The given research paper examines the characteristics of German private investors regarding the probability of using robo-advisory-services. The used data set was gathered for this purpose (N = 305) to address the research question by using a logistic regression approach. The presented logit regression model results indicate that the awareness of sustainable aspects make a significant difference in the probability of using a sustainable robo-service. Additionally, our findings show that being male and cost-aware are positively associated with the use of a sustainable robo-advisor. Furthermore, the probability of use is 1.53 times higher among young and experienced investors. The findings in this paper provide relevant research findings for banks, asset managers, FinTechs, policy makers and financial practitioners to increase the adoption rate of robo-advice by introducing a sustainable offering.

1. Introduction

Robo-advisors are fully automated investment services, which are provided online for private and institutional investors. Characteristics of this service are the use of mathematical algorithms and the use of artificial intelligence to advise clients. In doing so, the online service aims to replicate human service and even aim to surpass it. Robo-advisors operate according to rules and thus claim to be more objective and hence more successful in terms of investment performance. While humans may be led by emotions, thereby leading to false investment decisions, robos claim to be free of any biases

[1][2][3][1,2,3].

According to Oberhuber (2021), the COVID-19 pandemic has shown investors that online services are vital for investment purposes. Clients, who preferred to talk to a human advisor and even still prefer visiting a bank branch, are now gradually changing their behaviors. This is due to the fact, that banks shut down their branches when governments voted for a lockdown. Often, clients did not expect such a radical move and thus were spending more time on alternative services, which can provide an adequate client experience

[4].

Objective research results from independent institutions have shown that the COVID-19 pandemic was the first real test for robo-advisors. Before, markets were constantly on a rising trend, thereby making it relatively easy for robo-advisors to show good performances. This is expected since robos often make effective use of exchange traded funds (ETFs), which represent a passive investment style by replicating a certain benchmark or index. If the index is on a rising trend, so is the main part of robo-advisors. Therefore, no “real” proof-of-concept in terms of complex trading algorithms is necessary

[4][5][4,5].

In Germany, robo-advisors have already existed since 2013 but are currently still struggling to establish themselves in the minds of private and institutional investors. Many providers are now working on introducing new innovations and features to gain a competitive market advantage

[6][7][6,7]. This is necessary because the market is often regarded as being in a consolidation phase. Besides traditional bank and asset managers, especially FinTechs are offering this online service with high funding. This is one of the most dominant trends is the transition towards green investments. This relates to the general increasing awareness of investors to invest in an ethical manner. A testament for this trend is the introduction of the “Sustainable Finance Disclosure Regulation” by the European Union (EU). The new policy pays justice to the investor demand to have more transparency about investment funds, thereby leading to easier and more ethical decision making. The EU Policy provides requirements to clearly classify sustainable and non-sustainable investment products

[8][9][10][8,9,10].

The given research paper focuses on the research question if the introduction of sustainable investments has an influence on the willingness to use the services of a robo-advisor. The primary motivation is to provide empirical proof, that the introduction of a sustainable investment offering meets the demand of private investors. In Germany, some robo-companies already introduced sustainable portfolios, but most robo-advisors are still uncertain if it is a valid strategic business decision. The research findings aim to contribute to the establishment of this new business innovation by providing practical recommendations with a focus on a sustainable product offering.

1.1. Sustainability Preferences in Personnel Finance of Private Investors

In the increasingly competitive environment of the financial sector, client sensitivity to their choice of bank is sharpened. Ayadi et al. (2020) state in the British Journal of Management, that clients are becoming more aware about sustainable aspects in daily life. The authors used a sample of over 3000 banks from 32 European countries and showed that “reinventing” the own business model has positive impacts on profitability as well as business stability. The paper provides major strategic insights for financial companies and could be extended by a more detailed focus. For instance, the analysis of banks, which changed their business models towards a more sustainable approach, may be interesting for current academic debates

[11]. Younger generations, which will be disproportionately affected by the impacts of climate change, are already demanding sustainable products and services

[12][13][12,13]. Based on reputational risks, in a worst-case scenario, clients could migrate or decide ex-ante against a financial institute or company due to ignorance towards sustainability factors.

