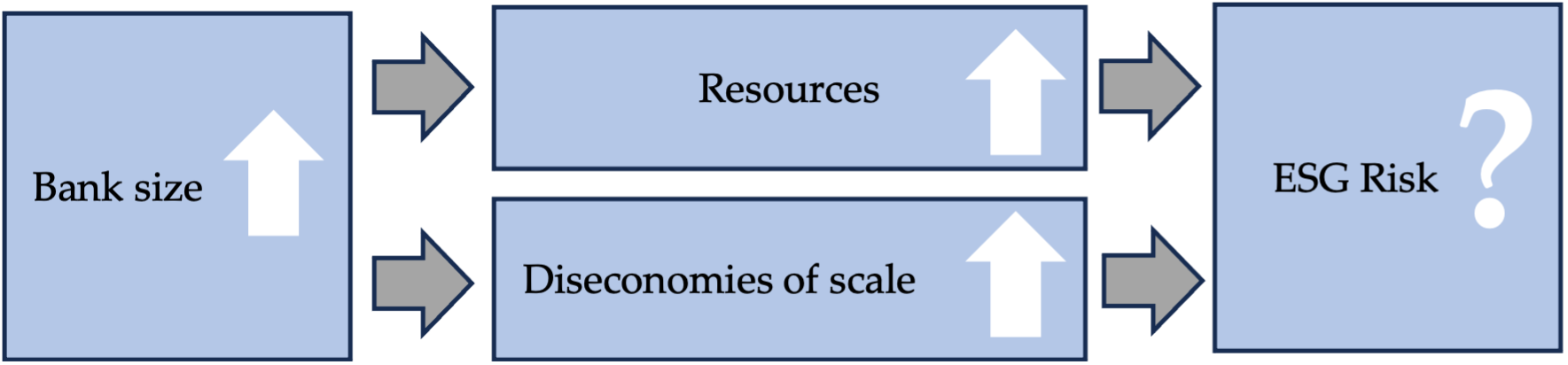

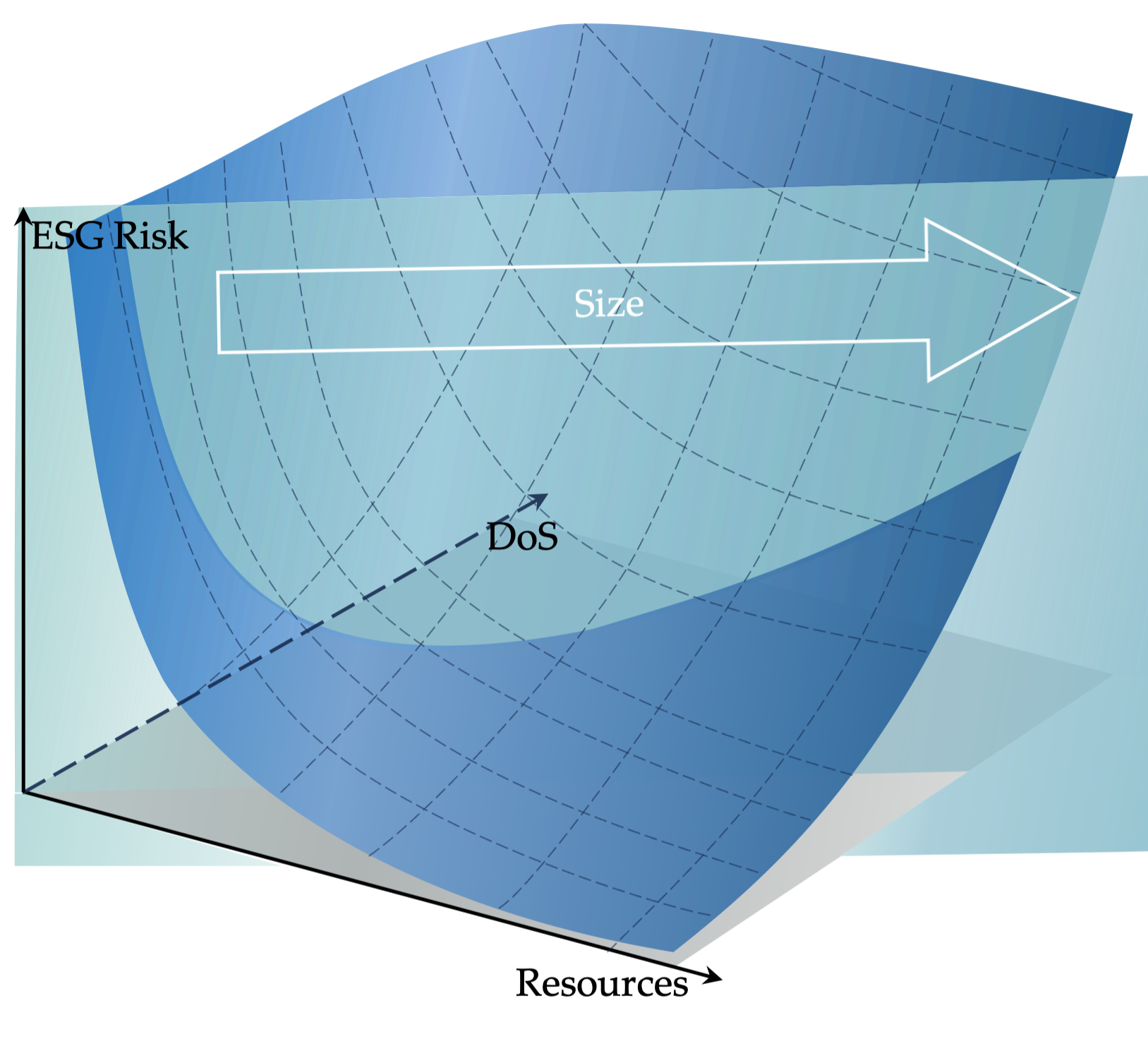

Although ESG risk is likely determined by a wide array of economic, social, and environmental factors in the case of banks, one of them—i.e., the company size—seems particularly interesting and worth being investigated. Overall, the specificity of the banking industry creates strong incentives for increasing the size of business activity, resulting not only from substantial economies of scale and scope, but also from additional competitive advantages and economic benefits arising from the “too big to fail” (TBTF) status assigned to the largest, systemically important institutions. On the one hand, larger banks may be expected to outperform smaller ones in the area of ESG challenges, as they are usually able to engage more resources and sophisticated knowledge-based management tools to address related concerns. They are also typically under more pressure from equity investors, regulators, and other major stakeholder groups to comply with ESG principles in order to legitimize their strategies and business decisions. On the other hand, however, as banks grow larger, their overall ESG risk exposure also builds up due to more numerous and more complex interactions with their external and internal stakeholders.

- ESG risk

- ESG risk management

- firm size

- banks

1. Introduction

2. The Impact of Size on Financial Performance, Risk, and ESG Performance in the Banking Industry

References

- Eccles, R.G.; Klimenko, S. Harvard Business Review; Harvard Business Publishing: Brighton, MA, USA, 2019; pp. 106–116.

- Nasdaq Clarity, Not Size Important in ESG Market|Nasdaq. 2022. Available online: https://www.nasdaq.com/articles/clarity-not-size-important-in-esg-market (accessed on 10 January 2023).

- Friedman, M. A Friedman Doctrine—The Social Responsibility Of Business Is to Increase Its Profits. The New York Times, 13 September 1970.

