Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 2 by Dean Liu and Version 1 by Shi Yin.

Digital green innovation management activities are the core of low-carbon intelligent development of prefabricated construction enterprises (PCEs) for sustainable urban development. PCEs have to seek joint venture partners to avoid the financial risk of digital green innovation projects.

- prefabricated construction

- digital green innovation management

- venture capital

1. Digital Green Innovative and Joint Venture Investment

(i) Digital green innovation. In recent years, some scholars have conducted in-depth research on digital green innovative management. They thought that digital green innovative management of enterprises is particularly important [40,41][1][2]. Khin & Ho (2018) put forward that digital technology can significantly improve the sales revenue and reduce the operating cost rate of enterprises [40][1]. Li et al. (2020) believed that, in the era of the digital economy, the application of digital technology can significantly promote the improvement of enterprises’ capabilities. The capability improvement effect of digital technology application can be more fully reflected in enterprises with a poor resource base and high dynamic capability [41][2]. Meanwhile, many scholars put forward their views on green innovation management [42,43,44][3][4][5]. Kaluarachchi (2021) believed that ecological and green development in the field of architectural design in China are promoted through the integration of digital technology and green building design [42][3]. Jiang (2021) believed that it is necessary to achieve high-quality fusion of digital economy and green economy development. The research of the green economy sustainable paradigm shift must consider the digital tools in environmental sustainability. Changing the thinking mode of environmental governance should not only attach great importance to the use of digital solutions but also cannot ignore the digital economy accountability of the carbon footprint [43][4]. Chaker et al. (2022) believed that the value of digital technology capability is beyond doubt, but its value potential is conditional. Digital technology enterprises must make further use of business model innovation to give full play to the potential value of digital technology [44][5].

(ii) Joint venture investment. Many scholars have discussed the motivations of joint venture investment [45,46,47,48,49,50,51,52,53,54,55,56,57][6][7][8][9][10][11][12][13][14][15][16][17][18]. Pence [45][6] (1982) and Perez [46][7] (1986) argued that venture capitalists are motivated to co-invest by obtaining a second opinion, which double-checks their investments using the views of other investment partners. It can not only prevent the deficiency of their own screening and management skills but also prevent the adverse selection problem caused by information asymmetry. This is supported by the empirical study conducted by Lerner [47][8]. The empirical results of Altintig et al. (2013) also supported both drivers [48][9]. Tykvova and Schertler (2014) examined the joint drivers of multinational venture capital. They found that joint investment was more conducive to obtain investment opportunities, improve risk allocation, and reduce information costs, thus indirectly proving both drivers [49][10]. Manigart and Lockett (2006) argued that risk diversification drivers and access to trade flow factors are more important than screening and appreciation drivers. In the early investment stage, there will be a stronger value-added motivation, and the motivation of joint investment with investors is to obtain the screening and value-added skills of leaders [50][11]. Lockett and Wright (2001) formally classified previous studies into risk diversification and resource accumulation. Resource accumulation motivation is more important for early-stage investment at least [51][12]. Brander et al. (2002) summarized joint venture capital factors as risk dispersion hypotheses for diversification of the portfolio, screening hypotheses for acquiring pre-investment screening skills, and value-added assumptions for managing post hoc investments. The study found more support for the value-added hypothesis [52][13]. Verwaal et al. (2010) tended to support access to transaction flow factors [53][14]. Ferrary (2010) believed that the motivation of a joint venture is the accumulation of resources [54][15]. Hopp and Rieder (2011) believed that the motive of venture capital association is not to diversify the asset portfolio but to disperse risks [55][16]. Lerner (1991) believed that venture capital institutions would engage in window dressing. Window dressing is the practice of quarterly performance reviews of fund managers in which market performance is a noisy indicator and investors also look at portfolios at the end of each quarter. As a result, fund managers are likely to buy shares in companies with good quarterly results and sell shares in companies with poor quarterly results [56][17]. Admati and Pfleiderer (1994) believed that the lead investor may deliberately overestimate the security price of the follow-up financing by using this information advantage to seek the interests of the co-investor. To prevent this opportunistic behavior, co-investors often invest together so that the lead investor must maintain a constant share [57][18].

