Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 2 by Lily Guo and Version 3 by Vicky Zhou.

The simplest net working capital can be defined as the difference between the value of current assets and short-term liabilities together with other short-term accruals. It is equivalent to the part of the current assets financed with equity, provisions for liabilities, long-term liabilities, and the remaining part of accruals. Therefore, it is the capital that finances only that part of the current assets that are not financed with short-term liabilities. This amount is financed with fixed capital. Summing up, net working capital is the fixed capital that finances the company’s current assets.

- working capital

- strategy

- financial liquidity

- financial security

There are many definitions of net working capital in the literature. It is often referred to as working capital, net working capital (NWC), or circulating capital. In the literature, the concept of working capital is most often considered in net or gross terms

1. Introduction

There are many definitions of net working capital in the literature. It is often referred to as working capital, net working capital (NWC), or circulating capital. In the literature, the concept of working capital is most often considered in net or gross terms

. On the other hand, gross working capital are current assets used in the normal operating cycle

.

The term “working capital” is derived from an old Yankee travelling merchant who loaded goods onto his cart and was on the way to sell them. These commodities were referred to as “working capital” as he had to circulate them in order to make a profit. The cart and horse were his fixed assets

[4]

. The merchant owned the cart and the horse, so they were financed with equity. However, he had to borrow funds to buy the goods that he wanted to sell. These were called working-capital loans and had to be paid off after each trip to prove the merchant’s creditworthiness. When the merchant was able to pay off the loan, the bank was willing to give him another

. The example of this definition clearly shows that working-capital management includes a number of key elements related to company finances, i.e., short-term receivables, inventories, cash, and short-term liabilities.

Authors usually present current assets and liabilities as two basic elements that influence the level of net working capital. Apart from current assets and current liabilities, profits that generate sales revenue are the third most important element that significantly influences the level of net working capital. Several studies showed that the length of the production process and other technological characteristics are important determinants of working-capital demand

.

However, current assets are the most relevant areas that affect the level of working capital. The entire current asset management process generally focuses on two elements, i.e., inventories and receivables from customers. Inventories are the component of current assets that generates high costs. By analyzing small and medium-sized enterprises in this area, one can find many places where unnecessary costs are incurred. Therefore, in order to create an optimal working-capital management strategy, it is necessary to introduce various methods, inventory-management tools derived from logistics, which optimize the level of inventories and the costs of their management.

In turn, receivables from customers are a component that directly impacts creating a policy of managing liabilities towards suppliers. Establishing a receivables-management strategy very often determines the policy of managing liabilities towards suppliers.

Decisions made by managers in the area of current assets should aim at determining the appropriate levels and structure of individual elements that make up the current assets

[5]. Inventories and short-term receivables are such elements of current assets in the case that the selection of an appropriate management strategy determines the level of costs incurred by an enterprise. Is it high or low cost? The prerequisite for effective management in this place is a continuous control of the risks associated with holding assets

. Inventories and short-term receivables are such elements of current assets in the case that the selection of an appropriate management strategy determines the level of costs incurred by an enterprise. Is it high or low cost? The prerequisite for effective management in this place is a continuous control of the risks associated with holding assets [10].

The second area that strongly influences working capital is the management of current liabilities. Managing this area mainly involves managing liabilities towards suppliers whose share in the structure of short-term liabilities is generally very high.

2. Working-Capital Level

When calculating net working capital, one can use the capital and property approaches: the first approach is referred to as equity, as the starting point of the calculations includes the company’s fixed capital.

