1. The Spanish Cogeneration Policy—Contextualization, Main Goals and Results

The Energy Conservation Law 82/1980

[1][42] initiated the impetus for cogeneration in Spain. This law introduced a remuneration system for facilities that utilized renewable energy sources and cogeneration. Its primary objective regarding cogeneration was to harness the residual energy generated by industrial processes and convert it into electricity. The “self-producer” was a regulatory concept employed to achieve this goal. To encourage self-production and develop Law 82/1980, RD 907/1982

[2][43] was put into effect. This was followed by the National Energy Plan 1991–2000 (NEP 1991–2000)

[3][44] publication, which included measures, actions, and objectives outlined in the Energy Efficiency and Savings Plan Annex (PAEE 1991–2000)

[3][44]. The PAEE 1991–2000 policy goal was to increase the installed capacity of CHP by 1263 MW by the end of 2000, reaching a total of 2222 MW

[3][44].

In 1994, Law 40/1994 was enacted to regulate the Spanish Electricity Sector (SES)

[4][45], partially repealing Law 82/1980. This law distinguished between conventional power plants and new renewable and cogeneration systems, creating a Special Regime (SR) for the latter. This was a positive step towards promoting high-efficiency cogeneration, as the SR benefited from a differentiated economic framework. Later, in 1994, RD 2366/1994

[5][46] was enacted to produce electricity through pumping, cogeneration, and other systems supplied by renewable energy sources. This developed the economic framework for the SR, which included CHP plants rated up to 100 MW and satisfying specific energy efficiency requirements

[5][46].

Starting from 1997, the SES initiated a process of liberalization that is still ongoing and is regulated by Law 24/2013. Throughout this liberalization period, multiple regulatory frameworks were established to encourage the promotion of RES, such as RD 2818/1998

[6][47], RD 436/2004

[7][48], RD 661/2007

[8][49], and RD 413/2014

[9][50]. The purpose of these frameworks was to accomplish the energy plans that were in place during those years. In this regard, and following the NEP 1991–2000

[3][44], Spain approved the Energy Saving and Efficiency Strategy (E4) in November 2003

[10][51]. The goal was to reach 7100 MW of installed power through cogeneration by 2011

[10][51]. This target was later revised with the Action Plan 2005–2007 and the Action Plan 2008–2012, increasing the objective to 10,851 MW by 2020

[11][12][52,53].

In February 2004, Directive 2004/8/EC

[13][7] was approved with the aim of promoting and developing high-efficiency CHP. It required Member States to provide a guarantee of the origin of the electricity to demonstrate that it was produced from high-efficiency cogeneration

[13][7]. In 2006, Directive 2006/32/EC on the efficiency of the final use of energy and energy services was published. It required Member States to reduce their energy consumption by at least 9% and expressly indicated cogeneration as one of the possible tools for improving energy efficiency in the industrial sector

[14][54].

The Energy and Efficiency Action Plan 2011–2020 (EEAP 2011–2020) was published in 2011, in accordance with Directive 2006/32/EC. The plan aimed to install 3751 MW in new cogeneration plants by 2020, out of which 2490 MW were planned to be installed between 2011 and 2016

[15][55]. The ultimate goal was to reach a total of 9807 MW by 2020. In October 2012, the Energy Efficiency Directive 2012/27/EU came into effect, replacing Directives 2004/8/EC and 2006/32/EC. The new directive established rules and obligations to help the EU achieve its 20% energy efficiency target by 2020

[16][5].

As part of the ‘Clean Energy for all Europeans package’ released in 2016

[17][56], an agreement was reached to update the policy framework until 2030 and beyond through the Directive on Energy Efficiency (2018/2002)

[18][6], which amended Directive 2012/27/EU. The key aim was to set a target of at least a 32.5% improvement in energy efficiency by 2030, based on the 2007 modelling projections for the same year. This target is meant to be attained collectively across the EU

[18][6].

In January 2020, Spain’s Integrated National Energy and Climate Plan 2021–2030 (INECP) was published, as stated in the 2016 ‘Clean Energy for All Europeans package’

[17][56]. According to the INECP, the country set a goal to achieve carbon neutrality by the year 2050 and reduce GHGEs by at least 90%, compared to 1990 levels. It also expected a considerable decrease in the installed power of cogeneration, going from an estimated 4373 MW of installed capacity by 2025 to 3670 MW by 2030

[19][57].