(iii) Based on the above literature review, it is summarized as follows. Many scholars only conducted research on digital innovation management or green innovation management. Few scholars put forward opinions on the integration of digital innovation management and green innovation management. According to the existing literature, the motivations of joint venture investment can be divided into risk dispersion motivation, resource accumulation motivation, and collusion motivation. Venture capital institutions have the need to reduce investment risk. Co-investing in one area can diversify a portfolio away from systemic risk. More importantly, it possesses the specific nature of a syndicate to improve the ability of investment against risk. Much of the literature supports the idea of risk diversification drivers [45,46,47,48,49,50][6][7][8][9][10][11]. According to the research of resource accumulation motivation, the main motivation of joint venture investment lies in the acquisition of pre-investment screening resources and post-investment management resources, as well as the acquisition and exchange of transaction flows [51,52,53,54,55][12][13][14][15][16]. The main motivation of venture capitalists’ association is to prevent the opportunistic behavior and window dressing behavior of leading investors [56,57][17][18]. It can be seen from the above literature that the existing studies tend to support the motivation of resource accumulation.

2. Criteria for Venture Capital Partner Selection and Characteristics of Preference

(i) Criteria for venture capital partner selection. In much of the literature on partner selection, different scholars have proposed different criteria for partner selection [58,59,60,61,62,63][19][20][21][22][23][24]. Zhu et al. (2010) built the green technology innovation of the enterprise environmental evaluation index system from the two dimensions of the enterprise internal environment and the external environment [58][19]. Bi et al. (2013) built an evaluation index system of green process innovation performance from the three aspects of economic performance, social performance, and ecological performance [59][20]. Ghisetti and Rennings (2014) measured green innovation efficiency, selected 92 indicators of energy consumption and environmental pollution, and made a distinction between energy efficiency innovation and environmental beneficial innovation based on the two aspects [60][21]. Salamat et al. (2018) established a partner selection index system for the international strategic alliance [61][22]. Dedehayir et al. (2018) studied the role of innovation leadership, direct value creation, value creation support, and the entrepreneurial ecosystem in the innovation ecosystem. They point out that organizational culture, partners, and technological level are important factors for the long-term development of the innovation ecosystem [62][23]. Yin et al. (2020) measured the four dimensions of regional green innovation input capacity, green innovation output capacity, green innovation environment capacity, and green diffusion input capacity [63][24].

(ii) Characteristics of preference. As for the characteristics of co-investment partners that venture capital institutions should or prefer to choose, scholars have studied as follows [64,65,66,67][25][26][27][28]. Du (2016) found that venture capital institutions are more inclined to unite with investment partners with similar experience [64][25]. Gompers et al. (2016) examined the impact of the individual-level characteristics of venture capitalists on the selection of joint investment partners. The study found that venture capitalists preferred to choose partners who had attended the same university and were of the same race and gender [65][26]. In terms of experience level, Lerner (1994) believed that experienced venture capitalists in the first round of investment tend to associate with investors with a similar experience level and generally do not choose smaller or junior partners. Casamatta and Haritchabalet (2007) theoretically believed that experienced venture capitalists would choose more experienced partners to unite [66][27]. In terms of capital scale and heterogeneous resource endowment, Hochberg et al. (2015) conducted a combined study and believed that risk diversification is not the main driving force for joint investment partner selection. By selecting partners with much resource endowment and specific heterogeneous resources, resource superposition and complementarity can be realized [67][28].

(iii) Based on the above literature review, it is summarized as follows. Many scholars expressed their opinions on the selection of evaluation indicators. However, the lack of a certain degree of summary is not conducive to the evaluation and implementation and a comprehensive grasp of the situation [58,59,60,61,62,63][19][20][21][22][23][24]. Based on the existing literature, there are two views on what characteristics venture capital institutions prefer to select as co-investment partners. The first view holds that venture capital institutions tend to form syndicates with partners with similar characteristics or types. The reason is that this type of syndicate also has lower agency costs and information asymmetry, making the investment risk lower. There is much literature supporting the selection of similarity partners [64,65][25][26]. The second view holds that venture capital institutions tend to form syndicates with partners with different characteristics or types and the same level of resource endowment. The reason is that joint investment with venture capital institutions with the same level of heterogeneity or resource endowment can obtain the heterogeneous resources of the other side, which is conducive to resource superposition, complementarity, and exchange to achieve cumulative advantages. There are two ways to combine venture capital to accumulate resources. One is to select partners with the same level of resource endowment for resource superposition. The other is to select partners with different characteristics or types for resource complementarity and exchange. With regard to supporting the view of selecting resource accumulation partners, the existing literature examines the effects of experience level, capital size, and heterogeneous resource endowment [66,67][27][28].

