Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 1 by Feyruz Mustafayev and Version 2 by Vivi Li.

Azerbaijan has a well-developed hydrocarbon industry backed with abundant domestic resources. Oil and gas have played a crucial role in the economic revival of the country since independence was regained back in 1991. The legal foundation of the transition to carbon-zero energy generation was laid in the 1990s with a number of acts mentioning the importance of the shift. The government has an ambitious plan to improve the situation, though an action plan with targeted renewables share in production and consumption is still to be prepared.

- Azerbaijan

- renewable energy

- solar power

- wind power

1. Introduction

Renewable energy is no longer an unusual source but is an inevitable transformation path that has become a focal point for almost all countries around the world. The advantages of renewable sources over conventional energy sources have been debated and proved in many platforms up to now. The major pros of hydrocarbons—lower price—are vanishing at a high pace with the technological development pushing green energy prices lower. As per the latest figures, high-efficiency solar and wind-based generation undercuts even the cheapest fossil-based generation plants in terms of levelized cost of electricity (LCOE) in 2020 [1]. According to the International Renewable Energy Agency (IRENA), wind and solar installation costs have seen up to an 81% decrease during 2010–2020, while the LCOE for those sources became cheaper by up to 85% (see Table 1).

| Total Installed Costs | Levelized Cost of Electricity | |||||

|---|---|---|---|---|---|---|

| (2020 USD/kW) | (2020 USD/kWh) | |||||

| 2010 | 2020 | Percent Change | 2010 | 2020 | Percent Change | |

| Solar PV | 4731 | 883 | −81% | 0.381 | 0.057 | −85% |

| Onshore wind | 1971 | 1355 | −31% | 0.089 | 0.039 | −56% |

| Offshore wind | 4706 | 3185 | −32% | 0.162 | 0.084 | −48% |

Meanwhile, the share of renewables in global energy generation increased to 29% in 2020, a 2% increase in comparison to 2019 [2].

Azerbaijan’s renewable energy journey is relatively new as its abundant fossil fuel reserves have long been serving as the main raw material for energy generation. Low production price, high energy security in terms of resource supply, and huge capital investments in the oil and gas industry have resulted in a long-standing focus on hydrocarbons as the sole resource to generate energy. Thus, the momentum of transition to carbon-zero energy generation in Azerbaijan is challenged by a lack of solid legal framework, no expertise on the matter, and low private and public capital investments. Since its independence, the shift to renewables has been obscured by the comfort of the immense domestic hydrocarbon resources of Azerbaijan. Nonetheless, understanding the scarcity of resources in lieu of decreasing extraction levels makes it clear that long-term reliance on hydrocarbons as the sole option to generate energy is unsustainable. The BP report presented figures showing the reserves-to-production (R/P) ratio of oil in Azerbaijan is around 24 years. The same indicator for natural gas is around 117 years though [3].

The shift to renewables accelerated during the last two decades with a number of renewable projects implemented and announced to be accomplished in the near future. Limited expertise in the industry, insufficient legal framework, and low public awareness on the topic are some of the challenges the country is facing. The major document to boost the green energy program, the State Program on the Use of Alternative and Renewable Energy Sources in the Republic of Azerbaijan, was adopted in 2004 with a clear-cut action plan defining relevant state entities responsible for implementation and setting timeframes for each of them [4]. The 2004 Program specifically listed wind, solar, hydro, biomass, and geothermal power accentuating existing privilege in terms of the abundance of mentioned resources. Nonetheless, no specific measures to attract private capital, liberate the energy market, incentivize ownership of green resources as the main source of energy generation were introduced.

2. Energy Infrastructure, Production and Consumption in Azerbaijan

Oil and gas have historically been the main commodity in Azerbaijan to produce income, generate energy, open workplaces, and develop the economy. The first industrial oil well was drilled in Bibi-Heybat, Azerbaijan in 1848. Local sources claim it was the first-ever industrial well [5][6][12,13]. The next fully industrial well in Azerbaijan was built in 1871 in Balakhani. As of 1872, Azerbaijan was already extracting more than a million poods (pood is a unit of mass measurement equivalent to 16.38 kg; Yakovlev, Development of Wrought Iron Production, Metallurgist press, 1957) of oil and reached a hallmark of 500 million poods in 1899 [7][14]. The historical expertise and loyalty to conventional resources, which became the main revenue generator in the late 1800s, transformed into a developed industry after the 1960s. All these combined with a relatively low level of development of REI, paved the path for fossils to become the cornerstone of the energy infrastructure in Azerbaijan.

