Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 3 by Jason Zhu and Version 2 by Jason Zhu.

Pension systems are one of the fundamental pillars of the welfare state. The ageing of the population caused by longer life expectancy and low birth rates has led to a crisis in the public pension system in developed countries.

- pensions

- ageing

- longevity

- social security

- bibliometric

1. Introduction

In recent years, researchers, public institutions, and individuals have become concerned about the sustainability of current pension systems [1], representing the most severe and enduring challenge for developed and developing welfare states [2]. This has been due to the increase in life expectancy coupled with the sharp reduction in the birth rate [3], which has led to the search for a new system that will guarantee their viability in the future [4]. Although many reforms have been implemented in recent years, they are considered insufficient to ensure the long-term sustainability of pensions [1][5].

The search for this necessary sustainability has given rise to incipient literature in the field of pensions, over the last decades, addressing aspects, such as the study of the different pension typologies [6][7]; the interaction between public and private pension systems [8]; the possible existence of a gender gap [9]; the reduction of pensions or the increase in workers’ contributions [10]; the analysis of new capitalisation systems [11][12]; or the study of demographic aspects, including age [13][14][15], educational level [16], place of residence [17], or belonging to certain groups [18].

However, the main challenge underlying the research is to solve the problem of the stability of the public social security system. Improvements in health care and quality of life have led to an ageing population, i.e., a lengthening of the retirement period. The higher cost of the pension system is jeopardising its stability, even in the short term. There are only two solutions if the current philosophy of the system is to be maintained: to increase revenue through higher contributions or reduce expenditure. The former can only be achieved by increasing the number of contributors (which, with unemployment levels and low birth rates, does not seem to be the solution) or the contribution paid by workers and companies. The latter implies a reduction in the amount of pensions or a delay in the retirement age. The challenge for researchers is to propose models that anticipate the results, using statistics, econometrics, and actuarial methodology.

This study has carried out a systematic review of the existing literature on pensions, intending to obtain the most critical and up-to-date knowledge on a topic of current concern, such as the sustainability of pensions in the future. To this end, bibliometric techniques have been applied to review the literature and find out which are the most influential authors, works, journals, and institutions, as well as the current trends in this area of research [19][20].

Since 1936, when the first article on pensions was published, the scientific community’s interest has been growing and has addressed a variety of topics. Initially, research focused on issues related to life expectancy and the ageing of the population. Over the years, researchers have managed the need to reform the various pension systems to ensure their long-term survival.

The present bibliometric analysis will examine the scientific output and represent the existing knowledge on pension research [21], which is possible thanks to the use of bibliometric indicators, as they provide valuable information on scientific production in its different expressions [22][23]. This bibliometric analysis will provide the scientific community with very interesting information on the current state of pensions research and help establish future research lines [24].

The purpose of this research is to analyse current trends in pension research. To this end, 1287 articles published in journals indexed in the Scopus database and published from 1936 to 2021 have been analysed using bibliometric techniques. These studies have been published in different areas of knowledge, such as economics, social sciences, business, or mathematics.

For the reason described above, this paper makes significant contributions to the literature on pensions by carrying out an exhaustive analysis of indicators, namely author production, the collaboration between authors, countries, institutions, or citations. Furthermore, this study has been carried out using three complementary tools: DataWrapper, Excel, VOSviewer, and SciMAT, which, together with the data used, offer a current and global view of the research carried out on pensions. Finally, researchers can state that the study carried out makes an essential contribution to the theoretical field of pension research by helping the scientific community to know what the main research topics are, how the concerns of scientists have changed since the publication of the first articles on the subject and, especially, to find new lines of research.

