The COVID-19 pandemic has generated disruptions in supply chains, traveling, businesses, and a loss of human lives that is being accounted for at least five million diseased. When the pandemic started, uncertainties, the lockdown of countries, and stay-at-home orders generated that millions of people made runs to grocery stores to buy essential products, the most distinctive being hygiene tissue, antibacterial formulations, and hand sanitizers. Then workers in essential processes in the medical, food, and manufacturing industries had to restart work to keep supply chains running. That generated further repercussions due to the infection of workers in multiple facilities, which created more considerable uncertainties. Universities and schools were mandated to close, and work-from-home orders were enacted in most sectors. In this entry, a summary of the essential factors, current situation, and future perspective regarding the effect generated by COVID-19 on the disruptions of supply chains is presented. The strategic sectors summarized are food and produce, transportation, paper products, chemicals and pharmaceuticals, medical supplies, automobiles, minerals and technology companies. At two years since the WHO declaration, there are still shockwaves that show some unpredictability. Hence, companies and governments should look for strategical plans for preparing for this kind of event, making supply chains resilient or even immune to pandemics, natural disasters and trade wars.

- COVID-19

- pandemic

- Coronavirus

- supply chains

- food

- shutdown

- work

1. Introduction

Over the past decade, most supply chains have been designed to be extremely lean, i.e., with innovations aimed at decreasing cycle time, reducing safety stock inventories, and boosting intercompany coordination to lower costs. However, optimizing these processes requires accurate information exchange between customers and suppliers, and that product flow remains within a small variability, often 5-10% [1][2]1,2.

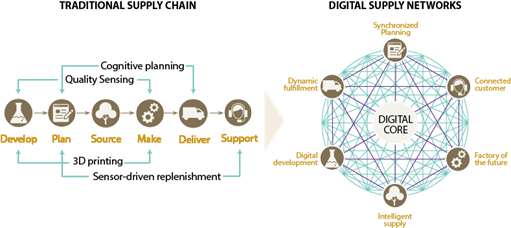

The interlinked and global nature of supply chains has generated more efficient processes [3]3. Nevertheless, at the same time, it has created vulnerabilities to various risks, with less margin of error for absorbing delays and disruptions (Figure 1) [4]4.

Figure 1. Schematic of traditional supply chain vs. new digital supply networks Adapted from [5]

Schematic of traditional supply chain vs. new digital supply networks Adapted from 5

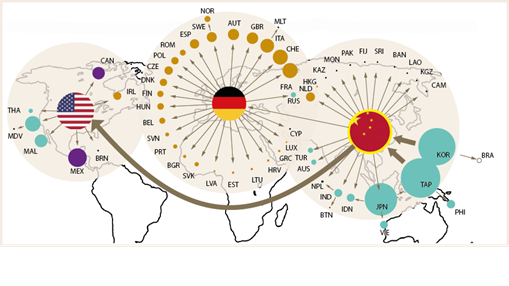

Nowadays, China is central to the entire supply chain network (Figure 2) [6]6. Therefore, in almost all nations, manufacturing disruptions in China would create secondary supply shocks in the industry sector [7]7. The same would happen in the case of disruptions in Germany, France, Switzerland, or Italy, which are the centers of manufacture in Europe. Similar points apply to North America, regarding Mexico and Canada [8][9]8,9.

Figure 2. International supply-chains. Adapted from [8].

International supply-chains. Adapted from 8.

In the spring of 2020, the spread across the world of COVID-19 created changes and disruptions in supply chains that radically increased supply and demand volatility [4]4. The existing supply chain systems and processes cannot handle this level of unpredictability and disruption, which will make it inevitable that new technological supply networks be considered and the different approaches revisited [1][10] 1,10.

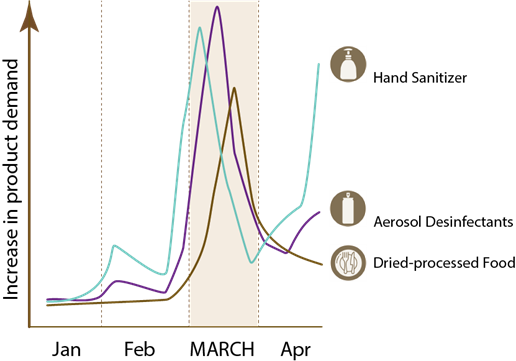

Covid-19 impact on supply chains has generated disruptions on local and international commerce [9][11] 9,11. Millions of people worldwide have become unemployed, and each company and individual have a unique demand and supply pattern; hence, the net effect is chaotic [1]1. This includes spikes in demand for certain products and lost interest in others (Figure 3) [12]12.