Net working capital = fixed capital − fixed assets

Net working capital = current assets − short-term liabilities

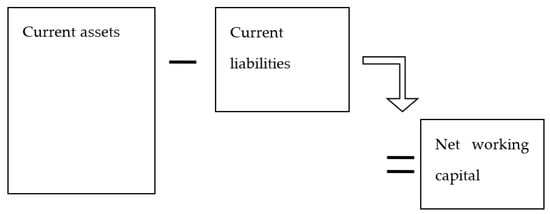

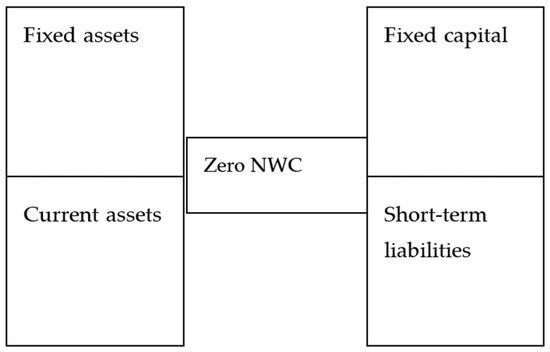

The value of working capital can also be calculated using the short- or long-term approach. In the short term, so called on the balance sheet, net working capital (NWC) is the surplus of current assets (CA) over current liabilities (CL). The net working capital calculated on a short-term basis is shown in Figure 1.

Figure 1. Net working capital on a balance-sheet basis. Source: own research.

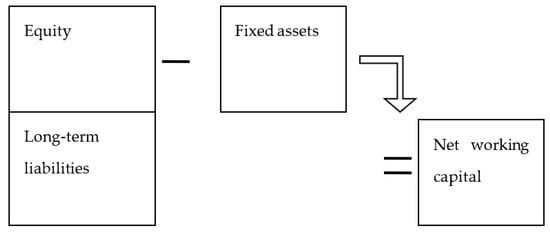

In long-term, i.e., capital terms, it is a surplus of fixed capital (FC) over fixed assets (FS). The fixed capital is the sum of equity capital (EC) and long-term liabilities (LL). The net working capital calculated on a long-term basis is shown in Figure 2.

Figure 2. Net working capital on a capital basis. Source: own research.

Regardless of how the calculations are made, the result must be the same. Net working capital can be:

-

positive,

-

negative, or

-

equal to zero.

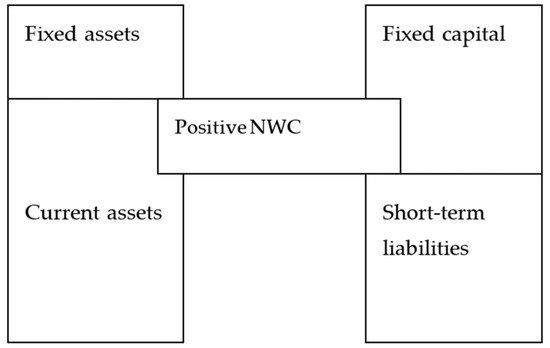

Positive net working capital (PNWC) is when current assets are higher than current liabilities, which is presented in detail in Figure 3.

Figure 3. Positive net working capital. Source: own research.

Positive working capital means the financial security of an enterprise. Current assets are financed with short-term liabilities and with fixed capital. The part of the fixed capital that finances the current assets is called positive net working capital. The positive working capital is the liquidity reserve that provides security for future situations in which cash shortages arise [10][12].

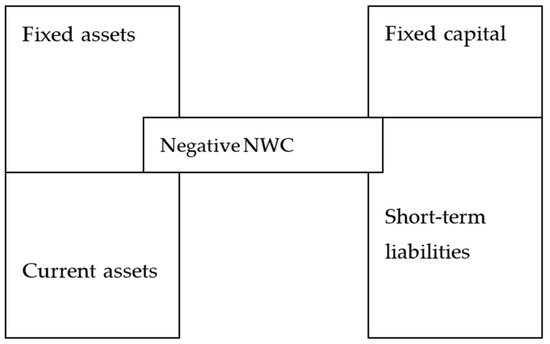

Negative net working capital is when short-term liabilities exceed current assets. It is a dangerous situation for enterprises and it means some problems with the payment of current liabilities.

The situation presented in Figure 4 shows the level of current liabilities that, apart from financing current assets, additionally finance fixed assets. The fixed assets that should naturally be financed with fixed capital are financed with short-term liabilities.

Figure 4. Negative net working capital. Source: own research.

Working capital is equal to zero occurs when current assets equal short-term liabilities, as shown in Figure 5.

Figure 5. Zero working capital. Source: own research.