2. Descriptive Analysis

2.1. Evolution of Scientific Production

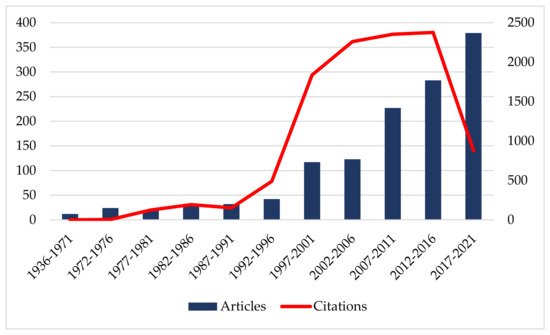

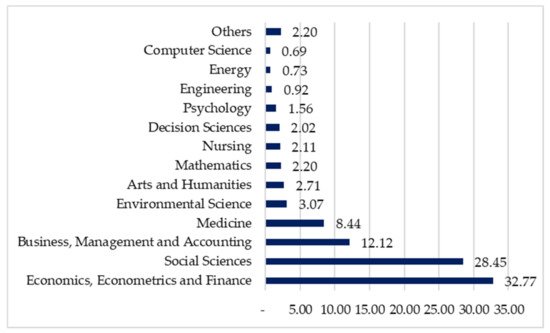

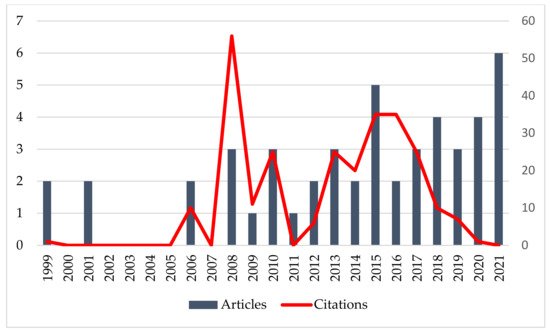

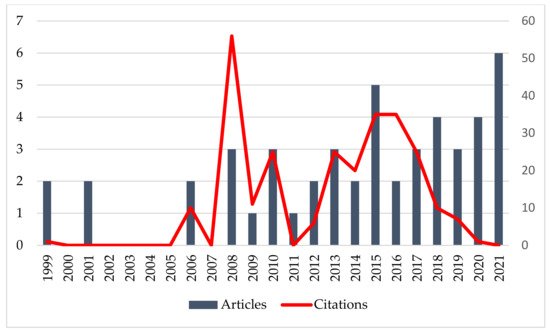

As shown in Figure 1, pensions are a topic of interest to researchers.

Figure 1. Evolution over time of the published articles in each period on pension research and the total number of citations they have obtained. The left axis represents the number of published articles, and the right axis the number of citations received by the published articles. Source: own elaboration.

Since the first article was published, in 1936 up to the present day, they have experienced a very significant growth. Especially, at the end of the 20th century, there was an increase in interest for researchers. It can also be observed that interest has increased even more in the recent years, as the number of articles published has grown exponentially. It is worth noting that more articles have been published on pensions in the last ten years than in the previous 75 years, which shows the growing interest in this topic today.

Figure 1 also exhibits the significant evolution of the number of citations received by the articles published in each period, demonstrating the interest in the future sustainability of pensions. The decline in the number of citations in the last period should be interpreted with caution, as not enough time has yet passed for these articles to generate citations, especially those published in the previous few years.

2.2. Distribution of Scientific Production

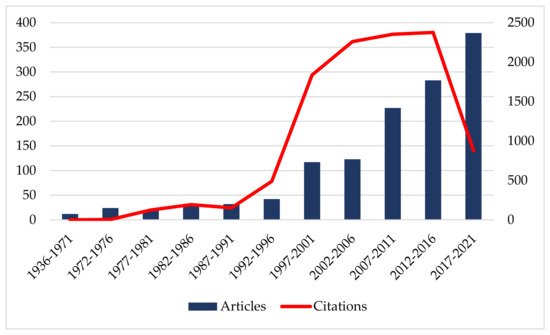

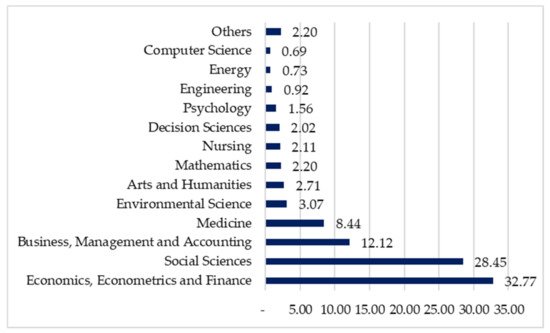

The articles on pensions have been classified into several thematic areas by the database. Figure 2 depicts these subject areas and indicates the percentage of published articles. The results show that the 3 most relevant areas are economics, econometrics and finance (32.77%), social sciences (28,45%) and business, and management and accounting (12.12%). These 3 areas account for 73.34% of the articles published. The remaining areas, including medicine, environmental sciences, and mathematics, account for the remaining 26.66%.

Figure 2. Documents by subject area (percentage) on pension research. Source: own elaboration.

The age-related pension problem of the social security system is an economic problem of financing: the shortage of funds in relation to the pensions to be paid. The solution involves econometric analyses that anticipate the future situation, that foresee possible scenarios based on the current situation. In other words, it is mainly a problem of economics, finance, and econometrics.

The journal that has issued the most articles is the International Social Security Review, which is specialised in the matter, as its name suggests. Specifically, it has published 122 papers (9.4% of the total number of articles published) since 1970, the year in which it published its first article on pensions. It can also be seen that this journal has received a total of 1092 citations (10.24% of the total number of citations received by articles on pensions). As for the nationality of these journals, it is worth noting that eight are published in Europe and two in the United States. The UK and the Netherlands share four of the European journals. It is also significant that 2 of the 10 journals are in quartile 1 of the SCImago Journal Rank (S.J.R.); the rest (except for 1 discontinued journal) are in quartile 2, which indicates a good interest in the subject of pensions in high-impact journals.

