A large gap exists between Argentina’s potential for solar energy utilization and the current solar energy deployment, despite advantages such as a high solar and land resources. This gap is, however, not static: different legal frameworks and governmental promotion programs have led to the deployment of large-scale and distributed off-grid photovoltaic installations, but they are at a volume (in terms of installed capacity) that lags years behind other countries with which Argentina shares relevant characteristics. For example, renewable energies Law 27424 and its implementations through the RenovAR promotion programs for renewable energy (RE) led to a promising initial PV deployment, which nevertheless stagnated.

- Argentina

- solar energy

- deployment

1. Introduction

2. Penetration of Solar Energy

2.1. Grid-Connected Photovoltaic Power Plants

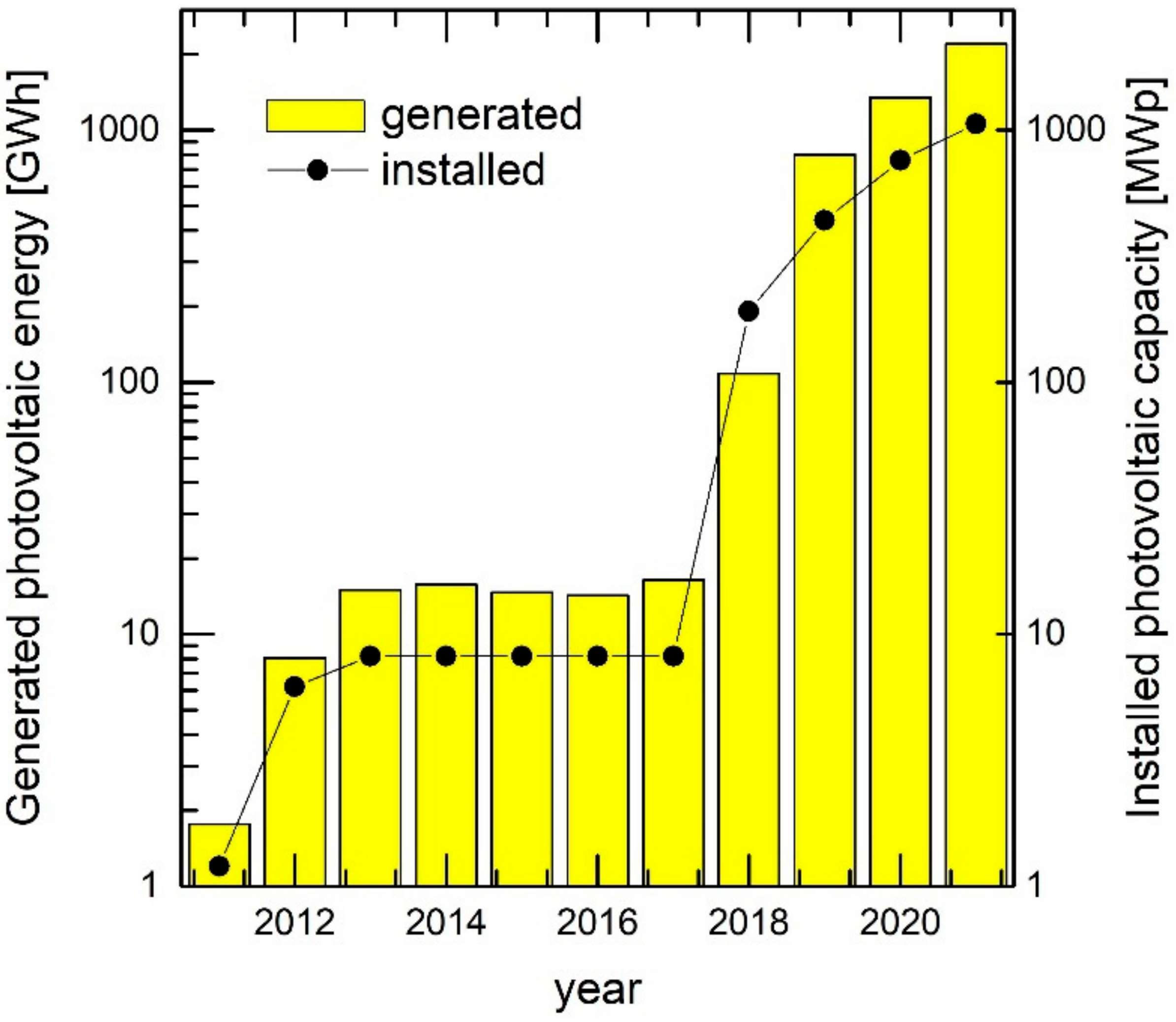

Figure 1 shows the evolution of PV´s contribution in terms of generated annual energy (yellow bars) and installed capacity (line-connected dots) in Argentina. The logarithmic y-axis reveals two waves of PV deployment: the first wave of PV installation corresponds to the GENREN program launched in 2009, while the second corresponds to the RenovAR program starting in 2016, with its successive rounds still being under execution. The 1 GW mark for installed PV capacity was reached very recently, in 2020, during the COVID-19 pandemic.

