You're using an outdated browser. Please upgrade to a modern browser for the best experience.

Please note this is a comparison between Version 2 by Dean Liu and Version 1 by Kalfin Kalfin.

Insurance as a form of disaster risk management has developed continually throughout the world. Disaster insurance has also received good responses from communities and governments, as indicated by the demand for disaster insurance both by the community (individuals) and by governments in the form of national disaster insurance.

- natural disasters

- risk

- insurance

- sustainable economic recovery

1. Development of Disaster Risk Insurance

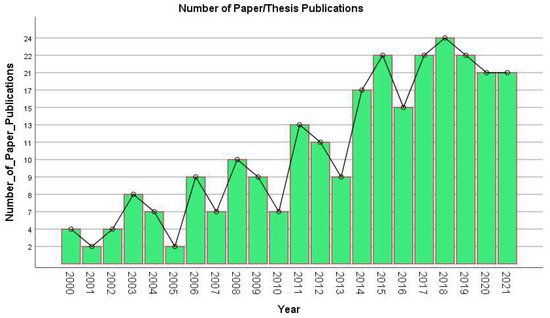

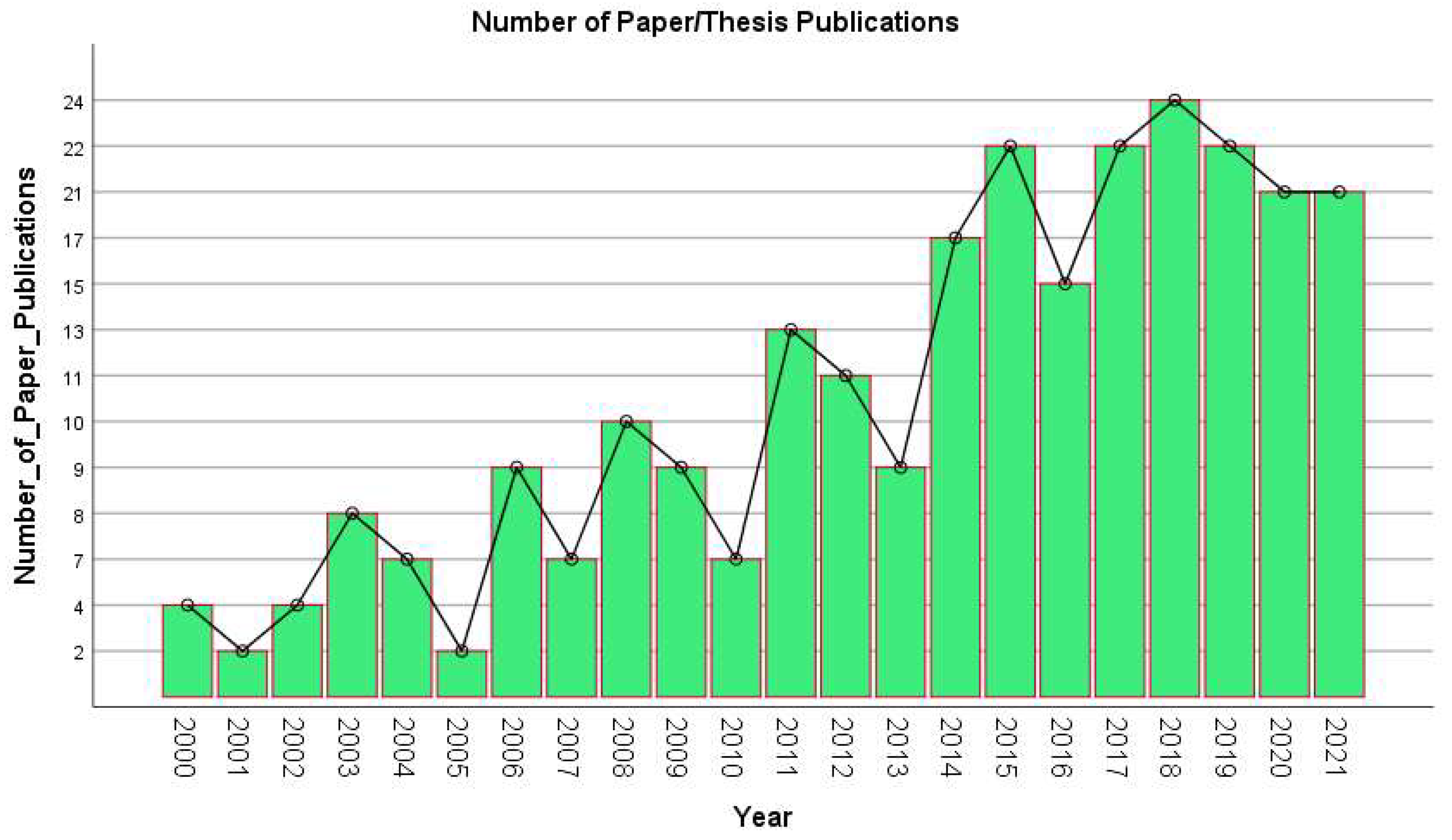

Insurance as a form of disaster risk management has developed continually throughout the world. Disaster insurance has also received good responses from communities and governments, as indicated by the demand for disaster insurance both by the community (individuals) and by governments in the form of national disaster insurance. Disaster insurance can provide an efficient solution for addressing the problem of losses that occur both among the closest communities and on a large scale, namely, the state. Insurance is considered sufficient to help communities in the event of a natural disaster. For example, if a flood disaster occurs, the agricultural sector will experience a significant loss in the form of damage to the crops of farmers. The existence of agricultural insurance can cover the risk of loss to farmers due to the occurrence of a flood disaster [50][1]; however, it should be noted that, in insurance, policyholders need to pay an agreed-upon premium as a form of conversion or compensation for losses experienced by farmers when a disaster occurs. In this case, the party who will convert or provide compensation is the insurance company [51][2]. Research related to disaster risk insurance has attracted a lot of attention among researchers. Research conducted on disaster risk insurance has been widely published in both Scopus and Google Scholar. The research that has been published in this area has tended to increase over the period from 2000 to 2021, as evidenced in Figure 1. Research published in the form of proceedings, journal articles, and doctoral theses was collected in a literature database. The development of disaster risk insurance research each year, from the collected database of articles, is shown in Figure 1.

Figure 1. Data for publication of works from 2000 to2021.

Based on Figure 1, the most publications related to insurance as disaster risk management occurred in 2018, with as many as 24 scientific articles being published. Meanwhile, the fewest number of publications occurred in 2001 and 2005, with only two articles in each of these years. Research in the disaster risk insurance sector has increased significantly leading up to 2021. This has been influenced by the risk of loss and the frequency of natural disasters that occur increasingly each year. Climate change leads to an increase in the frequency of disasters, especially those dependent on weather factors, such as droughts, floods, landslides, and storms. Indirectly, research related to disaster risk insurance is expected to continue to be a concern for researchers, even if it does not mean that the possibility will continue to increase.