Thus, the current energy infrastructure of Azerbaijan is heavily dependent on fossils, as 5550.5 MW out of 6721.5 total installed capacity relies on hydrocarbons to produce electricity. Hydropower plants are the second major contributor to the overall generation with an installed capacity of 1.171 MW (for the major power generating plants see Table 23).

| Thermal Power Plants (TPP) | Hydro Power Plants (HPP) | Small Hydro Power Plants (SHPP) |

|---|---|---|

| Azerbaijan TPP—2400 MW | Mingachevir HPP—402 MW | Gulabird SHPP—7.5 MW |

| Janub PP—780 MW | Shamkir HPP—380 MW | Oghuz SHPP 1,2 & 3–3.6 MW |

| Sumgait PP—525 MW | Yenikend HPP—150 MW | Goychay SHPP—3.1 MW |

| Shimal 1 and 2 PPs—800 MW | Fuzuli HPP—25 MW | Ismayıllı-1 SHPP—1.6 MW |

| Sangachal PP—300 MW |

16].

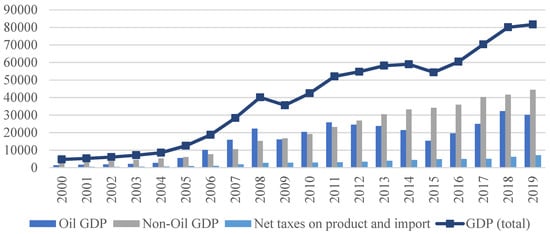

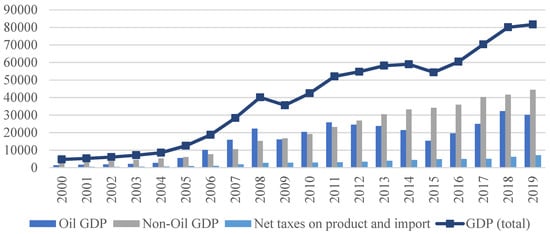

Soon after revenues from the sales of oil and gas resources started flowing, it became the major contributor to the economy of Azerbaijan. The share of oil- and gas-related income in gross domestic production (GDP) yielded significantly after the Baku-Tbilisi Jeyhan oil pipeline was set for operation in 2005 (see Figure 3).

Figure 3. Composition of GDP of Azerbaijan in million AZN [10][17] (USD 1 equals to AZN 1.7 as of 18 October 2021. Exchange rates are fixed and managed by the Central Bank of Azerbaijan (www.cbar.az, accessed on 18 October 2021). Average inflation rate for 2000–2020 in Azerbaijan constitutes 6.39% [11][18]).

The utilization of sunlight and wind as energy generation resources started a decade ago. Though in low capacity, wind and solar farms are not a rarity anymore. The State Agency for Alternative and Renewable Energy (SAARE) has implemented and drafted a number of wind and solar farm projects. The 2014 report of the SAARE included information about 12 wind plants with a total installed capacity of 402.94 MW (see Table 34). The 2018 presentation of the Ministry of Energy envisioned the development of 6 wind plants without giving detailed information on the earlier announced wind plants (see Table 45).