Figure 3. Changes in demand on some products during spring 2020 Adapted from [13].

Changes in demand on some products during spring 2020 Adapted from 13

The arrival of COVID-19 generated containment measures, which had a considerable economic impact. Wide-ranging passenger transportation and labor mobility restrictions generated disruptions in tourism, travel, and the entertainment industry, plant closures, or reduced activity. In May 2020, approximately 90% of countries remained with mostly closed borders. Governments and central banks tried to encourage the economies' movement through stimulus packages, mainly contributing to local supply chains' dynamics and resilience [14][15] 14,15. However, many sectors, including pharmaceuticals, agriculture, and energy, have been under pressure due to the reliance on China's economy [16] 16.

At the height of the pandemic, 86% of businesses reported supply chain disruption due to the inability to replenish inventories and supplies and the closure of manufacturing partners. While larger manufacturers stayed relatively consistent, smaller manufacturers had to shut down [17]17. Consumer goods and healthcare are among the major industries that have faced logistics challenges. In addition, most consumers experienced the fear of limited availability of household and healthcare products such as facemasks, hand sanitizer and tissue paper, causing supply pressure.

Companies are trying to adapt and develop new strategies to avoid disruptions, e.g., paying early suppliers to help them restock capacity [18][19]18,19. In addition, the agricultural sector has been exempted from the governments' restrictions. This has generated that sufficient supplies of food and other household products could be available for consumers [20] 20.

2. Effect of the COVID-19 pandemic on supply chains

2.1. China – U.S. trade

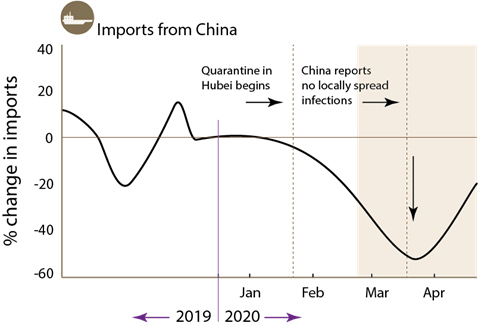

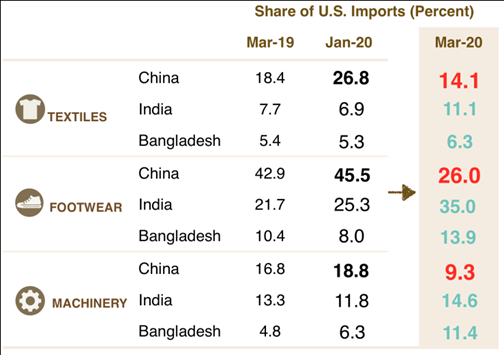

When China enacted the lockdown at the beginning of the pandemic, exports to the U.S. decreased significantly (Figure 4). This generated pressure on manufacturers to bring some activities locally or make changes to make supply chains less dependent on a single country [21]21. Table 1 shows that China's market share of U.S. imports of textiles, footwear, and machinery fell sharply in March 2020, while India and Bangladesh increased their market share for materials significantly, compared with January [22]22. This is representative of the volatilities and fluctuations that such irruptive events can generate.

Figure 4. The behavior of imports of the U.S. from China during winter 2019 and spring 2020 Adapted from [22].22

Table 1. China market share of textiles, footwear and machinery in march 2020 Adapted from [22].22

2.2. Food sector

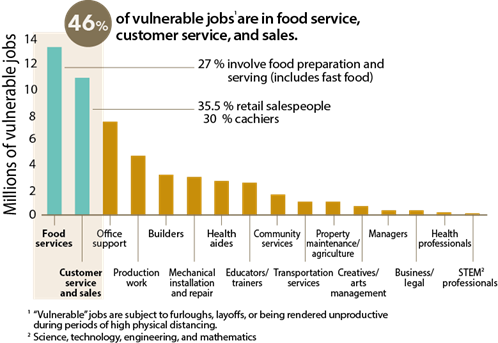

COVID-19 pandemic has disrupted food chains in different ways [23][24] 23,24. Supply has been still available to consumers, although some sectors had to adjust to the new conditions [25] 25. Beyond produce shortages due to production, the real impact has been on practices changes by food processors, suppliers, and retailers to ensure vulnerable workers' health (Figure 5) [26]26. Processors accustomed to employees working shoulder to shoulder had to adapt to new labor practices to protect their employees from contracting the virus [27][28] 27,28. Nevertheless, the food system, in general, showed robustness and resiliency in the face of an unprecedented shock based on demand [25][29]2925. Among the sectors that had to adjust due to changes, we can mention the following: (i) Online grocery shopping, (ii) Local foods, (iii) Produce, (iv) Meat and (v) Food packaging.

