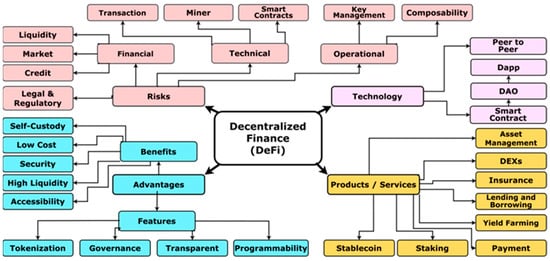

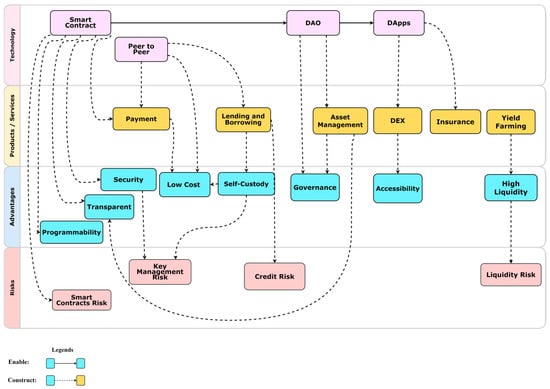

Decentralized Autonomous Organization

A decentralized autonomous organization (DAO) is a decentralized organization that operates on a public blockchain, allowing entities or organizations to establish self-governance and coordination among individuals based on predetermined rules. It is frequently characterized as a blockchain-based organizational structure, resembling a crypto-cooperative or a financial entity with the capacity for decentralized decision-making

[44][56]. DAOs enable continuous functioning and operations synchronization through computer code or smart contracts

[25][30], which are self-executing contracts with terms directly written into code on a blockchain network. These contracts define organizational rules, execute decisions, and allow for public auditing of proposals and voting. The backbone of a DAO is its smart contract, which holds the organization’s treasury and ensures that rule changes and fund spending require group approval. Smart contracts contribute to the autonomy, transparency, and security of DAOs by providing verifiability and visibility through public audits

[25][45][30,89].

In DAOs, investors typically maintain anonymity and may experience a lack of trust among one another. The decision-making process of a DAO operates on-chain and is executed automatically, ensuring transparency through a visible voting process on a public blockchain. Successful proposals are implemented automatically, eliminating the need for human intervention

[46][61]. DAOs excel in managing digital assets within DeFi by leveraging self-governance and coordination via autonomous code

[47][90]. DAOs utilize decentralized blockchains to achieve consensus on the allocation of funds.

Decentralized Applications (DApps)

Decentralized applications (DApps) differ from traditional applications by operating on a decentralized P2P network rather than relying on centralized servers

[1]. Transparency is established through blockchain technology, enabling public visibility and verification of all transactions. Economic participation refers to the utilization of cryptocurrency for transactions within the DApp ecosystem, facilitating economic interactions without intermediaries. Blockchain validation guarantees the validation and permanent recording of all DApp activities. The resilience against server disruptions is a consequence of blockchain’s decentralized architecture, ensuring the DApp’s uninterrupted operation, even in the event of node failures

[23][48][28,74].

On the contrary, DApps lack a solitary control point. Distributed applications entail a collection of computer programs that utilize computational resources across multiple, distinct computation nodes to attain a shared objective. DApps showcase four core attributes: transparency, economic engagement, blockchain validation, and robustness against server shutdowns. In practical scenarios, DApps effectively manifest the essence of DAOs

[14]. Smart contracts play a crucial role in the development of DApps, particularly in the domain of DeFi, which represents the most prevalent type. DeFi DApps transform TradFi functions services such as savings, loans, and insurance. DeFi offers secure and decentralized financial services, encompassing stablecoins, decentralized exchanges (DEXs), lending platforms, and investment funds. These applications utilize smart contracts on blockchain to facilitate secure transactions and store data

[1]. DApps and DAOs are both integral to blockchain technology, albeit with distinct functions. DApps are open-source applications executed by multiple users on a decentralized network, emphasizing decentralization and censorship resistance because they are not controlled by any single entity

[45][89]

