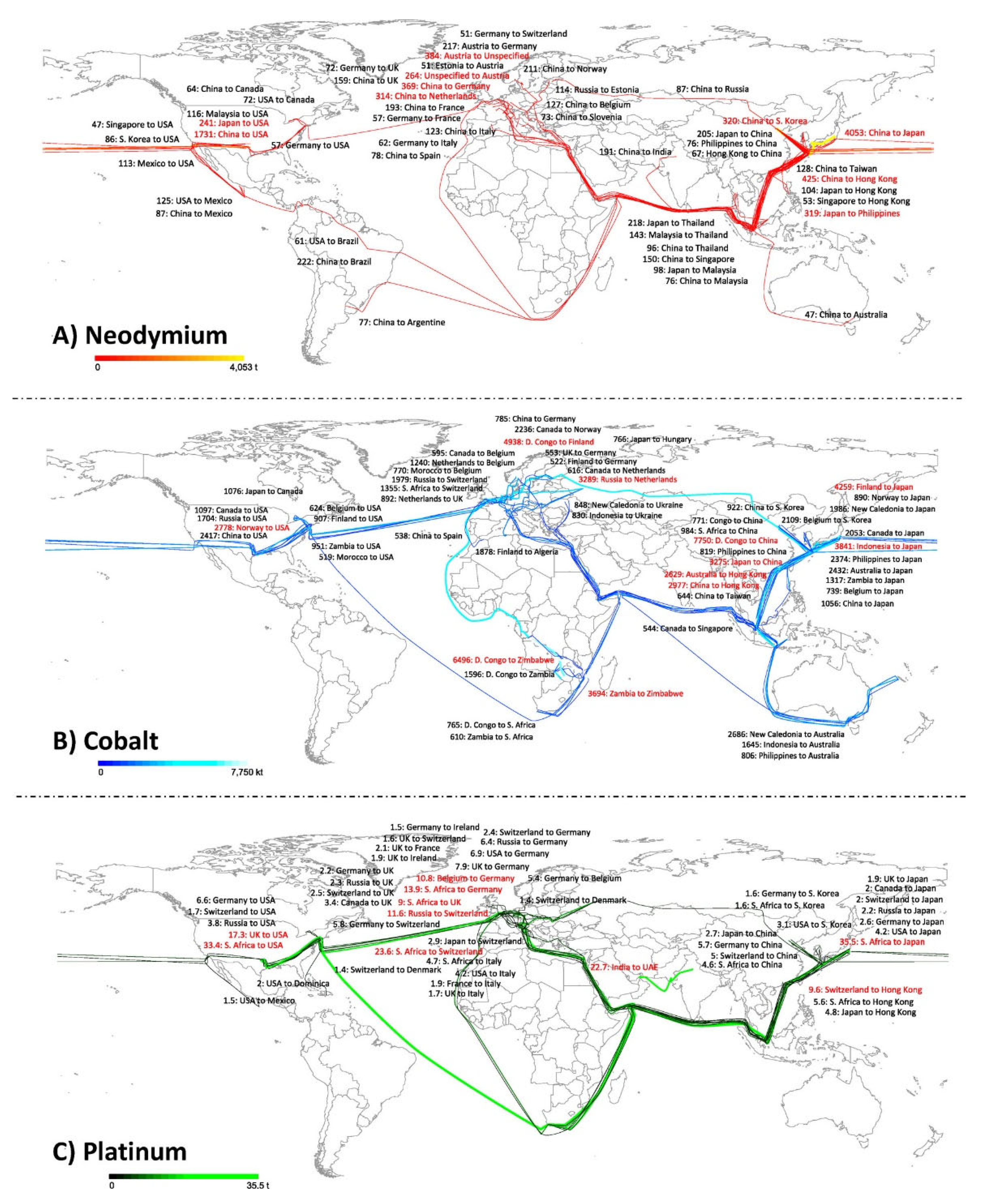

Due to considerable concern about supply risks, it is important to determine how individual countries in the global economy are involved in the flows of critical minerals and determine their strategic responsibilities. An example in Figure 3 shows the complexity of international trade and global flows of 18.6 kt of neodymium, 154 kt of cobalt and 402 t of platinum. It also identifies the main commodities with the top 50 bilateral trade links associated with these metals [22].

