Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 3 by Conner Chen and Version 2 by Conner Chen.

Alliance is a common organizational operation form in the logistics industry. A reasonable profit distribution mechanism is the foundation for the formation and stability of the logistics alliance.

- profit distribution

- logistics alliance

- logistics service quality

1. Introduction

Alliance is a common organizational operation form in the logistics industry. In reality, cold chain logistics companies, transportation companies, landing distribution companies, warehousing companies and other logistics companies with different main businesses often form alliances around a specific logistics task to jointly provide logistics services. On the one hand, the logistics industry is a typical industry with a high entry threshold, and the high investment and high risks that a single enterprise cannot afford can be shared in the form of alliances. On the other hand, alliances have significant advantages in reducing transaction costs, better meeting consumer demands, and achieving economies of scale. With the intensification of market competition, the importance of logistics alliance is increasingly more prominent, but it must also be seen that it faces the threat of instability. The logistics enterprises in the alliance are only temporary cooperative relationships formed to obtain excess returns. Looking at each logistics enterprise alone, it is still an independent rational economic entity, and still aims to maximize its own interests. Therefore, when the information is asymmetric, various logistics enterprises of the alliance will be lazy, hitchhiking, and breaking contracts, which will affect the stability and efficiency of the alliance. To sum up, how to reasonably and fairly distribute alliance revenue has become a key issue of coordinating the relationship between logistics enterprises, ensuring the stability of the alliance, and giving full play to the advantages of the alliance.

In response to this problem, the Shapley value method is currently recognized as the basic model of alliance profit distribution. This model distributes profits based on the marginal contribution of each alliance member, embodying the principle of more pay for more work, and effectively avoiding equal division [1]. Some subsequent scholars believe that the profit distribution of logistics alliance should also consider the influence of multiple factors such as risk-taking [2] and resource input [3], and in the determination of the weight of each influencing factor, it should be compared with the analytic hierarchy process (AHP) weighting method [4], the interval analytic hierarchy process (IAHP) weighting method [5], the technique for order preference by similarity to an ideal solution (TOPSIS) weighting method [6], and other methods to establish a modified Shapley value profit distribution model. However, these existing profit distribution models are all based on the assumption that members can form alliances freely, and cannot be applied to the profit distribution of logistics alliance with communication structure restrictions. In fact, constrained by business connections, special resources and technologies, and even political factors, not all logistics enterprises can freely form alliances, and the alliance structure is often restrictive. For example, the logistics alliance formed centered on the logistics enterprises with a regional pass, the logistics alliance formed around the logistics enterprises with cold chain equipment, and the leader-type logistics alliance initiated by a logistics enterprise with sufficient customers; in these alliances, members do not communicate and cooperate directly, but only cooperate with alliance-led enterprises which have special resources. Therefore, it is urgent to study how to design a profit distribution model to make the alliance revenue tilt towards the core of the alliance and the leading enterprises with strong comprehensive strength and great discourse power. In addition, as a derivative service, the completion quality of logistics tasks directly affects the revenue of logistics alliance. Therefore, how to motivate alliance members to improve logistics service quality through profit distribution is also a problem that needs to be explored in depth.

2. Analysis on Influencing Factors of Logistics Alliance Profit Distribution

Clarifying the influencing factors is the basis and premise of designing the profit distribution model of logistics alliance. According to the literature extraction method and rule analysis method, it is found that marginal contribution, resource input, and risk-taking are the most recognized and widely used elements of alliance profit distribution. On this basis, taking into account the fact that some logistics enterprises are unable to freely form alliances and the importance of service quality to the excess profit of the alliance, the key factors affecting the distribution of profits of logistics alliance are classified into five aspects: marginal contribution, alliance communication structure, resource input efficiency, risk-taking, and logistics task completion quality.2.1. Marginal Contribution

The distribution of profits according to the contributions made by the members to the alliance conforms to the principle of more pay for more work. Only by linking the contribution level of the alliance members to the profit distribution can their enthusiasm for work and investment be better stimulated, which is recognized as an important factor affecting the profit distribution of alliance. At present, the distribution of profits based on marginal contribution is based on the Shapley value method and is improved in combination with other influencing factors.2.2. Alliance Communication Structure