| Name of the WEP | Output Capacity (MW) | Location |

|---|---|---|

| Gobustan | 2.7 | Gobustan |

| Project Title | Capacity (MW) | |

|---|---|---|

| Khizi-1 (Shurabad) | 56.1 | |

| Shurabad | 15 | Khizi |

| Takhtakorpu HPP—25 MW | ||

| Ismayıllı-2 SHPP—1.6 MW | ||

| Baku TEC—107 MW | Shamkirchay HPP—25 MW | Balaken-1 SHPP—1.5 MW |

| Baku PP—105 MW | Varvara HPP—16.5 MW | Gusar SHPP—1 MW |

| Shahdagh PP—105 MW | Araz HPP—44 MW | Vaykhır HPP—5 MW |

| Astara PP—87 MW | Bilev HPP—22 MW | |

| Shaki PP—87 MW | Arpachay 1, Arpachay 2—21.9 MW | |

| Khachmaz PP—87 MW | Ordubad HPP—36 MW | |

| Nakhchivan PP—87 MW | ||

| Nakhchivan gas-turbine PP—64 MW |

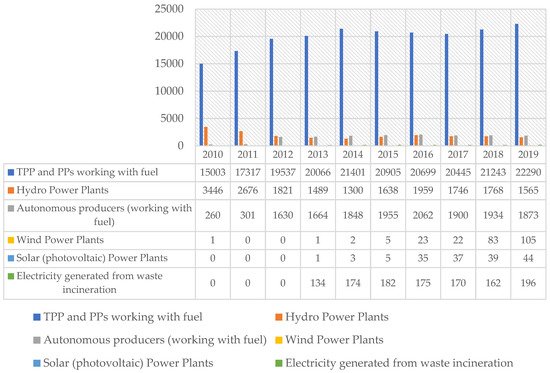

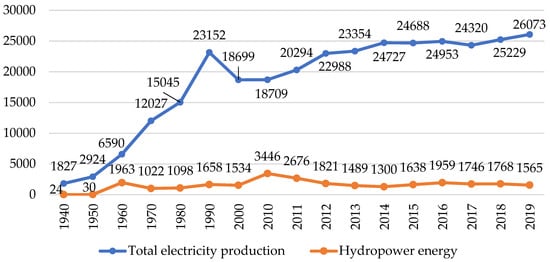

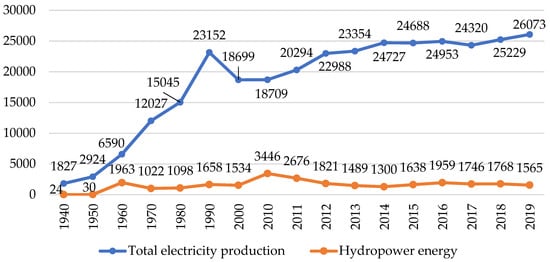

Not surprisingly, fossils remain the major shareholder in electricity production by resource type indicator. Hydrocarbon-based power and thermal power plants generate 22,290 million kWh out of the total of 26,072 million kWh electricity in 2019 (see Figure 1).

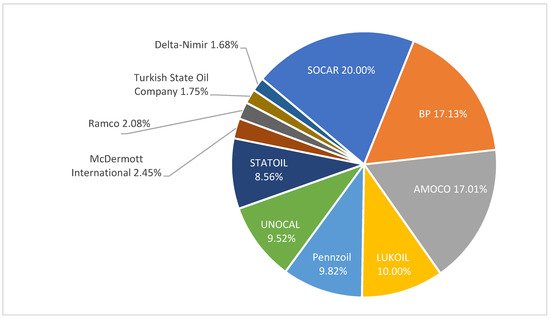

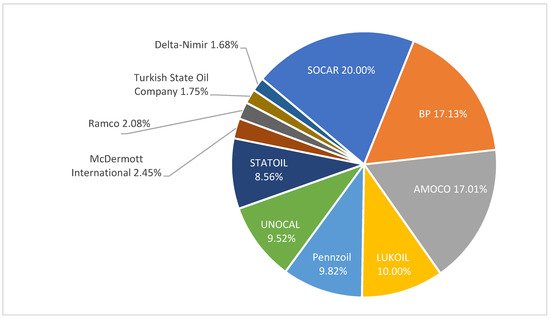

Oil and gas extracted from various spots, but mainly from the Caspian basin, helped not only with power generation, but became the main locomotive of the economy since the “Contract of the Century” was signed in 1994, three years after Azerbaijan declared its independence. Eleven global scale companies from seven countries have signed joint development and production sharing agreement that opened doors for cash flow into the hydrocarbon industry (see Figure 2).

| 25 | ||||

| Khizi-2 HES | 69.0 | |||

| Khizi | ||||

| Pirakushkul | 60 | Pirakushkul 1 | ||

| Pirallahi-2 | 150 | Pirakushkul 2 | ||

| Shurabad | 33 | Khizi | ||

| Sitalchay | 25 | Khizi | ||

| Khizi | 3.6 | Khizi | ||

| 7.2 | ||||

| Samukh-1 | 0.4 | |||

| Samukh-2 | 7.2 | Mushfiq | 9 | Mushfiq settlement |

| Pirallahi Wind Park | 15 | Caspian Sea | ||

| New Yashma | Baku | |||

| Clean City | 9.6 | Zira | ||

| Samukh Agro-Energy Complex | ||||

| Gobustan HES (solar component) | 5 | Samukh | ||

| TOTAL | 402.94 |

| Khizi-3 | |

| 5.0 | |

| Khizi-2 HES (solar component) | 10.0 |

| Absheron HES (solar component) | 10.0 |

| Siyazan | 4.5 |

| TOTAL | 50 |

Despite abundant sunlight, much attention is paid to the development of wind electricity production if to analyze the number of envisaged solar projects in comparison to the prospective wind farms announced.