According to Forcadell et al. (2020) and their presented paper in the journal “Contemporary Issues in Banking”, unnoticed reputational damages and distancing from existing and new clients can substantially threaten existing businesses. The authors analyzed a sample of 112 large international commercial banks from 13 developed countries with over 653 observations. They concluded that the introduction of corporate sustainability can reduce “clients’ fears of opportunistic behavior and information asymmetries”. The research design is interesting from a corporation point-of-view and may provide an even better holistic view if the client perspective would be included

[14].

As the shareholder activism example of the social-media-network Reddit

[15] or reactions to alleged greenwashing at companies has shown

[16], the high reach and effect strength of stakeholders must be taken into consideration in a digital age

[17].

Referring to Ayadi et al. (2020) and Forcadell et al. (2020) as selected excerpts from the given literature-review, the given paper aims to provide new detailed academic insights with emphasis on the client perspective. Beyond financial risks from existing retail clients, Chatzitheodorou et al. (2021) and Hübel and Scholz (2019) see the demands of institutional clients as an additional challenge

[18][19][18,19]. The risk of stranded assets due to a lack of consideration of sustainability risks can lead to potential misinvestments

[20][21][22][23][20,21,22,23].

Based on the discussion concerning the achievement of returns in the context of sustainability, numerous scientific studies question the singular financial consideration of returns from sustainable investments on different levels

[24][25][26][27][28][29][24,25,26,27,28,29]. One exemplary research work from Xie et al. (2018) investigates the connection between corporate efficiency and sustainability. After applying data envelopment analysis for estimation, they conclude a positive association with corporate efficiency and therefore returns

[27].

The study from Hodge et al. (2020) states that robo-advisors must consider the effect of humanizing robo-advisory. When correctly considered, investment recommendations may be better accepted by private investors, which may ultimately lead to better returns. However, Hodge et al. (2020) focus on a holistic view on robo-advice and does not include current robo-trends such as the integration of sustainable portfolios and how that would impact investor judgment.

Another relevant academic finding related to investment returns is presented by Kleine et al. (2019), that sustainability does not automatically lead to the suffering of lower returns. The authors describe their findings, which are grounded on an extensive meta-study, consisting of 195 relevant studies in the field of sustainability

[23]. The findings refer to a time frame between 1963 and 2011, thereby correctly forecasting the upcoming trend of sustainability in the investment field. Nonetheless, the market has changed and evolved, thereby making it necessary to consider new and recent publications in this field. The given paper aims to provide new and relevant quantitative research insights to contribute to the next iteration of meta study by Kleine et al. (2019) and other researchers around the world.

A first definitional approach challenges the determination of personal return targets. Thus, the guiding principle of maximizing returns from a financial perspective is assumed as the basic assumption, ignoring other potential influencing parameters of personal benefit preference

[19][23][19,23]. From a return-perspective, it is important to emphasize that investment decisions, whether conventional or sustainable, are made by considering risk over-return ratio considerations

[30][31][32][30,31,32]. Whether there is a trade-off between social and financial returns depends also on the utility preference of an acceptable return, thereby calculating personal objectives and risk

[33][34][33,34]. In this context, different asset classes must be regarded to enable valid comparisons.

1.2. Robo-Advisory as Financial Innovation

One current digital trend in the financial industry is constituted by the service of robo-advisors. The term of robo-advisory consists of the two words ‘robot’ and ‘advisor’, thereby representing a digital software service for wealth management. According to Hohenberger et al. (2019), the robo-offer is available for private and institutional investors to manage investment portfolios, thereby aiming to make financial management easier

[35].