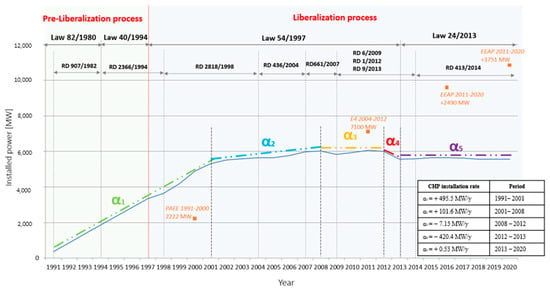

Figure 12 shows that from 1991 to 2004, there was significant growth in the CHP installed power, going from 356 MW in 1991 to 5643 MW in 2004. The objective of 2222 MW for the year 2000 set by the PAEE 1991–2000 was vastly exceeded by reaching 4890 MW, which was more than double the initial goal. The PAEE period coexisted with two different regulatory conceptions, the Pre-liberalization and Liberalization period. In the first phase, under Law 82/1980, RD 907/1982 and RD 2366/1994, the installation of CHP went exceptionally well, consistently exceeding the objectives set by the PAEE. In 1997, near the end of the PAEE period, the Spanish liberalization process started. All the previous frameworks were repealed, being the RD 2818/1998 responsible for promoting renewable energy sources and cogeneration. According to the figures, at the beginning of RD 2818/1998, the growth pace of installed CHP capacity (495.5 MW/year, see Figure 12 caption) remained the same. It might be assumed that this was due to the typical 2–3 years between the investment decision and the commissioning of a CHP plant.

Figure 12. Evolution of the installed CHP in the period 1991–2020. Source: self-elaboration based on

[20][59].

Nevertheless, despite the great variety of RDs addressed to promote CHP plants, from 2001 on, there was a decline in the installed CHP growth speed, changing from 5306 MW in 2001 to only 5989 MW in 2012 (see the lower growth paces at Figure 12 caption). The evolution worsened in 2013 because of a reduction of the installed power, which resulted in a final number of 5568 MW. These numbers more or less remained the same until 2020 with 5572 MW. As a result, the objectives set by E4 and EEAP 2011–2020 of reaching 10,851 MW by 2020 were not fulfilled.

2. A Description of the 1980–2020 Legal–Economic Frameworks for the CHP Plants in Spain

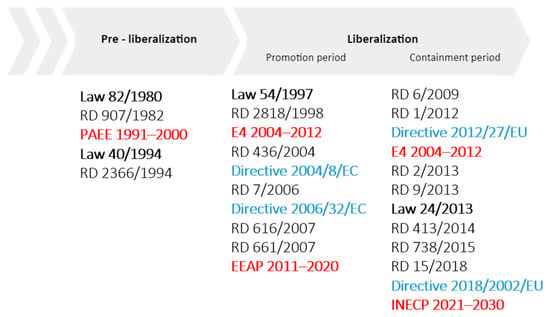

Due to the influence of the regulation on the development of CHP plants in Spain, in the following sections, the main characteristics of the several regulatory frameworks in force in the analysed periods will be described in detail. As a summary, Figure 23 collects the most representative Laws, RDs and directives that influenced the CHP plants through these years. In this regard, Laws are depicted in bold black letters, RDs in black, the energy plans in red and the European directives in blue.

Figure 23. A summary timeline of the regulatory frameworks in Spain in the period 1980–2020. Source: Self-elaboration.

2.1. The Pre-Liberalization Period: 1980–1997

It might be said that the start of the promotion of cogeneration in Spain began with Law 82/1980 on energy conservation. Cogeneration was one of the several technical solutions that could fall within the group of self-producers. As a result, CHP plants were eligible for fiscal benefits defined in the law, as well as for a future and expected economic regime to be developed

[1][42]. This economic regime was lately developed by RD 907/1982 on the promotion of the self-generation (or self-production) of electricity. According to it, the selling prices of the energy of the self-producers to the electricity companies at the point of connection to the network would be established by the Ministry of Industry and Energy

[2][43].The main regulatory characteristics are displayed in

Table 1.