Figure 5. Vulnerable jobs during the COVID-19 pandemic per sector of the economy Adapted from [27]27

2.2.1. Online grocery shopping

COVID-19 pandemic generated the online grocery delivery sector's growth and changes in consumers' choices to buy "local" food. After the pandemic ends, consumers could continue purchasing groceries online and acquiring them by delivery (both for food and non‐food items). This could be an element of the food distribution system that will be adopted, mainly by new generational groups (e.g., millennials and generation Z) [30] 30.

2.2.2. Produce

The closing of restaurants, schools, stadiums and other public services and institutions created high quantities of fresh produce retained on farms with no buyers. As a result, a share of those products went to waste in much higher amounts than usual during COVID-19 height [31] 31. The initial demand spike from panic buying behaviors was a short-term problem. Other demand‐driven effects on food supply chains could be a consequence of a fall in consumer incomes, impacting demand and changes in the choice of products [30] 30.

2.2.3. Meat

Large meat producers had to temporarily shut down plants where many workers contracted the virus [27][32]27,32. Meatpacking and processing plants in the U.S. and Canada have had to shut down due to outbreaks. Workers spending all day in such proximity led to more than one thousand workers being tested positive for the Coronavirus in just one beef processing plant [25]25. Smithfield Foods, one of the biggest pork processors in the U.S., announced closure due to Coronavirus spread among more than 200 of its employees in April. At least 20 workers at these plants died [27] 27.

Disruptions also hit pork and chicken processing plants [33] 33. The temporary production halt left farmers with livestock that had no established destination, which affected the supply chain and caused selected recall orders. The disruptions occurred mainly in the middle part of the supply chain; at this stage, cattle are sent to intermediate feedlots for near 150 days and then sent to slaughter. In addition, household demand for meat products rose by more than 40% in April due to people cooking at home [34]34. These led to some price rises, although not too severe [35] 35.

2.2.4. Food packaging

Packaging and shipping food for a restaurant or a hotel requires a big volume, very different compared to grocery stores. This is mainly because of variations in packaging and sizes. For example, large-scale suppliers had to change the size to smaller packaging to adjust to retailing for household use; the disruption occurred due to small-size packaging availability. Flour producers that distributed their production to bakeries in 25- and 50-pound bags had to set up large quantities of 2-pound bags to adjust their retailing production. Meat plants that are regularly supplying to restaurants and hotels would require more workers to change the portion size in a short time [36] 36.

2.3. Transportation

Transporting goods slowed during the height of the pandemic. One of the issues was workers and truckers getting sick from the virus 34. Roadways are relatively less affected by COVID-19 than airways and waterways transportation. Trucking became a critical mode of transportation in the first six months of the pandemic. However, the disruptions in this segment would be the potential driver shortage due to exposure to the virus, which makes ensuring the health and safety of the available drivers of paramount importance [20] 20.

2.4. Paper products

2.4.1. Hygiene Tissue

Hygiene tissue shortages were apparent during the beginning of the COVID-19 pandemic. This was not due to a decrease in supply; instead, the main reason was consumer behavior changes when millions of workers were sent home due to the pandemic, which made the demand for household tissue and other hygiene paper products increase severely [37] 37. The United States is the number one producer of all commercial hand towels, with 57 % of the share, 85 % made from recovered paper. In this case, the most crucial factor that can disrupt the tissue supply chain would be the availability of mixed office paper waste and virgin fibers to make standard and premium products.

The increase in people staying at home has decreased demand in the printing and writing sectors, while consumer at-home tissue product demand has increased. Therefore, the impact on the tissue business of the COVID-19 pandemic could be significant due to less availability of mixed paper waste and more demand for virgin fibers to produce high-quality tissue. That has generated an increase in the interest for research in other sources of fibers, i.e., non-wood fibers and old corrugated cardboard (OCC), and could promote the paper recycling sector in the U.S. [38][39] 38,39.

Corrugated containerboard furnish has seen increased demand between 20 to 40%; therefore, competition among producers for market share is evident. Prices are expected to rise while the pandemic continues due to diminishing supply and increasing domestic demand [40] 40. Due to the effects on trade-related to the COVID-19 pandemic, this turbulent scenario could impact the short-term projections of paper waste exports to China from the U.S. [41] 41.

