Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 2 by Bruce Ren and Version 1 by Huanyu Ren.

The tax policies in different sovereigns bring new challenges to the operators of CBSC, especially for the SMEs with weak capital risk resistance. The resulting tax-related costs will significantly affect the firms’performance and consumers' utility. Therefore, the interface between CBSC operations and tax planning has aroused broad concern from the industry.

- cross-border supply chain modeling

- international tax

- tax-effective supply chain

- off-shoring decision

- transfer pricing

1. Introduction

Benefiting from the proliferation of e-commerce platforms and international logistics networks, the material and information flow in cross-border supply chains (CBSC) have been significantly enhanced [1,2][1][2]. A wide range of small- and medium-sized enterprises (SME) and individuals have been involved in cross-border transactions, and operating a CBSC has become one of the core competitive advantages for most companies in the current business environment [3].

However, the tax policies in different sovereigns bring new challenges to the operators of CBSC [4], especially for the SMEs with weak capital risk resistance. The resulting tax-related costs will significantly affect the firms’ performance and consumers’ utility [5]. Therefore, the interface between CBSC operations and tax planning has aroused broad concern from the industry. For example, Deloitte launched a service named “tax aligned supply chain” to help its clients explore tax-savings opportunities from the perspective of supply chain design and management [6].

In practice, operating a tax-effective CBSC is not trivial. First, corporate income tax (CIT) rates vary across jurisdictions. Generally, regions with lower production costs tend to have higher CIT rates. According to Stef van Weeghel [7], the total amount of payable tax as a percentage of firms’ pretax profits in South America reached 53.3% on average in 2018, which is 14.9% higher than that in North America. This gives rise to new trade-offs between tax-saving benefits and production drawbacks [8]. Second, the value-added tax (VAT) export refund policies in different countries are inconsistent, which complicates a firm’s cross-border transactions [9]. For example, unlike other countries, the Chinese government does not apply a zero VAT rate for exported products, and changes in the export VAT refund rate will directly affect the profits of Chinese exporters [10]. Third, trade protectionism and local frictions have increased the uncertainty of CBSC taxes, especially tariff costs [4]. To avoid tax risks, multinational firms (MNF), such as IKEA and Apple, choose to adjust their CBSC structure and reassess their current offshore production and global procurement strategies. Finally, regional trade agreements (RTAs) and the corresponding preferential tariff areas are undergoing significant changes. According to the WTO [11], in recent years, there has been a significant increase in the number and scope of RTAs, and the number of RTAs under negotiation has increased even more significantly. To enjoy the tax benefits delivered by RTAs, the production and procurement of MNFs must meet the corresponding rules of origin, which usually is costly for many firms.

As mentioned above, with the new changes in the international business environment, operators of CBSCs need to pay considerable attention to the impact of different taxes. Academia has widely recognized the necessity of incorporating tax effects into CBSC models. However, most of the existing articles focus on certain tax types or tax regulations, such as carbon taxes [12[12][13],13], VAT rebate policies [9], tax cross-crediting policies [14], and CIT rate gaps [15].

To the best of our knowledge, only the interdisciplinary research of Henkow and Norrman [6] synthesized the impact of different types of tax policies on CBSC operations. Specifically, they combined the cross-border logistics system descriptions (based on workshops and interviews) with the legal analysis (from professional tax planners) to apply the main principles of the tax system to the design of cross-border logistics solutions. Although their study provided significant practical insights, it does not address the theoretical models. Moreover, the application scenarios of their research results are limited, as they only analyzed the impact of tax policies from the perspective of cross-border logistics solutions. Other related literature (or theoretical) reviews, such as the research of Cohen and Lee [4] and Handfield et al. [16], focused on the impact of new changes in the current global trade environment, including COVID-19, tariffs, and trade wars on CBSC operations. Their study indicated the significant impact of tax policies on CBSC operations but did not provide a systematic analysis for different tax policies. The specific impact and action mechanisms of different tax policies on CBSC operations are still unclear.

2. The Interface between CBSC Operations and Taxes

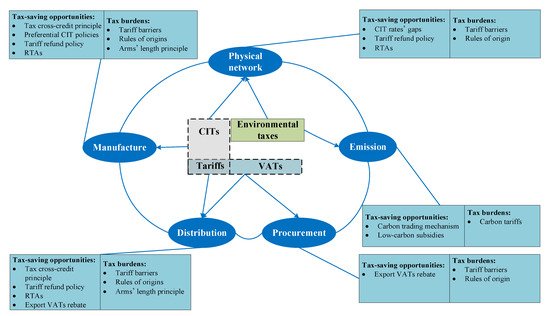

As shown in Figure 1, this study constructs a conceptual framework to analyze the interface between the tax system and CBSC operations.