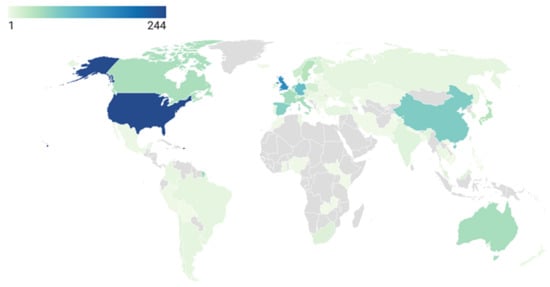

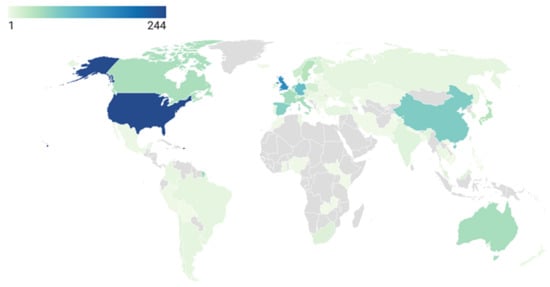

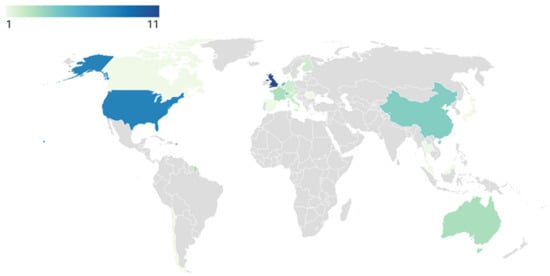

A total of 112 countries have published articles on pensions. These countries are represented in Figure 3.

Figure 3. Worldwide publications on pension research. Source: own elaboration.

The most prolific country is the U.S.A., with 18.95% of publications (244 articles), followed by the U.K. with 12.43% (160 articles), and Germany with 7.38% (95 articles). China and Spain are in fourth and fifth place with 76 and 72 articles, respectively.

Concerning the h-index, the top 3 positions coincide with the most prolific countries; the U.S.A. with 29, the U.K. with 22, and Germany with 21. However, the fourth position goes to the Netherlands with 14 and France and Canada share the fifth position with 13.

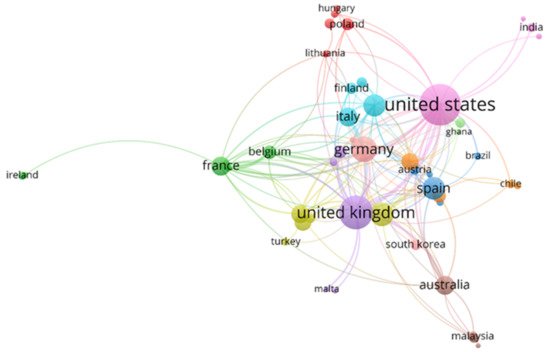

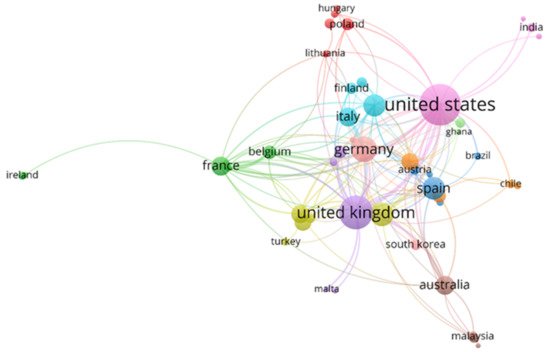

Figure 4 depicts networks showing cooperation among the 47 major countries that have published pension research. The colour of each of the spheres corresponds to a grouping of countries, while the size represents the number of articles published per country.

Figure 4. Network of cooperation based on authorship between countries. Source: own elaboration.

Eleven different groups have been observed. The red group includes the Czech Republic, Hungary, Lithuania, Poland, Slovakia, and Slovenia. The countries associated with the green colour are Belgium, Colombia, France, Ireland, Luxembourg, and Tunisia. The blue cluster, headed by Spain, also includes Brazil, Israel, Portugal, and Austria. The yellow group is led by China, with Canada, Japan, Taiwan, and Turkey as collaborators. The purple group, led by the U.K., comprises Russian, Switzerland, and Malta. The light blue includes the Netherlands, Italy, Denmark, and Finland. Sweden, Norway, Argentina, and Chile make up the orange cluster. The brown set, headed by Australia, includes Hong Kong, Malaysia, and Singapore. The pink group is led by the U.S.A., with India, Mexico, and New Zealand as collaborators. The salmon group comprises Germany, Romania, and South Korea. Finally, Ghana and South Africa make up the light green cluster.

The author with the highest number of publications is Pestieau, P. with 12 articles, followed by Williamson, J.B. with 11. However, Meijdam, L. has ten articles, the author who has received the most citations (182). The second author regarding the number of citations received is Pestieau, P. In terms of the results for the average number of citations per article, Claussen, B. with 18.67 is in the first position, followed by Meijdam, L. with 18.20 and Holzmann, R. with 16.71. It is curious that Verbon, H.A.A. published 6 of his 7 articles with Meijdam, L.