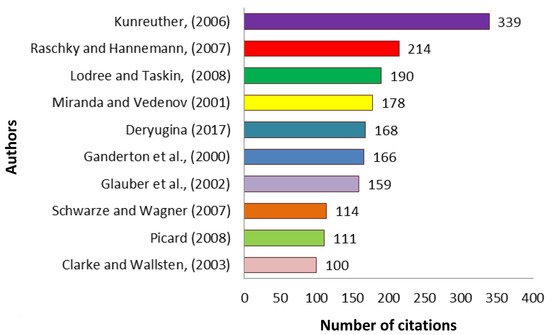

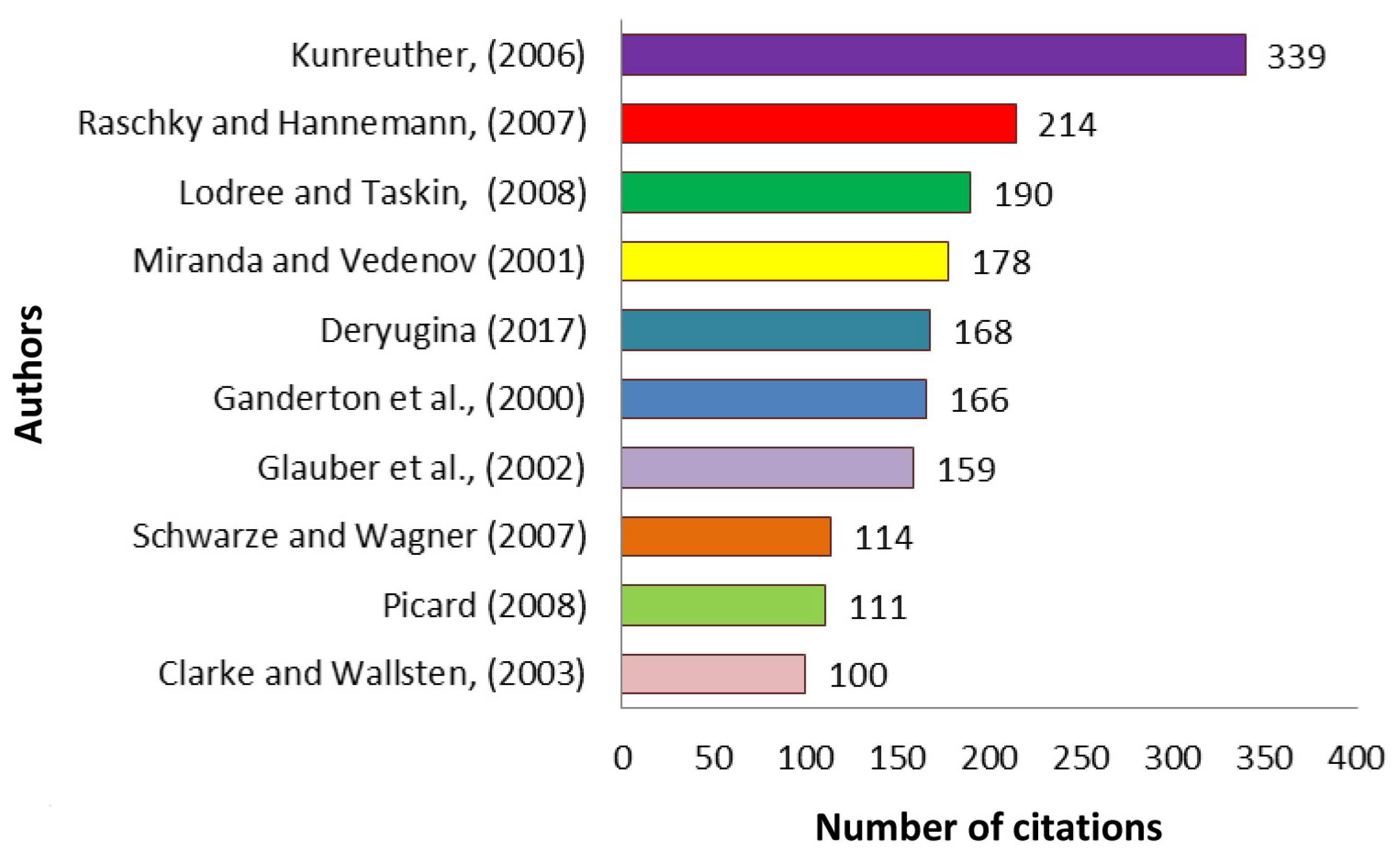

Based on a database of 266 published articles, wresearche rs classified the top 10 articles with the most citations. The citation count indicates how interesting the information provided in an article is, such that it can be used as a reference in other research articles. The more an article is cited, the more interesting the information it provides, and the more references are made in other articles in the following period. Figure 42 shows the citation information of the collected articles, with reference to the search results on Google Scholar.

Figure 2. Top 10 article citations based on the collected database.

The number of citations is not affected by how long ago the article was published. For example, looking at the number of citations in Figure 2, an article published in 2000 was in sixth place, while an article published in 2006 was in the first position. In addition, an article published in 2017 was in the fifth position and, when considering positions six to ten, most articles were published in the earlier part of the considered period; namely in 2000, 2002, 2003, 2007, and 2008. The number of citations of the article in the first position, that by Kunreuther in 2006, was a total of 339 citations in books, proceedings, journal articles, and other forms of articles. The ease of obtaining the article files, the quality of the article, and the information’s level all serve to attract the attention of researchers in making references in their research and determining whether the article may continue to be a reference for researchers in the future. A detailed explanation regarding the research topics discussed in the top 10 articles with the most citations is given in Table 1. Knowing the research topics from the top 10 most-cited articles provides material for evaluating the development of disaster risk insurance, both at present and in the future.

Table 1. Research topics from the top 10 most-cited articles.

| Author | Indexed Database | Keywords | Citation | Focus |

|---|

Table 2. Number of articles in the database by type of insurance in each country.

| Country | Type of Insurance and Number of Articles in the Database | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Kunreuther (2006) [52][3] | Scopus | Disaster insurance, building codes, homeowner motivation, community planning, disaster mitigation, risk assessment | 339 | Insurance, Hurricane Katrina, post-disaster economic recovery | |||||||||

| Raschky and Weck-Hannemann (2007) [53 | |||||||||||||

| China | 8 | 3 | 1 | 5 | 6 | 1 | |||||||

| ][4] | Scopus | Natural hazard insurance, market failure, government assistance | 214 | ||||||||||

| U.S.A. | Insurance, flood disaster, risk of economic loss | ||||||||||||

| 3 | 3 | 6 | 2 | 3 | Lodree and Taskin (2008) [54][5] | Scopus | Inventory, news seller, emergency response, supply chain disruption | 190 | Risk management, insurance, insurance premium | ||||