Table 1. Regulatory framework for CHP in the pre-liberalization sub-period 1980–1994. Source: self-elaboration based on

[1][2][42,43].

| Legislation |

Main Characteristics |

| Law 82/1980 |

|

| Subject |

Established rules, basic principles and incentives to do the following:

- -

-

Optimize the yields of energy transformation processes;

- -

-

Strengthen the use of renewable sources;

- -

-

Promote the use of residual energy from technological processes;

- -

-

Analyse and control the development of projects for the construction of industrial plants with high energy consumption, according to energy profitability criteria at a national level;

- -

-

Regulate the relationship between the auto-generators and the electricity distribution companies;

- -

-

Promote actions to reduce external energy dependence.

|

| Related to CHP installations |

The Law defined the self-production or self-generation concept. Those facilities belonging to this concept were described as those whose primary economic purpose was that other than electricity production. Nevertheless, this electricity production was obtained from energy processes using energy excedents. According to it, CHP facilities were embedded into the “self-producers” or “self-generators” definition. |

| Key concepts |

-

Self-generation or self-production;

-

Surplus of electricity when possible;

-

Beneficial fiscal framework.

|

| RD 907/1982 |

|

| Subject |

To promote the self-generation |

| Related to CHP installations |

The RD defined a set of legal conditions to be recognised as a self-producer or self-generator. Among these conditions were those related to facilities whose electricity production was derived from high energy efficiency heat production using conventional fuels or industrial waste heat. Again, according to it, CHP facilities were embedded into the “self-producers” or “self-generators” definition. Self-producers, or self-generators, were also classified into three categories: off-grid self-generators, grid-connected self-generators and assisted self-generators, which may receive energy from the grid in case of need. |

| Key concepts |

|

In December 1994, Law 40/1994 on the regulation of the national electricity system, which partially modified and repealed Law 82/1980, was enacted. This Law introduced an integrated tariff system for the electrical energy supply, where these tariffs supported all the recognised costs of the different activities of the SES. Energy production was a recognised activity divided into two groups: the ordinary regime and the SR. The SR aimed to back those energy solutions that used renewable energy sources and cogeneration. The Law stated the need for a new economic regime for the SR, which was developed in the same year by RD 2366/1994.

The 1994 new regulatory framework was an inflexion point concerning self-production treatment. Before 1994, the energy conservation approach was based on two great players: renewable energy producers and self-production. The first group was solely formed by hydroelectric power plants equal to or less than 5 MW. It might be inferred that the legislator had no confidence in other renewable energy power plant technologies. The second group was self-production. Those self-producers were energy assets addressed to either energy savings or electricity production through energetic subproducts or waste, which had a specific regulatory framework. After 1994, this clear differentiation was diluted thanks to Law 40/1994 and RD 2366/1994. According to the SR conception, any electricity production under the SR could fall into one of three categories: hydroelectric power plants with a capacity of up to 10 MW, other renewable power plants (including waste) and CHP, as well as electricity producers whose primary economic activity was not electricity production. These categories had a rated power (P) less than or equal to 100 MW.

Nevertheless, although the term “self-generator” or “self-producer” was no longer in the law, its essence was. The new framework allowed both the use of SR-produced energy in their facilities and/or the injection of this energy into the grid. The injected energy into the grid was considered surplus energy, and it was defined as the balance between the injected electricity into the grid and that received from the grid. All interconnection points between the “producer-consumer” facility were considered for this balance. As a result, the term “self-producer” was replaced by the term “producer-consumer”, characterized as the owner of a set of energy assets electrically connected to the grid within a facility that has subscribed to an energy supply contract.

The economic framework provided by RD 2366/1994 defined all income and cost streams for CHP plants regarding energy surpluses and consumed energy. As per the framework, CHP plants received revenues for the delivered energy and power while also facing penalties for non-compliance. In addition, distribution companies were forced to acquire the resulting energy surplus. CHP plants were also incentivized to contribute to reactive power regulation. In this regard, the framework enabled potential investors to predict the economic evolution of such energy assets. In Table 2, the main characteristics of these frameworks have been synthesised.

Table 2. Regulatory framework for CHP in the pre-liberalization sub-period 1994–1997. Source: self-elaboration based on

[4][5][45,46].

| Legislation |

Main Characteristics |

| Law 40/1994 |

|

| Subject |

To regulate activities to guarantee the electricity supply at the lowest cost possible.