Figure 1. The interaction between CBSC operations and the tax system.

The taxes that significantly affect CBSC operations include tariffs, CIT, VAT, and environmental taxes. Among them, tariffs affect a CBSC’s distribution decisions by changing the landed costs of cross-border products. In addition, the tariff uncertainty caused by trade frictions will make an MNF’s manufacturing headquarters more inclined to adopt a localized production strategy to avoid tariff risk. In addition to tariffs, the CIT is also one of the major concerns for MNF capacity investment decisions. The difference in CIT rates across different countries and the CIT incentives in emerging countries, such as the countries along the Belt and Road, offer MNFs considerable tax-saving opportunities when formulating appropriate offshoring decisions.

In contrast to the impact of tariffs and CITs, the VAT, as a kind of turnover tax, has more complex impacts on CBSC decisions, which largely depend on the VAT collection and refund policies for cross-border transactions in different countries. Taking China’s export-oriented VAT as an example, the government adopts the VAT regulation of “exemption, credit and refund” based on the exported goods’ FOB price. The calculation of the VAT payable to the Chinese tax authority is as follows [9,10][9][10]:

VAT payable to tax authority = domestic sales × VAT rate + (export sales − cost of imported materials) × (VAT rate − VAT refund rate) − input VAT

The Chinese government does not offer a zero export VAT rate, and the changes in the VAT refund rate will be magnified by multiplying export sales. Specifically, an increase in the VAT refund rate not only improves the revenue per product of Chinese exporters but also encourages MNFs to purchase more raw materials from China.

3. The Evolution of Supply Chain Themes

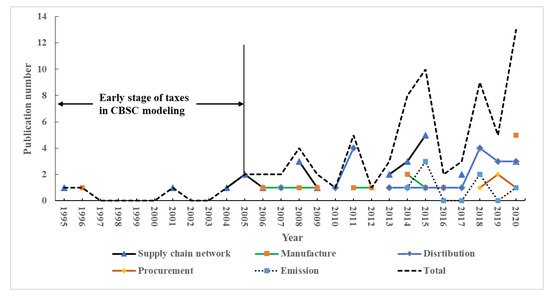

The evolution of supply chain themes in the selected articles is presented (see Figure 2). It is apparent that the tax-related supply chain themes have tended to diversify since 2005.

Figure 2. The evolution of supply chain themes over time.

Before 2005, researchers were mainly focused on the global supply chain network design problem. The corresponding decision-support models were based on mixed-integer programming models with the objective of maximizing global after-tax profit. Tax-related factors were treated as variable costs, which are proportional to freight volume or revenue. In this way, although tax costs were considered, they did not change the model structure of the typical CBSC network design problem [28,47,48][17][18][19]. Wilhelm et al. [25][20] improved the traditional CBSC network design models to cope with NAFTA’s influence, and they were the first to study this problem, i.e., global supply chain network design considering a specific tariff policy.

From 2005 to the present, extensive research has focused on other operational decisions, in addition to supply chain network design, to cope with tax-related issues. The most apparent tax-saving opportunities come from the combination of distribution decisions, such as distribution channel structure, transfer pricing, and CIT gaps in different countries [9,64,66][9][21][22]. In addition, embedding the tax effects into manufacturing decisions such as production outsourcing strategy [49,53,78][23][24][25] and procurement decisions [10] can also significantly reduce the tax costs in a CBSC.

The research methodologies applied in each supply chain theme are presented in Table 1. For the themes of the supply chain network, manufacture, and distribution, both quantitative and qualitative methodologies are applied to analyze the impacts of different taxes. However, qualitative methodologies, such as case studies and theoretical/literature reviews, are lacking for the themes of procurement and emissions.

Table 1. Research methodologies for each supply chain theme.

