As Earth’s fossil energy resources are limited, there is a growing need for renewable resources such as biodiesel. That is the reason why the social, economic and environmental impacts of biofuels became an important research topic in the last decade. Depleted stocks of crude oil and the significant level of environmental pollution encourage researchers and professionals to seek and find solutions. The study aims to analyze the economic and sustainability issues of biodiesel production by a systematic literature review. During this process, 53 relevant studies were analyzed out of 13,069 identified articles. Every study agrees that there are several concerns about the first generation technology; however, further generations cannot be price-competitive at this moment due to the immature technology and high production costs. However, there are promising alternatives, such as wastewater-based microalgae with up to 70% oil content, fat, oils and grease (FOG), when production cost is below 799 USD/gallon, and municipal solid waste-volatile fatty acids technology, where the raw material is free. Proper management of the co-products (mainly glycerol) is essential, especially at the currently low petroleum prices (0.29 USD/L), which can only be handled by the biorefineries. Sustainability is sometimes translated as cost efficiency, but the complex interpretation is becoming more common. Common elements of sustainability are environmental and social, as well as economic, issues.

- Biofuels

- biodiesel feedstocks

- blending mandate

- production cost

1. Introduction

Biofuels can be either fuel additives or almost purely used. Their common characteristics are the organic raw material (e.g., cereals, oilseed crops, fat or waste with organic origin) and their renewable nature. Basically, there are two types of biofuels, ethanol for Otto engines and biodiesel for diesel engines. At this moment, the most common raw materials of biodiesel production are oil-rich plants, such as sunflower seed, rapeseed or palm trees.

2. Biodiesel Generations

The basis of biodiesel production is the raw material. Based on the feedstocks and production methods, we can differentiate between three generations (Table 1).

Table 1. Biodiesel generations.

|

Generations |

Feedstocks |

Conversion Process |

Carbon Balance |

|

1st |

Rape, sunflower, palm, soybean, animal fat |

Transesterification |

Positive |

|

2nd |

Jatropha and nonedible oils |

Transesterification |

Positive |

|

3rd |

Algae and seaweeds |

Algal synthesis |

Negative* |

* It should be noted that the negative CO2 balance is based on the replaced CO2 in biodiesel production, which varies by the different algae species and technologies [6][1]. Source: authors’ composition based on [7][2].

Regarding the production process, there are, basically, two methods: cold and hot press extraction with additional transesterification. The latter provides more oil, and therefore large production units use only that method. As a comparison, cold crushers can reach about 80% oil extraction, while hot press extraction (hexane crusher process) may reach up to 99% efficiency, resulting in almost no oil left in the meal [8][3].

3. Major Raw Materials

Raw materials play the most important role in the biodiesel value chain. Therefore, their (highest possible) oil content has utmost importance. Depending on the raw material, this varies between 15% (soybean) and 70% (microalgae). Table 2 provides an overview of the currently used biodiesel raw materials and their oil content.

Table 2. Oil content of the major biodiesel feedstocks.

|

Type of oil |

Feedstock |

Oil Content (%) |

|

Edible |

Soybean |

15–20 |

|

|

Rapeseed |

37–50 |

|

|

Palm |

20–60 |

|

Nonedible |

Jatropha seed |

35–60 |

|

Other sources |

Microalgae |

30–70 |

Source: authors’ composition based on [9].

Source: authors’ composition based on[4].

In the case of, e.g., soybean oil, the raw material cost provided 75% of the total production cost based on data from the last 13 years (2007–2019) [10][5]. This is the reason why the use of used vegetable oils can be more profitable than that of any high-oleic, first-generation raw materials. Besides the raw material cost, low reactor efficiency and material/energy loss during the process could also be significant [11][6].

4. Productions Costs

Due to the current high production costs, the sustainability of biodiesel production is questionable. Baudy et al. [12][7] analyzed 11 different biofuel feedstocks and claimed that none of them are economically sustainable even at a 50 USD/barrel oil price as the end-users’ cost is positive. From the end-users’ perspective, biomass-based biodiesel has the lowest costs among the six biodiesel feedstocks. On the other hand, rapeseed biodiesel has the highest positive overall government budget impact, that is, 0.03 EUR/L in gasoline equivalent at a 50 USD/barrel oil price, while it goes up to 0.08 EUR/L in gasoline equivalent at a 180 USD/barrel oil price. However, considering environmental and land use issues, microalgae are the least suitable source for biodiesel production with a high end-user cost even at a 180 USD/barrel oil price (0.18 EUR/t additional cost) and with negative overall government budget impact (−0.08 EUR/L in gasoline equivalent at a 180 USD/barrel oil price) [12][7].