2.4.2. Printing paper

The increase in stay-at-home orders generated that the workforce (and students) that remained at home required fewer printouts. Writing, printing, and newsprint grades demand has decreased for several years, and COVID 19 could accelerate this trend. Mills that could adapt their processes to a higher production of packaging materials and tissue have an advantage in the present scenario [42] 42.

2.4.3 Corrugated boxes

The need for more corrugated paper and packaging has generated a transient increase in China's paper waste imports, but that could change soon. Due to the higher demand, some mills and paper producers have increased corrugated grade generation. That has produced a higher demand for recycled pulps and a price increase. Chinese mills have been asking their government to increase quotas of allowable imports due to the increase in corrugated paper demand [43]43. This trend might stay high due to consumer behavior changes, e.g., more people than ever doing their groceries or shopping via the internet.

2.5 Chemistry and pharmaceutics

The production and shipment of pharmaceuticals did not have severe disruptions, mainly due to the declaration of essential services that governments gave to these industries. Due to increased demand, a temporary decrease in inventory occurred for cleaning and antibacterial products and hand sanitizer. When companies started to produce more of these materials, the offer matched the demand by July. There was the probability of shortages due to the decrease in inventories, although that hasn't occurred [44] 44.

The pandemic has underlined China's influence on the world supply of pharmaceutical ingredients and chemical raw materials. This could generate an effort in the U.S. and European governments to strengthen their chemical supply chains to ensure the domestic production of pharmaceutics. However, that hasn't occurred with tangible results yet. In just three months after the pandemic was declared, Chinese suppliers were back in operation, and supply chains in the world were reactivating [44] 44.

The economic shocks generated by COVID-19, mainly because of the initial disruptions on university research, impacted the chemical industries due to the decrease in demand. However, that has been balanced in the case of companies that have adopted their processes to the actual demand and needs of consumers, e.g., more demand for antibacterial formulations, cleaning products, among others [45] 45.

2.6 Medical supplies

Medical gear demand increased abruptly due to COVID-19 [14] 14. Shortages were apparent at the beginning of the pandemic. Then, when China's exports and supply chains were back on track, the supply of facemasks, gloves, and other PPE recovered [28] 28. The apparent shortage effect lasted just 3-5 months, although it could last longer [46]46. After that, demand for PPE and other protective equipment increased exponentially due to mandates for companies to provide workers with sufficient PPE and apparel to protect themselves in their workplaces [25]25.

Another market segment that has kept supply chains moving is vaccine or treatment research looking for a solution for the virus from a clinical perspective. Several countries have announced trials, but tangible results are still in the second and 3rd phases of testing [47] 47.

2.7 Automobiles

Countries' disruptions on supply chains could generate a mid to long-term shift to regionalized supply chains and more localized production in the automobile sector [16][48][49]16,48,49. At the beginning of the shutdown orders, Mexican car exports fell by 90% [14] 14.

Worldwide automotive sales will fall 22% this year; this adds to the world recession effect due to the pandemic [20] 20. The automotive industry's most significant impact on supply chain disruptions was localized in East Asia due to the sourcing of parts from different countries where the manufacturing plants are [8]8.

2.8 Technology

Apple and other technology companies kept producing their products, mainly because of decreased demand. However, a reduction in production occurred when the manufacturers of components were not at full capacity [14] 14. Fewer shifts and fewer workers generated that parts that usually take 30 days could take triple the amount of time to be produced [20] 20.

China reopened its factories in April, which decreased the pressure on several technology companies worldwide. However, the computer and electronic industry is susceptible to disruptions due to reduced supply inventories, mainly because phones, computers, and other electronic parts are sourced from different countries.

2.9 Minerals

The International Energy Agency reported that the lockdown initially disrupted supply chains of metals like platinum produced in South Africa, which is used in emissions control devices, copper obtained through mining in Peru and Chile, and Nickel, mostly made in Indonesia. However, refining operations of rare metals, mainly based in China (lithium and cobalt refining), recovered but showed the dominance of China in this sector world market again [28][50] 28,50.

3. Perspectives for the future

The effect of COVID-19 has been a worldwide recession that is envisioned to last for at least one more year. Supply chain disruptions will push more companies to relocate parts of their supply chains to countries or cities nearer production sites [51]51. In the Americas and Europe, regional supply chain conformations are likely. Global companies will be better prepared for future shocks to their network if they are flexible. This would mean shifting the production of critical components from one region to another as lockdowns and factory closures occur in the case of pandemics or natural disasters.