There is no financial barrier because the digital service is independent from the financial status of an investor. On that basis, digital wealth management states an essential distinction to personal wealth management, which mainly targets high-net worth individuals. While personal wealth management requires human advisory, robo-advisors are based on mathematical algorithms. Boreiko and Massarotti (2020) state, that those algorithms are programmed by humans and possess the ability to perform systematic calculations to ultimately provide investment recommendations based on given input parameters. Exemplary parameters are the investment horizon, the investment amount or the budget surplus

[36].

The need of investors for financial advice can vary due to their personal preferences and life situation. For instance, risk appetite, risk preferences or the financial situation are major factors in the decision-making process. Additionally, available time and investment knowledge play an important role when approaching professional assistance. On that basis, robo-advisor companies provide different forms with specific functionalities to cover the different demands in the market. This can be done by implementing smart algorithms and artificial intelligence mechanisms

[37].

Since robo-advisory already achieved great success in Germany, the German consumer organization “Stiftung Warentest” took this development as an occasion to examine existing successful robo-advisory providers on the market. The examination involved the engagement with 18 robo-advisory firms regarding key characteristics such as risk profiling, portfolio offer and pricing. The online report also divided the forms of robo-advisory services into three different types which will be explained in the following: full-service robo, half-service robo and self-service robo

[38][39][38,39].

Full-Service-Robo: This form of robo-advice constitutes an automated portfolio management service. Hence, a full-service-robo “requires authorization from the German Federal Financial Supervisory Authority (BaFin) in accordance with section 32 (1) of the German Banking Act. The BaFin has the task of monitoring the robo-advisor’s business in favor of investor protection. Once the investor finishes an online questionnaire regarding their financial situation and goal, all provided information or parameters serve as foundation for the work of mathematical algorithms. On that basis, the robo-advisor’s algorithms do not solely provide a once-off recommendation. They rather perform consecutive recommendations to meet the complex and dynamic investment requirements. For instance, financial markets can show volatile tendencies, thereby necessitating reallocations within investment portfolios. Factors such as economic developments or political incidents can influence global markets and directly impact the investments

[38][39][38,39].

Half-Service-Robo: This robo-advice approach constitutes a service in which the advisor’s focus lies on the provision of investment proposals. In contrast to the full-service alternative, the robo-advisor does not hold a mandate to autonomously execute orders but rather acts as an investment intermediary according to section 34f of the German Industrial Code GewO. The monitoring falls under the responsibility of the German Chamber of Commerce and Industry (IHK). According to the given authorization, half-service-robos always require the investor’s consent to execute orders. Once the investor completes the online questionnaire, a matching to a specific portfolio structure takes place to establish the investment foundation. Therein, the portfolio structure consists of offensive and conservative investment shares. Due to the given investor information, the percentage weight can vary. Investors whose risk tolerance is high will have a higher percentage of risky investments, thereby enabling higher returns. In contrast, investors who seek investment security, will receive a proposal with a higher share of conservative investments, thereby reducing the chance for high returns. The offensive share is stated by stocks whereas the defensive aspects refer to conservative investments such as bonds. Once a portfolio structure is assigned (e.g., 20% offensive and 80% conservative), the portfolio structure will be kept until the investor provides new investment parameters, thereby changing the risk appetite

[38][39][38,39].

Self-Service-Robo: In this form of service, the main objective of the robo-advisor is to provide information to an investor, thereby assisting in the decision-making process. In comparison to the previously mentioned forms, a self-service-robo neither executes an order, nor opens a securities account at a custodian bank. Hence, there is no obligation to hold an authorization by the BaFin or the German Chamber of Commerce and Industry. Thus, the robo-advisor serves as an information source to gain investment proposals. This form of robo-advice is suitable for investors who prefer to manage the investment portfolio themselves. In doing so, they already hold knowledge and experience in investment matters to independently manage the portfolio. Despite of the investor’s expertise, there is still interest to gain additional information or investment proposals for verification purposes. Furthermore, another characteristic feature lies in the independent choice of the bank to open the securities account. This freedom of choice contributes to the high level of autonomy that a self-service-robo pays justice to

[38][39][38,39].