Definition of the SR economic framework is to promote RESs and CHP. It is the first time that the definition and recognition of the CHP were stated in the Law. |

| Related to CHP installations |

Facilities that produced electricity through high energy efficiency, including CHP facilities and other non-electric activities with a rated power up to 100 MW, were subjected to the SR under the Law. |

| Key concepts |

|

| RD 2366/1994 |

|

| Subject |

On the production of electricity through hydraulic, cogeneration and other installations powered by renewable sources or resources with P≤ 100 MW. |

| Related to CHP installations |

Definition of the economic regime for CHP with P ≤ 100 MW, which falls into group d (Article 2).

Definition of the necessary requirements for a CHP installation to fall under the SR. |

| Key concepts |

|

| Classification |

Group d |

| Economic regime |

Equation for the calculation of the incomes of the CHP: |

| FT = (PF∙Tp + Ec∙Te ± DH ± ER)∙Kf − AI |

where:

- -

-

FT is the income of the CHP;

- -

-

PF is the power to bill;

- -

-

Tp is the economic term related to the power;

- -

-

Ec is the transferred energy;

- -

-

Te is the economic term related to the energy;

- -

-

DH is a revenue time discrimination;

- -

-

ER is a revenue due to the reactive energy;

- -

-

Kf is a coefficient specified within the RD 2366/1994;

- -

-

AI is a payment for failure to perform.

|

| Rated Power |

Tp [EUR/kW] |

Te [EUR/kWh] |

| P ≤ 15 MW |

10.6 |

0.0478 |

| 15 MW < P ≤ 30 MW |

10.2 |

0.0462 |

| 30 MW < P ≤ 100 MW |

9.9 |

0.0448 |

| Further requirements |

Compliance with the effective electric efficiency (EEE) in accordance with Annex of this Royal Decree.

Compliance with the efficiency required for the specific installation. |

| Update |

Tp and Te annually updated |

| Energy supply limits |

Only electrical energy in excess of that produced by the facilities under examination may be incorporated into the system. |

2.2. Liberalization Period: 1997–Ongoing

The liberalization period began in 1997 and represented a radical change for the SES, introducing the concept of free trading in the electricity market. This period has two parts. The first part was the promotion sub-period from 1997 to 2009. As a consequence of several regulatory frameworks, this period was characterized by the sudden growth in installing energy assets related to the SR

[21][22][23][39,40,41]. Paradoxically, CHP was not among the technologies that suffered this outburst. Nevertheless, the resulting rise caused an economic burden on the SES that required containment regulatory measures. As a result, from 2009 to 2020, there was the so-called containment sub-period. Those periods will be discussed in detail below.

2.2.1. Promotion Sub-Period: 1997–2009

The liberalization period began with Law 54/1997 of the SES, which established the principles of a new operating model of the electricity market based on free competition. This law confirmed and preserved the distinction between the ordinary regime and the SR, establishing, for the later, a new remuneration system through the RD 2818/1998 to adapt the SR to the new regulation foreseen by Law 54/1997

[24][58].

The term “self-producer” appeared again in Law 54/1997. This term was used to refer to an energy production asset that supplied energy to its premises and used, when available, its surplus of energy to feed it into the grid.

It appeared in Article 25, where the exemptions to the energy market were set. According to it, in the case of energy assets under the SR, it allowed these energy assets to avoid the need for their surpluses to be sold in the energy market and for receiving economic remuneration. Additionally, this term was also used in the 8th Transitory Disposition when referring to those energy assets under the former RD 2366/1994.

In 1998, one year later, the definition of “self-production” was provided by RD 2818/1998. According to it, “self-producer” referred to those legal or natural people who generated electricity primarily for their own use. Facilities up to 25 MW had to self-consume at least, on an annual average, 30 per cent of the electrical energy produced, while for facilities equal to or greater than 25 MW, the percentage was at least 50 per cent. Additionally, according to RD, the self-producers’ assets could be either CHPs or thermal electricity production facilities unrelated to “electrical activities”.

In the same way, RD 2818/1998 also defined the concept of the electricity surplus introduced by Law 54/1997. In this regard, RD forced the SR assets to inject only the surplus into the grid, while the RESs were allowed to inject all their production.