- Principles for Responsible Investment, About the PRI. Available online: https://www.unpri.org/about-us/about-the-pri (accessed on 12 January 2023).

- Cerqueti, R.; Ciciretti, R.; Dalò, A.; Nicolosi, M. ESG Investing: A Chance to Reduce Systemic Risk. J. Financ. Stab. 2021, 54, 100887.

- Armanino LLP ESG Scores & Rating Agencies. Available online: https://www.armanino.com/articles/esg-scores/ (accessed on 12 January 2023).

- Drempetic, S.; Klein, C.; Zwergel, B. The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings Under Review. J. Bus. Ethics 2020, 167, 333–360.

- Galletta, S.; Mazzù, S.; Naciti, V. A Bibliometric Analysis of ESG Performance in the Banking Industry: From the Current Status to Future Directions. Res. Int. Bus. Financ. 2022, 62, 101684.

- Thompson, P.; Cowton, C.J. Bringing the Environment into Bank Lending: Implications for Environmental Reporting. Br. Account. Rev. 2004, 36, 197–218.

- Bolibok, P. The Impact of Social Responsibility Performance on the Value Relevance of Financial Data in the Banking Sector: Evidence from Poland. Sustainability 2021, 13, 12006.

- Zioło, M. Business Models of Banks Toward Sustainability and ESG Risk. In Sustainability in Bank and Corporate Business Models. The Link between ESG Risk Assessment and Corporate Sustinability; Palgrave Macmillan: Cham, Switzerland, 2021; pp. 185–209.

- Koleśnik, J. Operational Risk in Banks—Revolution or Regulatory Evolution. Res. Pap. Wrocław Univ. Econ. 2018, 509, 168–178.

- Galletta, S.; Goodell, J.W.; Mazzù, S.; Paltrinieri, A. Bank Reputation and Operational Risk: The Impact of ESG. Financ. Res. Lett. 2023, 51, 103494.

- Liu, S.; Jin, J.; Nainar, K. Does ESG Perform. Reduce Banks’ Nonperforming Loans? Financ. Res. Lett. 2023, 55, 103859.

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. Account. Rev. 2011, 86, 59–100.

