Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 1 by Stephen Morse and Version 2 by Camila Xu.

The provision of microfinance for the poor in developing countries has received much attention from politicians, economists, development workers and academics, especially since the 1990s, including a special issue recently published in this journal.

- institutional sustainability

- microfinance

- development

- faith-based development organizations

1. Introduction

The provision of microfinance for the poor in developing countries has received much attention from politicians, economists, development workers and academics, especially since the 1990s, including a special issue recently published in this journal [1]. Microfinance involves the provision of financial services such as credit, savings, money transfer and insurance [2], but the two main ones are credit (microcredit) and savings (microsavings). The use of the adjective ‘micro’ is a reflection of the amounts involved, which are typically small [3]. Microcredit can be provided, in cash or in kind, and often at low rates of interest or maybe with no interest at all [3]. Microsavings involves the provision of a service whereby the poor can put money aside on a regular basis and then drawdown those savings when needed. A requirement for a savings account can also be a pre-condition for access to microcredit. Having many small credit and savings accounts carries with it a substantial financial cost to the provider, and this is why many of these services are provided by public sector or by non-governmental organizations (NGOs), including faith-based development organizations (FBDOs). The theory behind microfinance as a tool in development is straightforward; the provision of such services can help people invest in their livelihood and thus help them break the ‘poverty trap’ [4][5][4,5]. If people can be provided with financial capital, either via credit or encouraging them to save and withdraw when needed, then they can improve their livelihood and make their finances more resilient to shocks and stresses. Indeed, the compelling logic behind microfinance has helped spawn a vast amount of literature on almost all aspects of its provision and impact in developing countries. However, one of the most debated and contentious aspects of microfinance provision has revolved around the financial self-reliance of those providing the service, a concept that many often equate with the theory of ‘institutional sustainability’. In its simplest sense, equating the financial self-reliance of microfinance providers with institutional sustainability means that they should pay for their services using the income derived via the charging of interest on loans and fees for their services [3][4][3,4]. This would mean that microfinance could become a tool for development that is funded by those who benefit from it. This would, in turn, free the provider of the microfinance service from seeking a constant injection of funding from development donors and avoid the potential for ‘donor fatigue’. But the charging of interest and other fees to help pay for microfinance services raises important issues, especially as those intended to benefit are typically the poorest in society. It also raises important issues for microfinance providers that are FBDOs.

The function and impact of FBDOs in microfinance provision has received much attention, and excellent reviews exist (e.g., [6]). A faith-based organization has been defined as “any organization that derives inspiration and guidance for its activities from the teachings and principles of the faith or from a particular interpretation or school of thought within that faith” [7] (p. 6). FBDOs have a long history of working in the developed and developing worlds, and their activities have spanned just about every aspect of development from the provision of infrastructure (bridges, roads, wells, schools, hospitals, etc.) to services such as health care, agricultural development and education. FBDOs often have a long-term presence in communities and often have the trust of those that they seek to help, and these provide advantages when it comes to microfinance provision [6][8][9][6,8,9]. But faith is also important in FBDOs, and there are global faiths such as Christianity, Hinduism and Islam that do differ in terms of their beliefs, teachings and practices [6]. There are also “different strains of the same religious faith” [6] (p. 247), such as Catholicism and various forms of Protestantism, which can be relevant. However, the influence of this religious diversity on microfinance provision has been relatively underexplored via empirical studies [6]. There are studies of microfinance services provided by organizations within each of these faiths, but few that make comparisons between them, and the same remains true of empirical studies designed to compare FBDO providers with secular ones [6]. Indeed, in terms of microfinance, many of the points noted above regarding leadership and impacts apply equally irrespective of whether the provider is faith-based or secular. However, there are nonetheless some intriguing notions about how some of the factors, most notably the attainment of institutional sustainability, may be influenced by the faith that is the foundation stone for the FBDO. After all, for FBDOs providing microfinance, this issue is potentially more acute than for secular organizations, especially as religious teachings often deplore (at the very least) usury, and for some religions, such as Islam, the charging of interest on loans is simply unacceptable. However, to date, there have been no reviews exploring how FBDO microfinance providers, especially in the developing world, respond to these pressures for financial self-reliance and how they navigate this path within the context of their faith. Hoda and Gupta in their review of microfinance provision by FBDOs [6] briefly address the sustainability, impact and financial performance of FBDO microfinance providers, but this is a topic of such importance that it warrants more attention.