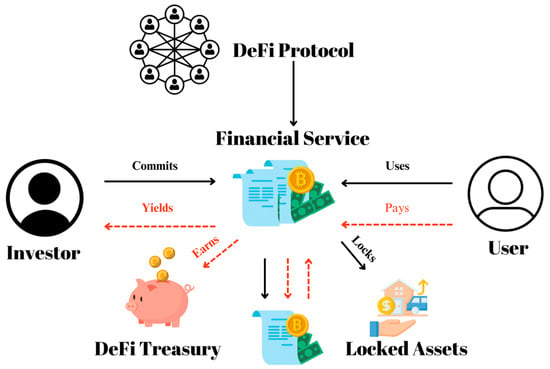

2.2. Product/Services

2.2.1. Payments

The Bitcoin blockchain is widely acknowledged as an early and prominent instance of a DeFi application. Although initially designed as a P2P payment system without smart contract functionality, it has garnered extensive adoption as a decentralized payment system. The emergence of solutions leveraging the Ethereum network and smart contracts has facilitated decentralized payment services and spurred diverse app innovations

[26][31]. Smart contracts, digital programs stored on a blockchain network, automate transaction execution based on predetermined conditions. They enable the execution of agreements and transactions among anonymous parties, eliminating the need for intermediaries or central institutions. Smart contracts also enable the automation of predetermined events, such as interest or dividend payments, without manual intervention

[8].

Payments in the DeFi ecosystem use P2P systems and smart contracts to facilitate transactions, promoting financial inclusion, streamlining payment processes, and maximizing security, efficiency, transparency, and cost-effectiveness. Smart contracts ensure secure, efficient, and cost-effective domestic and cross-border transactions, including those involving cryptocurrencies, while eliminating the need for intermediaries and reducing the risks associated with fraud and transaction delays. Smart contracts also eliminate the possibility of missed opportunities in trade finance and commodity trading

[42][49][88,91]. DeFi offers diverse payment solutions, with

Sablier standing out as a real-time finance protocol. It enables continuous payments over time rather than in a single transaction, finding applications in payroll processing, micro-consulting, and time-sensitive engagements.

Sablier operates through a smart contract, allowing gradual fund allocation set by the payment stream creator. Recipients can withdraw funds at any time, making it akin to an everyday payday. Payments in any ERC-20 token are supported, providing senders the flexibility to cancel streams if needed, with the remaining funds returned to them upon cancellation.

2.2.2. Lending and Borrowing

Lending and borrowing in the DeFi ecosystem involve providing monetary assets, either fiat or digital currency, to another party in exchange for a steady income stream. DeFi lending platforms enable cryptocurrency holders to lend significant funds quickly and anonymously to borrowers. To access this service, borrowers must provide sufficient collateral deposited in a smart contract and commit to repaying the loan within a predetermined timeframe. DeFi borrowing and lending introduce efficiency, accessibility, and transparency innovations compared to TradFi and participation in borrowing and lending is open to everyone, thereby democratizing financial service access. Enabled by smart contracts, the decentralized framework of DeFi lending and borrowing ensures a transparent and equitable blockchain-based system, granting users traditional financial tools like interest and liquidity while incorporating the advantages of decentralization, thereby fostering the continued expansion and development of the DeFi ecosystem

[6][50][6,46].

2.2.3. Asset Management

DeFi protocols for asset management use smart contracts to pool investors’ tokens, often for use on other decentralized applications

[29][19]. Smart contracts provide security and enable investors to allocate their tokens to other DApps. Blockchain technology facilitates decentralized transactions and registries of assets, promoting transparency and facilitating rapid settlement without the need for validation from central authorities. It encompasses both fungible and nonfungible assets

[29][38][51][19,42,92]. Fungible assets are those interchangeable into individual units

[51][92].

Asset management within the DeFi space features prominent examples such as the

DeFi Pulse Index (DPI) and

Balanced Crypto Pie (BCP).

DPI serves as a blockchain financial product designed to lower entry barriers for newcomers, providing exposure to DeFi for those lacking specialized expertise while offering experienced users a single-asset exposure to the DeFi sector.

Conversely,

BCP offers a convenient ERC20 token that grants equivalent exposure to Bitcoin, Ethereum, and DeFi assets.

BCP underlying assets continuously generate profits and enhance holdings through automated rebalancing to maintain the set allocation.

2.2.4. Insurance

DeFi insurance mirrors traditional insurance by providing financial compensation for losses within the DeFi ecosystem. It safeguards against market, technical, and credit risks, crucial for maintaining stability in the expanding DeFi market. Users can purchase coverage from others in the ecosystem, and smart contracts automatically pay out claims when specific criteria are met. The primary objectives are affordability, speed, and transparency. Automation makes coverage accessible, expedites payments, and ensures transparent claim decisions

[3][26][3,31].