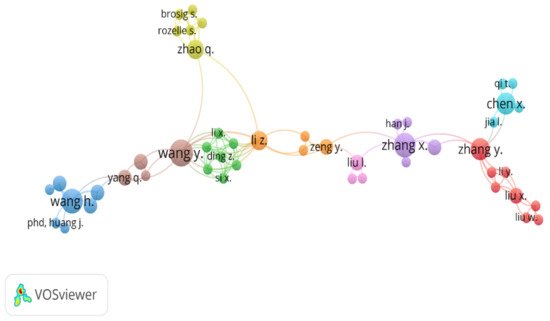

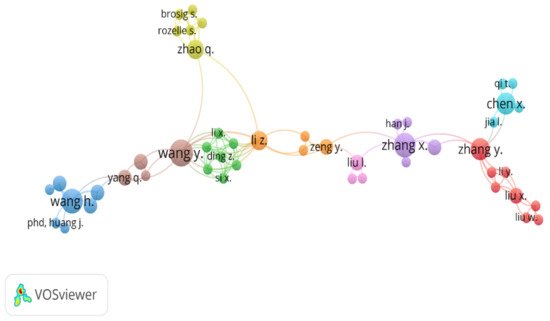

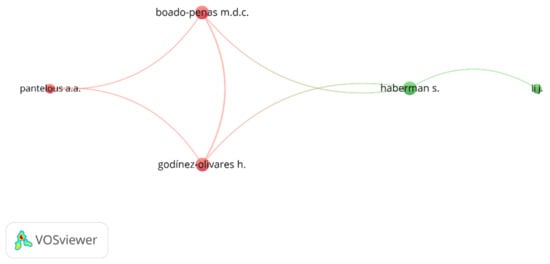

Different collaborative networks have been created from the co-authorships of the principal authors. These networks are shown in Figure 5.

Figure 5. Network of cooperation based on co-authorship of the principal authors. Source: own elaboration.

Each of the colours corresponds to a cluster grouping its main collaborators. Nine distinct clusters have been found. The red cluster comprises eight authors: Fang I., Gong J., Li Y., Liu W., Liu X., Ning M., Pan W., and Zhang Y. The green cluster groups seven authors: Ding Z., Guo Y., Li X., Si X., Wei H., Zhang W., and Zheng S. The blue cluster is made up of five authors: Huang J., Liu Q., Shen I., Sun S., and Wang H. The yellow group is made up of six authors: Brosing S., Luo R., Rozelle S., Yue A., Zhang I., and Zhao Q. The purple cluster consists of five authors: Deng D., Han J., Meng Y., Zhang X., and Zhang Z. The light blue set also consists of five authors: Chen X., Jia L., Qi T., Sun A., and Zhong S. The orange cluster is made up of four authors: Chen Z., Li Z., Sun J., and Zeng Y. The same is true for the brown cluster, formed by: Wang Y., Xin I., Yang Q., and Zhang J. Finally, the three authors composing the pink cluster are: Liu L., Rettenmaier A.J., and Saving T.R. The brown cluster has the highest number of citations with 62, followed by light blue with 33, orange with 25, blue with 20, and purple with 19 citations. The remaining clusters have fewer than 10 citations.

3. Content Analysis

3.1. Research Trends

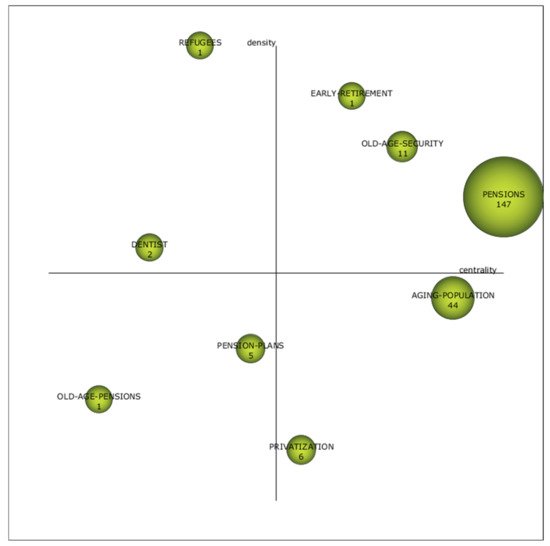

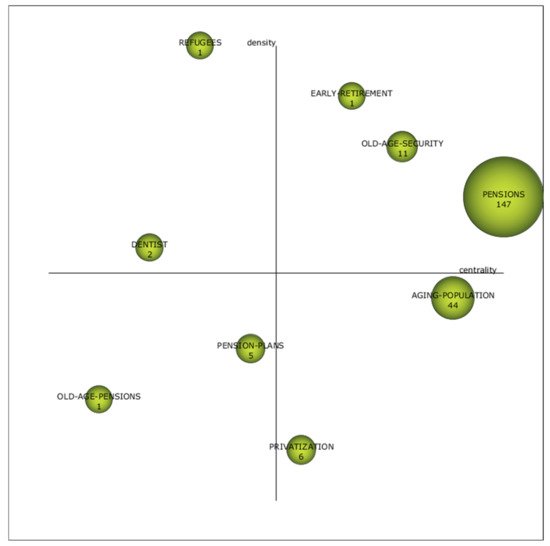

As established by previous research in other areas of study, in order to carry out a correct analysis of the strategic diagrams, the study has to be divided into two stages [25][26]. For this reason, researchers have divided the period analysed into two periods: the first period from 1936 to 2010 and the second period from 2010 to 2021. The first period is the longest one, but the scientific production is smaller than the second one. The first period includes a total of 625 articles, while the second period includes 662 articles.