In 2019, the government of Azerbaijan struck a deal with well-established companies to set up solar and wind plants. A solar plant with a total output capacity of 200 MW is agreed to be set up in Azerbaijan jointly with Abu Dhabi Future Energy Company “Masdar”. The annual electricity generation capacity of the plant is estimated to be around 410,000 MWh. The estimated cost of the project is USD 120 million. The LCOE of solar electricity generated in the mentioned projects will be approximately equal to USD 0.031 per kWh, as per available information (the calculation is carried out based on the exchange rate provided by the Central Bank of Azerbaijan for 14 August 2021; 1 USD equals 1.7000 AZN (www.cbar.az, accessed on 14 August 2021)). In the same year, the government signed a contract with the “ACWA Power” company of the United Arab Emirates on the construction of a wind energy plant with an output capacity of 240 MW. The anticipated yearly electricity output of the project is equal to 1 million MWh. The construction cost is estimated to be around USD 280 million. The LCOE of electricity generated in these plants will approximately equal to USD 0.032 per kWh. The energy market remains monopolized by public entities, although existing legislation allows private generators to become an actor. The main actors in the energy market are listed in Table 67.

Table 67. Key energy market actors.

| Actors | Roles | |

|---|---|---|

| 1 | Ministry of Energy | Regulates the market; acts as the main body responsible to implement the legal acts |

| 2 | Azerenerji OJSC | Produces electricity |

| 3 | 135.0 | |

| Absheron HES | 55.2 | |

| Lokbatan | 26.7 | |

| Gobustan HES | 8.0 | |

| TOTAL | ||

| 50 | ||

| Khizi | ||

| 350 | Ecological Park | 0.04 |

The total installed solar capacity was 40 MW across 11 plants, as per the Ministry of Energy of Azerbaijan in 2020 [14][20].

Unfortunately, there is not much publicly available information on solar plants in operation, though the SAARE and the Ministry of Energy claim a total generation capacity of 37 MW. One of the SAARE reports enlisted a number of solar projects implemented as of 2020 with a total installed capacity of 50 MW (see Table 56).

3. Potential of Renewable Energy in Azerbaijan and Its Integration into the Energy System

For more than a hundred years, hydropower was the major renewable source of energy in Azerbaijan. The first hydropower plant (HP) was constructed in 1883 in Galakend village in the Gedebey district. That plant was designed to supply electricity to the residents, and also to the industrial infrastructures of the community [15][21]. In the 1950s, Varvara HP and Mingachevir HP boosted the generation levels marking the next stage of the development for the hydropower industry. Mingachevir HP remains one of the biggest hydropower plants in Azerbaijan to date. Until 2009, when the first kW of wind electricity was produced, water remained the only source of renewable energy. Below is the Figure 4, demonstrating overall electricity generation and the share of hydropower plants in it.

Though Azerbaijan is located in a favorable geographical location to farm solar and wind power, its renewable potential has never been fully studied until recently. In 2002 and 2009, a few studies were conducted by the members of the Azerbaijan National Academy of Sciences to assess the wind energy potential [12][7]. As of 2019, the Ministry of Energy of Azerbaijan started collecting more data on the renewable potential of the country. The major research in this direction was concluded in 2020 by IRENA who indicated high solar and wind potential in the final report. Table 78 shows the renewable resources potential in Azerbaijan.