Small Grid–Connected Generators

Data on distributed generation (DG), available from the Energy Secretariat of Argentina and updated monthly, reports the number of participating user-generators for different applications: residential, commercial and industrial [8]. As of November 2021, a total of 679 DG projects have been connected to the grid, for a total of 8.6 MW, of which 1.5 MW are residential, 6.4 W are industrial and commercial, and 0.7 MW are allocated to other applications. Possible reasons for the small number of residential connections are the net billing scheme adopted in the legislation and the low, subsidized electrical tariffs which are applicable to electricity from conventional sources and large hydro plants. Additionally, there is a question as to whether all grid-connected generators report their projects to the Energy Secretariat, or only those meeting Distributed Energy Generation Incentive Scheme regulations do, which would tend to undercount DG installations.2.2. Off-Grid Photovoltaics

Despite their much smaller size in terms of installed capacity, off-grid photovoltaic installations deserve a separate mention, as they started to appear some 10 years before the grid-connected power plants. The driving force was a government initiative: the Project for Renewable Energy in Rural Markets (or PERMER, for its Spanish acronym). PERMER’s goal is to provide access to energy generated by renewable resources to rural populations located too far from the electric distribution networks to be cost-effectively connected. The project targets homes, rural schools, small communities and small productive initiatives, and subsidizes the equipment and installation cost for the end users [9]. Since the beginning of the project in 1999, up to 2015, rural systems were installed, with a total PV power of over 8 MWp, providing access to electricity to rural residents [9]. Several studies show the immediate social, health, educational and economic benefits linked to project [10]. However, diverse factors slowed down the rate of new installations [11], resulting in an extension of the project (PERMER II) in 2018, which aimed to provide electricity access to more rural residents. The project is currently active, and it is estimated to practically close the electricity access gap nationwide [12].2.3. Analysis of the Local PV Value Chain