3. Approaches for Venture Capital Partner Selection

In terms of partner selection methods, Nikghadam et al. (2016) have proposed partner selection methods based on fuzzy target optimization [68][29]. Chen and Han (2018) constructed linear planning models for the case of incomplete attribute information [69][30]. For the case where the weight information is completely unknown, Gao et al. (2016) proposed methods based on minimum and maximum entropy values [70][31]. Yin et al. (2018) proposed methods that considered membership and non-membership [71][32]. Liang & Chong (2019) proposed the gray model and the DEA method [72][33]. In terms of the weighting method, Zhang et al. (2021) used the TOPSIS method to solve the optimal capacity configuration of the system [73][34]. Zhao and Yu (2021) used the coefficient of variation method to comprehensively evaluate the indicators through the corresponding weight combination [74][35]. Liu et al. (2021) used the ideal point method to construct the evaluation model [75][36]. Liu (2021) used the ideal point method to optimize the hierarchical analysis method, entropy weight method, and excessive weighting method [76][37]. Lin and Bai (2021) used the TOPSIS method to construct a weighted standard matrix and evaluated the advantages and disadvantages of each power plant [77][38]. Chen et al. (2021) established a combined weight optimization method based on the Gini coefficient method and excessive weighting method [78][39]. Chou et al. (2022) proposed a combined weight method based on MOEAD [79][40].

Numerous studies provide methods and ideas for partner selection. On the level of partner selection and weighting, many opinions and ideas have been provided by predecessors [68,69,70,71,72,73,74,75,76,77,78,79][29][30][31][32][33][34][35][36][37][38][39][40]. In terms of evaluation methods, there are methods such as the comprehensive index method, grey correlation method, grey fuzzy comprehensive evaluation method, AHP, combination weight, and so on. However, the combination evaluation and in-depth analysis with other evaluation methods are rarely carried out, and there are some problems, such as a lack of consistency in the evaluation results. Regarding the determination of weights, the subjective weighting method may be highly subjective and arbitrary, influenced by the decision-maker’s lack of knowledge or experience. Objective weighting ignores the subjective information of decision-makers. The algorithm complexity of the combination weighting method is generally high. Each of these methods has advantages and disadvantages.