The economic regime to which CHP was subjected changed again in 2004 with RD 436/2004. The new RD did not affect the definitions and conception of the term self-producer besides developing the definition of the self-consumption term. According to RD 436/2004, self-consumption was the electricity supply delivery from CHP to the company’s premises or any of the members of a group that owns the installation. In this RD, electricity producers falling under the SR could choose between receiving FIP or FIT, both calculated considering the average electricity tariff (AET)

[7][48].

In May 2007, the RD 616/2007

[25][60] was published in response to Directive 2004/8/EC, on the promotion of the cogeneration. In the same year, RD 661/2007 was enacted to regulate the activity of electricity production in the SR while repealing former RD 436/2004. The RD 661/2007 stated an objective method to determine the amount of electricity production from CHP assets and its energy efficiency

[8][49]. This RD incorporated the modifications of the Royal Decree-Law (RDL) 7/2006

[8][49] concerning abolishing the “self-producer” term in the SES for CHP technologies. In addition, the economic regime of the installations belonging to the SR was again modified.

2.2.2. Containment Sub-Period: 2009–2020

In 2009, the deviation between the income and the regulated costs of the SES was a matter of concern. As a result, containment policies began to be enacted to restrain the regulated costs of the SES. To this end, RDL 6/2009

[26][62], RDL 1/2012

[27][63], RDL 2/2013

[28][64] and RDL 9/2013

[29][65] were approved. The latter, in particular, clarified the new bases of the economic framework that were yet to come and would affect SR installations

[29][65]. Considering the deficiencies of Law 54/1997 that led to the financial burden of the SES, it was decided to modify the framework of the SES. In light of the above, in December 2013, Law 24/2013 of the SES was approved

[30][66]. This law erased the two economic regimes system, forcing electricity power plants to negotiate in the electricity market. Nevertheless, a specific remuneration regime was applied to those installations that produced electricity through renewable sources, high-efficiency cogeneration and residues

[29][65].

The principles settled in the RDL 9/2013 and in Law 24/2013 would be later developed through the RD 413/2014

[9][50] to regulate the activity of electricity production through renewable sources, cogeneration and residues. To assign the specific remuneration regime, a standard installation type was associated with each power plant based on its physical and economic characteristics. The legislator performed the classification of those standard installations. It was based on a set of representative parameters calculated in compliance with the principle of an “efficient and well-managed power plant”

[28][29][64,65]. RD 413/2014 would be partially modified first by RDL 15/2018 and then by RDL 17/2019, due to the simultaneous increase in the cost of emission rights established by the EU and to update the value of reasonable profitability

[31][32][67,68], respectively.

3. An Assessment of the 1980–2020 Energy Policy for the CHP Plants in Spain

During the pre-liberalization period, the Spanish government actively promoted the CHP sector to improve energy efficiency and reduce GHGEs using an asset of policies, including tax incentives, grants and favourable tariff structures to encourage its adoption. Consequently, CHP went through significant growth and diffusion in Spain.

The PAEE 1991–2000 targeted an installed power in CHP plants of 2222 MW by 2000

[3][44]. This goal was overcome with more than 5522 MW installed capacity in 2000, representing a 125% surplus of installed power compared to the expected target.

Among the most significant characteristics of the RDs that defined the economic regime of cogeneration in the pre-liberalization period, the following must be highlighted:

-

Energy was rewarded at the consumption price, not the production price, generating favourable sales conditions for self-generators;

-

The energy that self-generators could sell to electricity companies was not limited to excess energy alone, as would happen with RD 2818/2018 and RD 436/2004;

-

The remunerated energy was paid at a price corresponding to 80% of the average high-voltage tariff;

-

The nominal power of the plant was not restricted to specific values to receive benefits from the system, as it would happen with liberalization limiting the rated power up to 50 MW;

-

Very advantageous tax and financial incentives boosted the development of the Spanish CHP into the industrial base, such as the chemical, food processing and paper industries.

State institutions played a highly active role in fostering and financing the development and dissemination of CHP in the country during the pre-liberalization period, creating exceptionally favourable conditions for CHP plant installations. Notably, the Institute for the Diversification and Saving of Energy (Instituto para la Diversificación y Ahorro de la Energía, (IDAE)), a public entity attached to the State Secretariat for Energy, exemplified this commitment by supporting industries conducive to CHP installation. This support encompassed the execution of pre-feasibility studies and the supervision of viability studies conducted by specialized engineering teams. The scope of assistance extended to technical and administrative realms, encompassing the management of the inclusion process for the SR

[33][69]. Of note was the significant financial aid extended to businesses for investment, covering up to a substantial 90% of the total investment cost. This robust support framework underscored the proactive engagement of state institutions in catalysing the successful implementation of CHP technologies

[34][70]. As a result, at the end of the pre-liberalization period, many industries decided to take advantage of these conditions, contributing to the successful deployment of CHP in the pre-liberalisation period with installation rates of about 500 MW/year.