The most significant effect on supply chains has been whether there are enough workers in producing sites due to the lockdowns. Supply chains have shown resiliency [15][27]15,27. To make supply chains more resilient or even immune [46] 46, diversification is necessary to find the solution in another provider [14]14. In this case, contingency plans for manufacturing plants are of utmost importance [23][28]23,28.

3.1 Opportunity to develop a circular economy

Individuals and organizations may have an opportunity to adopt circular economy concepts principles, i.e., redesign, reduce, reuse, and recycle [28] 28. People are becoming more aware of the relationship between food and packaging, although the determining step for reusing all the corrugated packaging that is being produced and used is reactivating the recycling industry, which requires competitive prices for recycled paper in the U.S. [25].25

These changes could indicate that lean manufacturing processes, which were the trend before the pandemic and were shown productive, could look like vulnerabilities. Decreasing inventory levels helps a manufacturer deploy its capital more effectively and leaves it without sufficient raw materials when a supplier shuts down. Sourcing materials in high volumes from a few partners can drive down costs but reduce suppliers' diversity that companies need to recover from disruptions. Global supply chains allow companies to benefit from lower labor costs in emerging economies but leave them exposed if trade tensions, pandemics, or natural disasters disrupt the regular flow of goods [20][52] 20,52.

A trend towards increasing automation in manufacturing sites is also possible [53] 53. Disruptions in manufacturing lines due to social distancing measurements were more important at the pandemic beginning. Hence, automation could significantly decrease those effects. By the way, one of the reasons why food production is so labor-intensive right now is that local and sustainable product offerings have been growing and have diversified the market [54][55]54,55. Those small companies could be hard to automate in the short term. Hence, the trend of higher automation is a real probability in the middle to long term 56, [8][56]8.

3.2 What companies should do

A set of strategies have been recommended for companies to prepare and create resiliency in the case of pandemics or natural disasters that could disrupt supply chains[1][57][58] 1,57,58:

- Set up a robust response team structure and processes

- Enable operation teams for procurement, manufacturing, logistics, quality, engineering to safeguard immediate supply and develop solutions.

- Focus on components with critical supply situations.

- Continuously challenge assumptions

- Plan for paradigmatic supply chain change.

- Prioritize customers and suppliers.

- FastTrack support activities that secure supply

- Involve not only managers, preferably all parts of the company's organizations

- Organizations can effectively manage the influx of new information in their supply chain using automation and data analytics. This would be useful when preparing for the next pandemic or natural disaster

3.3 What to do in recessions

During recessions, consumers usually save money by switching from brand-name products to private labels. Therefore, one of the decisions in companies that have been successful is to choose to make more private-label products, thus staying profitable and giving consumers what they were looking for. In addition, consumers are also inclined to postpone purchasing new vehicles; hence, manufacturers could have an alternative slowing production of new cars and focus on selling automotive parts and performing repairs.

Five steps companies could follow to prepare for the subsequent recessions are outlined in a recent study [59] 59:

- Gradually adopt technology and automation. Trends indicate that labor costs are increasing, while technology costs are becoming more affordable [60] 60.

- Consider making strategic investments and decreasing underperforming assets to have savings.

- Combine related departments, supply chains, and inventory management are vital.

- Give consumers, retailers, and wholesalers the reason to choose your company.

- Avoid personnel gaps and find specialty personnel.

4. Conclusions and perspectives

Supply chains could be fragile; nevertheless, planning and establishing strategic plans in governments, companies and businesses could make them resilient or immune to unpredictable events. The COVID-19 pandemic showed this fragility as disruptions in many sectors occurred. Nonetheless, some sectors were resilient, indicating how critical strategic planning is. For example, transportation, hygiene tissue, PPE supplies, household products, and meat processing facilities were among the most disrupted in their supply chain, either by increased demand or by closing businesses due to the virus. Other sectors as pharmaceuticals, technology, paper packaging were not affected that much.

These changes indicate nowadays how important automation and technology are for companies. Data analytics and modeling generated a trend of creating lean supply chains, which depend on short storage time and low raw materials inventory; this has shown to be a successful strategy in the case of having conventional data and trends that could be modeled. However, in the case of events that generate unpredictable disruptions on supply chains, that seems to not hold as total truth. Hence, given 2020' events, revisiting the recent trends and implementing new strategies to prepare, show resiliency and even be immune to the shockwaves of natural disasters, trade wars and other events seem of paramount importance for companies, businesses and countries worldwide.