2. Microfinance: A Brief Outline

2.1. The Rise of Microfinance as a Tool in Development

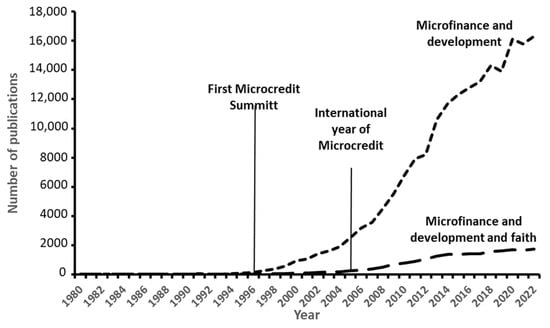

Microfinance has a long history and is said to have originated in Europe with the ‘Raiffeisenbanks’ (cooperative lending banks) in Germany which were early examples of credit unions established in the 19th century, along with the revolving loan funds in Ireland following the devastating famines in the 16th and 17th century [9][10][9,10]. The use of microfinance as a tool to help address poverty in the developing world has a more recent history dating back to the early 1900s [11]. There are strong ties here with what has been called ’social banking’ with its emphasis on the ‘triple bottom line’ (people, profit, planet) and maximum transparency in terms of what finance is used for in order to support human development [12]. Indeed, the years that followed the end of the second world war saw something of a surge in the popularity of microfinance as a tool in development [11]. Indigenous (informal) microfinance institutions, often operating at the village level, in the developing world were known to exist but were largely ignored by economists and development practitioners, partly because they were considered exploitative (charging very high interest rates) and because they were regarded as being ineffective in a development context. Quite simply, it was thought the loans provided via these informal microfinance institutions were too small and the repayment periods too short [8]. For many years, the provision of microfinance at a scale that would be effective for development was seen as the prerogative of governments and international aid agencies [8]. For much of the post-war period, the term microfinance was seen by many as being synonymous with ‘microcredit’ [13], and the 1990s witnessed a significant surge in interest in the application of microfinance as a tool in development [4][8][14][15][16][17][4,8,14,15,16,17]. This was accelerated by the 1997 ‘Microcredit Summit’ held in Washington DC, which had some 3000 attendees from 137 countries [18]. An outcome from the summit was the creation of a microcredit ‘campaign’ with the aim of making microcredit available to 100 million of the world’s poorest by 2005. The 1997 summit was followed by a series of other high-profile summits focused on microfinance [19], and 2005 was declared the ‘International Year of Microcredit’ by the United Nations [3]. Microfinance has also been embraced by all the major multilateral agencies such as the World Bank and International Monetary Fund. This surge of interest in microfinance as a tool in development from the 1990s can be seen in Figure 1. The data in this figure have been derived from Google Scholar to capture interest beyond journal publications, with ‘Microfinance AND Development’ as the search term. The 1990s witnessed the publication of many seminal pieces in microfinance (e.g., [16][17][16,17]), and indeed, many of the issues mentioned in the introduction, including the need for the institutional sustainability of providers and how that equates to financial self-reliance, were already being noted and discussed in the literature at that time. The number of publications that mention faith alongside microfinance and development are also shown in Figure 1, and since 1990, these have typically accounted for around 10 to 11% of the total.

Figure 1. Number of publications each year between 1980 and 2022 that mention microfinance and development. Also shown are the number of publications that mention microfinance and development and faith.