In such a situation, there is no fixed capital to finance the current assets. The fourth possible situation arises when there is no equity capital in an enterprise. The equity is negative. This is an extreme case in entities that have become insolvent and go bankrupt.

The level and size of net working capital can also be determined at the stage of preliminary financial analysis, where the share of fixed assets in the total assets and the share of fixed capital in the total liabilities should be compared. If the share of fixed capitals in the structure of liabilities is higher than the share of fixed assets in total assets, then there is positive net working capital in an enterprise. If the opposite is the case, there is negative net working capital.

The level and size of working capital allow for determining the financial security of an enterprise. If the working capital is at a low level, then short-term liabilities are at a high level in financing current assets. The level of short-term liabilities is reduced through the timely payment of liabilities, which must be caused by the rapid rotation of short-term receivables in days. In order to pay off short-term liabilities, a company must have free cash. Therefore, trade-credit management policy largely impacts the level of net working capital. Trade-credit management appears on the side of receivables from customers, and on the side of liabilities to suppliers. The low level of net working capital is also information about effective management of working capital. Efficient, but risky, as a low level of net working capital can lead to a loss of financial liquidity.

In the case when the working capital is at a high level, it may mean a large involvement of equity in financing current operations. If this is due to additional long-term loans, there are additional financial costs. If the equity capital increases, it should be positively assessed if an enterprise has strong and “healthy” fundamentals for further operation. Every enterprise should be led to this direction. A very good method to increase revenue and profits in small enterprises is the use of group purchases. Enterprises acting together achieve the scale effect, which positively influences the reduction in the prices of purchased goods and materials.

3. Circulation of Working Capital

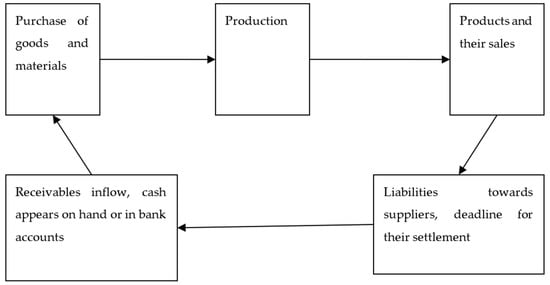

Net working capital circulates in an enterprise. Its individual elements are in constant motion, which causes the transfer of one asset to another. Details are shown in Figure 6.

Figure 6. Circulation of working capital.

Figure 6 shows the circulation of working capital divided into five stages:

- -

-

Enterprises purchase raw materials necessary for production. Cash is converted into inventory. However, if payment is made on credit terms, there are current obligations towards suppliers.

- -

-

The production process starts, which creates an obligation towards employees.

- -

-

The effects of production appear. A margin is used when selling, which increases current assets with possible inflows.

- -

-

Payment deadlines for liabilities expire. If receivables from suppliers have not yet been received, the company looks for new sources of financing, e.g., bank loans. However, if cash is received earlier, liabilities are repaid, which is the same as the reduction in current assets and liabilities.

- -

-

Receipt of receivables from customers. The obtained funds allow for paying off liabilities.

The above-mentioned steps comprise the working-capital cycle. Its definition is as follows: it is the period that elapses from the moment of spending funds for the purchase of factors of production until obtaining cash revenues for sold products, which are produced thanks to these factors [6][10]. The length of this cycle consists of the inventory-, the receivables-, and liabilities-conversion cycles.

Working-capital management involves both choosing the amount to invest and managing the cash-conversion cycle (the time that it takes to convert working capital into cash)

.

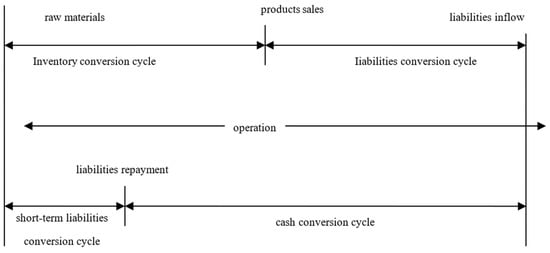

Working-capital turnover is related to the operating cycle (OC) and the cash-conversion cycle (CCC).