2. Materials and Methods

The research question is to assess which investor characteristics play a significant role for the probability of investing via a sustainable robo-advisory-offering. Thus, the choice of methodology is grounded in the existing research gaps, which are elaborated in

Section 1.1 and 1.2 in the fields of sustainability and robo-advisory. Besides the existing literature base, quantitative research by means of regression model is suitable for addressing the unanswered hypotheses. The illustrated excerpt from the literature review shows that there is still room for more quantitative research, which combines both sustainability with investment management for private clients. In doing so, the choice of regression analysis is eligible to test whether sustainability has an impact on the willingness to invest via robo-advisory.

2.1. Research Hypotheses

Based on the existing literature review with the outlined research gaps, the following hypotheses of the study are presented below (see Table 1):

Table 1. Research Hypotheses.

| |

Hypothesis |

| H1 |

The likelihood of using a sustainable robo-advisor is higher among male investors. |

| H2 |

The higher the age, the higher the likelihood to use a sustainable robo-advisor. |

| The higher the cost-awareness, the higher the likelihood of using a sustainable robo-advisor. |

| H10 |

3. Results

The logistic regression analysis was conducted to predict the key determinants considered by young professionals to use the offer of sustainable robo-advisors. As described beforehand, the generated dataset was modified to prepare for the logistic analysis (e.g., dummyfication of categorical variables).

The dependent variable “ROBO_USE_PROB_SUST_DUMMY” thus represents the probability of the young professionals to invest in a sustainable robo-advisor. Along the presented hypotheses in

Section 2.2, the following

Table 2 shows the results for each independent variable with the corresponding p-values.

Table 2. Logit, using observations 1-305.

| |

Coefficient |

Std. Error |

z |

p-Value |

|

| 1.78710 |

−4.867 |

<0.0001 |

*** |

| MALE |

0.741439 |

0.301207 |

2.462 |

0.0138 |

** |

H3 |

The likelihood of using a sustainable robo-advisor is higher among academics. |

| AGE |

0.0914433 |

0.0361638 |

2.529 |

0.0115 |

** |

H4 |

The likelihood of using a sustainable robo-advisor is higher among investors with investment experience. |

| EDUC_DUMMY |

0.671967 |

0.303410 |

2.215 |

0.0268 |

** |

H5 |

If the reason for investing is long-term oriented, the likelihood of using a sustainable robo-advisor is higher. |

| INVESTED_ALREADY |

−0.284926 |

0.492762 |

−0.5782 |

0.5631 |

|

H6 |

The likelihood of using a sustainable robo-advisor is higher among investors preferring professional finance advice. |

| REASONS_INVESTING |

0.0630840 |

0.377005 |

0.1673 |

0.8671 |

|

H7 |

The higher the risk appetite, the higher the likelihood of using a sustainable robo-advisor. |

| ADVISING_INVESTMENTS |

0.931415 |

0.279045 |

3.338 |

0.0008 |

*** |

H8 |

The higher the demand for investment transparency, the higher the likelihood of using a sustainable robo-advisor. |