| Indonesia | 3 | 3 | 1 | 6 | Miranda and Vedenov (2001) [55][6] | Scopus | Agricultural insurance, natural disasters, weather, risk of loss | 178 | Extreme weather, agricultural risk, index-based insurance | ||||

| Korea | 3 | 2 | 3 | 6 | Deryugina (2017) [56][7] | Scopus | Disaster relief, hurricane fiscal costs, social insurance | 168 | Hurricane, climate, risk of loss, insurance | ||||

| Japan | 1 | 3 | 2 | Ganderton et al. (2000) [57][8] | Scopus | Disaster, risk, insurance | 166 | Natural disasters, risk of loss, insurance | |||||

| New Zealand | 7 | 1 | Glauber et al. (2002) [58][9] | Scopus | Disaster risk protection, crop insurance, climate change, disaster relief | 159 | |||||||

| Australia | Extreme weather, crop loss, crop Insurance | ||||||||||||

| 1 | 1 | Description: | Schwarze and Wagner (2007) [59][10] | Scopus | Political economy, natural hazards, flood insurance, Germany, EU | 114 | Flood disaster, insurance, economic loss | ||||||

| England | 1 | Picard (2008) [60][11] | Scopus | Equity–efficiency trade-off, natural disaster insurance | 111 | Natural disasters, risk of loss, insurance | |||||||

| Clarke and Wallsten (2003) [61][12] | Google Scholar | Insurance, Jamaica, altruism, natural disasters, migration | 100 | Hurricane, loss, insurance | |||||||||

2. Types of Disaster Insurance

Natural disasters that occur have different types, and the risks caused by disasters vary. For example, the risk of loss from an earthquake comes typically in the form of damage to buildings while, in a drought disaster, the risk of loss is most felt in the agricultural sector, namely, due to the death of community agricultural crops. Therefore, with the development of research, the types of insurance are progressing. Disaster insurance has become able to focus more on dealing with the specific risk of losses incurred. Disaster risk insurance can be mainly divided into six types: agricultural insurance, flood insurance, property insurance, earthquake insurance, crop insurance, and natural disaster insurance. Based on the database of articles collected, these types of disaster insurance have been widely used in various countries across the world. The purchasing of disaster insurance is adjusted according to the disasters that occur and the risks posed to the country. However, not all countries implement disaster insurance when tackling the risk of losses that occur. In such cases, disaster management still uses assistance from the government, in terms of funding the risk of losses that occur. The availability of disaster insurance by type in each country is detailed in Table 2.| 1 |