4. Theoretical Model of Joint Investment Partner Selection

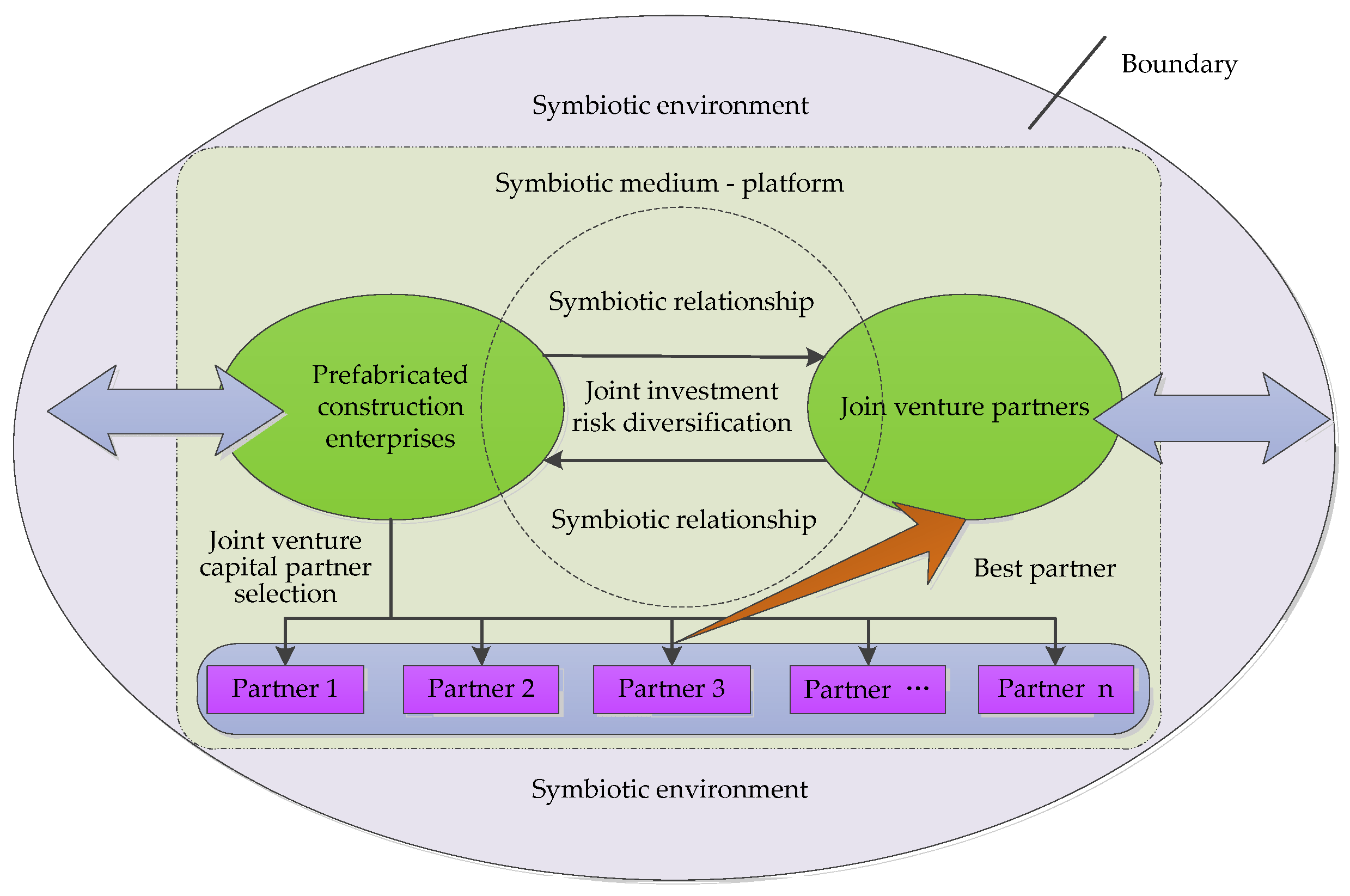

Digital green innovation projects usually occur in the process of enterprise change. Digital green innovation plays an important role in improving the performance of PCEs. It is regarded as one of the key factors affecting the green competitive advantage and strategic selection of PCEs. However, PCEs have to face significant investment pressure for innovative activities in many digital green R&D projects. More and more PCEs are choosing joint partners to spread risks and share resources when conducting digital green innovation activities. This practice has helped the construction industry to some extent. Problems related to the selection of joint partners by prefabricated construction firms can be solved by constructing joint venture capital networks. The specific theoretical model is shown in Figure 1.

Figure 1. Theoretical model of PCEs choosing joint venture capital partners.

In the joint venture network, PCEs and joint venture partners are the two main subjects of digital green innovation projects. The exchange of green knowledge and digital innovation technologies between construction firms and joint venture partners helps to promote business development and technological progress because this kind of cooperation not only combines heterogeneous partners but also combines heterogeneous knowledge. In the process of knowledge and technology exchange, PCEs and joint venture partners gradually form a mutually beneficial symbiotic relationship. The two share more and more complementary resources on digital green innovation. Whether PCEs can choose appropriate joint venture partners is directly related to the development of mutualistic symbiosis. In the joint venture capital network, it is particularly important to select one or more joint venture partners for PCEs to carry out digital green innovation activities. However, this selection is a complex decision-making process. This paper addresses this issue.