One of the most significant effects of the pandemic has been the increase in the household's consumption of e-commerce products, which has incremented waste, mainly corrugated packaging. Therefore, measures must be taken to ensure that landfilling and incineration of waste doesn't increase significantly and prevent the pandemic from becoming a new environmental problem.

Funding: This research received no external funding.

Conflicts of Interest: The authors declan ere no conflict of interest.

References

- Byrnes, J. Coronavirus: How to Manage Supply Chain Shock Waves | MarketingProfs. https://www.marketingprofs.com/articles/2020/42891/coronavirus-how-to-manage-your-supply-chain-shock-waves.

- Govindan, K., Mina, H. & Alavi, B. A decision support system for demand management in healthcare supply chains considering the epidemic outbreaks: A case study of coronavirus disease 2019 (COVID-19). Transp. Res. Part E Logist. Transp. Rev. 138, 101967 (2020).

- Hald, K. S. & Coslugeanu, P. The preliminary supply chain lessons of the COVID-19 disruption—What is the role of digital technologies? Oper. Manag. Res. 1–16 (2021) doi:10.1007/s12063-021-00207-x.

- Araz, O. M., Choi, T., Olson, D. L. & Salman, F. S. Data Analytics for Operational Risk Management. Decis. Sci. deci.12443 (2020) doi:10.1111/deci.12443.

- Mussomeli, A. The rise of the digital supply network. https://www2.deloitte.com/content/dam/insights/us/articles/3465_Digital-supply-network/DUP_Digital-supply-network.pdf.

- Tang, C.-H., Chin, C.-Y. & Lee, Y.-H. Coronavirus disease outbreak and supply chain disruption: Evidence from Taiwanese firms in China. Res. Int. Bus. Financ. 56, 101355 (2021).

- Cai, M. & Luo, J. Influence of COVID-19 on Manufacturing Industry and Corresponding Countermeasures from Supply Chain Perspective. J. Shanghai Jiaotong Univ. 25, 409–416 (2020).

- Baldwin, R., Weder, B. & Mauro, D. Economics in the Time of COVID-19. (CEPR Press, 2020).

- Ivanov, D. Exiting the COVID-19 pandemic: after-shock risks and avoidance of disruption tails in supply chains. Ann. Oper. Res. 1–18 (2021) doi:10.1007/s10479-021-04047-7.

- Ye, F. et al. Digital supply chain management in the COVID-19 crisis: An asset orchestration perspective. Int. J. Prod. Econ. 245, 108396 (2022).

- Nikolopoulos, K., Punia, S., Schäfers, A., Tsinopoulos, C. & Vasilakis, C. Forecasting and planning during a pandemic: COVID-19 growth rates, supply chain disruptions, and governmental decisions. Eur. J. Oper. Res. 290, 99–115 (2021).

- Shmalz, F. COVID-19 is disrupting supply chains — here’s how companies can react - Business Insider. https://www.businessinsider.com/covid-19-disrupting-global-supply-chains-how-companies-can-react-2020-3.

- Schmalz, F. COVID-19: Tracking the Impact on FMCG, Retail and Media – Nielsen. https://www.nielsen.com/us/en/insights/article/2020/covid-19-tracking-the-impact-on-fmcg-and-retail/.

- Ivanov, D. & Das, A. Coronavirus (COVID-19/SARS-CoV-2) and supply chain resilience: A research note. Int. J. Integr. Supply Manag. 13, 90–102 (2020).

- Minton, Z. Globalisation unwound - Has covid-19 killed globalisation? | Leaders | The Economist. https://www.economist.com/leaders/2020/05/14/has-covid-19-killed-globalisation.

- Taylor, C. Coronavirus will undo globalization, make supply chains regional: EIU. https://www.cnbc.com/2020/05/13/coronavirus-will-undo-globalization-make-supply-chains-regional-eiu.html.

- Byrne, C. Supply Chains Still Recovering from Coronavirus | UPS - United States. https://www.ups.com/us/en/services/knowledge-center/article.page?name=supply-chains-still-recovering-from-coronavirus&kid=art17203c40453.

- Gallagher, D. Local supply chain learn lessons from coronavirus experience | Bellingham Herald. https://www.bellinghamherald.com/news/business/article242578061.html.

- Jorgensen, B. How Covid-19 Could Accelerate the Digital Supply Chain. https://epsnews.com/2020/05/13/how-covid-19-could-accelerate-the-digital-supply-chain/.