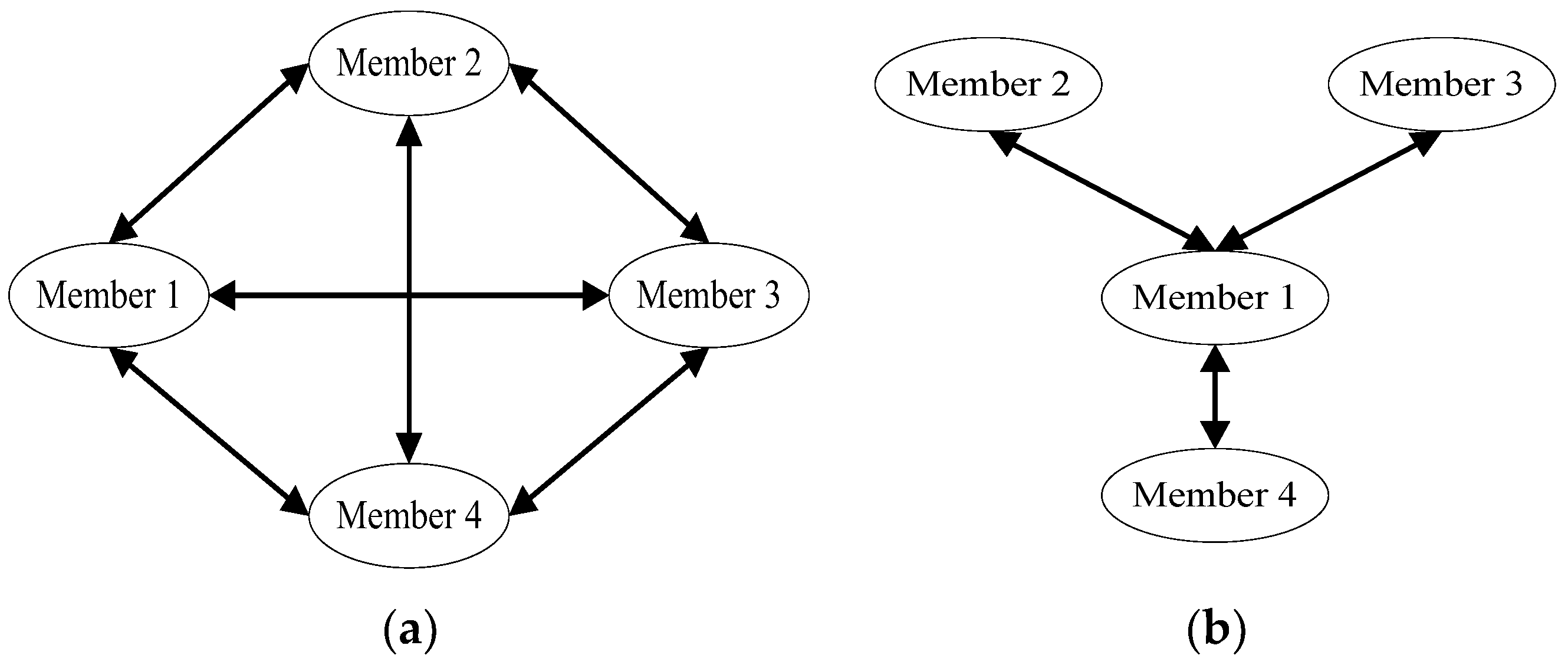

As shown in Figure 1, the structure of logistics alliance has various forms. Figure 1a is a fully connected logistics alliance, and all nodes are edge-connected, which represents equality between alliance members and free alliance cooperation between each other. Figure 1b is an alliance with communication structure restrictions (In addition to the star structure represented in Figure 1b, the structural form of the alliance with communication structure restrictions also has a tree structure, incompletely-connected structure, etc., which are not listed here.), and the nodes of Members 2, 3, and 4 are only edge-connected with Member 1, but are not edge-connected with each other, which means that member 1 has a prominent position in the alliance. Obviously, the profit distribution of logistics alliance under the limitation of communication structure must reflect the difference of member status, which can be solved by the A-T solution method.

Figure 1. (a) Alliance without communication structure restrictions; (b) alliance with communication structure restrictions.