- Gregory, A.; Tharyan, R.; Whittaker, J. Corporate Social Responsibility and Firm Value: Disaggregating the Effects on Cash Flow, Risk and Growth. J. Bus. Ethics 2014, 124, 633–657.

- Agnese, P.; Giacomini, E. Bank’s Funding Costs: Do ESG Factors Really Matter? Financ. Res. Lett. 2023, 51, 103437.

- Andrieș, A.M.; Sprincean, N. ESG Performance and Banks’ Funding Costs. Financ. Res. Lett. 2023, 54, 103811.

- Simpson, W.G.; Kohers, T. The Link between Corporate Social and Financial Performance: Evidence from the Banking Industry. J. Bus. Ethics 2002, 35, 97–109.

- Wu, M.-W.; Shen, C.-H. Corporate Social Responsibility in the Banking Industry: Motives and Financial Performance. J. Bank. Financ. 2013, 37, 3529–3547.

- Gangi, F.; Mustilli, M.; Varrone, N.; Daniele, L. Corporate Social Responsibility and Banks’ Financial Performance. Int. Bus. Res. 2018, 11, 42–58.

- Penas, M.F.; Unal, H. Gains in Bank Mergers: Evidence from the Bond Markets. J. Financ. Econ. 2004, 74, 149–179.

- Philippon, T.; Reshef, A. Wages and Human Capital in the U.S. Finance Industry: 1909–2006. Q. J. Econ. 2012, 127, 1551–1609.

- International Monetary Fund. Global Financial Stability Report. Moving from Liquidity- to Growth-Driven Markets; World Economic and Financial Surveys; International Monetary Fund: Washington, DC, USA, 2014.

- Calomiris, C.W.; Nissim, D. Crisis-Related Shifts in the Market Valuation of Banking Activities. J. Financ. Intermediation 2014, 23, 400–435.

- Wheelock, D.C.; Wilson, P.W. Do Large Banks Have Lower Costs? New Estimates of Returns to Scale for U. S. Banks. J. Money Credit Bank. 2012, 44, 171–199.

- Hughes, J.P.; Mester, L.J. Who Said Large Banks Don’t Experience Scale Economies? Evidence from a Risk-Return-Driven Cost Function. J. Financ. Intermediation 2013, 22, 559–585.

- Davies, R.; Tracey, B. Too Big to Be Efficient? The Impact of Implicit Subsidies on Estimates of Scale Economies for Banks. J. Money Credit Bank. 2014, 46, 219–253.

- Minton, B.A.; Stulz, R.M.; Taboada, A.G. Are the Largest Banks Valued More Highly? Rev. Financ. Stud. 2019, 32, 4604–4652.

- Santos, J.A.C. Evidence from the Bond Market on Banks’ “Too Big to Fail” Subsidy. SSRN J. 2014, 20, 29–39.

- Smirlock, M. Evidence on the (Non) Relationship between Concentration and Profitability in Banking. J. Money Credit Bank. 1985, 17, 69–83.

- Bikker, J.A.; Hu, H. Cyclical Patterns in Profits, Provisioning and Lending of Banks; DNB Staff Reports; De Nederlansche Bank: Amsterdam, The Netherlands, 2002.

- Goddard, J.; Molyneux, P.; Wilson, J.O.S. The Profitability of European Banks: A Cross-Sectional and Dynamic Panel Analysis. Manch. Sch. 2004, 72, 363–381.

- Platonova, E.; Asutay, M.; Dixon, R.; Mohammad, S. The Impact of Corporate Social Responsibility Disclosure on Financial Performance: Evidence from the GCC Islamic Banking Sector. J. Bus. Ethics 2018, 151, 451–471.

- Athanasoglou, P.P.; Brissimis, S.N.; Delis, M.D. Bank-Specific, Industry-Specific and Macroeconomic Determinants of Bank Profitability. J. Int. Financ. Mark. Inst. Money 2008, 18, 121–136.

- Nizam, E.; Ng, A.; Dewandaru, G.; Nagayev, R.; Nkoba, M.A. The Impact of Social and Environmental Sustainability on Financial Performance: A Global Analysis of the Banking Sector. J. Multinatl. Financ. Manag. 2019, 49, 35–53.

- Tui, S.; Nurnajamuddin, M.; Sufri, M.; Nirwana, A. Determinants of Profitability and Firm Value: Evidence from Indonesian Banks. IRA-Int. J. Manag. Soc. Sci. 2017, 7, 84–95.

- Ersoy, E.; Swiecka, B.; Grima, S.; Özen, E.; Romanova, I. The Impact of ESG Scores on Bank Market Value? Evidence from the U.S. Banking Industry. Sustainability 2022, 14, 9527.