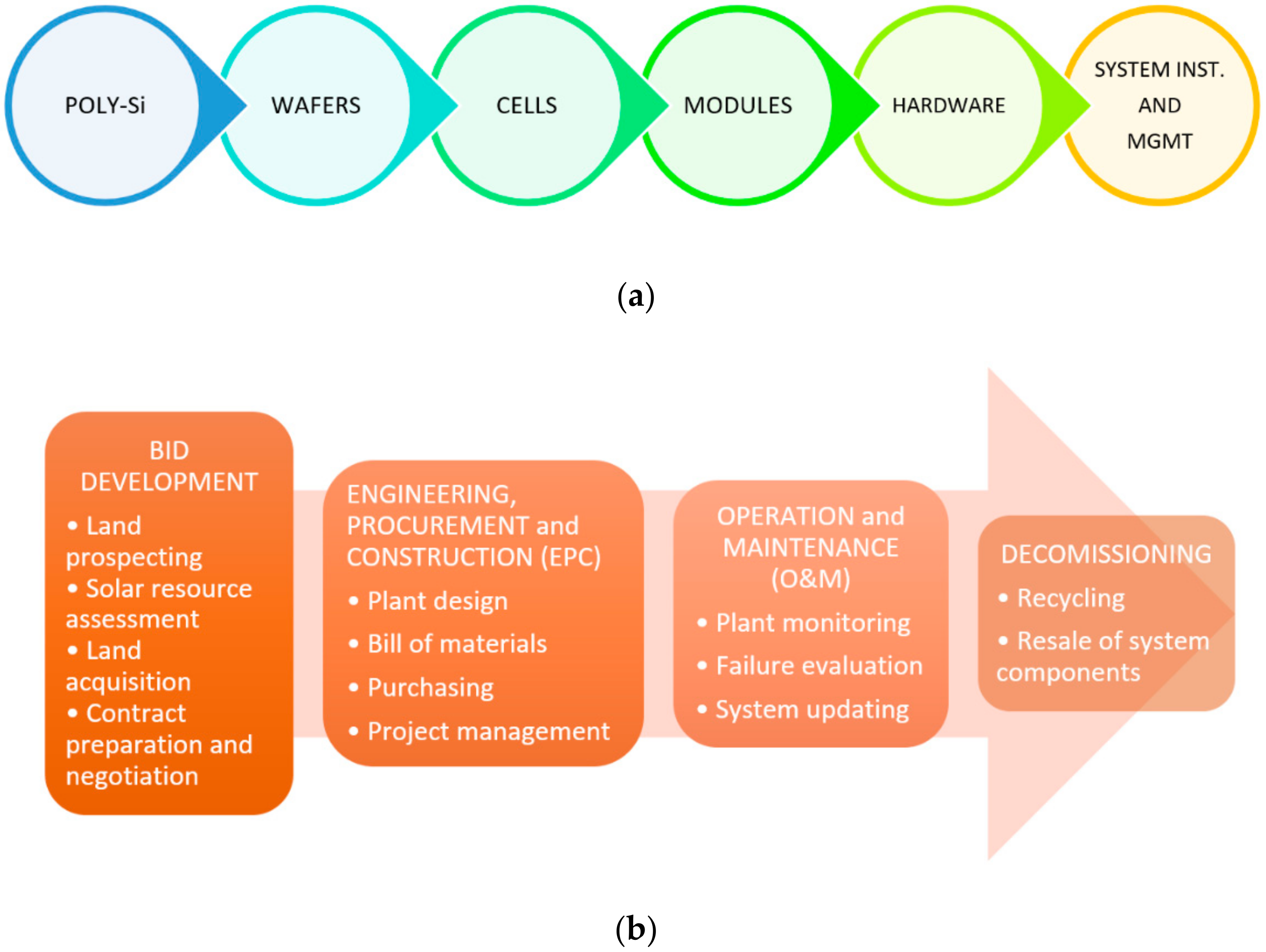

Figure 5a shows the succession of links composing the PV value chain. Because Crystalline Silicon is used in most installations in Argentina . Argentina had a relatively late entry to the PV Industry; therefore, if somebody were to limit ourselves to the description of actors in the PV value chain only up to the module stage (as is common practice [13]), researchers would fail to present a complete picture of Argentina’s PV industry. Therefore, the expanded view of the PV value chain includes links that are key in the delivery of PV energy to the user: ‘Hardware’ and ‘System Installation and Management’, cf. Figure 5. Under this view, Hardware includes, e.g., electronics and module mounting components, while System Installation includes the tasks specified in Figure 5b. According to Gomel and Rogge, data on PV and wind projects show a stated average local component content in the first RenovAR tenders which is typically between 20% and 30% [14].

2.3.1. Local Manufacturing

There is currently no large-scale module manufacturing in Argentina. SOLARTEC was an early participant in the industry, and operated a manual production module line beginning in 1986 with an output, which was highly dependent on the changing protection measures in the local PV market [17]. Its market was initially in communications infrastructure and off-grid rural applications within the PERMER project, with the company eventually expanding into grid-connected applications. A relatively recent entrant, LV-Energy has operated a fully automated module plant since 2014, using solar cells as the input, offering IEC61215 and IEC61730-1/2 certified 280 Wp modules. Regarding larger module production volumes, a key Argentine organization planning to become a high-technology PV manufacturer is EPSE (Energía Provincial Sociedad del Estado). The company, owned by the Province of San Juan, manages and distributes the conventional and alternative energy produced in its territory. In order to incorporate PV technology as a tool in the province’s future, EPSE is currently installing a fully integrated module manufacturing line with a projected yearly output of 71 MW. The semiautomatic line includes all of the processes from casting to module assembly. The German company Gebrüder Schmidt GmbH is supplying the turnkey plant [18]. This project is sited in an area of approximately 41,000 m2, including internal roads and raw materials storage, and includes approximately 12,000 m2 of production and 1100 m2 of offices. This planned line appears too small to compete in price with ‘tier one’ PV manufacturers; however, EPSE’s strategy is to selectively place its product in projects where the effect of the module cost on LCOE can be compensated by other local advantages, while developing PV technology skills and a local material supply chain. EPSE plans first to complete the module production line using imported cells, and to install 350 MW of PV in San Juan during the next five years [19]. As an aside, that during over ten years of PV activity, EPSE has also developed valuable skills in the service side of the PV supply chain, with focus on project design and management. In 2009, EPSE built a 1.2 MW PV pilot plant Solar San Juan I in Ullum, which is shown in Figure 6. The plant includes three silicon technologies: amorphous, multi- and single-crystal silicon, mounted on single- and two-axis trackers and adjustable fixed structures. It is equipped with data acquisition, supervision and control systems, and a state-of-the-art weather station. The data from this pilot plant contributed to a decision to adopt crystalline silicon as the basis for EPSE’s efforts in the industry. A program operated in Argentina and Europe offers training for local professionals using this plant as a tool. EPSE is also promoting other PV projects, notably the construction of a 132 kV/32 kV transformer station and a 132 kV line to connect 185 MW of PV power to the Argentine grid, as well as pilot PV irrigation plants and distributed generation plants [20]. Recently, EPSE has been involved as an EPC contractor in a 50 MW PV plant in Neuquén province. Remarkably, with the approximate coordinates of 38° S, 69° W, this project would be the first MW-sized PV plant located in Patagonia [21].