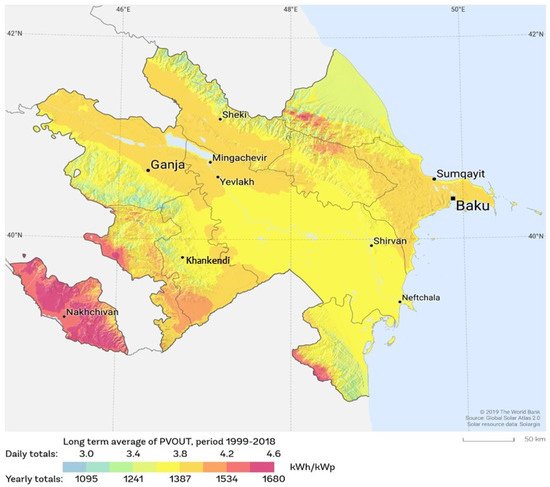

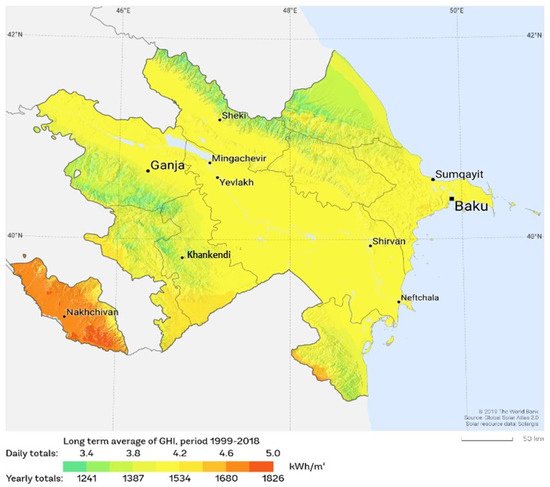

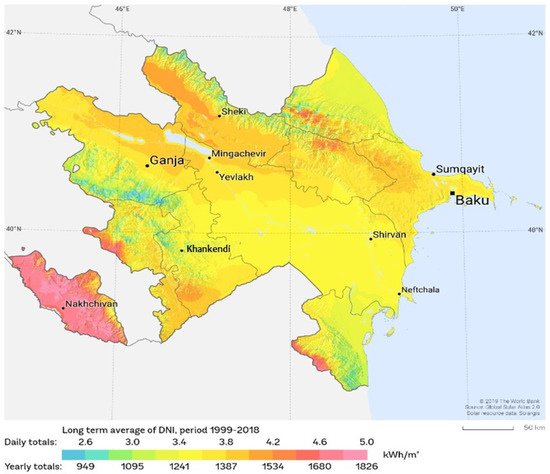

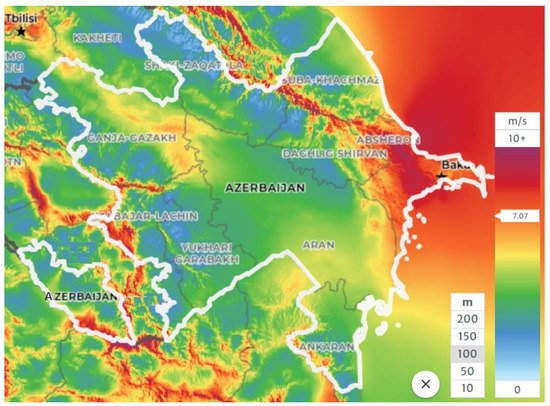

3.1. Solar Potential

Azerbaijan has enough annual sunlight volume to generate significant energy from it. IRENA’s assessment of the solar potential of Azerbaijan discovered the 23,000 MW potential [17][23]. As per governmental records, the amount of solar energy per square meter is somewhere around 1.5–2.0 MWh [18][24]. The SAARE reports indicate 170 to 260 W/m2 radiation levels in the country. The World Bank’s Global Solar Atlas confirms that the specific photovoltaic power output (SPPO) indicator for Azerbaijan ranges between 3.21–4.48 kWh/kWp (specific photovoltaic power output indicates how much electricity can be produced for every kWp of the module capacity over a course of year [19][25]). The Direct Normal Irradiation (DNI) and Global Horizontal Irradiation (GHI) indicators are in the range of 2.71–4.84 kWh/m2 and 3.44–4.80 kWh/m2 per day, respectively [20][26].

The above maps in the Figure 5, Figure 6 and Figure 7 indicate adequate sunlight to invest in solar farms as alternative energy. Hence, the government has already presented three large-scale potential solar farm projects with a total of 2825 MW installed capacity (see Table 89).