- Wood, L. COVID-19 Impact on Logistics & Supply Chain Industry Market by Industry Verticals, Mode of Transport, Region - Global Forecast to 2021 - ResearchAndMarkets.com. https://apnews.com/d934cd2d21ef45de908668aae56ac3c4.

- Heise, S. How Did China’s COVID-19 Shutdown Affect U.S. Supply Chains? -Liberty Street Economics. https://libertystreeteconomics.newyorkfed.org/2020/05/how-did-chinas-covid-19-shutdown-affect-us-supply-chains/.

- Watts, W. Here’s what China’s coronavirus shutdown did to global supply chains - MarketWatch. https://www.marketwatch.com/story/heres-what-chinas-coronavirus-shutdown-did-to-global-supply-chains-2020-05-12.

- Inskeep, S. USDA Secretary Says Despite Plant Closures, He Does Not Anticipate Food Shortages : Coronavirus Live Updates : NPR. https://www.npr.org/sections/coronavirus-live-updates/2020/05/15/856594198/agriculture-department-to-fix-disruptions-in-nations-food-supply-chain.

- Barman, A., Das, R. & De, P. K. Impact of COVID-19 in food supply chain: Disruptions and recovery strategy. Curr. Res. Behav. Sci. 2, 100017 (2021).

- Grimshaw, J. COVID-19: Food Supply Chains Shaken, But Not Broken | Logistics | Supply Chain Digital. https://www.supplychaindigital.com/logistics/covid-19-food-supply-chains-shaken-not-broken.

- Snowdon, A. W. & Saunders, M. COVID-19, Workforce Autonomy and the Health Supply Chain. Healthc. Q. 24, 15–26 (2021).

- Athwal, N. Coronavirus And Our Food Supply. https://www.forbes.com/sites/navathwal/2020/05/12/coronavirus-and-our-food-supply/#46687bf02df3.

- Sharif, A. Coronavirus Is Changing Consumer Habits in the Food Industry – BRINK – News and Insights on Global Risk. https://www.brinknews.com/how-well-are-food-supply-chains-holding-up-in-the-developed-world/.

- Zhang, W., He, H., Zhu, L., Liu, G. & Wu, L. Food Safety in Post-COVID-19 Pandemic: Challenges and Countermeasures. Biosensors 11, 71 (2021).

- Hobbs, J. E. Food supply chains during the COVID‐19 pandemic. Can. J. Agric. Econ. Can. d’agroeconomie 1–6 (2020) doi:10.1111/cjag.12237.

- Garcia, S. The coronavirus broke the food supply chain. Here’s how to fix it. | Grist. https://grist.org/food/coronavirus-food-grocery-store-empty-farm-food-waste-solution/.

- Hobbs, J. E. The Covid-19 pandemic and meat supply chains. Meat Sci. 181, 108459 (2021).

- Hayes, D. J., Schulz, L. L., Hart, C. E. & Jacobs, K. L. A descriptive analysis of the COVID‐19 impacts on U.S. pork, turkey, and egg markets. Agribusiness 37, 10.1002/agr.21674 (2021).

- Mosley, T. Coronavirus Pandemic, Supply Chain Problems Cause Prices Of Grocery Store Staples To Skyrocket | Here & Now. https://www.wbur.org/hereandnow/2020/05/13/coronavirus-food-grocery-bill.

- Kohler, J. Colorado ranchers, restaurants confront cascading effects of coronavirus on beef processing industry. https://www.denverpost.com/2020/05/10/coronavirus-colorado-meat-supply-chain-shortage/.

- Nixdorf, K. One flour mill is operating 18 hours a day to keep up with demand - Business Insider. https://www.businessinsider.com/flour-shortage-baking-quarantine-coronavirus-2020-5.

- Zambrano, F., Marquez, R., Jameel, H., Venditti, R. & Gonzalez, R. Upcycling strategies for old corrugated containerboard to attain high-performance tissue paper: A viable answer to the packaging waste generation dilemma. Resour. Conserv. Recycl. 175, 105854 (2021).

- Bruce, J. Coronavirus to Alter Global Toilet Paper & Tissue Production. https://www.fisheri.com/blog/coronavirus-covid-19-toilet-paper-tissue-production-changes.

- de Assis, T. et al. Performance and sustainability vs. the shelf price of tissue paper Kitchen Towels. BioResources 13, 6868–6892 (2019).

- Staub, C. What to expect in domestic recycled paper markets - Resource Recycling News. https://resource-recycling.com/recycling/2020/08/04/what-to-expect-in-domestic-recycled-paper-markets/ (2020).

