The Sustainable Development Goals (SDGs) are a unique collective agreement of the modern time, which was concluded between government, society, and business at a global scale and which ensures outstanding progress in sustainable development. Society is the direct beneficiary of the SDGs, but bears the lowest expenditures for their implementation and, thus, supports them. The government protects society’s interests, and implementation of the SDGs is among its main responsibilities. Participation of business in the achievement of the SDGs is complex and contradictory, deserving special attention. It is no coincidence that the necessity for the integration of the SDGs into corporate strategies is a part of the agenda in the Decade of Action.

1. Introduction

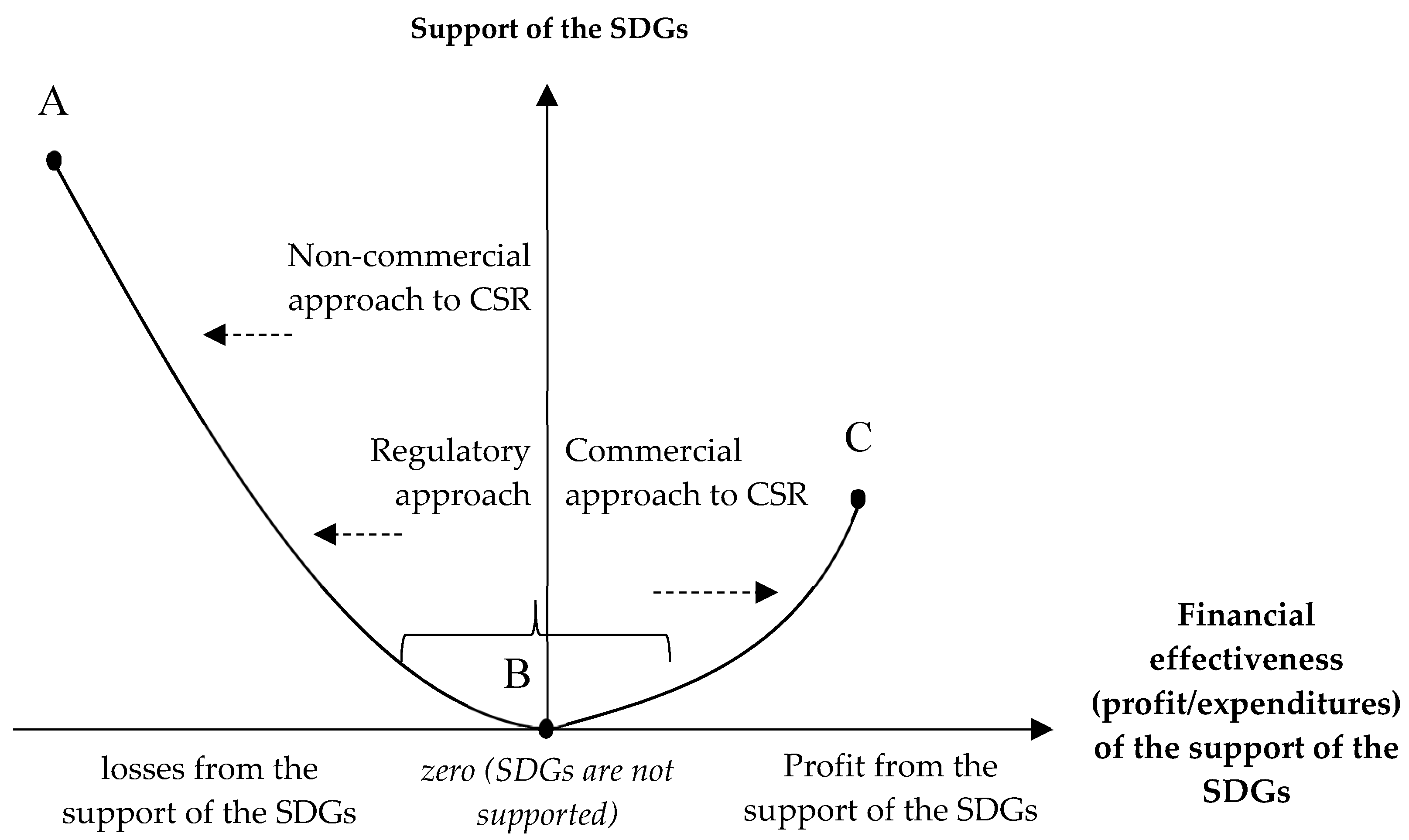

In most

csitua

setions, support of the S

DGs ustainable Development Goals (SDGs) means losses for business (including a shortfall in profits—alternative costs), i.e., contradicts its financial interests. The existing scientific

literatureresearch distinguishes three approaches to the integration of the SDGs into corporate strategies. The 1st—regulatory—approach is based on companies’ unpreparedness for voluntary losses, so the implementation of the SDGs is a “market gap”. That is the reason why the government does not provide companies with the choice and opportunity to voluntarily support the SDGs (expecting that this will not take place at the required scale). Instead of this, the government adopts and controls the observation of labour and ecological standards, as well as standards of corporate financial reporting (

Batóg and Batóg 2021). On the one hand, this ensures wide support of the SDGs by entrepreneurship, but, on the other hand, government interference with the natural processes distorts the effect of the market mechanism and decreases the effectiveness of entrepreneurship (

Hamed et al. 2022;

Liu 2021).

The other two approaches are based on corporate social responsibility and are widely studied

in the existing literature. A lot of scientific publications are devoted to the research of the interconnection between corporate social responsibility and the indicators of a company’s activity (

Fontana 2017;

Jaisinghani and Sekhon 2022;

Kaul and Luo 2018;

Schramm-Klein 2015).

A lot of

res

tudies earches are undertook the testing of the interconnection between corporate social responsibility and the indicators of a company’s activity, including profitability, firm risk, stock liquidity

, etc and so on. (

Akbar et al. 2021;