Prospective solar plant projects presented by the Ministry of Energy of Azerbaijan [27].

| Project Name and Location |

Planned Output Capacity |

Estimated Generation |

|---|---|---|

| Project 1—2200 hectares in Hajigabul district | 1100 MW (4.4 million panels × 250 W) | 1.46 million MWh/year |

| Project 2—850 hectares in Absheron peninsula | 425 MW (1.7 million panels × 250 W) | 579,000 MWh/year |

| Project 3—2600 hectares next to Alat settlement | 1300 MW (5.4 million panels × 250 W) | 1.725 million MWh/year |

Calculation estimations conducted by Feyruz Mustafayev have revealed other potential projects that could be implemented in the Nakhichevan Autonomous Republic, where solar indicators are even higher in comparison with the rest of the country (see Table 910) [22][28].

Table 910. Potential solar plants in the Nakhichevan Autonomous Republic.

| Project Name | Estimated Installed Capacity |

Estimated Generation |

|---|---|---|

| Area 1–794 ha | 372.5 MW (1.49 million panels × 250 W) | 385,000 MWh/year |

| Area 2–514 ha | 240 MW (963,000 panels × 250 W) | 250,000 MWh/year |

| Area 3–416 ha | 195 MW (780,000 panels × 250 W) | 202,000 MWh/year |

Source: Feyruz Mustafayev, Design of Solar Plants and Wind Farms Locations in Azerbaijan in the Perspective of Twenty Years, Working paper, 2021 [22][28].

Industrial-sized plants require huge upfront investments and carry enormous technical/administrative burdens and business risks. Nonetheless, large-scale solar plants are not the only option for sunlight farming. The specifications of photovoltaic panels and technological developments open doors to develop private small- or community-scale generation sites. Besides, the opportunity of roof-top installation creates significantly high generation potential without sacrificing large territories under plants. According to the Ministry of Energy and various foreign open sources, daily sunny hours in Azerbaijan average at 7–8 h (average number is derived from available documents of the Ministry of Energy of Azerbaijan, www.worlddata.info, and www.weather-and-climate.com websites. All sources were accessed on 10 October 2021). Considering 1.6 m2 250 W monocrystalline photovoltaic panels with a 20% efficiency rate (the most widely used and accessible panels [23][29]), the output of 0.375 kWh/day or 11.25 kWh/month can be obtained from a single panel installed privately (the calculation is made based on the following formula: E = (H × W × 20)/100). Obviously, the lack of a number of factors, such as tilt degree, air temperature, shade, precipitation, etc., decreases the validity of the calculations. Nonetheless, it puts the perspective of private utilization potential on the surface. Observing the Figure 7, it must be noted that the areas with the highest solar potentials are located far from the economic centers of Azerbaijan (such as Baku), which will create a challenge for the transmission of this energy to the center. On the other side, providing autonomous renewable energy system for the Nakhichevan Autonomous Republic can reduce the present tension for limited access to energy in this region. The development of solar energy installations in this region would also increase the energy security for the Republic of Azerbaijan.

Summing up, Azerbaijan has notable sunlight energy potential, especially in regions with extraordinary conditions for photovoltaic farms location (Nakhichevan AR) and, therefore, solar energy is the first natural direction of renewable energy development in the country. We assess those findings as significant and with low-risk bias.

3.2. Wind Potential

Although the estimated wind potential in Azerbaijan is lower in comparison to the solar potential (see Table 78), many efforts are being put into the development of wind electricity production. The decreasing price of wind electricity farming is another factor stimulating interest in this industry. In 2018, wind electricity generation costs went lower in comparison to conventional generation, as per Forbes [24][30]. The current generation capacity of WEPs in Azerbaijan is around 66 MW [14][20].

The IRENA’s assessment of the wind potential of Azerbaijan does not include data on annual average wind speed and the number of windy days based on months and different regions. The only available dataset on this indicator was presented in 2014 by Nijat Imamverdiyev in his “Azerbaijan’s Wind Energy Potential and its Utilization Perspectives” study (see Table 101). This study, however, provides enough insight for the assessment of investment opportunities in this area in Azerbaijan.