| Supply Chain Network | Manufacture | Distribution | Procurement | Emission | |

|---|---|---|---|---|---|

| MIP model | √ | √ | √ | ||

| NLP model | √ | √ | √ | √ | |

| Game theory model | √ | √ | √ | √ | |

| Newsvendor model | √ | √ | √ | ||

| Equilibrium model | √ | √ | |||

| MLP model | √ | √ | |||

| Dynamic programming model | √ | ||||

| Deep learning | √ | ||||

| Structural equations model | √ | ||||

| Interpretive structural model | √ | ||||

| Questionnaire surveys/Semi-structured interviews | √ | √ | |||

| Case study | √ | ||||

| Theoretical/literature review | √ | √ | |||

| System dynamics model | √ | ||||

| Simulation experiment based on discrete events | √ |

4. The Impacts of Different Taxes

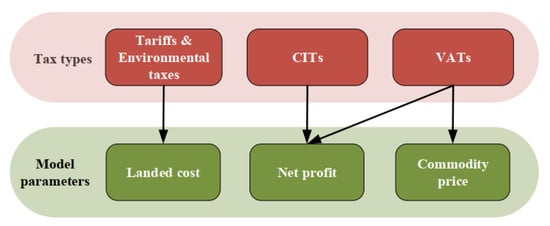

The tax types investigated in the selected articles include CIT, tariffs, environmental taxes, and VAT. Furthermore, different types of taxes affect the operation of CBSCs in different ways.

As shown in Figure 3, environmental taxes and tariffs will directly affect the landed cost of markets in different jurisdictions and then change the production configuration along a global supply chain, which has been fully explained in the existing supply chain network design model. In addition to the function of production configuration, tariff costs could also affect an MNF’s production outsourcing decision, and this impact may even outweigh the rising transportation cost and falling labor cost. For example, many MNFs located in developed economies, especially the USA, were considering reshoring overseas plants because of the rise of tariffs in their home countries.

Figure 3. The impact of taxes on CBSC model parameters.

In many cases, the CIT alone may account for more than thirty percent of an MNF’s total pretax income. Furthermore, MNFs tend to shift their taxable income from high-tax to low-tax jurisdictions to exploit tax rate differentials [95][26]. In practice, managers can affect taxable income through transfer pricing, i.e., transactions between different divisions located in different jurisdictions. Although the price charged for the products is fully determined by the managers, it is still subject to different jurisdictional regulations. The interactions among the transfer price, tax rate differentials, and regulations in different jurisdictions make capacity decisions that consider the impact of transfer prices nontrivial.

The regulations concerning VATs mainly affect CBSC modeling in two aspects: commodity prices andfirmnet profit. For example, Hsu and Zhu [9] focused on China’s export-oriented tax rules, i.e., export VAT rebate regulations. They found that China’s export VAT rebate regulations will significantly affect supply chain organizational structures, i.e., reallocating at the final product level or at the imported component level and keeping a single bonded warehouse or two warehouses for bonded and unbonded inventories.

5. New Trade-Offs

Based on the summary of the selected articles and the observation of real cases, the new trade-offs that international taxes bring to CBSC operations are presented in this section.

The most significant trade-offs occur in the reverse relationship between preferential CIT policies and material acquisition costs. In general, emerging manufacturing countries adopt preferential CIT policies to attract MNFs’ capacity investment; for example, countries along the Belt and Road have reduced or exempted the CIT of the first five years for MNFs that come to build factories there. However, these emerging manufacturing countries generally do not have a complete supply network, and MNFs building factories in these countries will inevitably lead to an increase in material acquisition costs.

In addition, an MNF’s global procurement strategy and the increasingly strict rules of origin are other trade-offs in CBSC operations. In the current global trading environment, both developed and developing countries are committed to expanding the domestic portion of the global value chain and forming appropriate ROOs to achieve this goal. For example, due to the procurement of components from China, Caterpillar, a famous American machinery and equipment manufacturer, bears an additional cost of 250 million to 350 million US dollars due to high tariffs.

In addition to the above two trade-offs, the increasing tariff barriers bring additional trade-offs for MNFs’ offshore production strategy. The offshore production mode plays an essential role in the world economy. MNFs such as Apple and IBM have established offshore partnerships with contract manufacturers around the world. On the one hand, by outsourcing production, MNFs can focus on product research and development; MNFs, as brand owners, can utilize the location advantages of offshore manufacturers to open up overseas markets while reducing unit production costs. However, with the increase in tariff barriers, the cost advantage of offshore production is no longer obvious.

References

- Durbhakula, V.K.; Kim, D.J. E-business for Nations: A Study of National Level Ebusiness Adoption Factors Using Country Characteristics-Business-Technology-Government Framework. J. Theor. Appl. Electron. Commer. Res. 2011, 6, 1–12.

- Knol, A.; Tan, Y.H. The Cultivation of Information Infrastructures for International Trade: Stakeholder Challenges and Engagement Reasons. J. Theor. Appl. Electron. Commer. Res. 2018, 13, 106–117.

- Navaretti, G.B.; Venables, A.J. Multinational Firms in the World Economy; Princeton University Press: Princeton, NJ, USA, 2020.