DeFi insurance plays a pivotal role in safeguarding user assets against potential financial losses caused by system vulnerabilities. Examples like

Etherisc (DIP) and

InsurAce (INSUR) demonstrate this. Etherisc offers P2P funding pools for traditional and crypto-specific insurance, covering areas like crop insurance, flight delays, and protection for crypto wallets and loans.

InsurAce operates similarly, pooling user funds to disburse payments for adverse occurrences such as hacks or stake releases. These initiatives showcase the potential of smart contracts and blockchain technology in enabling robust DeFi insurance solutions

[3][26][3,31].

2.2.5. Stablecoin

Stablecoin is a cryptocurrency pegged to a stable asset or basket of assets, reducing price volatility. This stability makes them suitable for various DeFi applications, including lending, borrowing, and trading. Stablecoin is a digital currency designed to maintain a stable value and purchasing power by incorporating an economic framework

[52][93]. Noncustodial stablecoins are a specific type of stablecoin that aims to keep a stable value relative to a target currency, typically USD, through the implementation of various economic mechanisms

[53][52]. These stablecoins are available in the DeFi space, allowing investors to earn returns on their cryptocurrency investments while minimizing the volatility and its negative impacts. Stablecoins offer a reliable solution to the price fluctuations commonly found in the DeFi ecosystem, allowing for fast and low-cost fund transfers and creating a more stable market environment.

2.2.6. Staking

Staking in the DeFi ecosystem resembles a traditional deposit, wherein investors lock their crypto assets into smart contracts for a specific duration to earn passive income. It is closely associated with proof-of-stake (PoS) blockchain networks, where users become validators by staking a certain amount of the platform’s native tokens. In PoS, validators undergo a rigorous approval process to prevent fraudulent transactions. The stake in PoS algorithms corresponds to one’s wealth and represents the sum of currency locked up for a defined period. Staking allows users to participate in the consensus algorithm, supporting blockchain’s security and operation without the high computational energy requirements of traditional proof-of-work mechanisms

[1][53][54][1,52,94]. DeFi has notable examples of staking platforms, including

AQRU and

Cardano.

AQRU offers advanced order types, margin trading, and competitive fees. The platform’s staking and rewards programs for selected coin/token holders provide attractive returns. Unique features such as advanced infrastructure, real-time market data, and decision-making tools enhance user analysis.

AQRU’s advanced order types grant users greater trade control with limit orders, stop orders, and trailing stop orders. Margin trading, while potentially profitable, involves higher risks, requiring users to understand market dynamics.

AQRU distinguishes itself with a low fee structure, maximizing user profits with competitive trading and minimal withdrawal fees. Its staking program offers passive income opportunities by holding specific coins/tokens, yielding higher returns than traditional savings accounts. The

AQRU rewards program also incentivizes coin/token ownership, providing benefits like exclusive features or reduced fees.

Cardano is a blockchain platform that delivers scalable and reliable DApps infrastructure.

Cardano’s staking mechanism, delegation, lets users delegate

ADA tokens to staking pools and earn rewards. Known for its emphasis on sustainability and security,

Cardano is a trusted staking platform promoting decentralization. Blockchain’s unique approach involves peer-reviewed research for rigorous testing and security, setting it apart from other platforms with its scientific verification and academic oversight.

2.2.7. Yield Farming

Yield farming entails depositing tokens into a DeFi protocols to maximize the value generated from crypto assets. While it can manifest in various ways, the most prevalent method involves depositing funds into high-yield lending protocols. Yield farming relies on smart contracts to secure tokens and generate interest, offering rates ranging from a few percentage points to triple-digit returns. Often, locked tokens are loaned to users who, in turn, pay interest on their borrowed crypto, channeling a portion of these profits to liquidity providers. Alternatively, locked tokens can provide liquidity for decentralized exchanges, facilitating trading. Yield framing practice benefits DeFi platforms and users by presenting opportunities for passive capital growth and active speculation, potentially surpassing returns from traditional financial instruments. Operating primarily on the Ethereum network through ERC-20 tokens, yield farming mechanisms vary based on protocols and strategies employed

[55][62].

Compound is an example of yield farming, which offers innovative financial services enabling users to earn interest on their cryptocurrencies without the risks associated with yield farming. Yield farming has gained significant popularity due to its perceived advantages.