2.2. Microsavings: The Forgotten Half of Microfinance

It has been claimed that the ‘forgotten half’ of the microfinance ‘coin’ is savings [13], given that so much emphasis has been placed on microcredit [20][21][20,21]. Notions of self-help and self-reliance became prominent in the mid-1980s, and part of this was a greater emphasis on the use of microsavings rather than donors providing more funds for credit [21]. A watershed in the greater use of savings emerged with the Third UN International Symposium on the ‘Mobilization of Personal Savings in Developing Countries’ which was held in 1984 in Cameroon, West Africa [22], and microfinance provision that included both savings and credit components began to be seen as an improvement [4]. After all, an individual or group may be able to forego the need for credit if their savings are sufficient. However, the challenge is that in many cases, the size of one’s savings in any ‘reasonable’ time frame is simply not enough to make a significant difference. Indeed, it was often assumed that there was little demand for a savings scheme amongst the poor as they had no surplus money [21]. As a compromise, some microfinance projects required that potential borrowers first save money with the lender before a loan was granted, and this is often referred to as ‘forced’ or ‘required’ savings’ [23]. This has the advantage of providing some security for the lender [4], as savings can be used to cover any defaults on loan repayment [23]. In addition, a requirement that makes it incumbent for one to save before being given credit installs a selective mechanism [13]. Savings can also be used as ‘insurance’ against bad times, especially if other types of insurance are unavailable [24][25][26][24,25,26]. For example, Paxson [27] noted how rice farmers in Thailand faced with irregular rainfall patterns will save as a means of ‘evening out’ consumption, and Alderman [28] came to very similar conclusions for farmers in Pakistan. There are various factors that may influence savings behaviour, and one of these is the interest rate that savings can accrue [13][29][13,29]. There may be a fear that savings can be lost through theft, although Bouman [24] suggests that such cases have been relatively rare. There can also be social pressures such as jealousy and criticism if large amounts of money are held in savings while friends and family require funds [24]. A useful compromise in such situations is for the saver to provide their savings as a loan to others [24].2.3. Impacts of Microfinance

Microfinance schemes can be based on individuals or groups. If the latter, then the ‘client’ for the scheme is a group of individuals and it is up to them to manage the division of responsibilities. The advantage of a group-based scheme is that the benefits and indeed risks can be spread amongst members, and any issues regarding the misuse of funds or failure to repay on the part of an individual can be managed by the group. Also, in group-based microfinance schemes, meetings can provide an opportunity for socializing and the exchange of ideas and even economic and market intelligence [24]. In such circumstances, microfinance may be as much a social as an economic activity [23] and the benefits that accrue can be difficult to measure [25]. There are numerous studies that have shown positive benefits of microfinance provision for the poor in both rural and urban contexts in the developing world [30], and a broad consensus has emerged which suggests that microfinance projects have helped alleviate poverty [31]. However, their usefulness in development terms, at least in some contexts, has been questioned [11][32][11,32]. The main issue behind this criticism is that given severe limitations on cash availability, relatively few people in a community can obtain credit, the amounts received by any one person are typically small and those that do obtain credit may not make the best use of it [4][16][17][29][31][32][4,16,17,29,31,32]. Hence microfinance can end up benefiting those in society who are better off as they are able to borrow relatively more and may also make better use of the credit than the poorest in society [4][16][17][4,16,17]. Hence, a microfinance provider may have to purposely target the poorest with loans carrying a low interest rate, but that brings with it other issues, such as how to identify these people as well as the need to support them so they can make the best use of credit.3. The Landscape of Microfinance Institutions

3.1. Formal Microfinance Sector

The formal microfinance sector spans providers that are publicly owned, commercial and NGOs. However, commercial banks have typically not been involved in the provision of microfinance to the poorest in society [24][33][34][24,33,34]. There are various reasons for this [33], including risk and the costs of having to handle many relatively small transactions. Hence, commercial banks prefer to lend to established larger-scale enterprises with a good track record of loan repayment and return on investment as well as more collateral to offer against failure to repay loans [34]. A second challenge for the commercial sector is that the cost of processing small loans may be prohibitive [34]. Thirdly, commercial banks may charge interest rates that are too high for poorer lenders, and it is not unusual for governments to intervene and either set up their own public-sector-owned banks or subsidize commercial banks to provide credit to the poor with an interest rate that is more appropriate [20][29][20,29]. Indeed, as Adams and Von Pischke [11] pointed out, it is noteworthy how the terms ‘credit’ and ‘loans’ have beneficial connotations while the term ‘debt’ does not, though the latter is the inevitable consequence of the former.3.2. Non-Governmental Organizations and Microfinance