| RISK |

0.0928086 |

0.171748 |

0.5404 |

0.5889 |

|

|

| GOVERNANCE |

0.200450 |

0.144973 |

1.383 |

0.1668 |

|

| Mean dependent var |

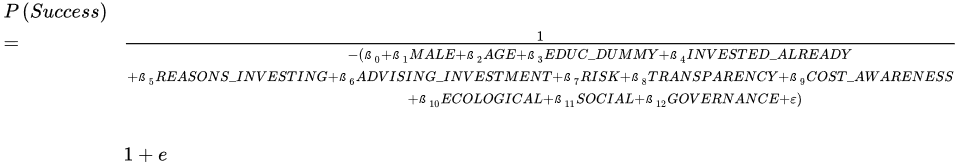

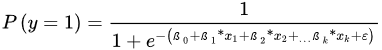

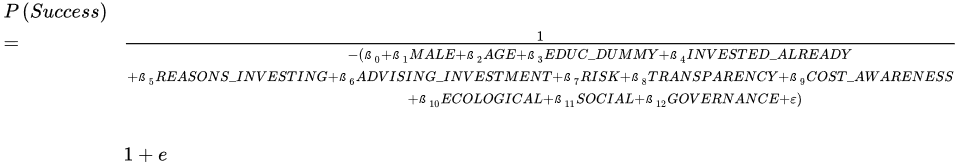

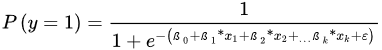

- =1): Observing probability of an analyzed event, that y = 1;

- e: Base of the natural logarithm (Euler’s number);

- xk: Independent variables;

- ßk: Regression coefficients of independent variables;

- ε:Error value.

With regards to the final model presented in Table 2, the adjusted logistic regression model is given by:

The McFadden R-squared shows a value of approximately 0.21, which can be considered as good or acceptable. Since this research approach uses a logistic model and not a linear model, the value is acceptable and comparable to other research papers, which use the same academic procedure. Furthermore, the number of cases “correctly predicted can also be stated as good with approximately 73.4%.

Focusing on the independent variables, it becomes evident, that 6 out of 12 are significant (given an α < 0,05 and excluding the constant). Hence, the independent variables “INVESTED_ALREADY”, “REASONS_INVESTING”, “RISK”, “TRANSPARENCY”, “SOCIAL” and “GOVERNANCE” do not have an impact on the probability to invest in a sustainable robo-advisor. In other words, it has no effect whether a young professional already has investment experience or not. Additionally, the reasons behind the investment—neither short- nor long-term—are significant in the given model and thus of interest for the dependent variable. Moreover, the social and governance aspects of sustainability do not play an important role in the investment process, which indicates that young investors tend to pay more attention to the ecological aspect of sustainability.

The regression model was checked on collinearity problems, thereby referring to the variance inflation factors. The minimum possible value for an independent variable is 1.0. Values > 10.0 may indicate that a collinearity problem may exist. The results in

Table 3 show that all given independent variables show no signs of collinearity problems because the range of the VIF reaches a maximum value of 2611, which is far from the critical value of > 10.0, thereby indicating appropriate values for positive interpretation.

Table 3. Variance Inflation Factors of Independent Variables.

| Independent Variable |

Variance Inflation Factor |

| MALE |

1194 |

| AGE |

1100 |

| EDUC_DUMMY |

1110 |

| H9 |

.

Table 4. Odds Ratios of Significant Independent Variables.

| Significant Independent Variable |

Coefficient |

| | Odds Ratio |

| Hypothesis |

| 1392 |

| Testing Result |

| MALE |

0.741439 |

2.098953737 |

| 1.958085088 |

| TRANSPARENCY |

| −0.118239 |

| 0.244411 |

−0.4838 |

| The higher the importance for ecological aspects, the higher the likelihood of using a sustainable robo-advisor. |

| H11 |

The higher the importance for social aspects, the higher the likelihood of using a sustainable robo-advisor. |

| H12 |

The higher the importance for governance aspects, the higher the likelihood of using a sustainable robo-advisor. |

To understand the underlying research questions and address the hypotheses, suitable data had to be collected to evaluate the financial characteristics of private investors regarding the use of sustainable robo-advisors. Due to the novelty of the research topic—especially the sustainable technological perspective—the collection method of the primary data was chosen. With the aim of increasing the effectiveness of the study, a questionnaire was introduced, which was conducted with an appropriate target group. To ensure flexible availability, the questionnaire was collected and stored on an online platform that was published only for the participant group and could be accessed using their respective internet-enabled devices.