2.2.8. Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) are digital marketplaces that use smart contracts to enable direct cryptocurrency transactions between traders without the involvement of a third-party intermediary in managing their assets

[6][56][6,95]. DEXs operate on a decentralized infrastructure that relies on self-executing smart contracts containing specific conditions to be met before a trade can occur. These exchanges facilitate various functions, including creating the liquidity pool between tokens, adding or removing liquidity, and exchanging tokens

[57][59]. DEXs offer liquidity benefits while minimizing market price impact. Liquidity in DEXs is determined by automated market maker (AMM) mechanisms. AMMs enable users to trade tokens while concurrently upholding market liquidity and stability efficiently. A prevalent AMM type sets exchange rates using the formula “Amount of token X × Amount of token Y = constant.” These AMMs employ smart contracts for token locking and interest payments, offering rates from a few percentage points to triple-digits. They determine pricing through algorithms, ensuring instant quotes despite liquidity pool depth. As AMMs evolve, future designs are expected to lower fees, reduce friction, and enhance liquidity for DeFi users.

2.3. Advantages

2.3.1. Benefits

DeFi has the capacity to revolutionize business operations by optimizing processes, increasing efficiency, reducing costs, and enhancing overall performance. Integrating DeFi with Fintech presents considerable benefits, including heightened security and governance, thereby delivering substantial value. Below are a few examples of the benefits of using DeFi.

Self-Custody

Self-custody in DeFi allows individuals or businesses to hold and manage their digital assets, like cryptocurrencies, independently without relying on third-party custodians. Within the DeFi ecosystem, users maintain complete ownership and control of their assets, interacting with financial applications and protocols without requiring permission from intermediaries. This direct interaction often results in lower transaction costs

[11].

Self-custody offers individuals complete control over their assets, ensuring privacy and protecting identities from external interference. It enables constant access and use of assets from any location, which is considered beneficial for preserving crypto wealth over time. However, self-custody poses risks, such as potential loss or theft of private keys if not securely managed or backed up.

Accessibility

TradFi systems restrict access with geographical barriers, high fees, and documentation requirements, limiting access for some individuals and communities. DeFi has the potential to establish an inclusive and available financial system, unlike TradFi, which may not be affordable for everyone. DeFi allows for convenient access to financial services, regardless of geographical location, as long as one has an internet connection, a cryptocurrency wallet, and a smartphone. DeFi benefits include reduced costs and 24/7 availability

[11]. DeFi protocols are designed to be accessible to anyone, which may lead to an open and accessible financial system. The infrastructure requirements are low, and the risk of discrimination is almost nonexistent due to the lack of identities. If regulations demand access restrictions, such as for security tokens, such limitations can be implemented in the token contracts without compromising the integrity and decentralization properties of the settlement layer

[38][42].

Security

Enhanced security in a financial system creates a secure environment where institutions and users can conduct activities without concerns about asset theft or information compromise. Blockchain ensures the security of DeFi by offering a decentralized and immutable digital ledger recording all transactions and smart contracts. These contracts establish agreements between two or more parties and only become effective once the specified conditions are met. The use of blockchain technology in DeFi offers a high level of appeal in terms of security while still maintaining privacy, thanks to several properties that it supports, including immutability, transparency, traceability, data consistency, tokenization, and governance. Each transaction on blockchain is secured using cryptographic principles, ensuring data integrity and authentication through public key infrastructure (PKI), which provides users with public keys for receiving assets and private keys for protection

[58][59][96,97].

Low Cost

DeFi service providers execute operations at a lower cost than TradFi, primarily due to the absence of fees charged by banks and other financial entities for service usage, enabling investors to respond to changing environmental circumstances more affordably. Moreover, the decentralized and automated nature of DeFi operations leads to significantly narrower profit margins than those of TradFi institutions, resulting in advantageous rates for borrowers and heightened operational efficiency. These cost efficiencies stem from the automated and unregulated environment of DeFi platforms, resulting in lower marginal costs when contrasted with banks and nonbank entities across advanced and emerging market economies. DeFi provides cost-effective services through smart contracts, eliminating the necessity of intermediaries such as financial institutions and banks.

High Liquidity

High liquidity pertains to the seamless exchangeability of tokens or cryptocurrencies with other tokens in DeFi. Liquidity is paramount in DeFi, facilitating user transactions on decentralized exchanges without relying on centralized market makers. At the core of the DeFi ecosystem are liquidity pools, which are collaborative reserves of cryptocurrencies or tokens held in smart contracts. These pools empower users to contribute asset liquidity and earn rewards through transaction fees. Liquidity is indispensable for DeFi, serving as a vital catalyst for trading and eliminating impediments to the fluidity of digital assets

[13][60][13,98].