For each period, researchers will make a strategic diagram representing two dimensions on a Cartesian coordinate axis: centrality (relationship of one node of the graph to another) and density (strength of the relationship between the entities within each node). Thus, the upper right quadrant shows motor themes, i.e., closely related to each other and others. The lower right quadrant shows basic and cross-cutting themes. The upper left quadrant shows isolated themes or highly developed themes internally but not linked to the others, as is the case with motor themes. Finally, the lower left quadrant shows emerging or declining themes.

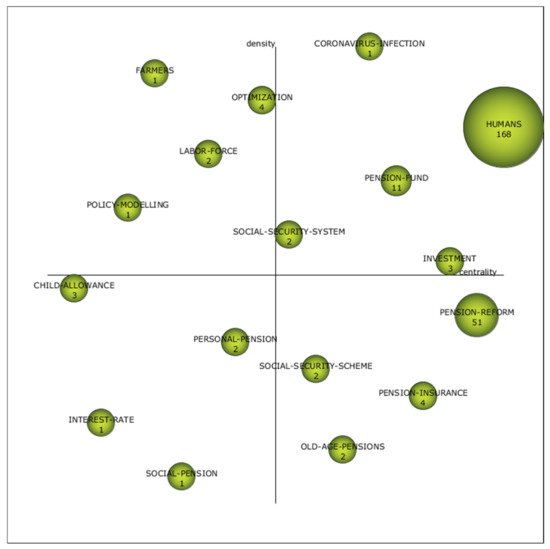

Figure 6 represents the strategic diagram of the first period from 1936 to 2010.

Figure 6. Strategic diagram of keywords on pension research from 1936–2010.

As can be seen, it presents three driving themes (upper right quadrant): early retirement, old age security, and pensions. These are the well-developed and essential themes of pensions research.

It can be seen that there are two basic themes (lower right quadrant): ageing population and privatisation. Studies on private pension systems have increased, especially in the last years. Figure 6 also presents two emerging or disappearing themes (lower left quadrant): old age pensions and pension plans. When researchers look at the next period, researchers will see whether these are emerging or disappearing themes. Finally, it can be seen and two highly developed themes: dentist and refugees. These themes are highly developed but unrelated to each other. The size of each of the circles reflects the h-index and, as can be seen, pensions and the ageing population have the highest h-index.

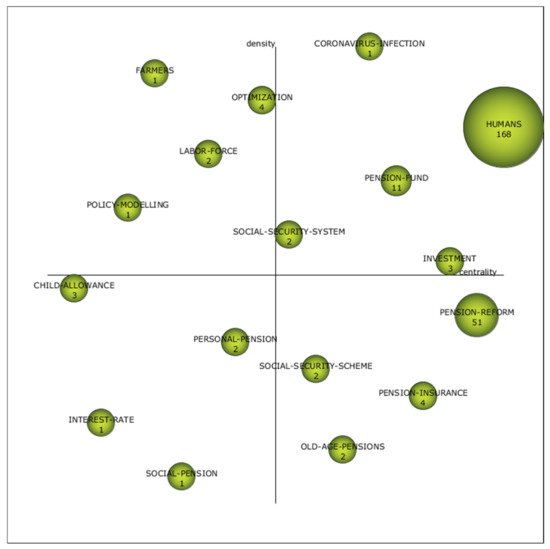

As can be observed in Figure 7, the second period from 2011 to 2021 shows four terms in each of the quadrants, except for the driving themes, which are five. The driver themes are humans, investment, social security system, pension-fund, and coronavirus infection. The appearance of a COVID-19 related issue is striking, although it is logical. As for the basic themes: pension reform, social security scheme, pension insurance, and old age pension, it can be seen that old age pension was, in the previous period, an emerging rather than a declining theme. However, the pension plan was a declining theme. In this section, the most important theme is covering studies on pension reforms. These reforms aiming at the sustainability of the system have become increasingly necessary. The emerging or disappearing themes are child allowance, personal pension, interest rate, and social pension in this period. Finally, highly developed themes, but unrelated to each other, are farmers, optimisation, labour force, and policy modelling.

Figure 7. Strategic diagram of keywords on pension research from 2011–2021.

Human is the main driving theme for this second period. This theme has been covered in 168 articles and has received 1152 citations with an h-index of 16. The second most important topic is the one dealing with the reform of pension schemes (pension reform) with a total of 51 articles, 327 citations, and an h-index of 10. In third place, although with much less importance, are the pension funds, with a total of 11 articles, 20 citations, and an h-index of 3.

Indeed, the ageing population in developed countries and the decline in the number of employed people relative to the number of retired people has led to a rethinking of the reform of traditional pension systems. The use of private pension plans and alternative life insurance to supplement state pensions is increasingly recommended, which is reflected in the scientific literature or recent years. The economic support of human beings at retirement age is a central problem in the most developed economies.