Figure 3. Global flow of critical minerals neodymium (A), cobalt (B) and platinum (C) through international trade in 2005. For the top 10 flows, the countries and volumes of mineral involved (tonne for neodymium and platinum, 103 × tonne for cobalt are indicated in red [22].

A capability of quantifying the implications of prospective manufacturing trends for raw material resources is valuable in order to control the efficient resource management. At present, there are specific methodologies used for assessment of the product-level supply risk [23] with examples described in [24]. Although the general issues of supply security are commonly accepted, there is no unified approach to their assessment methods with some authors pointing to a lack of adherence to risk theory [25]. The mineral supply and related risks are highly dynamic and constantly evolving due to geopolitics and trade tensions, metallurgical and extractive advances and technological innovations. Therefore, mineral markets are continuously analyzed, and new methods are developed to determine the supply chain resilience and to predict potential issues well in advance.

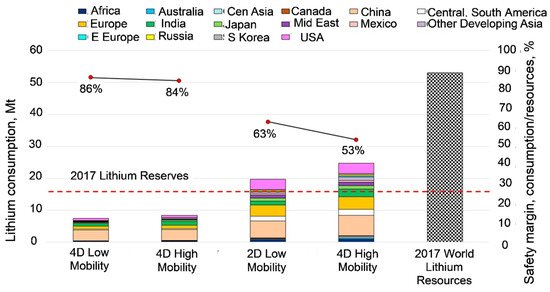

As an example, the TIMES Integrated Assessment Model (TIAM-IFPEN version) was used to assess the lithium supply for the production of EVs [26]. Through incorporating an endogenous representation of the lithium supply chain, its dynamic criticality was determined based on several paths of climate and/or mobility scenarios. The modeling outcome in Figure 4 shows that the cumulated demand over the period 2005–2050 reaches up to 53% of the current resources in the 2 °C scenario with a high mobility of 75% of the worldwide fleet. Although there was an absence of geological criticality, certain forms of metal supply vulnerability were revealed. The issue is that world lithium resources are estimated at 22 Mt [27] so for both scenarios, the predicted Li consumption would exceed it.

Figure 4. Modeling the critical minerals consumption in clean transportation using the TIMES Integrated Assessment Model (TIAM-IFPEN version): comparing the cumulated lithium consumption (2005–2050) and the world resources in 2017. As modeled, only 2 °C scenarios will reach cumulative lithium consumption higher than the 2017 level of lithium reserves (red dotted line); for a 4 °C scenario, the cumulated lithium demand is far under the 2017 reserves [26].

References

- International Energy Agency (IEA). The Role of Critical Minerals in Clean Energy Transitions, World Energy Outlook Special Report; International Energy Agency (IEA): Paris, France, March 2022; Available online: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary (accessed on 20 April 2022).

- Hertwich, E.G.; Gibon, T.; Bouman, E.A.; Arvesen, A.; Suh, S.; Heath, G.A.; Bergesen, J.D.; Ramirez, A.; Vega, M.I.; Shi, L. Integrated life-cycle assessment of electricity-supply scenarios confirms global environmental benefit of low-carbon technologies. Proc. Natl Acad. Sci. USA 2015, 112, 6277–6282.

- Hache, E. Do renewable energies improve energy security in the long run? Int. Econ. 2018, 156, 127–135.

- Gloser, S.; Espinosa, L.; Gandenberger, C.; Faulstich, M. Raw material criticality in the context of classical risk assessment. Resour. Policy 2015, 44, 35–46.

- Dill, H. The “chessboard” classification scheme of mineral deposits: Mineralogy and geology from aluminum to zirconium. Earth Sci. Rev. 2010, 100, 1–420.

- Roush, G. Strategic Mineral Supplies, 15. Strategic and Critical Minerals. Mil. Eng. 1938, 30, 370–374.

- Office of the Legislative Council. Strategic and Critical Materials Stock Piling Act; Office of the Legislative Council: Washington, DC, USA, 1939; Chapter 190; Section 1.