The operating cycle is otherwise known as the gross cycle of working capital, and it is the sum of the inventory- and receivables-conversion cycles. It is the period of involvement of cash in raw materials until it is recovered as a result of an inflow of receivables [4][5][6].

3.1. Operating Cycle = Inventory-Conversion Cycle + Receivables-Conversion Cycle

The operating cycle is often referred to as the current asset management efficiency index.

If we subtract the liabilities-conversion cycle from the operating cycle, then the net working capital cycle is created, more commonly known as the cash-conversion cycle. (Figure 7).

Figure 7. Operating and cash-conversion cycles.

3.2. Cash Conversion Cycle = Operating Cycle − Liability-Conversion Cycle

The cash-conversion cycle is the part of the operating cycle that is not financed with short-term liabilities due to their repayment before the end of the cycle. The cash-conversion cycle (CCC) is a basic measure of working-capital management that is widely used in the literature [12][13][14].

Another definition of the cash-conversion cycle is represented as follows.

3.3. Cash-Conversion Cycle = Inventory-Conversion Cycle + Receivables-Conversion Cycle − Short-Term Liabilities-Conversion Cycle

The cash-conversion cycle expresses the time over which current assets are financed with fixed capital. Otherwise, the net working-capital cycle can be defined as the period corresponding to the time range from the moment of cash outflow related to the payment for the delivered materials to the moment of cash inflow for sold products [14][15]. Another interpretation of this indicator informs us about how many days an enterprise needs its own cash to conduct operating activities. Thus, this is the period in which an entity operates by making its operating expenses out of finance from equity or long-term liabilities [3][4], which is the period of freezing money in current assets. Enterprises strive to minimize the time between the inflow of funds related to a purchase and the inflow of funds related to a sale. This period may also be called the “cash gap” [15][16][17][18][19][20].

4. Working-Capital Management Strategies

Positive working capital and its management primarily keep the company in a good and healthy financial condition—“financial health” [19][20]. The literature often reports that working capital directly impacts the company’s financial liquidity [20][21][22][23], profitability [24][25][26][27][28][29][30][31][32][33], and solvency, which allows for optimizing costs [21][33][34][35][36][37][38]. Therefore, its role and influence on the financial situation of an enterprise are enormous. There are also authors who claim that working-capital decisions have a positive effect on the efficiency and effectiveness of enterprise-asset management [39][40][41][42][43][44]. Because working capital significantly impacts financial security, profits, operational efficiency, and the process of optimizing the costs of the enterprise, it is necessary to create an optimal policy for enterprise management.

The literature presents three main classical strategies for managing net working capital: conservative, moderate, and aggressive.

The conservative strategy is to keep current assets high and short-term liabilities relatively low. Enterprises implementing this type of strategies maintain a high level of inventories and a relatively lower level of short-term receivables. Cash is also kept high. This type of strategy requires low short-term liabilities. The conservative strategy is associated with a high level of liquidity, as there is a significant advantage of current assets over current liabilities. It is a safe strategy for an enterprise [29].

The aggressive strategy is designed to keep current assets low compared to current liabilities. Managers try to maintain a slight advantage of current assets over current liabilities. Funds practically do not appear, as they are used to immediately settle liabilities. Liabilities also account for a small share, while receivables are kept at a relatively high level. The high level of receivables is because sales based on trade credit are directed to regular customers and to low credibility [25][29][35].

The moderate strategy is about minimizing the weaknesses of previous strategies and maximizing their benefits.

When analyzing individual working-capital management strategies, the moderate–conservative one should be considered to be optimal. Business management should be based on solid, secure foundations; therefore, the basis for a working-capital management strategy should be a conservative strategy. The main task of managers is to introduce appropriate modifications to each of the components of working capital in order to optimize the level of net working capital.

The first step should be to establish cooperation with a group of enterprises, e.g., as a part of a purchasing group, in order to obtain a low price of purchased goods or materials, and an attractive trade credit. The length of the trade credit is crucial for managing receivables from customers.