- Staub, C. China ban causes programs to cut collection. https://resource-recycling.com/plastics/2017/10/25/china-ban-causes-programs-cut-plastics-collection/ (2017).

- Elhardt, M. Global Printing & Writing: Are More Storm Clouds Ahead Amid COVID-19? https://www.fisheri.com/blog/global-printing-and-writing-coronavirus-covid-19-demand-impacts-data.

- Matthis, S. Corrugated box industry keeps supply chain moving amid COVID-19 challenges | PULPAPERnews.com. https://www.pulpapernews.com/20200324/11298/corrugated-box-industry-keeps-supply-chain-moving-amid-covid-19-challenges.

- Mullin, R. COVID-19 is reshaping the pharmaceutical supply chain. https://cen.acs.org/business/outsourcing/COVID-19-reshaping-pharmaceutical-supply/98/i16.

- Wang, L. Coronavirus dims chemistry job market prospects. https://cen.acs.org/careers/employment/Coronavirus-dims-chemistry-job-market/98/i18.

- Finkenstadt, D., Handfield, R. & Guinto, P. Why the U.S. Still Has a Severe Shortage of Medical Supplies. https://hbr.org/2020/09/why-the-u-s-still-has-a-severe-shortage-of-medical-supplies.

- Nature. Coronavirus papers: Viral proteins point to potential treatments. Nature (2020) doi:10.1038/d41586-020-00502-w.

- Shaikh, S. How COVID-19 is Transforming Automotive and Industrial Supply Chains | IndustryWeek. https://www.industryweek.com/covid19/article/21131043/how-covid19-is-transforming-automotive-and-industrial-supply-chains.

- Belhadi, A. et al. Manufacturing and service supply chain resilience to the COVID-19 outbreak: Lessons learned from the automobile and airline industries. Technol. Forecast. Soc. Change 163, 120447 (2021).

- O’Donoghue, A. COVID-19 disrupts global supply of critical minerals - Deseret News. https://www.deseret.com/utah/2020/5/9/21252187/covid-19-disrupts-global-supply-minerals-platinum-copper-nickel-lithium-cobalt.

- Petropoulos, F. & Makridakis, S. Forecasting the novel coronavirus COVID-19. PLoS One 15, e0231236 (2020).

- Gupta, N. & Soni, G. A Decision-Making Framework for Sustainable Supply Chain Finance in Post-COVID Era. Int. J. Glob. Bus. Compet. 16, 29–38 (2022).

- Handfield, R. Automation in the Meat Packing Industry is on the Horizon | SCM | Supply Chain Resource Cooperative (SCRC). https://scm.ncsu.edu/scm-articles/article/automation-in-the-meat-packing-industry-is-on-the-horizon.

- Karmaker, C. L. et al. Improving supply chain sustainability in the context of COVID-19 pandemic in an emerging economy: Exploring drivers using an integrated model. Sustain. Prod. Consum. 26, 411–427 (2021).

- Rafigh, P., Akbari, A. A., Bidhandi, H. M. & Kashan, A. H. Sustainable closed-loop supply chain network under uncertainty: a response to the COVID-19 pandemic. Environ. Sci. Pollut. Res. 1–17 (2021) doi:10.1007/s11356-021-16077-6.

- Corinaldesi, G. Food Supply Chains and Covid-19 | Duke Today. https://today.duke.edu/2020/05/food-supply-chains-and-covid-19.

- Wyman, O. COVID-19: Managing Supply Chain Disruption. Setting up immediate response capabilities. https://www.oliverwyman.com/content/dam/oliver-wyman/v2/publications/2020/March/managing-extreme-supply-chain-disruption.pdf (2020).

- B., H. R., Gary, G. & Laird, B. Corona virus, tariffs, trade wars and supply chain evolutionary design. Int. J. Oper. Prod. Manag. 40, 1649–1660 (2020).

- Bachman, D. What to expect when you’re expecting a recession | Deloitte Insights. https://www2.deloitte.com/us/en/insights/economy/issues-by-the-numbers/what-to-expect-when-expecting-recession-business-adapting-to-economic-cycles.html.

- Agrawal, A., Gans, J. S. & Goldfarb, A. Artificial Intelligence: The Ambiguous Labor Market Impact of Automating Prediction. J. Econ. Perspect. 33, 2, 31-50.

This entry is from: Understanding COVID-19 effect on the U.S. supply chain of strategic products: important factors, current situation, and future perspective