5. Framework System of Joint Investment Partner Selection

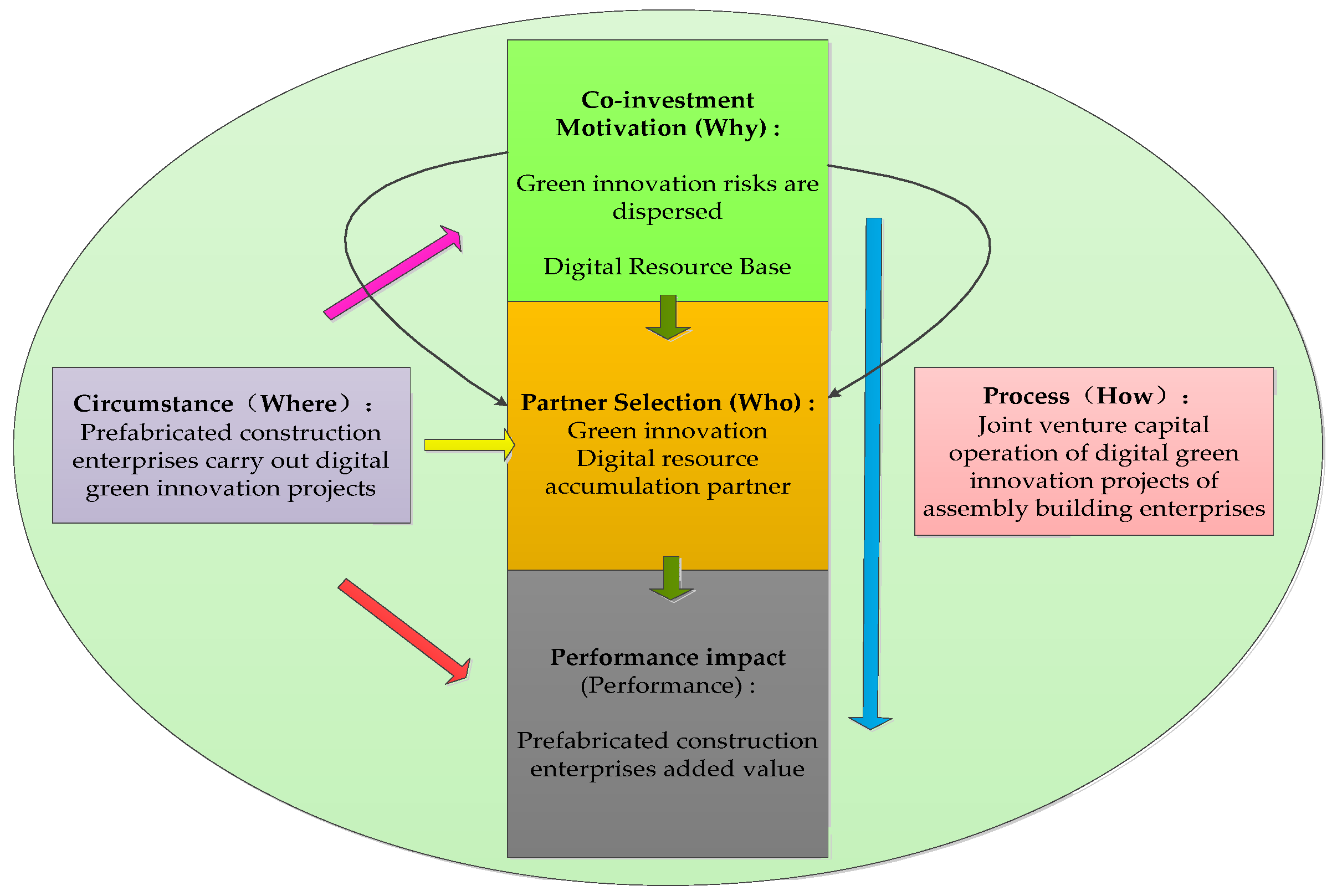

By systematically sorting out and summarizing the five aspects of the knowledge of alliance motivation (why), partner selection (who), situation influence on alliance (where), alliance process (how), and alliance investment influence on the performance of PCEs, it can be found that there is a certain logical relationship between them.

First, motivation affects partner selection, which, in turn, affects firm performance. Namely, PCEs choose joint venture partners based on the risk diversification motivation to carry out digital green innovation projects to promote the enterprise venture investment performance. In this mechanism, PCEs are in different situations, leading to different joint motivations and partner selection behaviors. The impact on performance will be different, and the play of the mechanism will present heterogeneity.

Secondly, partner selection and the impact on the performance of PCEs is to analyze the process of the black box of joint venture investment. PCEs carry out digital green innovation projects to carry out joint venture investment, which is the process of joint venture capital partners investing in PCEs. In this process, joint venture partners and PCEs will play against each other based on the principle of maximizing their own interests.