If the company can long-term repay its liabilities to suppliers, it could build an attractive policy of managing short-term receivables, and more precisely, with trade credit. It can gain new customers through a favorable trade-credit offer, which positively affects sales revenues, which should increase. Extending the deadlines for paying off receivables is a sign of departure from the typical conservative receivables-management strategy. When managing trade credit, an enterprise should control receivables so as to not lead to a situation where the turnover of receivables in days is longer than the turnover of liabilities in days. Receivables must more quickly be transferred to the bank account, before the payment of liabilities to suppliers is due.

In the case of the last element, which is inventory, companies operating, for example, within group purchasing organizations can easily, e.g., through benchmarking, improve the inventory-management process and reduce inventory levels. In addition, integration within the supply chain is not only a reduction in costs, but also an improvement of the supply system. It is a departure from a conservative towards a moderate policy. Inventories are kept high, but excess inventories are reduced. These activities allow for reducing the costs of inventory management. If an enterprise obtains a low price of goods, for example, purchased materials, through joint purchases, then lower costs appear later in the item value of goods sold at the purchase price. In this way, the company increases profits by reducing costs.

The final step to optimize net working capital is in the hands of the owners. They should never withdraw all profits, but they should leave some of it in the company. The profit retained in the enterprise increases the level of equity, which increases the level of net working capital.

An interesting solution from the point of view of working-capital management may be functioning within a group purchasing organization. The working-capital management strategy in such organizations is characterized by a high level of positive working capital and high profitability [35]. This is due to the scale effect and high purchasing power of this type of organization. Thanks to the group’s huge purchasing power, enterprises receive attractive prices and trade credits. This allows for extending the deadline for crediting recipients and is an incentive for new contractors to cooperate. Attractive prices of the purchased goods should increase profits. Cooperation on the line of the central unit of the group purchasing organization and individual participants leads to the optimization of the inventory level, which also has a positive effect on the level of NWC and profitability of enterprises. As part of multientity organizations, enterprises increase their competitive position, which leads to an increase in sales revenues, which is the basis for an optimal working-capital management strategy.

5. Conclusions

Management of net working capital means the management of positive working capital. Its main purpose is to match the current positive working capital with the actual demand.

Global research on working capital management has shown that higher levels of working capital enable companies to increase their sales volume [40]. Sales are revenues from sales, and their increase is a chance for higher profits, which may positively affect the level of equity. If profit is retained in an enterprise, such actions positively affect the added level of net working capital, and its level increases. In addition, an increase in sales means greater opportunities to obtain more favorable discounts [29][35]. Discounts are another chance to improve the level of profits if one makes early payments [26]. As a result of increasing the scale of sales, enterprises can gain greater access to free cash, which allows for taking advantage of bargains that may be unexpectedly offered by suppliers. Free financial resources are an opportunity to lower the level of bank loans of an enterprise. Moreover, additional discounts help to improve the competitive position of enterprises, so they are very important in a situation when the enterprise is fighting hard for a new contractor or tries to keep regular customers.

The use of attractive discounts should attract new business partners, which should positively impact the volume of sales revenues and profits.

To sum up, in order to efficiently manage working capital, managers should base their working-capital management strategies on a high volume of sales, which should improve profitability and financial security.

References

- Wędzki, D. Strategie Płynności Finansowej; Oficyna Ekonomiczna: Kraków, Poland, 2003. Wędzki, D. Strategie Płynności Finansowej; Oficyna Ekonomiczna: Kraków, Poland, 2003.

- Nowak, E. Analiza Sprawozdań Finansowych; PWE: Warszawa, Poland, 2010. Nowak, E. Analiza Sprawozdań Finansowych; PWE: Warszawa, Poland, 2010.

- Dębski, W. Teoretyczne i Praktyczne Aspekty Zarządzania Finansami Przedsiębiorstw; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2005. Dębski, W. Teoretyczne i Praktyczne Aspekty Zarządzania Finansami Przedsiębiorstw; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2005.