- Hayes, S.; McCullough, E. Critical minerals: A review of elemental trends in comprehensive criticality studies. Resour. Policy 2018, 59, 192–199.

- Schrijvers, D. A review of methods and data to determine raw material criticality. Resour. Conserv. Recycl. 2020, 155, 104617.

- Eggert, R. Minerals go critical. Nat. Chem. 2011, 3, 688–691.

- European Commission. Critical Raw Materials Resilience: Charting a Path towards Greater Security and Sustainability; Communication from the European Parliament; the Council; the European Economic and Social Committee; the Committee of the Regions; European Commission: Brussels, Belgium, 2020.

- McNulty, B.; Jowitt, S. Barriers to and uncertainties in understanding and quantifying global critical mineral and element supply. iScience 2021, 24, 102809.

- Government of Canada. Critical Minerals. Available online: https://www.nrcan.gc.ca/our-natural-resources/minerals-mining/critical-minerals/23414 (accessed on 18 May 2022).

- What is a Critical Mineral? Government of Northwest Territories. Retrieved 2022-8-26.What is a Critical Mineral? . Government of Northwest Territories. Retrieved 2022-8-26

- Burton, J. US Geological Survey releases—2022 list of critical minerals. USGS, 22 February 2022. Available online: https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals(accessed on 16 May 2022).

- European Commission, Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs. Methodology for Establishing the EU List of Critical Raw Materials: Guidelines. 2017. Available online: https://op.europa.eu/en/publication-detail/-/publication/2d43b7e2-66ac-11e7-b2f2-01aa75ed71a1 (accessed on 28 June 2022).

- Andersson, P. Chinese assessments of “critical” and “strategic” raw materials: Concepts, categories, policies, and implications. Extr. Ind. Soc. 2020, 7, 127–137.

- Zhai, M.; Wu, F.; Hu, R.; Jiang, S.; Li, W.; Wang, R.; Wang, D.; Qi, T.; Qin, K.; Wen, H. Critical Mineral Resources. China Sci. Found. 2019, 2, 106–111.

- Zhou, L.; Fan, H.; Ulrich, T. Editorial for Special Issue Critical metals in hydrothermal ores: Resources, recovery, and challanges. Minerals 2021, 11, 299.

- Nakano, J. The Geopolitics of Global Supply Chains, Chapter 6—Japan; Center for Strategic and International Studies (CSIS): Washington, DC, USA; pp. 19–22, 1 March 2021.

- Australian Government. 2022 Critical Materials Strategy; Department of Industry, Science, Energy and Resources, Canberra, Australian Government: Canberra, Australia, 2022.

- Nansai, K.; Nakajima, K.; Kagawa, S.; Kondo, Y.; Suh, S.; Shigetomi, Y.; Oshita, Y. Global Flows of Critical Metals Necessary for Low-Carbon Technologies: The Case of Neodymium, Cobalt, and Platinum. Environ. Sci. Technol. 2014, 48, 1391–1400.

- Gao, W.; Sun, Z.; Wu, Y.; Song, J.; Tao, T.; Chen, F.; Zhang, Y.; Cao, H. Criticality assessment of metal resources for light-emitting diode (LED) production—A case study in China. Clean. Eng. Technol. 2022, 6, 100380.

- Cimprich, A.; Bach, V.; Helbig, C.; Thorenz, A.; Schrijvers, D.; Sonnemann, G.; Young, S.; Sonderegger, T.; Berger, M. Raw material criticality assessment as a complement to environmental life cycle assessment: Examining methods for product-level supply risk assessment. J. Ind. Ecol. 2019, 23, 1226–1236.

- Frenzel, M.; Kullik, J.; Reuter, M.; Gutzmer, J. Raw material ‘criticality’—Sense or nonsense? J. Phys. D Appl. Phys. 2017, 50, 123002.

- Hache, E.; Seck, G.; Simoen, M.; Bonnet, C. Critical raw materials and transportation sector electrification: A detailed bottom-up analysis in world transport. Appl. Energy 2019, 240, 6–25.

- U.S. Geological Survey. Mineral Commodity Summaries; U.S. Geological Survey: Reston, VA, USA, 2022.

More