Gennaro 2021;

Zhang et al. 2021;

Bednarczyk et al. 2021). Using the existing

litone

rature, the following two approaches are differentiated by the criterion of the risks of corporate social responsibility for profit.

The 2nd—non-commercial—approach to corporate social responsibility implies that companies have to voluntarily refuse their financial interests in favour of implementing the SDGs and accept high risks for profit. According to this approach, corporate social responsibility is associated with charity. As a matter of act, charity events, volunteering, and companies’ donations allow accelerating the progress in the achievement of the SDGs.

Many

studiare

s (in particular,

Kuzey et al. 2022;

Loor-Zambrano et al. 2022;

Bu et al. 2022) provide

d with arguments in favour of the idea that companies can “do well by doing good”. In other words, a company must experience a loss when it contributes to CSR, especially when stakeholders in the company appreciate the CSR practices.

However, in the background of non-profit activities lie commercial profits, while the widespread deprivation of companies of the principal opportunity to make a profit would lead to their bankruptcy (

Chu and Fang 2021). Only the most successful and stable companies can accept large risks for profit. That is why the non-commercial approach to corporate social responsibility cannot be extended to entrepreneurship, on the whole, i.e., it has limited capabilities for scaling the practices of integrating the SDGs into corporate strategies (

Jackson 2021).

The 3rd—commercial—approach to corporate social responsibility means that, during its implementation, companies are guided by their main goal, which is connected to making a profit, and the achievement of the SDGs is the priority. This ensures low risks of corporate social responsibility for companies’ profit. This approach fits the nature of entrepreneurship in the market economy in the best way and thus has potential for wide practical use since it ensures the largest systemic profit for all interested parties in the long term (

Ang et al. 2022;

Song and Tao 2022;

Xie et al. 2022;

Zhang et al. 2022).

2. Corporate Social Responsibility Based on Integrating the SDGs into Corporate Strategies

The theory of integration of the SDGs into corporate strategies, which describes and characterises in detail all three existing approaches to this integration. Their comparative analysis is given in

Table 1.

Table 1.

Comparative analysis of the existing approaches to the integration of the SDGs into corporate strategies.

