Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 1 by Yugang He and Version 2 by Vivi Li.

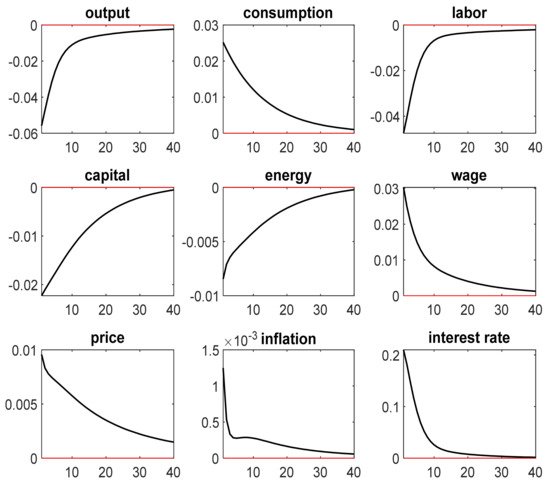

Under the double pressure of the Ukrainian–Russian war and the COVID-19 pandemic, the global energy crisis has also engulfed the Korean economy. According to an empirical study using the impulse response function, the results show that an energy price shock causes a decline in production, labor supply, capital stock, and energy consumption, as well as an increase in consumption, wages, the goods price level, inflation, and the deposit interest rate. Meanwhile, variance decomposition findings indicate that the energy price shock has a greater impact on the Korean macroeconomy than other shocks.

- Korean macroeconomy

- energy price shock

- impulse response function

- variance decomposition

1. Introduction

The supply of energy in South Korea is mainly reliant on imports, and any shifts in the energy supply would have a significant influence on the Korean economy. A good illustration of this is the fact that the global energy supply has been severely disrupted as a result of the combined effects of the war between Ukraine and Russia and the COVID-19 pandemic, which has also placed a significant strain on the Korean economy. Raw material price information was obtained from the Ministry of Industry, Trade, and Resources of the Republic of Korea on June 1. As of that date, the import price of liquefied natural gas in Korea rose 68.4% (USD 534.9 per ton), while the price of coal used for power generation increased 125.5% (USD 206.3 per ton) year on year. In the meantime, a report from the Korean Institute of Contemporary Economics suggested that South Korea was already suffering from a lack of available resources. In addition, Korea’s economy, which was mostly based on the heavy chemical industry, was heavily reliant on the world’s supply of raw materials and its economic interactions with the world. As a result, it is possible that it will be impacted more severely than other countries.

Given the significance of energy to the progress of Korea’s economy, a significant number of academics have focused their emphasis on this specific feature. Oh and Lee [1] investigated this subject using the vector error correction model. They came to the conclusion that the use of energy was a significant factor that promoted economic development. Cunado et al. [2] investigated the macroeconomic effects of oil price fluctuations in Korea. For empirical analysis, they employed the structural vector autoregression approach. They discovered that an oil price shock had a substantial impact on the gross domestic product, the consumer price index, the exchange rate, and the interest rate. Masih et al. [3] assessed the volatility in Korea. Using a linear error correction model and an asymmetric two-period Markov switching model for empirical analysis, they discovered that variations in gross domestic product, interest rate, and stock returns were induced by the oil price. Moreover, Lee and Cho [4], Hsieh [5], and Hoffmaister and Roldós [6] explored this issue using various methodologies. Likewise, they arrived at the same conclusions.

The research background that was discussed before serves as the point of departure for the work that will be done in this papentryr. As a result of this, researcherswe make use of a stochastic general dynamic equilibrium model to study how the energy price shock affects the Korean macroeconomy. Based on the findings of an investigation that made use of the impulse response function, an energy price shock leads to a drop in output, labor supply, capital stock, and energy consumption, as well as a rise in consumption, wages, goods price level, inflation, and deposit interest rate. In the meantime, results from variance decomposition suggest that the energy price shock has a higher influence on the macroeconomy of Korea than other shocks. Additionally, these new findings, which were obtained by using international data, modifying the inflation response coefficient and the output response coefficient, and adjusting the degree of staggered pricing for re-simulation, are supported by the conclusions that were derived beforehand.

The following are some of the contributions that this enstrudy makes in comparison to the great majority of the Korean studies that have been conducted in the past: to begin, it has come to light that past investigations into this topic that were carried out in Korea made use of the vector autoregressive technique, the structural vector autoregressive approach, and the vector error correction approach. These techniques, on the other hand, are not supported by any economic evidence. As a result of this rationale, the dynamic stochastic general equilibrium model was used in this entrstudy to investigate the effects that a shock in the price of energy might have on the Korean macroeconomy. The model has microeconomic foundations in three sectors: households, firms, and central banks. Furthermore, since Korea is an energy importer, changes in the price of energy are very sensitive to Korean macroeconomic variables’ fluctuations. As a result, looking at this topic from the perspective of Korea is the most representative way to approach it.