At the country level, Table 3 provides an overview of the biodiesel production costs of the major producers.

Table 3. Production cost of the major biodiesel producers, 2019.

|

Countries |

USD/L |

Weighted USD/L * |

|

Argentina |

0.60 |

0.66 |

|

Brazil |

0.64 |

0.71 |

|

EU |

0.75 |

0.82 |

|

Indonesia |

0.68 |

0.75 |

|

USA |

0.42 |

0.47 |

* Weighting takes into account the approximately 10% lower energy content of biodiesel compared to petroleum [13][8]. Source: authors’ composition based on [14,15][9][10].

The current, low oil price (West Texas Intermediate (WTI) crude oil is 45.52 USD/barrel [16][11]) results in a 0.29 USD/L petroleum price that causes unprofitable biodiesel production even for the most efficient producer, the USA. This is even worse if the lower energy content of biodiesel is taken into account (weighted USD/L price). Practically it means that without additional support, tax credit or blending mandate, biodiesel production could not be profitable even for the most efficient producers[12] [1]. The major raw material is soybean in the USA, Argentina and Brazil. Although its oil content is low (only 18%), the remaining meal is a valuable feed with good export markets for Argentina and Brazil [17][13]. In the case of the USA, the production process is also strengthened by genetic engineering to increase soybean yields and oil content. The Indonesian biodiesel production is based on palm oil with a production cost of 0.68 USD/L, while the rapeseed-based European production is the most expensive among the analyzed countries (0.75 USD/L). However, it should be kept in mind that most of these values are subject to changes in exchange rates (local currency/USD), e.g., the strong euro against the US dollar in 2019 made the European production cost higher.

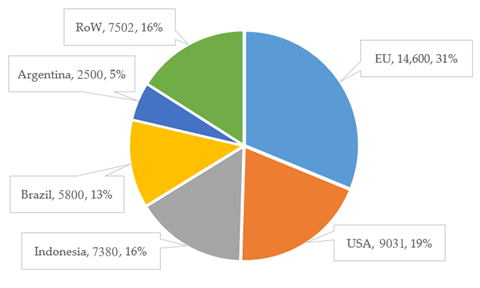

The world biodiesel production is highly concentrated, where the four largest producers provide 78.63% of the total production (Figure 1). The EU produced 14,600 million liters of biodiesel (31% of the total production) and the USA produced 9,031 million liters (19% share), while the Indonesian and Brazilian productions were 7,380 and 5,800 million liters (16% and 13% of the global production, respectively).

Figure 1. World biodiesel production and its composition, 2019 (million liters). Source: authors’ composition based on [14].

World biodiesel production and its composition, 2019 (million liters). Source: authors’ composition based on[9].

Despite the highest production cost, the EU as a whole is the major biodiesel producer of the world. This reflects the highest share of diesel cars in Europe which was 41.9% of the vehicle fleet [18][14] with a 35.9% share of new passenger cars in 2018 [19][15]. However, this differs greatly among the member states, e.g., this was 60.0% in Spain, 51.9% in France, 44.4% in Italy and 32.2% in Germany [18][14]. Biodiesel is used mostly for buses and light, medium and heavy commercial vehicles in the other significant producer countries, as well as being blended with petroleum according to the different blending mandates of the countries. Brazil can be characterized by a high share of flexible-fuel vehicles, while diesel passenger cars have a negligible role in the USA.

As of the future, biodiesel production is expected to decrease by 2.53% in the next ten years; however, the market structure will not change significantly [14][9]:

-

The TOP5 producer will be the same in 2029;

-

The share of the EU, the USA and Indonesia will slightly decrease;

-

Meanwhile, the share of Brazil and Argentina is expected to increase.