Within the present study, extra-occupational students from one private university in Germany were consulted to participate in the survey. Thereby, both Bachelor and Master students were included in the group of participants. The age of the students from initial responses is between 19–39 years. The average age of the given sample is 28. The groups were selected randomly from a list of different courses, to increase the odds of a non-biased dataset and were asked to attend in the context of a lecture. In total, 305 students completed the survey. Following a conservative approach and to ensure data quality, only fully-competed surveys were considered. Furthermore, patterned entries, e.g., showing exclusively highest (value of “5”) or lowest (value of “1”) possible values for Likert scale over all responses have been validated with no findings. As per the operations of the researchers, all fields of the questionnaire have been set as mandatory.

After completion of the data gathering procedure, the underlying questionnaire was used and prepared for a quantitative study. The questionnaire can be provided upon request to encourage further research. For this purpose, the variables were coded and transformed by using the open-source software “Gnu Regression, Econometrics and Time-series Library” (“GRETL”, latest release 30 September 2021). Regarding general principles of data transformation, it should be mentioned that data in the form of a Likert scale were transformed into a binary category system. This must be considered, for example, in the coding of the dependent variable (ROBO_USE_PROB_SUST), but also in the weighting of the sustainability preference of the participants [ECOLOGICAL; SOCIAL; GOVERNANCE]. Furthermore, dummy classification was typically carried out for variables that, for example, offered assessments or choices in the form of texts. Further variables considered in the model are explained in more detail below. The age [AGE] of the students was entered in its basic form, as a metric scale level was continuously available. The multi-level variable of highest educational attainment [EDUC_DUMMY] was summarized into the binary dummy subdivision of academic and non-academic degrees. The aspect of using a robo-advisor [ROBO_USE] was—again in a binary transformation—only evaluated as an acceptance in the case of a clear affirmative answer and alternatively translated into a rejection. Gender could be coded in binary, considering ethical aspects, as no alternative answers were found in the data set. The naming of the selected variable [MALE] corresponds to ‘1’ in the coding principle. To understand the source of investment advice for Young Professionals, transformation of the corresponding variable [ADVISING_INVESTMENT] into independent information gathering and professional advice from a certified investment advisor was undertaken. The reasons for the investment behavior [REASONS_INVESTMENT] are translated into a temporal component of short- and long-term investment goals.

2.2. Main Procedures & Statistical Analysis

The data was collected in five waves during the winter semester of 2021. To ensure comparability, the same procedure was used in each of the five rounds of surveys. After a consistent introduction to the topic covering explanations of the planned course of the survey, students were given time to answer the sections of the questionnaire. The previously communicated expected maximum time of 10 minutes was met in all rounds. After carrying out the data collection as well as the shaping of the final data set, as described in the data and variables section, examination of the data was conducted.

As in many scientific studies on determinant research, this study uses regression models to answer which factors influence the use of a sustainable robo-advisor. Due to the prevailing research question about the factors influencing use, a binary pattern emerges in answering this question. Since binary correlations cannot be meaningfully modelled linearly, the researchers resorted to a logistic regression model. More precisely, a logit model is used. Regarding the expected statements and the interpretation of the results, the following principles should be observed. If the coefficient is positive, the probability that the criterion takes the value 1 increases the higher the value of the predictor. If, on the other hand, the regression coefficient is negative, the probability decreases as the predictor value increases. If the sign of a regression coefficient is positive, this means that the probability of 1 increases with an increase in the relevant independent variable. If the sign is negative, this means a decrease in the probability, which is to be distinguished from the linear model.

| const |

−8.69691 |

| H1 |

The likelihood of using a sustainable robo-advisor is higher among male investors. |

Fail to reject |

| AGE |

0.0914433 |

1.095754646 |

| H2 |

The higher the age, the higher the likelihood to use a sustainable robo-advisor. |