2. MLiteracroeconomic Effects of Energy Pricture Review

The effects of energy prices on the macroeconomy have been studied by a significant number of economists. In this section, researchwers establish the theoretical foundation for this entryarticle by conducting a literature review of research techniques, research goals, and research results from previous studies. Using the recursive vector autoregressive model and the vector error correction model, Ran and Voon [7] investigated whether oil price shocks had a substantial impact on the Korean economy. Regardless of the model’s assumptions, they found no significant impact on real gross domestic product. However, after three period lags, they discovered substantial positive impacts on unemployment. Park et al. [8] employed a structural vector autoregressive model to examine the impact of oil price variations on provincial macroeconomic indicators. They divided Korea into four main areas (Central, Honam, Gyeongsang, and Capital) based on the number of metropolitan cities and provinces in Korea. Then, they investigated how changes in the price of oil affected the economies of these areas. They discovered a negative reaction to industrial output and prices. Meanwhile, oil price variations had less of an impact on the capital area than on the other three provincial areas. Alom et al. [9] used a structural vector autoregressive model to assess the macroeconomic effects of an oil price shock on the Korean economy. They observed that the oil price shock had a substantial influence on the economic operations of resource-scarce countries such as Korea, which was recognized for its proficiency in heavy manufacturing sectors. Ioannidis and Ka [10] conducted research on the effects of oil price shocks on the South Korean economy using a structural vector autoregressive framework. They discovered that interruptions in oil supply had a short-term negative influence on interest rates. In addition, the results of Akay and Uyar [11], Jin and Kim [12], and Ran and Baek [13] were in line with the findings presented above. Using a global vector autoregressive model, Park and Shin [14] conducted an empirical investigation to study how oil prices affected the Korean economy. According to what they discovered, the influence of oil prices became quite significant in the case of real output, equity prices, and real exports. Greenwood-Nimmo et al. [15] also used a global vector autoregressive model to study this topic in Korea. Despite the fact that this factor has a minor effect on inflation, they found that the financial markets and the real economy are extremely sensitive to fluctuations in the price of oil. This was a surprising finding given that inflation is mostly influenced by other factors. Nusair and Olson [16] explored the asymmetric impact of oil prices on the Korean economy using a nonlinear autoregressive distributed lag technique. They found that an increase in oil prices had an asymmetrically higher impact on output than a decrease in oil prices did. In addition, they used nonlinear causality tests to demonstrate the causal relationship between oil price and output in Korea. Baek [17] also used a nonlinear autoregressive distributed lag technique to examine the economic effects of oil prices. They made the discovery that there was evidence suggesting that fluctuations in oil prices seemed to impact Korea’s trade in an unbalanced manner both in the long run and in the short run. Furthermore, Coffman [18], Bastianin and Manera [19], and Lee and Huh [20] all provided evidence that supported the aforementioned findings. The simultaneous equation model was used by Hsieh [5] to investigate the impact of oil price shocks and macroeconomic variables on output variations for Korea. He discovered that the elasticity of output with regard to the oil price was assessed to be −0.042, implying that a 1% increase in the oil price would result in a 0.42% decline in real gross domestic product. Using the vector error correction model, Glasure [21] investigated the link between the price of energy and the level of national income, paying particular attention to the factors that were left out of the analysis. He came to the conclusion that the oil price was a significant factor in both energy consumption and real national income. Previous research failed to account for some factors, which resulted in either a lack of or the presence of a causal relationship between energy consumption and real income. He also discovered that the combination of the two kinds of oil price shocks had a detrimental effect on real national income. Kim [22] conducted research to examine how fluctuations in the price of oil impacted the production operations of Korean manufacturers. Using a structural vector autoregressive model as the basis for his empirical research, he discovered that an increase in the price of oil led to a decline in both the level of industrial output and the price level of goods. This finding demonstrated how a rise in oil prices had a negative effect on industrial production activities not only by slowing demand in local markets but also by contracting supply in export markets. In addition to this, these results were in line with those found by Lee et al. [23], Van Wijnbergen [24], and Cha [25].3. The Effects of Energy Price Shock on Korean Macroeconomy

According to Yoo and Jung [26][37], and Kim and Yoo [27][38], the role of energy was becoming an increasingly major component, despite the fact that there were numerous factors impacting the economic fluctuations in Korea. In the meantime, on 21 June 2022, the Chosun Ilbo reported that, in response to Russia’s invasion of Ukraine, the United States had decided to ban the import of Russian crude oil as a penalty, resulting in a dramatic increase in international oil prices. On the global market, the price of oil imported by Korea also increase to USD 120 per barrel. The Chosun Ilbo further said that the Korean economy was greatly reliant on foreign energy and that the increase in international oil prices would be catastrophic for the Korean economy. As energy costs increased, prices would be subject to global upward pressure. As the enterprise’s costs grew, its revenue would similarly decrease. Together, household income, investment, and consumption would decline. Therefore, the aim of this subsection is to examine how energy price shock affects the Korean macroeconomy. The results are presented in Figure 1.

Figure 1.

The effects of energy price shock on the Korean macroeconomy.