| Settlement | March | June | September | December | Annual Average |

|---|---|---|---|---|---|

| Shubani | 8.7/14.5 | 8.5/12.5 | 8.2/11.5 | 7.2/10 | 8/145 |

| Sumgait | 7.7/14.6 | 6.4/9.1 | 6.9/10.7 | 6.8/13 | 7/139 |

| Puta | 7.2/10.8 | 7.3/10.8 | 6.4/9.5 | 5.5/7.5 | 6.7/114 |

| Pirallahı | 7.2/8.6 | 6.2/4.2 | 6.5/5.8 | 6.6/6.2 | 6.6/72 |

| Bina | 7.3/11.5 | 6.7/7.5 | 5.8/7 | 5.8/7.8 | 6.4/100 |

| Sangimughan | 6.9/7.3 | 5.6/5.1 | 6.9/6.9 | 6.7/6.3 | 6.4/73 |

| Baku | 6.9/7.5 | 6.5/6.2 | 6.2/4.7 | 5.6/4.8 | 6.3/67 |

| Chilov island | 6.6/5.3 | 5.8/4 | 6.3/4.1 | 6.3/5.2 | 6.2/54 |

| Oil rocks | 6.9/6.9 | 5.3/3.3 | 6.4/4 | 6.7/4 | 6.2/52 |

| Mardakan | 6.6/7.4 | 5.8/4.7 | 5.4/5.2 | 5.6/4.6 | 5.9/67 |

| Mashtaga | 6.7/7.9 | 5.7/4.2 | 5.3/4.7 | 5.4/5.4 | 5.8/64 |

| Davachi | 4.6/4.8 | 4.6/4.2 | 4.6/5 | 4.1/3.4 | 4.5/51 |

| Neftchala | 4.8/3.8 | 4.4/2.3 | 4.2/2.9 | 3.7/1.9 | 4.2/30 |

| Sara island | 4.4/4.3 | 4.5/4 | 3.9/3.3 | 3.2/2.1 | 4/36 |

| Alat | 4/4.1 | 4.1/2.8 | 4.2/3.3 | 3.3/2.5 | 3.837 |

| Astara | 2.8/1.3 | 2.7/0.5 | 2.7/0.3 | 2.7/1.1 | 2.8/30 |

| Khachmaz | 2.4/0.9 | 2.5/0.9 | 2.3/1.2 | 2/0.6 | 2.3/13 |

| Guba | 1.8/0.8 | 2.1/0.4 | 1.9/0.2 | 1.7/0.4 | 1.9/6 |

| Lankaran | 1.7/0.5 | 1.9/0.3 | 1.8/0.2 | 1.4/0.2 | 1.8/3 |

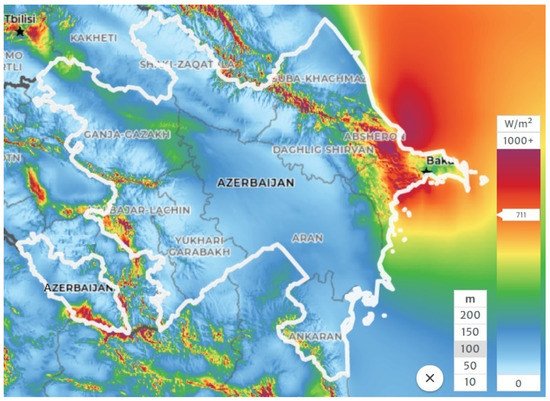

The Absheron peninsula and the surrounding areas have high wind energy generation potential with an annual average wind speed of 6–8 m/s and up to 145 windy days per year. The majority of widely used industrial-size wind turbines operate at minimums of 3–5 m/s wind speed (information is obtained from official web sites of Siemens and Vesta, global scale wind turbine manufacturers [25][26][31,32]). The data available at the website of the World Bank’s Global Wind Atlas indicate 8 m/s mean wind speed and 810 W/m2 power density at 50-m altitude in the Absheron peninsula and its outskirts. At a 100-m height, the indicators reach 9.1 m/s and 1026 W/m2, respectively [27][33].

Absheron peninsula is not the only region with enough wind potential to produce power. As Figure 8 and Figure 9 demonstrate, the Northern Sumgait and Khizi districts, Kalbajar-Lachin and Ganja-Gazakh territories have enough wind to generate electricity. At a 100-m altitude, the mean wind speed around Khizi district is >9 m/s, and the power density can peak 1000 W/m2. In the Kalbajar-Lachin zone, results are 8 m/s and >700 W/m2, respectively. The latter zone is mainly a mountainous territory which makes wind farming challenging. Nonetheless, the successful experience of Switzerland and technological advancements open the door for the establishment of community-sized WEPs in the mentioned area. The same can be applied in the Ganja-Gazakh economic zone where the mean wind speed is at around 5.45 m/s, perfectly suitable for utilization of mid-sized turbines.