Finally, it can be seen that PCEs’ selection of joint investment partners is a process of investment behavior. The motivations of joint venture, partner selection, and game behavior in the process of a joint venture are bound to be affected by the situation of joint venture partners and PCEs.

Based on the above analysis and the idea of six analysis methods, thires paper earchers integrated the above logical relations. The activity of PCEs choosing joint venture partners in digital green innovation projects innovatively puts forward a research framework of joint venture capital, 3W1H-P, as shown in Figure 2.

Figure 2. PCEs choose the joint investment partner 3W1H-P research framework.

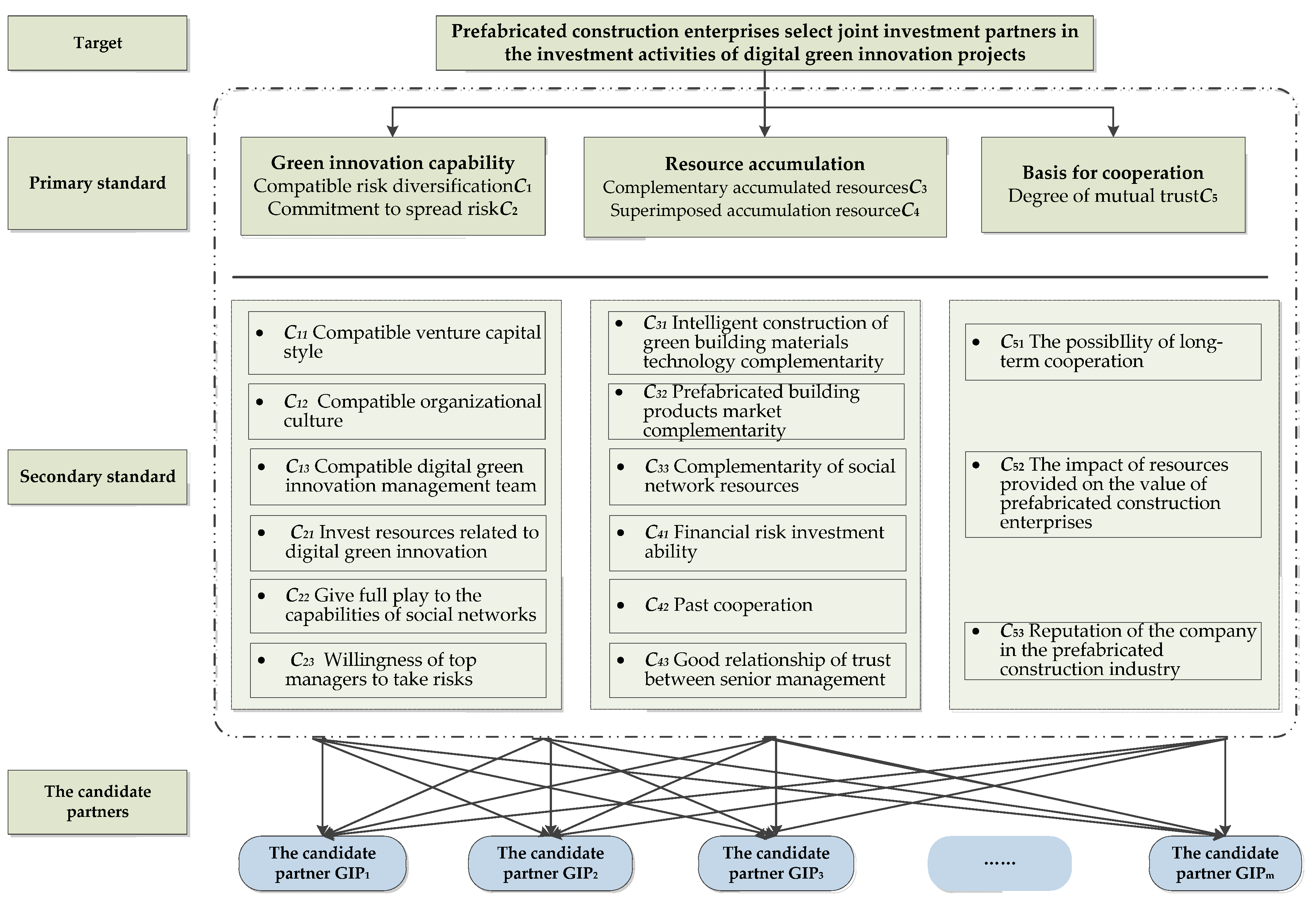

Many scholars have emphasized the importance of partner selection criteria [58,59,60,61,62,63][19][20][21][22][23][24]. Partner selection should be based on the level of environmental protection [60,63][21][24]. Innovative leadership, direct value creation, and value creation support are considered when selecting strategic alliance partners [62][23]. Scholars have put forward their own views on the environmental, economic, social, and ecological aspects [59][20]. At the same time, organizational culture, partners, and other factors cannot be ignored [62][23]. ThiRes paper earchers established a research system for PCEs to select joint venture partners when carrying out digital green innovation projects, as shown in Figure 3.

Figure 3. Criterion framework for PCEs to select joint venture partners when carrying out digital green innovation projects.

References

- Khin, S.; Ho, T.C. Digital technology, digital capability and organizational performance: A mediating role of digital innovation. Int. J. Innov. Sci. 2018, 8, 256–269.

- Li, Y.; Dai, J.; Cui, L. The impact of digital technologies on economic and environmental performance in the context of industry 4.0: A moderated mediation model. Int. J. Prod. Econ. 2020, 229, 107777.

- Kaluarachchi, Y. Potential advantages in combining smart and green infrastructure over silo approaches for future cities. Front. Eng. Manag. 2021, 8, 98–108.

- Jiang, J.H. Sustainable digital era: High-quality integrated development of digital economy and green economy. Enterp. Econ. 2021, 7, 23–30.