NGOs, spanning both FBDOs and secular organizations, have a long history of involvement in microfinance [22]. The typical model is for a donor agency, often based in a developed country, to link with an NGO based in the field which instigates and manages the scheme. The donor provides the start-up and running costs of the microfinance scheme and often subsidizes a low interest rate charged for credit as well as a continual top-up of the loan fund [35][36][35,36]. NGOs have been seen as the best means of delivering effective microfinance provision as they generally have extensive and robust linkages with the local population and thus gain much local knowledge and trust [35]. It is often argued that the latter is especially the case for FBDOs, as these tend to have longevity, are embedded in the local community and can draw upon other institutions that are a part of the faith. For example, in the early days (1970s) of the development of a microfinance scheme by a Catholic-church-based FBDO called the Diocesan Development Services (DDS) in a rural area of Nigeria, the operation of microfinance (credit and savings) at the village level was handled by parish priests belonging to a missionary order [8]. However, perhaps the most famous and indeed most cited examples of an NGO engaged in microfinance is the Grameen Bank, Bangladesh [35][36][37][38][35,36,37,38]. The Grameen Bank (‘rural bank’ in Bengali) is the largest rural bank in Bangladesh and is “currently present in 81,678 (94%) villages in the country and provides services to nearly 45 million people (including family members) through 10.44 million borrower members” [38]. The bank was initiated by Muhammad Yunus in 1976 and he and the Grameen Bank were subsequently awarded the Nobel Prize for Peace in 2006 [9]. The Grameen Bank was established as a secular organization, although a large majority of its members are Muslim, and Islam is by far the predominant faith in Bangladesh. It began as a small personal project in a village (Jobra) located near Chittagong University campus where Yunus taught economics. Bangladesh experienced a devastating famine in 1974 that resulted in an estimated loss of 1.5 million lives, and this catastrophe led Yunus to an examination of the underlying reasons for their poverty. The lack of cheap credit quickly emerged as a limiting factor, and to solve this problem, Yunus established the Grameen Bank with the stated target group being the poorest within the community [37]. It is interesting to note that at least in the Grameen Bank’s early days, a key indicator for targeting services was based on land ownership, with those owning less than 0.5 acre of land or assets worth less than 1 acre of land being eligible for credit [35][36][35,36]. Borrowers are organized into groups, and peer pressure within the group helps prevent anyone from defaulting. The ‘peer pressure’ approach, also referred to as ‘Solidarity Groups’, has been very successful in the Grameen Bank, as indeed it has been with other institutions employing this method [39], and repayment rates of 97 to 99% have been claimed by the Grameen Bank [35][40][41][35,40,41]. A majority of Grameen Bank members are women, and there are three main reasons for this [42][43][42,43]. Firstly, women traditionally have the least economic opportunity in Bangladesh. Secondly, credit supplied to women tends to be more beneficial for the whole family compared to when it is given to men. Thirdly, women are generally much more careful about managing their debts than men. In addition, the emphasis on female members by the Grameen Bank is perhaps a reflection of a much wider issue regarding the lack of access women in the developing world typically have to finance from formal sources such as commercial banks [10]. Globally, it has been estimated for the period 2016 to 2019 that while 46% of men reported having access to formal financial services, the corresponding figure for women was only 37% [44]. Hence, women are often more reliant when it comes to microfinance provided by NGOs or the informal sector [2][45][46][2,45,46]. As Bartel [47] (p. 41) has noted: “microfinance targets the bottom-billion women, grouped into the essentialized categories of demure debtors who will be responsible financial subjects in the service of gendered and racialized economic stereotypes. Women, and most prominently women of color, now make up almost 90% of micro-credit recipients in the world”. However, others have noted that just providing women with access to microfinance does not necessarily empower them to engage positively in local development [48] or challenge any prevailing patriarchal system [49]. The success of the Grameen Bank has served as a model for many other microfinance organizations, both