- Cohen, M.A.; Lee, H.L. Designing the right global supply chain network. MSOM-Manuf. Serv. Oper. Manag. 2020, 22, 15–24.

- Cerrillo, R.A.; Rodriguez, M.G.L. Tax Implications of Selling Electronic Books in the European Union. J. Theor. Appl. Electron. Commer. Res. 2016, 11, 28–40.

- Henkow, O.; Norrman, A. Tax aligned global supply chains: Environmental impact illustrations, legal reflections and crossfunctional flow charts. Int. J. Phys. Distrib. Logist. Manag. 2011, 41, 878–895.

- Stef van Weeghel, A.P.; Dane, T.; Ramalho, R.; Croci, S.; Nasr, J. Paying Taxes 2020; PwC, the World Bank and International Finance Corporation: Washington, NY, USA, 2020; pp. 1–11.

- Feng, C.M.; Wu, P.J. A tax savings model for the emerging global manufacturing network. Int. J. Prod. Econ. 2009, 122, 534–546.

- Hsu, V.N.; Zhu, K.J. Tax-effective supply chain decisions under China’s export-oriented tax policies. MSOM-Manuf. Serv. Oper. Manag. 2011, 13, 163–179.

- Xu, J.Y.; Hsu, V.N.; Niu, B.Z. The impacts of markets and tax on a multinational firm’s procurement strategy in China. Prod. Oper. Manag. 2018, 27, 251–264.

- WTO. Regional Trade Agreements; World Trade Organization: Geneva, Switzerland, 2020.

- Singh, S.; Haldar, N.; Bhattacharya, A. Offshore manufacturing contract design based on transfer price considering green tax: A bilevel programming approach. Int. J. Prod. Res. 2018, 56, 1825–1849.

- Schenker, O.; Koesler, S.; Löschel, A. On the effects of unilateral environmental policy on offshoring in multi-stage production processes. Can. J. Econ. 2018, 51, 1221–1256.

- Hsu, V.; Hu, Q.H. Global sourcing decisions for a multinational firm with foreign tax credit planning. IISE Trans. 2020, 52, 688–702.

- Hammami, R.; Frein, Y. Integration of the profit-split transfer pricing method in the design of global supply chains with a focus on offshoring context. Comput. Ind. Eng. 2014, 76, 243–252.

- Handfield, R.B.; Graham, G.; Burns, L. Corona virus, tariffs, trade wars and supply chain evolutionary design. Int. J. Oper. Prod. Manag. 2020, 40, 1649–1660.

- Arntzen, B.C.; Brown, G.G.; Harrison, T.P.; Trafton, L.L. Global supply chain management at Digital Equipment Corporation. Interfaces 1995, 25, 69–93.

- Fandel, G.; Stammen, M. A general model for extended strategic supply chain management with emphasis on product life cycles including development and recycling. Int. J. Prod. Econ. 2004, 89, 293–308.

- Vidal, C.J.; Goetschalckx, M. A global supply chain model with transfer pricing and transportation cost allocation. Eur. J. Oper. Res. 2001, 129, 134–158.

- Wilhelm, W.; Liang, D.; Rao, B.J.; Warrier, D.; Zhu, X.Y.; Bulusu, S. Design of international assembly systems and their supply chains under NAFTA. Transp. Res. Part E Logist. Transp. Rev. 2005, 41, 467–493.

- Nagurney, A.; Besik, D.; Nagurney, L.S. Global supply chain networks and tariff rate quotas: Equilibrium analysis with application to agricultural products. J. Glob. Optim. 2019, 75, 439–460.

- Niu, B.Z.; Xu, J.W.; Lee, C.K.M.; Chen, L. Order timing and tax planning when selling to a rival in a low-tax emerging market. Transp. Res. Part E Logist. Transp. Rev. 2019, 123, 165–179.

- Niu, B.Z.; Li, Q.Y.; Liu, Y.Q. Conflict management in a multinational firm’s production shifting decisions. Int. J. Prod. Econ. 2020, 230, 107880.

- Xiao, W.Q.; Hsu, V.N.; Hu, Q.H. Manufacturing capacity decisions with demand uncertainty and tax cross-crediting. MSOM-Manuf. Serv. Oper. Manag. 2015, 17, 384–398.

- Fang, Y.; Yu, Y.G.; Shi, Y.; Liu, J. The effect of carbon tariffs on global emission control: A global supply chain model. Transp. Res. Part E Logist. Transp. Rev. 2020, 133, 101818.

- Drtina, R.; Correa, H.L. How transfer prices can affect a supply chain strategic decision. Int. J. Logist. Syst. Manag. 2011, 8, 363–376.

More