- Chaker, N.N.; Nowlin, E.L.; Pivonka, M.T.; Itani, O.S.; Agnihotri, R. Inside sales social media use and its strategic implications for salesperson-customer digital engagement and performance. Ind. Mark. Manag. 2022, 100, 127–144.

- Pence, C.C. How Venture Capitalists Make Investment Decisions; UMI Research Press: New York, NY, USA, 1982.

- Perez, R.C. Inside Venture Capital: Past, Present, and Future; Praeger Pub Text: Westport, CT, USA, 1986.

- Lerner, J. Venture capitalists and the decision to go public. J. Financ. Econ. 1994, 35, 293–316.

- Altintig, Z.A.; Chiu, H.H.; Goktan, M.S. How does uncertainty resolution affect VC syndication? Financ. Manag. 2013, 42, 611–646.

- Tykvova, T.; Schertler, A. Does syndication with local venture capitalists moderate the effects of geographical and institutional distance? J. Int. Manag. 2014, 20, 406–420.

- Manigart, S.; Lockett, A.; Meuleman, M.; Wright, M.; Landström, H.; Bruining, H.; Hommel, U. Venture capitalists’ decision to syndicate. Entrep. Theory Pract. 2006, 30, 131–153.

- Lockett, A.; Wright, M. The syndication of venture capital investments. Omega 2001, 29, 375–390.

- Brander, J.A.; Amit, R.; Antweiler, W. Venture-capital syndication: Improved venture selection vs. the value-added hypothesis. J. Econ. Manag. Strategy 2002, 11, 423–452.

- Verwaal, E.; Bruining, H.; Wright, M.; Manigart, S.; Lockett, A. Resources access needs and capabilities as mediators of the relationship between VC firm size and syndication. Small Bus. Econ. 2010, 34, 277–291.

- Ferrary, M. Syndication of venture capital investment: The art of resource pooling. Entrep. Theory Pract. 2010, 34, 885–908.

- Hopp, C.; Rieder, F. What drives venture capital syndication? Appl. Econ. 2011, 43, 3089–3102.

- Lerner, J. The Syndication of Venture Capital Investments. Financ. Manag. 1994, 23, 16–27.

- Admati, A.R.; Pfleiderer, P. Robust financial contracting and the role of venture capitalists. J. Financ. 1994, 49, 371–402.

- Zhu, Y.Y.; Ma, Z.Q.; Chen, Y.Q. Multi-stage fuzzy comprehensive evaluation of enterprise green technology innovation environment. Sci. Technol. Prog. Countermeas. 2010, 9, 102–105.