* CSR—CSR. Source: acontributhors.

As shown in

Table 1, the regulatory approach uses the mechanism of state regulation during the integration of the SDGs into corporate strategies. With that, support for the SDGs is forced. Market implications of the integration of the SDGs into corporate strategies are linked to the slowdown of economic growth and development of the shadow economy, and the risks of support of the SDGs for profit are high (

Pizzi et al. 2021;

Rahman 2021;

Raithatha and Shaw 2021).

The other two approaches use the mechanism of CSR during the integration of the SDGs into corporate strategies. According to the non-commercial approach to CSR, support of the SDGs is voluntary. The market implications of integrating the SDGs into corporate strategies are linked to the slowdown of economic growth and dysfunction of the market mechanism (but the risks of support of the SDGs for profit are also high

Akopova et al. 2020;

Mochales and Blanch 2022;

Shayan et al. 2022;

Sinkovics et al. 2021;

Waheed and Zhang 2022;

Wang et al. 2022).

The commercial approach to corporate social responsibility implies the voluntary support of the SDGs, which becomes a new form of “healthy” competition in the market (in addition to price competition and quality competition) (

Medentseva 2017;

Muhmad and Muhamad 2021;

Petrovskaya et al. 2022;

Roy et al. 2022;

Vagin et al. 2022).

A serious drawback of the first two (regulatory and non-commercial) approaches is the high risks of support of the SDGs for profit (

Kornieieva 2020;

Lassala et al. 2021;

Martí-Ballester 2020). The commercial approach is very different due to the low risks of support of the SDGs for profit. This is illustrated by the bi-directional vector scale of the integration of the SDGs into corporate strategies from the standpoint of financial risks in various distinguished approaches (

Figure 1).

Figure 1. Bi-directional vector scale of the integration of the SDGs into corporate strategies from the positions of risk for profit in various distinguished approaches. Source: authorscontributors.

The scale in

Figure 1 shows that the non-commercial approach to CSR and the regulatory approach stimulate the movement from point A to point B. In section BA, business suffers losses from the support of the SDGs, the size of which grows in the course of approach to point A.

The commercial approach to corporate social responsibility opens a perspective for the movement to the right (to point C) along the stretch BC. In

the works of Battisti et al. (

2022),

Kong (

2022),

Quang et al. (

2022),

Wentzel et al. (

2022), it is noted that the risks of integrating the SDGs (UN standards) into corporate strategies are rather high for the risks on the whole.

The detailed characteristics of the integration of the SDGs into corporate strategies in alternative approaches (based on the existing

litone

rature) are presented in

Table 2.

Table 2.

Detailed characteristics of the integration of the SDGs into corporate strategies during the alternative approaches.

| Direction of CSR |

Indicator of the UN (2021) |

Symbol |

Supported SDGs—UN Standards |

CSR Measures to Support the SDGs |

| Responsible HRM * |

Gender gap in time spent doing unpaid work (minutes/day) |

SRSDG(1) |

SDG5, SDG8 |

Provision of gender-neutral jobs and fair wages |

| Unemployment rate (% of the total labour force) |

SRSDG(2) |

SDG8 |

Keeping a stable number of jobs or increasing it to support employment |

| Fundamental labour rights are effectively guaranteed (worst 0–1 best) |

SRSDG(3) |

SDG8 |

Guarantee of labour rights (official employment) |

| Fatal work-related accidents embodied in imports (per 100,000 population) |

SRSDG(4) |

SDG8 |

Provision of occupational safety and health |

| Responsible production (corporate environmental responsibility) |

Production-based SO2 emissions (kg/capita) |

SRSDG(5) |

SDG13 |

Improvement of treatment systems to reduce environmental pollution |

| Production-based nitrogen emissions (kg/capita) |

SRSDG(6) |

SDG13 |

| Carbon Pricing Score at EUR60/tCO2 (%, worst 0–100 best) |

SRSDG(7) |

SDG13 |

Refusal to include environmental costs in the price |

| Responsible finance |

Corruption Perception Index (worst 0–100 best) |

SRSDG(8) |

SDG16 |

Business’s fight against corruption |

| Corporate Tax Haven Score (best 0–100 worst) |

SRSDG(9) |

SDG16 |

Full-scale payment of taxes (official business) |

* HRM—human resources management. Source: acontributhors.