- Bringham, E.F.; Houston, J.F. Podstawy Zarządzania Finansami; PWE: Warszawa, Poland, 2005. Bringham, E.F.; Houston, J.F. Podstawy Zarządzania Finansami; PWE: Warszawa, Poland, 2005.

- Andrew, J.; Gallagher, T. Financial Management: Principles and Practice; Freeload Press: Madison, WI, USA, 2007. Andrew, J.; Gallagher, T. Financial Management: Principles and Practice; Freeload Press: Madison, WI, USA, 2007.

- Blinder, A.S.; Maccini, L.J. The resurgence of inventory research: What have we learned? J. Econ. Surv. 1991, 5, 291–328. Blinder, A.S.; Maccini, L.J. The resurgence of inventory research: What have we learned? J. Econ. Surv. 1991, 5, 291–328.

- Brealey, R.A.; Myers, S.C.; Marcus, A.J. Fundamentals of Corporate Finance, 7th ed.; McGraw Hill: New York, NY, USA, 2012. Brealey, R.A.; Myers, S.C.; Marcus, A.J. Fundamentals of Corporate Finance, 7th ed.; McGraw Hill: New York, NY, USA, 2012.

- Nunn, K. The strategical determinants of working capital: A product line perspective. J. Financ. Res. 1981, 4, 207–219. Nunn, K. The strategical determinants of working capital: A product line perspective. J. Financ. Res. 1981, 4, 207–219.

- Kim, Y.; Srinivasan, V. Advances in Working Capital Management; JAI Press: Greenwich, CT, USA, 1988. Kim, Y.; Srinivasan, V. Advances in Working Capital Management; JAI Press: Greenwich, CT, USA, 1988.

- Groppelli, A.; Nikbakht, E. Finnance; Barrons: London, UK, 2006. Groppelli, A.; Nikbakht, E. Finnance; Barrons: London, UK, 2006.

- Sierpińska, M.; Wędzki, D. Zarządzanie Płynnością Finansową w Przedsiębiorstwie; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2005.

- Fazzari, S.M.; Petersen, B. Working capital and fixed investment: New evidence on financing constraints. Rand. J. Econ. 1993, 24, 328–342.

- Kieschnick, R.; Laplante, M.; Moussawi, R. Working Capital Management and Shareholders’ Wealth. Rev. Financ. 2013, 17, 1827–1852.

- Almeida, J.R.; Eid, W., Jr. Access to finance, working capital management and company value: Evidences from Brazilian companies listed on BM&FBOVESPA. J. Bus. Res. 2014, 67, 924–934.

- Gill, A.; Biger, N.; Mathur, N. The relationship between working capital management and profitability: Evidence from the United States. Bus. Econ. J. 2010, 10, 1–9.

- Neale, B.; Pike, R. Corporate Finance and Investment: Decisions & Strategies; FT Prentice Hall: Hoboken, NJ, USA, 2006; p. 375.

- Boer, G. Managing the cash gap. J. Account. 1999, 1, 111–119.

- Eljelly, A.M. Liquidity-Profitability Tradeoff: An Empirical Investigation in a Emerging Market. Int. J. Commer. Manag. 2004, 2, 20–31.

- Bhalla, V.K. Working Capital Management: Text and Cases; Anmol Publications: New Delhi, India, 2005; p. 2.

- Opler, T.; Pinkowitz, L.; Stulz, R.; Williamson, R. The determinants and implications of corporate cash holdings. J. Financ. Econ. 1999, 52, 3–46.

- Kim, S.C.; Mauer, D.C.; Sherman, A.E. The determinants of corporate liquidity: Theory and evidence. J. Financ. Quant. Anal. 1998, 33, 335–359.

- Aktas, N.; Croci, E.; Petmezas, D. Is working capital management value-enhancing? Evidence from firm performance and investment. J. Corp. Financ. 2015, 30, 98–113.

- Dhole, S.; Mishra, S.; Pal, A.M. Efficient working capital management, financial constraints and firm value: A text-based analysis. Pac. Basin Financ. J. 2019, 58, 101212.

- Lazaridis, I.; Tryfonidis, D. Relationship between working capital management and profitability of listed companies on the Athens Stock Exchange. J. Financ. Manag. Anal. 2006, 19, 26–35.