2.3. Resource Input Efficiency

The logistics industry is a typical resource-intensive industry, which requires a lot of labor, infrastructure, and capital investment. The main goal of logistics alliance is to gather and optimize the allocation of resources behind multiple logistics enterprises. However, due to different divisions of business, each logistics enterprise has different contributions of resource input to the alliance, and the distribution of profits should reflect this difference. At the same time, in reality, the goals and contents of different logistics alliances are different, and the same investment of members plays different roles in different alliances. Therefore, the profit distribution based on resource input should also consider the scarcity of resources and whether they have made effective contributions to the alliance revenue, that is, whether a certain amount of resource input can obtain effective output in increasing the profit of the alliance, improving the overall service level and market competitiveness of the alliance. In a highly competitive market environment, invalid investment cannot correspond to high profit distribution. In view of this, ithis paper can be proposesd to distribute profits through the resource input efficiency assessment of alliance members, so as to avoid the drawbacks of only focusing on input quantity and ignoring output quality. Specifically, the measurement of resource input efficiency will learn from the practice of He Xijun [7] and use the data envelopment analysis (DEA) method to analyze the ratio of multiple resource inputs to multiple outputs. The calculation model is:2.4. Risk-Taking

There are many potential risks in the operation of logistics alliance, such as member moral risk, logistics operation risk, market competition risk, and natural disaster risk. According to utility theory, members who take more risks in alliance activities will demand more compensation in the profit distribution. Thus, the paper usesing the loss value brought by the risk to measure the risk of each logistics enterprise, that is, the risk w is a function of the probability P of risk events and the loss C caused by risk events, w=F(p,c). In addition, since each logistics enterprise in the alliance undertakes risks with all the investment at most, the loss caused by risk events is ci=αiIi, where αi is the risk loss rate of logistics enterprise i, and Ii is the logistics subtask input of i. Therefore, it can be obtained that the risk undertaken by the logistics enterprise i is wi=piαiIi, i={0,1,2,…,n}, and the proportion of the overall risk taking is Wi=wi∑1nwi.2.5. Logistics Task Completion Quality

As a service industry, the completion quality of logistics tasks directly affects the logistics demand, which is the foundation of the existence of logistics alliance and represents its core competitiveness. Therefore, in order to form incentives for alliance members, the profit distribution of logistics alliance must be based on the quality inspection of logistics task completion. The measurement of logistics task completion quality is usually completed by constructing an evaluation index system, and the specific evaluation indexes include cargo damage and error rate, error processing, and logistics time. Finally, the logistics enterprises with higher evaluation scores get more profits in the alliance.References

- Roth, A.E. The Shapley Value as a Von Neumann-Morgenstern Utility. Econom. J. Econom. Soc. 1977, 45, 657–664.

- Tian, G.; Ma, Z.Q.; Mei, Q.; Zhuang, J.C.; Li, S.W.; Luo, J.Q. Research on the Symbiotic Benefit Distribution Model of Logistics Enterprises and Manufacturing Enterprises Considering Innovation Incentives. Procasting 2014, 33, 64–69.

- Gan, J.H.; Wang, J.W.; Chen, Z.; Zhao, J. The Income Distribution Strategy of Small and Medium Logistics Enterprises Alliance under Quality Guidance. J. Tech. Econ. Manag. 2014, 30, 38–43.

- Xu, M.Z.; Zhou, X.; Cui, L.G.; Liu, Y.; Yu, G.Y. Co-distribution Mode and Benefit Distribution of Express Delivery in Low Distribution Density Areas. Comput. Integr. Manuf. Syst. 2020, 26, 181–190.

- Du, Z.P.; Zhang, M. Profit Distribution of 4PL Cross-border E-commerce Logistics Alliance Based on IAHP-Shapley Value. J. Commer. Econ. 2019, 15, 81–84.

- Lin, Y.; Wang, X.B. Research on Profit Distribution of Logistics Alliance Based on TOPSIS & Shapley Value Method. J. Northeast. Agric. Univ. (Soc. Sci. Ed.) 2016, 14, 32–37.

- He, X.J.; Wu, Y.Y.; Jiang, G.R. Research on Benefit Distribution Model of Supply Network Based on Shapely Modification. Soft Sci. 2014, 28, 70–73.

More