3.2. Keywords

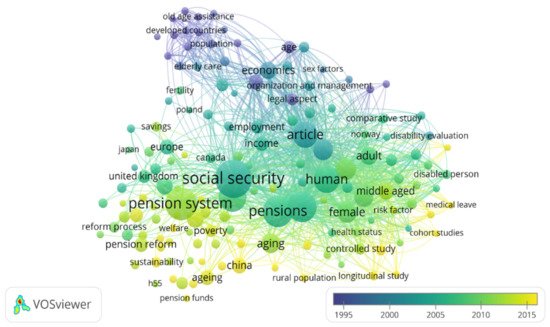

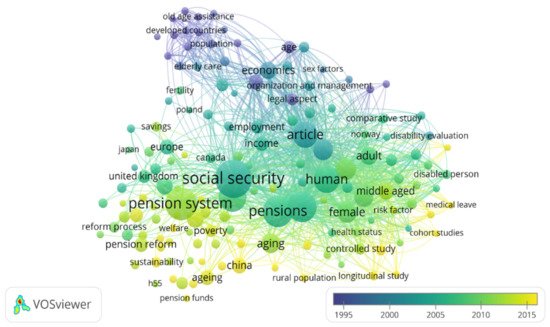

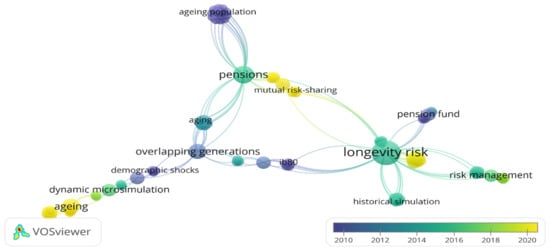

The study of trends in pension research ends with the analysis of the 3389 keywords. It has been performed through a network visualisation map based on the co-occurrence of keywords shown in Figure 8.

Figure 8. Evolution of the main keywords network based on co-occurrence (1936–2021). Source: own elaboration.

Figure 8 shows how the topics of interest in pension research have evolved. Since 1995, aspects, such as organisation, country development, and care for the elderly, were the most important topics. As time went by, the social security system and pensions gained more and more ground in the articles published, ending up in the days with an increasing concern about the much needed reform of the pension system to ensure sustainability. Furthermore, the results show that from the beginning of the period, 2010 or 2012, there was a concern about the sustainability of the social security system and the necessary pension reform. It also shows how society has become increasingly aware of the need for private coverage to complement social security pensions and how new alternative products have emerged, even to private pension plans, such as unit-linked plans, which combine insurance and investment operations in a single financial product.

4. Results in the Mathematics Area

Once the bibliometric analysis of all published articles on pension research has been completed, researchers will carry out a specific analysis of those published in the area of Mathematics.

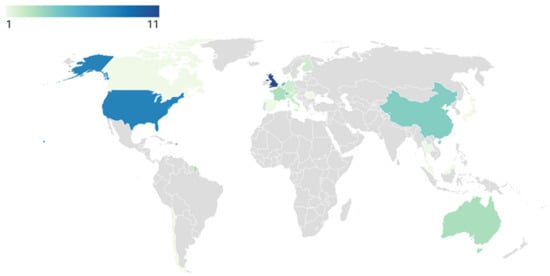

As can be seen in Figure 9, whose left axis represents the number of articles and the right axis the number of citations, pension research is also a topic of interest in the area of Mathematics, especially since 2008 when researchers’ interest in this topic increased. The articles written in 2008, and those of 2015 and 2016, have aroused the most interest, garnering the highest number of citations.

Figure 9.

Evolution over time of published articles and total citations on pension research in the Mathematics area. Source: own elaboration.

These countries are represented in Figure 11. However, 32 out of 48 papers have been published in 5 countries. It should be noted that an article can cover more than one country, as authors can co-author it from different institutions. The most prolific country is the U.K., with 22.91% of publications (11 articles), followed by the U.S.A. with 16.66% (8 articles), and the Netherlands with 10.41% (5 articles). China and Switzerland are in fourth and fifth place with four articles.

Figure 10. Worldwide publications on pension research in the Mathematics area. Source: own elaboration.

It has been shown how this higher publication of articles by country does not correspond to the position in terms of citations per article received. Thus, in this case, the country that received the most citations is the Netherlands, which ranked third in terms of the number of publications. The same situation occurs with the h-index, as the Netherlands is again the country with the highest h-index with 4 and the rest with 3, except for Switzerland, which is in last place with 1.

Figure 11 depicts networks showing cooperation among the nine major countries that have published articles on pension research in the Mathematics area. The colour of each of the spheres corresponds to a grouping of countries, while the size represents the number of articles published per country.

Figure 11.

Network of cooperation based on co-authorship between countries in the Mathematics area. Source: own elaboration.

Four different groups have been observed. The red group includes Belgium, Germany, and Luxembourg. The countries associated with the green colour are Austria and Spain. The blue cluster comprises Italy and the U.S.A. Finally, the U.K. led the yellow group, including the Netherlands.