2.3.2. Features

Transparent Transaction

DeFi stands out for its transparency, encompassing software components, data, and processes involved

[26][31]. It aims to eliminate private agreements, back-room deals, and centralization, allowing users to scrutinize the precise rules governing financial assets and products

[61][73]. Most DeFi projects have transparent transactions, allowing users to verify and audit all activities

[11]. In the DeFi context, financial information is typically publicly available, benefiting researchers and users. This transparency provides historical and current data, significantly improving compared to TradFi systems, where information is often scattered across proprietary databases or unavailable. DeFi’s transparency facilitates identifying and preventing unwanted events and a quicker understanding of their origins and potential consequences

[38][42].

Programmability

Programmability refers to the smart contracts’ capacity to automate financial activities and create novel financial instruments and digital assets. These contracts are easily executable on a blockchain platform, interacting with business logic to function automatically without human intervention. DeFi platforms leverage this potential, emphasizing the security of their automated processes, which operate strictly as programmed and are immune to manipulation, distinguishing them as more secure than TradFi systems

[11][26][11,31].

Programmability enables the modification, embedding, or reduction of predefined code instructions. Smart contracts within DeFi platforms automate operations by adjusting programs based on programmatic business logic. They drive the creation of innovative financial instruments and digital assets while allowing for easy modification and creation of new programs

[62][99]. This emphasis on security stems from the system’s adherence to programmed rules, ensuring its immunity to manipulation, a marked contrast from TradFi systems

[20][25].

Tokenization

The digital assets concept is relatively unexplored in TradFi, but in the DeFi ecosystem, it provides a standardized framework for asset tokenization

[9]. Tokenization can create a new asset class for investors, enhancing accessibility, streamlining operations, reducing costs, and accelerating processes in the financial industry

[63][100]. The Ethereum Request for Comments-20 (ERC-20) standard has emerged as the widely adopted choice for asset tokenization in DeFi, offering comprehensive asset coverage.

Governance

In the realm of TradFi, centralized governance prevails, with decision-making authority concentrated in the hands of a few central entities or organizations. In contrast, DeFi embraces decentralized governance, which involves a broader and more distributed network of participants in decision-making processes. Governance in DeFi encompasses the establishment of rules, processes, and mechanisms that govern the operation and management of various aspects within the DeFi ecosystem, including protocol updates, fund allocations, and rule changes. Key stakeholders, represented by token holders, play a significant role in shaping the governance of DeFi protocols, thereby enhancing efficiency, transparency, and inclusivity

[64][101]. Blockchain-based governance in DeFi strikes a balance between accountability and decentralization, leveraging both on-chain and off-chain structures to facilitate decision-making

[65][102]. On-chain governance explicitly defines the governance arrangement within the protocol, allowing stakeholders to vote or propose changes directly on blockchain.

2.4. Risks

In the financial sector, fraudulent activities and excessive risk-taking are prevalent, because money is a target for criminal activities. DeFi is not immune to these risks and is particularly vulnerable due to its relative novelty and slower adoption compared to its theoretical potential

[48][74]. The DeFi ecosystem presents various risks, including smart contract attacks, protocol changes, liquidity issues, regulatory uncertainty, and market risk. Smart contract attacks are a common risk, with vulnerabilities such as flash loan attacks, oracle manipulation, and reentrancy.

The DeFi ecosystem harbors diverse risks with potential repercussions for users and investors. Effective risk mitigation requires establishing a classification system to prioritize and categorize these risks. Prominent threats include smart contract flaws, where weak coding may lead to fund theft, particularly in liquidity pools. Protocol changes, such as impermanent loss and liquidity crises, pose risks to the functionality and profitability of DeFi platforms.

2.4.1. Technical Risks

The DeFi realm grapples with inherent technical risks. Although Ethereum, as the leading public blockchain, has not encountered major breaches, other sectors in DeFi have faced targeting. Technical risks and breaches have targeted blockchain-based wallets, centralized exchanges, and DApps

[66][84]. Concerns in DeFi revolve around fraudulent activities, money laundering, and illegal financing, which are all persistent issues in the cryptocurrency sphere

[67][68]. The reliability of DeFi hinges on the security of underlying smart contracts and blockchain protocols. Errors or vulnerabilities in code can lead to substantial hacks and losses for DApp users.