Fail to reject |

REASONS_INVESTING |

The likelihood of using a sustainable robo-advisor is higher among investors with investment experience. |

| TRANSPARENCY |

| 1469 |

| EDUC_DUMMY |

1097 |

| ADVISING_INVESTMENTS |

0.931415 |

2.538098047 |

| H3 |

The likelihood of using a sustainable robo-advisor is higher among academics. |

Fail to reject |

Fail to reject |

ADVISING_INVESTMENTS |

1092 |

COST_AWARENESS |

0.371011 |

1.449199014 |

| H5 |

If the reason for investing is long-term oriented, the likelihood of using a sustainable robo-advisor is higher. |

Rejected |

COST_AWARENESS |

| H6 |

The likelihood of using a sustainable robo-advisor is higher among investors preferring professional finance advice. |

0.6285 |

|

| Fail to reject |

| H7 |

The higher the risk appetite, the higher the likelihood of using a sustainable robo-advisor. |

Rejected1332 |

| H8 |

The higher the demand for investment transparency, the higher the likelihood of using a sustainable robo-advisor. |

Rejected |

ECOLOGICAL |

2580 |

COST_AWARENESS |

0.455738 |

|

S.D. dependent var |

0.498855 |

| McFadden R-squared |

0.209759 |

|

Adjusted R-squared |

0.147917 |

| Log-likelihood |

| RISK | −166.1191 |

| 0.671967 |

| H9 |

The higher the cost-awareness, the higher the likelihood of using a sustainable robo-advisor. |

Fail to reject |

0.371011 |

0.181503 |

2.044 |

0.0409 |

** |

| SOCIAL |

2611 |

| H10 |

The higher the importance for ecological aspects, the higher the likelihood of using a sustainable robo-advisor. |

|

Akaike criterion |

358.2381 |

| Schwarz criterion |

406.6022 |

|

Hannan-Quinn |

377.5828 |

The general logistic regression model is shown in the following:

with

| GOVERNANCE |

| ECOLOGICAL |

| 0.743656 |

| ECOLOGICAL |

| 0.743656 |

| 0.193921 |

3.835 |

0.0001 |

*** |

| 1473 |

SOCIAL |

Since GRETL is not able to display the odds ratio, the calculation was manually conducted via Excel by using the coefficients (b) and the excel function Exp(b). In doing so, it makes the results from the logistic regression model easier to interpret and show the impacts of each significant independent variable on the dependent variable. The analysis and interpretation of the results show surprising but logical (in terms of the academic discussion) findings. For male investors, the probability of using a sustainable robo-advisor is increased 2.09 times. This still underlines the fact that in general, investors tend to be male. Furthermore, if the age increases by a value of 1, it increases the probability of use by 9.5%. In the research, the focus lies on young professionals within the age range of 19 to 39 years. This can be referred to the fact that young investors may not have the money to invest in a robo-advisor. With growing age and ongoing career, financial situation may change, thereby leading to a higher awareness towards investing opportunities. Another very significant result shows that the probability of use increases by 96% if the investor shows an education on an academic level (e.g., bachelor or master’s degree). This may indicate an important hint for robo-advisors, who are offered by traditional banks or asset managers. They often struggle to target the right clients within their existing clientele. Another important finding underlines the benefits of robo-advisory as a very cost-efficient investment offering. The probability of using a sustainable robo-advisor increases by 44% with every increase on the Likert scale regarding the cost awareness of investors. The same effect can also be stated on the Likert scale towards the ecological awareness, thereby leading to 1.1 times higher probability of use with increasing Likert values. The results are summarized in

Table 4

| 2.103612279 |

| Fail to reject |

| H11 |

| The higher the importance for social aspects, the higher the likelihood of using a sustainable robo-advisor. |

| Rejected |

| 0.00317336 |

0.211120 |

On that basis, the following research hypotheses stated in

Section 2.1 were tested, thereby leading to the following conclusions in

Table 5:

Table 5. Final Hypothesis Testing Results.

| H4 |

| H12 |

| 0.01503 |

| The higher the importance for governance aspects, the higher the likelihood of using a sustainable robo-advisor. |

| Rejected |

| 0.9880 |

Based on the analysis of the data and the hypothesis testing results presented in

Table 5, practical implications can be derived. In the following, the significant research insights are listed and explained in a way, that robo-advisors and companies, which plan to introduce a digital advisory service, gain immediate orientation for strategic business decisions.