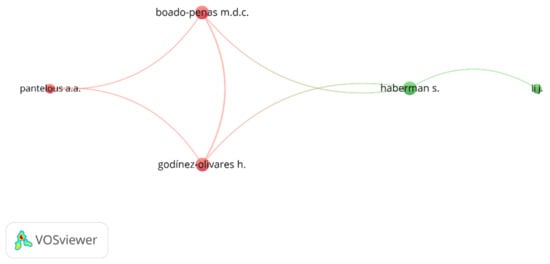

Different collaborative networks have been created from the co-authorships of the main authors. These networks are shown in Figure 12. Each of the colours corresponds to a cluster grouping its main collaborators. Two distinct clusters have been found. The red cluster comprises three authors: Boado-Penas M.d.C., Godínez-Olivares, H., and Pantelous, A.A. The green cluster groups two authors: Haberman S. and Li J.

Figure 12.

Network of cooperation based on co-authorship of the main authors in the Mathematics area. Source: own elaboration.

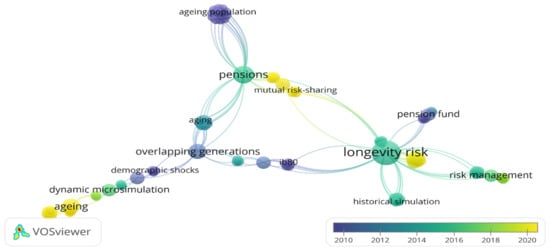

Figure 13 shows how the topics of interest in pension research in the Mathematics area have evolved. It can be seen how, at first, issues related to population, ageing, and social security were the most relevant. From 2014 onwards, topics, such as longevity, pensions, pension reform, and risk management, came to the fore. Finally, the most relevant topics are currently those related to unit-linked contracts. It is significant how this type of contract has been introduced as a means of hedging in recent years. Mortality models with covariant and survival models are also relevant topics in the area of Mathematics.

Figure 13. Evolution of main keywords network based on co-occurrence in the Mathematics area (1999–2021). Source: own elaboration.

5. Discussion

The research aimed to conduct a bibliometric analysis of published research on pensions through a structured literature review. The study was carried out on a total of 1287 articles published from 1936 to 2021 and found in the Scopus database. The study analysed the most relevant indicators that characterise an article, such as authors, journals, countries, institutions, subject areas, keywords, and citations.

The results obtained show that since the first article on pensions was published in 1936, the number of articles has not stopped growing. This growth has been very significant in the last ten years, where more than half of the papers have been published. The increasing interest in pensions has been due to concerns about the difficulty of sustaining pensions in the future. This expansion in the number of articles published has led to an increase in the number of authors, countries, and journals interested in this topic in recent years.

The results also show that the main subject area in which these articles have been published is Economics, Econometrics, and Finance with 32.77% of the production, followed by Social Sciences with 28.45%, and Business, Management, and Accounting with 12.12%. The journal that has published the most articles is the International Social Security Review, with 122 articles. This journal is also the one that has received the most citations, with 1092. In addition, it has also been found that the most productive journals are in the upper quartiles of Scopus.

Analysing the number of countries that have contributed to the pension literature, researchers can see that the number is 112. However, half of the articles published have been from only one country, with the U.S.A. being the most productive country. Another important conclusion to note is that the 10 journals that have published the most articles belong to Western countries, 8 European countries and 2 to North America, which shows the greater interest in the more developed countries in the future of pensions. Strong collaborative networks between these countries in pension research have also been demonstrated.

It can be seen as the author with the highest number of publications is Pestieau, P. with 12 articles, followed by Williamson, J.B. with 11. However, neither of these two authors is the one who receives the most citations, as this first place is occupied by Meijdam, L., with 182 citations. The findings also show the existence of important collaborative networks among authors specialising in this field.

Another important issue analysed was the contribution by institutions, with 2 Dutch institutions publishing the most articles, with 30 and 21, respectively. However, it is a U.S. institution, with 14 articles, that has received the most citations, with 761. On the other hand, the most cited article has been published by Fogel R. W. et al. [27], with 226 citations since its publication in 1997.

Finally, an analysis of the latest trends in pension research shows that the most current topics are humans and pension funds, with 168 and 51 articles, respectively.

A specific analysis of the 48 articles published in the area of Mathematics has also shown a growing interest in recent years, with a significant increase in production in 2021. Researchers can find articles published by 99 authors representing 24 different countries within this thematic area. The most important journal in this area is Insurance: Mathematics and Economics, with 14 articles and 156 citations. It is important to note that the prominent journals in this area are all European. Finally, the results show that the five authors who published the most on pensions represent five different universities and only two countries (the U.K. and the Netherlands).

References

- Alonso-García, J.; Rosado-Cebrian, B. Financial crisis and pension reform in Spain: The effect of labour market dynamics. J. Econ. Policy Reform 2021, 24, 201–218.

- Hinrichs, K. Recent pension reforms in Europe: More challenges, new directions. An overview. Soc. Policy Adm. 2021, 55, 409–422.