- Enqvista, J.; Grahamb, M.; Nikkinenc, J. The impact of working capital management on firm profitability in different business cycles: Evidence from Finland. Int. Bus. Financ. 2014, 32, 36–49.

- Lind, L.; Pirttil, M.; Viskari, S.; Schupp, F.; Karri, T. Working capital management In the Automotive industry: Financial value chain analysis. J. Purch. Supply Manag. 2012, 18, 92–100.

- Shin, H.H.; Soenen, L. Efficiency of working capital management and corporate profitability. Financ. Pract. Educ. 1998, 8, 39–45.

- Zimon, G. Strategie zarządzania kapitałem obrotowym a płynność finansowa przedsiębiorstw. In Rachunkowość a Controlling; Nowak, E., Nieplowicz, M., Eds.; Wydawnictwo Uniwersytetu Ekonomicznego: Wrocław, Poland, 2014.

- Zimon, G.; Tarighi, H. Effects of the COVID-19 Global Crisis on the Working Capital Management Policy: Evidence from Poland. J. Risk Financ. Manag. 2021, 14, 169.

- Ek, R.; Guerin, S. Is there a right level of working capital? J. Corp. Treas. Manag. 2011, 4, 137–149.

- Bei, Z.; Wijewardana, W. Working capital policy practice: Evidence from srilankan companies. Procedia Soc. Behav. Sci. 2012, 40, 695–700.

- Ding, S.; Guariglia, A.; Knight, J. Investment andfinancing constraints in China:does working capital management make a difference? J. Bank. Financ. 2013, 37, 1490–1507.

- Mun, S.G.; Jang, S.S. Working capital, cash holding, and profitability of restaurantfirms. Int. J. Hospit. Manag. 2015, 48, 1–11.

- Deloof, M. Does working capital management affect profitability of Belgian firms? J. Bus. Financ. Account. 2003, 30, 573–587.

- Zimon, G. An Analysis of Working Capital Management Strategy in Small Enterprises Operating within Group Purchasing Organizations. In Eurasian Economic Perspectives; Springer: Cham, Switzerland, 2020; pp. 103–111.

- Jose, M.; Lancaster, C.; Stevens, J.L. Corporate returns and cash conversion cycles. J. Econ. Financ. 1996, 20, 33–46.

- Zimon, G.; Babenko, V.; Sadowska, B.; Chudy-Laskowska, K.; Gosik, B. Inventory Management in SMEs Operating in Polish Group Purchasing Organizations during the COVID-19 Pandemic. Risks 2021, 9, 63.

- Biana, Y.; Lemoinea, D.; Yeunga, T.G.; Bostelb, N.; Hovelaquec, V.; Vivianic, J.-L.; Gayraud, F. A dynamic lot-sizing-based profit maximization discounted cash flow model considering working capital requirement financing cost with infinite production capacity. Int. J. Prod. Econ. 2018, 196, 319–332.

- Smith, K. Profitability versus liquidity tradeoffs in working capital management. In Readings on the Management of Working Capital; Smith, K.V., Ed.; West Publishing Company: Eagan, MN, USA, 1980; pp. 549–562.

- Baños-Caballero, S.; García-Teruel, P.J.; Martínez-Solano, P. Working capital management, corporate performance and financial constraints. J. Bus. Res. 2014, 67, 332–338.

- Chauhan, G.S. Are working capital decisions truly short-term in nature? J. Bus. Res. 2019, 99, 238–253.

- Dalci, I.; Ozyapici, H. Working capital management policy in health care: The effect of leverage. Health Policy 2018, 122, 1266–1272.

- Salehi, M.; Mahdavi, N.; Dari, S.Z.A.; Tarighi, H. Association between the availability of financial resources and working capital management with stock surplus returns in Iran. Int. J. Emerg. Mark. 2019, 14, 343–361.

- He, W.; Mukherjee, T.K.; Baker, H.K. The effect of the split share structure reform on working capital management of Chinese companies. Glob. Financ. J. 2017, 33, 27–37.

More