- Bi, K.X.; Yang, Z.J.; Huang, P. Regional differences and influencing factors of green process innovation performance in China. China Ind. Econ. 2013, 10, 57–69.

- Ghisetti, C.; Rennings, K. Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117.

- Salamat, V.; Aliahmadi, A.; Pishvaee, M.; Hafeez, K. A robust fuzzy possibilistic AHP approach for partner selection in international strategic alliance. Decis. Sci. Lett. 2018, 7, 481–502.

- Dedehayir, O.; Mäkinen, S.J.; Ortt, J.R. Roles during innovation ecosystem genesis: A literature review. Technol. Forecast. Soc. Chang. 2018, 136, 18–29.

- Yin, S.; Zhang, N.; Li, B. Enhancing the competitiveness of multi-agent cooperation for green manufacturing in China: An empirical study of the measure of green technology innovation capabilities and their influencing factors. Sustain. Prod. Consum. 2020, 23, 63–76.

- Du, Q. Birds of a feather or celebrating differences? The formation and impacts of venture capital syndication. J. Empir. Financ. 2016, 39, 1–14.

- Gompers, P.A.; Mukharlyamov, V.; Xuan, Y. The cost of friendship. J. Financ. Econ. 2016, 119, 626–644.

- Casamatta, C.; Haritchabalet, C. Experience, screening and syndication in venture capital investments. J. Financ. Intermed. 2007, 16, 368–398.

- Hochberg, Y.V.; Lindsey, L.A.; Westerfield, M.M. Resource accumulation through economic ties: Evidence from venture capital. J. Financ. Econ. 2015, 118, 245–267.

- Nikghadam, S.; Sadigh, B.L.; Ozbayoglu, A.M.; Unver, H.O.; Kilic, S.E. A survey of partner selection methodologies for virtual enterprises and development of a goal programming–Based approach. Int. J. Adv. Manuf. Technol. 2016, 85, 1713–1734.

- Chen, S.M.; Han, W.H. A new multiattribute decision making method based on multiplication operations of interval-valued intuitionistic fuzzy values and linear programming methodology. Inf. Sci. 2018, 429, 421–432.

- Gao, M.M.; Sun, T.; Zhu, J.J. Interval-intuitionistic fuzzy multi-attribute decision making based on improved entropy and new score function. Control Decis. 2016, 10, 1757–1764.

- Yin, S.; Yang, Z.; Chen, S.Y. Interval intuitionistic fuzzy multi-attribute decision making based on improved fuzzy entropy. Syst. Eng. Electron. 2018, 5, 1079–1084.

- Liang, R.; Chong, H.Y. A hybrid group decision model for green supplier selection: A case study of megaprojects. Eng. Constr. Archit. Manag. 2019, 26, 1712–1734.

- Zhang, D.; Zhang, B.; Zhang, R.; An, Z.J. Optimal configuration of multi-energy complementary cosupply systems based on entropy-weight TOPSIS. J. Huazhong Univ. Sci. Technol. 2021, 10, 1–8.

- Zhao, Y.G.; Yu, Z. Evaluation of influencing factors of satisfaction of different automobile brands based on entropy-weight variation method. China Automob. 2021, 10, 4–9.

- Liu, Y.; Xiong, S.J.; Wang, F.Q.; Wei, H.F.; Wang, Y. Evaluation of heavy equipment manufacturing resources based on entropy-ideal point method. Heavy Mach. 2021, 5, 49–56.

- Liu, J. Application of fuzzy mathematical model based on combined weights in water quality assessment of Jinghe River reach in Pingliang City. Gansu Sci. Technol. 2021, 16, 33–36.

- Lin, Y.J.; Bai, Q.F. Operation index evaluation of thermal power plant based on combined weight and TOPSIS method. Shandong Electr. Power Technol. 2021, 8, 61–65.

- Chen, W.Q.; Yang, R.Z.; Zhao, Y.F.; Liu, L.P. Evaluation of rock slope stability based on combination-weighted TOPSIS. J. Saf. Environ. 2021, 3, 1–12.

- Chou, J.S.; Truong, D.N. Multiobjective forensic-based investigation algorithm for solving structural design problems. Autom. Constr. 2022, 134, 104084.

More