Furthermore, it cannot be ignored that CHP represented a novelty from the point of view of the industrial sector and the State. First, CHP allowed industries to achieve higher energy efficiency and cost savings. Concerning the State’s point of view, CHP was a technology that had a set of advantages that allowed the system to do the following:

-

Obtain the energy savings objectives;

-

Apply these measures within a sector, the industrial sector, that was well known and was used to collaborate with the institutions and manage the required investment funds.

In contrast, the liberalization period was characterized by a clear setback in the spread of CHP, as shown by the set of its different installation rates. Excluding the first α1 installation rate, which is derived from the inertia momentum concerning the former period, the rest of the installation rates were lower (even negative) when compared to the initial one. The reasons for such a slowdown are varied, and can be found partly in the intrinsic characteristics of this technology and in the developed regulatory framework over the years.

First, in the liberalization period of the SES, CHP had become well established within the industrial sector. Namely, a significant part of the potential user base had already adopted CHP or other alternative technologies, which might have resulted in fewer opportunities for rapid growth than an emerging market.

Second, it is worth highlighting that the liberalization of the SES under Law 54/1997 introduced the electricity market as a new reference element of the SES. The electricity market would be responsible for setting the value of the remuneration for power plants, as well as one of the relevant energy costs for Spanish consumers. In this regard, in terms of the revenue of CHP related to the electricity market prices, the uncertainty concerning the evolution of these prices might have hampered the predictability of the economics of the projects. Additionally, the regulatory scenario led to a new paradigm where the focus on sustainable electricity production included technologies other than CHP, redirecting policies and incentives towards RESs and drawing attention and investment away from CHP. Furthermore, RD 2818/1998 introduced a restriction on the rated power of CHP, limiting its value up to 50 MW. The relevance of this restriction was that it also affected those CHPs that had been installed under the former pre-liberalization regulatory frameworks. This retroactive measure might have affected the risk perception of future investments.

Consequently, all the factors mentioned above might have impacted the resulting value of the α2 installation rate, which, with 101.6 MW/year, was significantly lower than before.

In 2008, the regulated costs of the SES were higher than expected. The sharp evolution of the installed capacity of some RES technologies resulted in surpassing the power objectives and, consequently, an increase in the scheduled remuneration to be applied to those technologies. Additionally, by this year, the real-estate economic crisis already hit the Spanish economy, worsening the evolution of the SES due to the reduction in the energy demand. In this context, a downward evolution of the parameter α3 took place. In this period, retroactive regulatory incentives were addressed to contain the regulated costs, mostly applied to photovoltaic systems. In this regard, it is not surprising that in this period, RD 661/2007 was not able to sustain the moderate rate of installation of CHP, as it happened during 2001–2008. Instead, from 2008 to 2012, the rate of installation of CHP (α3 = −7.15 MW/year) was negative, and a set of former CHPs decided to shut down their facilities and end their activity in the SES. As a result, the strategy plan E4 2004–2012 CHP objectives were not achieved by approximately 1000 MW.

In 2012, through RDL 1/2012, the need for a new regulatory scheme in terms of a new electricity law and a new way to remunerate and regulate the RES and CHP was announced. The sole announcement induced a shutdown of 61 CHP facilities, resulting in an installation rate value (α4) of −420.4 MW/year.

In 2013, the new electricity Law 24/2013 was enacted, along with the regulatory framework to promote RES, CHP and waste RD 413/2014. This brought a new mechanism to remunerate CHP and was applied to new and existing CHP facilities as well. The former CHPs saw a significant impact on their revenue determination. The new remuneration scheme, however, failed to attract the necessary investment into CHP facilities, resulting in an installed capacity of 5616 MW by the end of 2020 (α5 of 0.53 MW/year). This was far below the 9500 MW capacity objectives set by the E4 2012–2020 energy strategy for CHP.