publicly owned and NGOs, established throughout the developing and even the developed world [37][40][37,40], including other initiatives in Bangladesh itself [50]. Indeed, Bangladesh is often regarded as the heartland of microfinance [51]. The approaches taken by the Grameen Bank have been duplicated in other Asian countries [52] and Africa. A noteworthy example of the latter is provided by the People’s Bank established by the Federal Government of Nigeria [34][53][34,53] on 1 October 1990 [54]. By 1991, the People’s Bank had 200 branches, and by 1992, it had 228 branches [34]. In just its first year of operation, the bank had 90,000 borrowers [53]. However, the People’s Bank faced significant challenges and the government in Nigeria eventually merged the People’s Bank with some other institutions to create the Nigerian Agricultural, Cooperative and Rural Development Bank, citing low capitalization and inefficient operations as some of the reasons for this [55]. Although it has been widely applauded for its achievements in helping the poor, the Grameen Bank has had its critics [42][51][42,51]. While the Grameen Bank was not formed as an FBDO, it is based in a country with a Muslim majority, and Islamic fundamentalists in Bangladesh have claimed the bank is ‘anti-Islamic’ as charging credit on loans is regarded as usury in Islam [40]. The relationship between Islam and microfinance provision is an intriguing one on so many levels [56] and is quite distinctive from microfinance run by secular and indeed Christian FBDOs. The ethics that underpin microfinance provision by Islamic institutions are based on Shariah laws and principles set out in the Qur’an and As-Sunnah. Shariah sets out permissible and non-permissible sectors for Muslims and requires that any earnings be respectable, and that interest not be charged on loans [57][58][59][57,58,59]. Hence, the fundamental aspects of Islamic banking require that loans must carry no interest and no uncertainty in terms of one’s ability to repay and must not involve support for ‘unethical’ conduct [59]. It has been suggested that despite the Grameen Bank’s objective of targeting the poorest in society [37], in 1996, only 20% of Grameen’s borrowers were the poorest landless agricultural workers [60]. Indeed, similar issues regarding stringent lending requirements which thereby exclude the poorest in society have been raised for many other microfinance institutions modelled on the Grameen Bank [52], and this has been referred to as ‘mission drift’ [61]. The Grameen Bank and other microfinance providers have had to adapt and charge a higher interest on loans so they can become financially self-sustaining [51]. Also, the evidence regarding the beneficial impacts of the Grameen Bank has been mixed, and this may be related to a lack of support provided by the bank to its lenders [51]. While NGO microfinance providers are typically regarded as being distinctive from those in the private sector, there can be relationships. For example, NGOs may use commercial banks for lodging the money they have collected from their clients. This helps with security, but the money will also earn interest which can be shared with members of the scheme. Indeed, the lines between these types of organizations can become blurred, and some NGOs can begin to look and behave very much like commercial banks [62]. In some cases, commercial banks may form partnerships with NGOs, with the banks providing the capital and the NGOs becoming their field partners or, as Parekh and Ashta [63] (p. 324) put it in the context of a microfinance partnership in India, “execution partners”. Also, microfinance providers of all types can in some circumstances compete for customers [64], and the private sector can provide a diverse market-based source of capital for microfinance providers [65].3.3. Informal Microfinance Sector

The informal (or indigenous, traditional) microfinance sector can be substantial in some countries. Such informal microfinance institutions are typically founded on savings often in conjunction with a credit component [23][33][23,33], although their extent and effectiveness can be challenging to assess [22]. Examples of informal microfinance schemes are widespread, and some for Sub-Saharan Africa can be found in Tanzania [66], Malawi [67], Ghana [68] and Nigeria [8][69][8,69]. Such schemes can be operated by an individual or on a group basis [20]. Seibel in his pioneering work on the topic [22] suggests that there are essentially four types of informal microfinance schemes run by groups:-

Rotating savings associations (RSAs)

-

Rotating savings and credit associations (ROSCAs)

-

Non-rotating savings associations (nRSAs)

-

Non-rotating savings and credit associations (nROSCAs)