Beside the commercial vehicles, biodiesel is used as an additive to petroleum. Its share can vary between 1 (B1) to up to 100% (B100). Blending mandates are an important and stable element of the biodiesel demand, and they also maintain and even boost the biodiesel production. Maintaining biorefineries is important, independent of the (low) oil prices, as they are an important source of innovations. Biodiesel blending mandates vary around the world [20][16]:

-

Argentina introduced B10; however, the country exports more biodiesel than its domestic consumption;

-

Brazil has the B10 mandate and the country is 100% self-sufficient with almost no exports or imports;

-

Biodiesel use in China and India is insignificant;

-

The EU’s blending objective for 2020 is B7; however, that may differ at the country level;

-

Indonesia has recently introduced B20;

-

No country-level mandates in the USA; only Oregon introduced B5 at the state level, while the B20 mandate is delayed for Minnesota.

References

- Attila Bai; József Popp; Károly Pető; Irén Szőke; Mónika Harangi-Rákos; Zoltán Gabnai; The Significance of Forests and Algae in CO2 Balance: A Hungarian Case Study. Sustainability 2017, 9, 857, 10.3390/su9050857.

- Satyanarayan Naik; Vaibhav V. Goud; Prasant K. Rout; Kathlene Jacobson; Ajay K. Dalai; Characterization of Canadian biomass for alternative renewable biofuel. Renewable Energy 2010, 35, 1624-1631, 10.1016/j.renene.2009.08.033.

- Jaeger, W.K.; Siegel, R. Economics of Oilseed Crops and Their Biodiesel Potential in Oregon’s Willamette Valley; Special Report 1081; Oregon State University, Extension Service: Corvallis, OR, USA, 2008.

- Arianna Callegari; Silvia Bolognesi; Daniele Cecconet; Andrea G. Capodaglio; Production technologies, current role, and future prospects of biofuels feedstocks: A state-of-the-art review. Critical Reviews in Environmental Science and Technology 2019, 50, 384-436, 10.1080/10643389.2019.1629801.

- CARD. Historical Biodiesel Operating Margins. Iowa State University, Center for Agricultural and Rural Development. Available online: https://www.card.iastate.edu/research/biorenewables/tools/hist_bio_gm.aspx

- Amiri, P.; Arabian, D.; The Effect of Reactor Configuration and Performance on Biodiesel Production from Vegetable Oil. J. Appl. Biotechnol. Rep. 2016, 3, 403–411.

- Gino Baudry; Florian Delrue; Jack Legrand; Jeremy Pruvost; Thomas Vallée; The challenge of measuring biofuel sustainability: A stakeholder-driven approach applied to the French case. null 2017, 69, 933–947.

- European Commission. Directive (EU) 2015/1513 of the European Parliament and of the council of 9 September 2015 amending Directive 98/70/EC relating to the quality of petrol and diesel fuels and amending Directive 2009/28/EC on the promotion of the use of energy from renewable sources. Off. J. Eur. Union 2015, 239, 1–29.

- OECD/FAO. OECD-FAO Agricultural Outlook 2020–2029. Available online: https://stats.oecd.org/# (accessed on 9 December 2020).

- IRS. Yearly Average Currency Exchange Rates. Available online: https://www.irs.gov/individuals/international-taxpayers/yearly-average-currency-exchange-rates (accessed on 9 December 2020).

- Bloomberg. Markets Energy. Available online: https://www.bloomberg.com/energy (accessed on 9 December 2020).

- Tamás Mizik; Impacts of International Commodity Trade on Conventional Biofuels Production. Sustainability 2020, 12, 2626, 10.3390/su12072626.

- Cremonez, P.A.; Feroldi, M.; Nadaleti, W.C.; de Rossi, E.; Feiden, A.; de Camargo, M.P.; Cremonez, F.E.; Klajn, F.F. Biodiesel production in Brazil: Current scenario and perspectives. Renew. Sust. Energy Rev. 2015, 42, 415–428.

- ACEA. Passenger Car Fleet by Fuel Type. Available online: https://www.acea.be/statistics/tag/category/passenger-car-fleet-by-fuel-type

- ACEA. Fuel Types of New Passenger Cars. Available online: https://www.acea.be/statistics/tag/category/share-of-diesel-in-new-passenger-cars

- Lane, J. Biofuels Mandates Around the World: 2019. BiofuelsDigest. Available online: https://www.biofuelsdigest.com/bdigest/2019/01/01/biofuels-mandates-around-the-world-2019/