Regarding H1: the collected data set consists of 47.2% (144 respondents) male online participants with an average age of 28, which is also the average age of the whole population. The findings indicate that a primary focus on male investors may have the highest chance of winning new clients for the robo-advisory-service. Strategic marketing operations could target young and male clients, who have typically finished their studies in that life period and started to earn money from employment.

Regarding H2: the higher the age, the higher the probability to use a sustainable robo-advisor. This may refer to various factors, which are not subject to this study. Some hypotheses may be eligible to state, that there is a positive correlation between the age and the available household income. Furthermore, another valid hypothesis could be that there is a positive correlation between the age and the interest in sustainable investment matters. Robo-advisors should consider that a profitable foundation is grounded on a healthy balance between young clients (e.g., as stated in H1) and older clients with a more beneficial financial status. The sole emphasis on young clients with an average age of 28 may not be sufficient to cover business expenses and to lead to a positive annual result.

Regarding H3: academics are more likely to use a sustainable robo-offering. This indicates that robo-advisors should make use of their big data departments to identify the partial number of existing clients with an academic degree. Furthermore, strategic marketing measures may focus on the establishment of an academic clientele. This could be a concise marketing strategy at universities or other research institutes to attract the desired target group.

-

-

Regarding H4: experienced investment clients show higher acceptance towards the use of a sustainable robo-advisor. Besides the already mentioned facts, another strategic approach is to focus on experienced clients and provide them with marketing information to create awareness for the robo-offering.

-

Regarding H6: the results of this hypothesis test is surprising because robo-advisory is a digital service, which originally seeks to substitute human advisory by using algorithms. Nonetheless, the gathered data prove that clients who are loyal to their advisors may also be a strategic target group for the sustainable offering. However, this may be of secondary priority because businesses seek to create new revenue streams by winning new clients with the digital alternative. Human advisory services still are more profitable due to the higher pricing.

-

Regarding H9: cost-aware clients are more likely to use the robo-offering. Banks or robo-advisors often do not have data regarding the cost-awareness of clients. In that case, traditional banks may use the existing relationship of the advisors with their clients to manually assess the partial number of cost-aware clients. In doing so, it provides a promising approach to identify high-potential prospects for the digital service alternative.

4. Conclusions and Discussion

The given research paper provides essential findings on how to define a possible target group for sustainable robo-advisors. Especially from a bank or asset manager point-of-view, existing clientele can be purposefully targeted when using the research findings from this paper (as outlined in the part of practical implications in

Section 3). Based on the findings, the indication is valid that there is demand for sustainable robo-advisory, especially among young and male investors. It is interesting that the ecological aspect of sustainability is more dominant than governmental or social aspects. This allows the conclusion, that sustainability is mainly associated among the population in this study. With the stated practical implications, companies providing robo-advisory have confidence in introducing sustainable portfolios to meet private investors’ demands. In doing so, the paper indicates several strategic starting points in terms of gender, age or financial characteristics.

The result of this paper stands in accordance with the Sustainable Finance Disclosure Regulation from the European Union, which was introduced in March 2021. The regulation aims to increase transparency by providing classification investments to easily identify sustainable and non-sustainable investment-fund products. Subject to discussion could be an increased focus on stressing social and governmental aspects of investing because the given findings show a lack of awareness among private investors. Policy makers may introduce regulatory requirements to clearly outline the scope of ESG in each investment service, independent from whether it concerns human or digital advisory

[10]. Since robo-advisory still constitutes a rather young business model, objective institutions such as Stiftung Warentest regularly analyzes the performance and the service quality of the robos. The sustainability trend and the findings in this paper could facilitate analysis on how sustainable the investments and recommended portfolios really are

[40].