Smart Contracts Risk

Smart contracts are critical in the DeFi ecosystem and carry significant risks. This is because malicious actors can exploit any bugs or errors in the code to achieve their goals. A notable example is the

Qubit Finance incident, where an attacker exploited a bug in the Qubit smart contract, converting an Ethereum-based token into almost USD 80 million worth of Binance Coin

[68][80].

Miner Risks

Miner risks are the possibility of transaction processors engaging in malicious actions toward certain transactions. In a blockchain system, users send transactions to the network along with a fee that will be paid to the miner who successfully includes it in a block. Miners are responsible for determining the sequence in which proposed transactions will be executed

[69][79]. Nonetheless, a miner may opt to prioritize a lower-fee transaction over a higher-fee one, especially if the former is deemed more profitable or receives a side payment from the originator of the lower-fee transaction

[70][81].

Transaction Risks

Transaction risks refer to the shortcomings or breakdowns in the underlying blockchain network. If the network for base-layer settlement is successfully attacked, permits double-spending becomes overly costly for transactions, or lacks the necessary capacity, these failures will affect the application layer. Therefore, the planned Ethereum 2 upgrade aims to improve performance significantly, representing a crucial development for DeFi. This upgrade will also transition Ethereum to proof-of-stake consensus, eliminating energy-intensive proof-of-work mining

[69][79].

2.4.2. Financial Risks

Liquidity Risk

Liquidity risk in DeFi refers to the possibility of having insufficient funds to realize the value of a financial asset. In DeFi, market makers are encouraged to liquidate under-collateralized loans, akin to a foreclosure auction in real estate. However, if these incentives for liquidation do not work, the original counterparties and liquidity providers may face unexpected default risk. Decentralized services do not have the same last-resort remedies as centralized exchanges, which can take offline trading during flash crashes

[69][79]. The hope among DeFi participants is that blockchain’s widespread adoption will attract more liquidity to ensure its long-term viability

[29][19].

Market Risk

DeFi market risk refers to the potential for a decline in the value of assets over time due to various factors, such as idiosyncratic behaviors of investors, new information, or changes in market conditions. The ease of fund transfer and the complexity of novel instruments in DeFi create an environment where there is an increased possibility of abuse by DeFi protocol creators, exchange operators, or third-party manipulators

[69][79]. The ease of fund transfer in DeFi highlights the importance of regulatory oversight in the DeFi space to mitigate these risks

[29][19].

Credit Risk

Credit risk refers to the possibility of counterparties failing to fulfill their obligations to a financial instrument. In DeFi, this risk is particularly problematic due to the volatility of underlying digital assets that can result in undercollateralization, the ease of credit creation leading to excessive leverage, or inaccuracies in algorithmic determination of interest rates. Furthermore, the absence of fixed identities in a pseudonymous network presents additional difficulties in determining creditworthiness

[69][79].

2.4.3. Operational Risks

Composability Risk

Composability is a fundamental principle of system design that enables the creation of applications by assembling individual components. In DeFi, composability serves as a crucial design principle, allowing different pieces of code to be combined like building blocks, fostering flexibility within the ecosystem. This concept, often referred to as “money legos”, has significantly accelerated innovation in DeFi.

Key Management Risk

The management of cryptographic keys is a crucial aspect of DeFi and is commonly referred to as the risk of private key loss. A DeFi cryptographic system’s security relies on individuals’ ability to safeguard their private keys effectively. However, it is important to acknowledge the possibility that attackers can gain access to keys through brute force attacks, physical access, side-channel attacks, or exploiting weak encryption. In such cases, they can steal or transfer funds from targeted accounts. As a decentralized system, no mechanism exists to recover stolen currency

[69][79].

2.4.4. Legal and Regulatory Risk

Legal and regulatory risk in the DeFi context refers to using DeFi for illegal purposes or to evade regulatory compliance. This type of risk involves the possibility of government intervention that could affect the operation of DeFi protocols. Creating laws that regulate or even ban DeFi protocols altogether is a potential outcome. DeFi is facing increasing regulatory challenges, particularly concerning licensing and transparent regulations. The absence of such regulations makes it challenging for users to report issues or seek redress. However, implementing governance and decision-making processes that comply with financial regulations would go against the core principles of DeFi, which prioritize decentralization

[67][69][71][68,77,79].