| Malaysia | 1 | 2 | Agricultural insurance | |||||

| France | 1 | 1 | ||||||

| Bangladesh | 2 | 1 | Flood insurance | |||||

| India | 1 | 2 | ||||||

| Ethiopia | 1 | Property insurance | ||||||

| Kenya | 1 | |||||||

| Hungary | 1 | Earthquake insurance | ||||||

| Georgia | 1 | |||||||

| Nigeria | 1 | Natural disaster insurance | ||||||

| Netherlands | 3 | |||||||

| Honduras | 1 | Plant insurance | ||||||

| Colombia | 1 | |||||||

| Mongolia | 2 | |||||||

| Caribbean | 1 | |||||||

| Mexico | 1 | |||||||

| Jamaica | 1 | |||||||

| Ghana | 1 | |||||||

| Poland | 1 | |||||||

| German | 1 | |||||||

| Egypt | 1 | |||||||

| Italy | 1 | |||||||

| Uganda | 1 | |||||||

| Georgia | 1 |

3. Methodology Used in Disaster Risk Insurance Studies

Based on the collected database of scientific publications, five main methods are used to determine the type of disaster risk insurance. Based on the results of the analysis, the most frequently used method is the characterization approach, which is present in as much as 40% of the article database. The next method is statistical approaches (in 18% of the article database), followed by inventory approaches (16% of the article database), heuristic approaches (15% of the article database), and deterministic approaches (12% of the article database). Methods using a characterization approach are the most widely used in determining the type of disaster risk insurance, as such an approach is based on the characteristics of the disasters that have occurred in the area being observed. Determination of disaster characteristics based on published articles is carried out by looking at geographic and topographical information in the observed area. Thus, the type of insurance offered is considered acceptable among the public and the government. Thus, in determining the type of disaster insurance by adapting to the characteristics of the disasters in a given area, effective risk management can be provided. Statistical approaches are mostly used to analyse the factors influencing the purchase of certain types of insurance and the number of premiums that are paid by the public. This approach can provide insurance companies with an overview of the type of insurance and the number of premiums paid by the public. Thus, the insurance offered to the public is deemed both acceptable and desirable. Studies using the characterization method are carried out by analysing the geographical and topographic maps of an area to determine the types of disasters that may occur. The software used by the researchers may include ArcGIS (geographical information system) and HidroSIG Java (for visualization and analysis of hydro-climatological data tools). Among the studies applying a statistical approach, there are several statistical analyses that are commonly used, such as regression analysis, the Black–Scholes method, and Structural Equation Modelling (SEM). Among the studies following a statistical approach, researchers generally use software, such as SPSS (for interactive statistical analysis) in the statistical data analysis process, and MATLAB (for numerical computational programming) in the process of determining insurance premiums. Researchers using an inventory approach collect data in the form of the types of disasters and risks that occur in the area studied. These researchers use software such as AutoCAD Map to carry out data processing and the analysis of Geographic Information Systems. In the heuristic approach, the researchers apply a search strategy based on existing supporting data, in the form of disaster risk, to determine the best insurance policy. Finally, the researchers using a deterministic approach seek to estimate the parameters of the insurance model under study. These five approaches used by researchers are generally applied to determine the type of insurance, premiums, influencing factors, or the level of willingness to purchase the insurance on offer. Based on the approach used in determining the type of insurance, the type of disaster due to extreme weather was the most discussed, in as much as 39% of the articles in the database. This was followed by natural disasters in general (as much as 32% of the articles), flood disasters (19%), and earthquake disasters (10%). Of the several researchers who discussed extreme weather disasters, they conducted research on disasters in the form of droughts, storms, floods, and forest fires. The number of researchers discussing extreme weather disasters has been influenced by a significant increase in the potential for disasters that have impacts on various sectors. Several sectors may be affected by extreme weather disasters; for example, an increase in high rainfall causes an increase in the potential for floods and landslides, which have impacts on the risk of loss for community settlements, agricultural land, and livestock. In addition, the research revealed that the mainland of the African continent has experienced the worst droughts. This is due to extreme weather disasters on the mainland of the African continent, causing minimal rainfall and increasing high temperatures, leading to drought on community agricultural land and causing crop failures for agricultural products. According to the research results, several types of insurance related to extreme weather disasters are offered, namely, crop, agricultural, flood, and property insurance.References

- Arshad, M.; Amjath-Babu, T.; Kächele, H.; Mueller, K. What drives the willingness to pay for crop insurance against extreme weather events (flood and drought) in Pakistan? A hypothetical market approach. Clim. Dev. 2016, 8, 234–244.

- Mutaqin, D.J.; Usami, K. Smallholder Farmers’ Willingness to Pay for Agricultural Production Cost Insurance in Rural West Java, Indonesia: A Contingent Valuation Method (CVM) Approach. Risks 2019, 7, 69.

- Kunreuther, H. Disaster Mitigation and Insurance: Learning from Katrina. Ann. Am. Acad. Politi-Soc. Sci. 2006, 604, 208–227.

- Raschky, P.; Weck-Hannemann, H. Charity hazard—A real hazard to natural disaster insurance? Environ. Hazards 2007, 7, 321–329.

- Lodree, E.J., Jr.; Taskin, S. An insurance risk management framework for disaster relief and supply chain disruption inventory planning. J. Oper. Res. Soc. 2008, 59, 674–684.

- Miranda, M.; Vedenov, D.V. Innovations in Agricultural and Natural Disaster Insurance. Am. J. Agric. Econ. 2001, 83, 650–655.

- Deryugina, T. The Fiscal Cost of Hurricanes: Disaster Aid versus Social Insurance. Am. Econ. J. Econ. Policy 2017, 9, 168–198.

- Ganderton, P.T.; Brookshire, D.S.; McKee, M.; Stewart, S.; Thurston, H. Buying Insurance for Disaster-Type Risks: Experimental Evidence. J. Risk Uncertain. 2000, 20, 271–289.

- Glauber, J.W.; Collins, K.J.; Barry, P.J. Crop insurance, disaster assistance, and the role of the federal government in providing catastrophic risk protection. Agric. Financ. Rev. 2002, 62, 81–101.

- Schwarze, R.; Wagner, G.G. The political economy of natural disaster insurance: Lessons from the failure of a proposed compulsory insurance scheme in Germany. Eur. Environ. 2007, 17, 403–415.

- Picard, P. Natural Disaster Insurance and the Equity-Efficiency Trade-Off. J. Risk Insur. 2008, 75, 17–38.

- Clarke, G.; Wallsten, S. Do remittances act like insurance? Evidence from a natural disaster in Jamaica. Evid. A Nat. Disaster Jam. Available SSRN 2003, 1–27.

More