- Pérez-Salamero González, J.M.; Regúlez-Castillo, M.; Vidal-Meliá, C. Differences in Life Expectancy Between Self-Employed Workers and Paid Employees when Retirement Pensioners: Evidence from Spanish Social Security Records. Eur. J. Popul. 2021, 37, 697–725.

- Valls Martínez, M.d.C.; Cruz Rambaud, S.; Abad Segura, E. Savings operations over random periods. Cogent Bus. Manag. 2018, 5, 1515572.

- Symeonidis, G.; Tinios, P.; Xenos, P. Enhancing Pension Adequacy While Reducing the Fiscal Budget and Creating Essential Capital for Domestic Investments and Growth: Analysing the Risks and Outcomes in the Case of Greece. Risks 2020, 9, 8.

- Weaver, R.K. The politics of pensions: Lessons from abroad. In Framing the Social Security Debate; National Academy of Social Insurance: Washington, DC, USA, 1998; pp. 183–229.

- Wolf, I.; Lopez del Rio, L.C.y. The Expectation for Pension Insurance in Funded Schemes: Theoretical Model and Global Implementation. Acad. J. Interdiscip. Stud. 2021, 10, 161.

- Ebbinghaus, B. The varieties of pension governance. In Pension Privatization in Europe; Oxford University Press: Oxford, UK, 2011.

- Möhring, K. Employment histories and pension incomes in Europe: A multilevel analysis of the role of institutional factors. Eur. Soc. 2015, 17, 3–26.

- Hammond, R.; Baxter, S.; Bramley, R.; Kakkad, A.; Mehta, S.; Sadler, M. Considerations on State Pension Age in the United Kingdom. Br. Actuar. J. 2016, 21, 165–203.

- Wang, X.; Williamson, J.B.; Cansoy, M. Developing countries and systemic pension reforms: Reflections on some emerging problems. Int. Soc. Secur. Rev. 2016, 69, 85–106.

- Febrero, E.; Cadarso, M.Á. Pay-As-You-Go versus funded systems. Some critical considerations. Rev. Polit. Econ. 2006, 18, 335–357.

- Fernández López, S.; Vivel Búa, M.; Otero González, L.; Rodeiro Pazos, D. El ahorro para la jubilación en la UE: Un análisis de sus determinantes. Rev. Econ. Mund. 2012, 31, 111–135.

- Hira, T.K.; Rock, W.L.; Loibl, C. Determinants of retirement planning behaviour and differences by age. Int. J. Consum. Stud. 2009, 33, 293–301.

- Pan, G.; Li, S.; Geng, Z.; Zhan, K. Do Social Pension Schemes Promote the Mental Health of Rural Middle-Aged and Old Residents? Evidence From China. Front. Public Health 2021, 9, 710128.

- Lee, S.-L.; Park, M.-H.; Montalto, C.P. The effect of family life cycle and financial management practices on household saving patterns. Int. J. Hum. Ecol. 2000, 1, 79–93.

- Fontes, A. Differences in the likelihood of ownership of retirement saving assets by the foreign and native-born. J. Fam. Econ. Issues 2011, 32, 612–624.

- Harrysson, L.; Montesino, N.; Werner, E. Preparations for retirement in Sweden: Migrant perspectives. Crit. Soc. Policy 2016, 36, 531–550.

- Díaz Casero, J.C.; Fernández Portillo, A.; Sánchez Escobedo, M.C.; Hernández Mogollón, R. Estructura intelectual del fracaso empresarial. Faedpyme Int. Rev. 2014, 3, 43–55.

- Shi, Y.; Li, X. An overview of bankruptcy prediction models for corporate firms: A systematic literature review. Intang. Cap. 2019, 15, 114–127.

- Li, H.; Yu, J.-L.; Yu, L.-A.; Sun, J. The clustering-based case-based reasoning for imbalanced business failure prediction: A hybrid approach through integrating unsupervised process with supervised process. Int. J. Syst. Sci. 2014, 45, 1225–1241.

- Payán-Sánchez, B.; Belmonte-Ureña, L.J.; Plaza-úbeda, J.A.; Vazquez-Brust, D.; Yakovleva, N.; Pérez-Valls, M. Open innovation for sustainability or not: Literature reviews of global research trends. Sustainability 2021, 13, 1136.

- Merigó, J.M.; Yang, J.-B. A bibliometric analysis of operations research and management science. Omega 2017, 73, 37–48.

- Snyder, H. Literature review as a research methodology: An overview and guidelines. J. Bus. Res. 2019, 104, 333–339.

- Zambrano Farias, F.; Valls Martínez, M.d.C.; Martín-Cervantes, P.A. Explanatory Factors of Business Failure: Literature Review and Global Trends. Sustainability 2021, 13, 10154.

- Terán-Yépez, E.; Marín-Carrillo, G.M.; del Pilar Casado-Belmonte, M.; de las Mercedes Capobianco-Uriarte, M. Sustainable entrepreneurship: Review of its evolution and new trends. J. Clean. Prod. 2020, 252, 1–21.

- Fogel, R.W.; Costa, D.L. A theory of technophysio evolution, with some implications for forecasting population, health care costs, and pension costs. Demography 1997, 34, 49–66.

More