The Ministry of Energy of Azerbaijan has presented five potential WEPs that could be set up with a total installed capacity of 442.5 MW (see Table 112).

Potential utilization of territories other than the Absheron peninsula for wind farming purposes was suggested by F. Mustafayev in his study (2021). Two prospective WEPs could be set up in the Kalbajar-Lachin and Ganja-Gazakh territories with a total installed capacity of 207 MW (see Table 123).

Table 123. Prospective WEPs in the Ganja-Gazakh, and Kalbajar-Lachin zones.

| Project Name | Planned Output Capacity | Annual Estimated Production | |||

|---|---|---|---|---|---|

| Khizi 2 | 69 MW (20 turbines × 3.45 MW) | 192,000 MWh/year | |||

| Ganja-Gazakh (at a projected area of ≈700 ha) |

138 MW (40 Siemens SG 3.4 turbines) | ≈362,000 MWh/year | |||

| Khizi 3 | 135.3 MW (41 turbines × 3.3 MW) | ||||

| Kalbajar-Lachin | 414,000 MWh/year | ||||

| (at a projected area of ≈350 ha) | Gizildash | 105 MW (35 turbines × 3.0 MW) | 313,670 MWh/year | ||

| 69 MW (20 Siemens SG 3.4 turbines) | ≈181,000 MWh/year | ||||

| Total | 207 MW (60 Siemens SG 3.4 turbines) | ≈543,000 MWh/year | Pirekushkul | 78 MW (26 turbines × 3.0 MW) | 225,000 MWh/year |

| Absheron-Garadagh | 55.2 MW (16 turbines × 3.45 MW) | 198,000 MWh/year |

Source: Feyruz Mustafayev, Design of Solar Plants and Wind Farms Locations in Azerbaijan in the Perspective of Twenty Years, Working paper, 2021 [22][28].

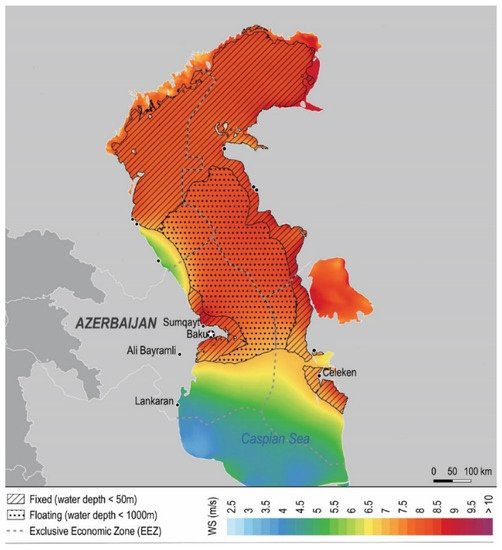

The off-shore potential of the Caspian Sea is as attractive as the on-shore potential of the territories mentioned above. The World Bank study of the technical potential of the Caspian Sea indicates more than 7.5 m/s mean wind speed in the basin around the Absheron peninsula and northern part of Azerbaijan at the depth of fewer than 50 m (see Figure 10) [29][35].

In 2019, Florin Onea and Eugen Rusu carried out estimations to test the feasibility of wind electricity farming in the Caspian Sea, and the results were not satisfying. Based on the data obtained from the European Centre for Medium-Range Weather Forecasts and the AVISO+ (Archiving, Validation, and Interpretation of Satellite Oceanographic Data), Onea and Rusu have concluded that the only acceptable results could be achieved through the utilization of capable Siemens turbines at the 140-m altitude (results showed estimated production of 19.29 GW/h) [30][36]. Back in 2004, the National Academy of Sciences of Azerbaijan drafted a project in the Caspian Sea where an output capacity of 1800 MW was envisaged to be achieved through the installation of 3000 turbines in the area of 180 km2 [31][37]. Nonetheless, the reliability of the mentioned study is questionable since the technological opportunities at the time were behind the current advancement.

Summing up, from a technical and organizational point of view, it looks as if locating wind farms in Azerbaijan could be easier due to the proximity to consumers and a market. The most proposed locations for WEPs are near Baku conurbation (main centers of the country) and the transfer of energy for short distances cannot be a problem. The successful realization of the Contract of the Century in petrochemical industry can be an example that Azerbaijan can be a good partner for such collaboration. The collected evidence is assessed as highly certain with low-risk of bias.