As shown in

Table 2, though CSR can support all SDGs at once, it is mostly focused on the following SDGs: SDG 5, SDG 8, SDG 13, and SDG 16. These SDGs have the potential for commercialisation.

Other SDGs belong to the sphere of charity (and the potential contribution of business to their practical implementation is less vivid), so they are not considered

in this paper. The performed systematisation allowed distinguishing three key directions of corporate social responsibility to support the SDGs: responsible human resource management (HRM), responsible production (corporate environmental responsibility), and responsible finance.

Let

u's present specific measures that are implemented in the above directions and provide a more detailed description of the CSR practices and their support for the SDGs. The measures of corporate social responsibility to support the SDGs (UN standards—on the stretch BC in

Figure 1) include the following (from the positions of responsible human resources management (HRM)):

Provision of gender-neutral jobs and fair wages (

He and Kim 2021;

Hirsu et al. 2021). Using this measure, the CSR practices in support of the SDGs imply the creation of equal conditions for the professional activities of all employees, regardless of their gender. Additionally, a transparent and flexible approach to wages, which takes into account the individual results of each employee’s work, is used:

- −

-

Stability or increase in jobs to support employment (

Zhao et al. 2021). Using this measure, the CSR practices in support of the SDGs imply the refusal of personnel cuts even amid a crisis, the formation of a personnel reserve for continuous filling of jobs, and the creation of additional jobs, apart from the satisfaction of the company’s main needs for personnel in the striving for the growth of the intensity of business processes in the connection to human resources.

-

- −

-

Guarantee of labour rights (official employment) (

Chanda and Goyal 2020;

Ramos-González et al. 2021). Using this measure, the CSR practices in support of the SDGs imply providing employees with an expanded spectrum of social labour guarantees, which covers the basic obligations of employers, dictated by the labour law.

-

- −

-

Provision of production safety (

Rawshdeh et al. 2019). Using this measure, the CSR practices in support of the SDGs imply accelerated automatisation of the types of labour activities that are potentially dangerous for life and health and employees, with the preservation of jobs (employees perform the function of remote control over automatised business processes).

-

From the position of responsible production (corporate environmental responsibility):

- −

-

Improving treatment systems for reducing environmental pollution (

Han and Cao 2021). Using this measure, the CSR practices in support of the SDGs imply a voluntary transition of companies to higher environmental standards of their activities and issued products (for example, automobile manufacturing) and implementation of ecological innovations.

-

- −

-

Refusal to include ecological costs in the price (

Setyowati et al. 2021). Using this measure, the CSR practices in support of the SDGs imply a voluntary refusal of companies of a part of the profit in favour of an increase in environmental friendliness of their activities.

-

From the position of responsible finance:

- −

-

Business’s fight against corruption (

Dela Cruz et al. 2020). Using this measure, the CSR practices in support of the SDGs imply the companies’ refusal to participate in corruption schemes and disclosure of these schemes.

-

- −

-

Full-scale payment of taxes (official business) (

Panos and Wilson 2020). Using this measure, the CSR practices in support of the SDGs imply companies’ refusal to participate in the schemes of tax evasion.

-

Despite the in-depth elaboration of the issues of the support of the SDGs with the help of corporate social responsibility, the following aspects remain poorly studied and unclear:

- (1)

-

Which SDGs (UN standards) are supported by companies in different regions of the world (research gap No. 1)?

-

- (2)

-

Which (of the list given in

Table 2) measures of corporate social responsibility to support the SDGs are implemented in the practice of companies in different regions of the world (research gap No. 2)?

-

- (3)

-

Which approach is used? What are the risks of support of the SDGs (UN standards) with the help of corporate social responsibility for profit (research gap No. 3)?

-