- Di Tommaso, C.; Thornton, J. Do ESG Scores Effect Bank Risk Taking and Value? Evidence from European Banks. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2286–2298.

- Ferretti, R.; Gallo, G.; Landi, A.; Venturelli, V. Market-Book Ratios of European Banks: What Does Explain the Structural Fall? CEFIN Working Papers; CEFIN: Modena, Italy, 2018; No. 65.

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L.; Redondo Hernández, J. ESG Performance and Shareholder Value Creation in the Banking Industry: International Differences. Sustainability 2019, 11, 1404.

- Kuzucu, N.; Kuzucu, S. Does Efficiency Contribute to Market Valuation of Banks Evidence from Turkish Banking System. Pressacademia 2019, 9, 9–13.

- Avramidis, P.; Cabolis, C.; Serfes, K. Bank Size and Market Value: The Role of Direct Monitoring and Delegation Costs. J. Bank. Financ. 2018, 93, 127–138.

- Acharya, V.V.; Pedersen, L.H.; Philippon, T.; Richardson, M. Measuring Systemic Risk. Rev. Financ. Stud. 2017, 30, 2–47.

- Hagendorff, J.; Keasey, K.; Vallascas, F. When Banks Grow Too Big for Their National Economies: Tail Risks, Risk Channels, and Government Guarantees. J. Financ. Quant. Anal. 2018, 53, 2041–2066.

- Acharya, V.V.; Steffen, S. The “Greatest” Carry Trade Ever? Understanding Eurozone Bank Risks. J. Financ. Econ. 2015, 115, 215–236.

- Gennaioli, N.; Martin, A.; Rossi, S. Banks, Government Bonds, and Default: What Do the Data Say? J. Monet. Econ. 2018, 98, 98–113.

- Demsetz, R.S.; Strahan, P.E. Diversification, Size, and Risk at Bank Holding Companies. J. Money Credit Bank. 1997, 29, 300–313.

- Dell’Ariccia, G.; Laeven, L.; Suarez, G.A. Bank Leverage and Monetary Policy’s Risk-Taking Channel: Evidence from the United States. J. Financ. 2017, 72, 613–654.

- Soussa, F. Too Big to Fail: Moral Hazard and Unfair Competition. In Financial Stability and Central Banks, Selected Issues for Financial Safety Nets and Market Discipline; Halme, L., Hawkesby, C., Healey, J., Saapar, I., Soussa, F., Eds.; Centre for Central Banking Studies, Bank of England: London, UK, 2000; pp. 5–31.

- Chih, H.-L.; Chih, H.-H.; Chen, T.-Y. On the Determinants of Corporate Social Responsibility: International Evidence on the Financial Industry. J. Bus. Ethics 2010, 93, 115–135.

- Shen, C.-H.; Wu, M.-W.; Chen, T.-H.; Fang, H. To Engage or Not to Engage in Corporate Social Responsibility: Empirical Evidence from Global Banking Sector. Econ. Model. 2016, 55, 207–225.

- Bissoondoyal-Bheenick, E.; Brooks, R.; Do, H.X. ESG and Firm Performance: The Role of Size and Media Channels. Econ. Model. 2023, 121, 106203.

- Scholtens, B.; Dam, L. Banking on the Equator. Are Banks That Adopted the Equator Principles Different from Non-Adopters? World Dev. 2007, 35, 1307–1328.

- Mathuva, D.M.; Kiweu, J.M. Cooperative Social and Environmental Disclosure and Financial Performance of Savings and Credit Cooperatives in Kenya. Adv. Account. 2016, 35, 197–206.

- Lian, Y.; Gao, J.; Ye, T. How Does Green Credit Affect the Financial Performance of Commercial Banks? Evidence from China. J. Clean. Prod. 2022, 344, 131069.

- Ge, L.; Zhao, H.; Yang, J.; Yu, J.; He, T. Green Finance, Technological Progress, and Ecological Performance—Evidence from 30 Provinces in China. Environ. Sci. Pollut. Res. 2022, 29, 66295–66314.

- Gutiérrez-Ponce, H.; Wibowo, S.A. Do Sustainability Activities Affect the Financial Performance of Banks? The Case of Indonesian Banks. Sustainability 2023, 15, 6892.

- Menicucci, E.; Paolucci, G. ESG Dimensions and Bank Performance: An Empirical Investigation in Italy. Corp. Gov. Int. J. Bus. Soc. 2022, 23, 563–586.

- Neitzert, F.; Petras, M. Corporate Social Responsibility and Bank Risk. J. Bus. Econ. 2022, 92, 397–428.

- Chiaramonte, L.; Dreassi, A.; Girardone, C.; Piserà, S. Do ESG Strategies Enhance Bank Stability during Financial Turmoil? Evidence from Europe. Eur. J. Financ. 2022, 28, 1173–1211.

- Van Gysegem, F.; Blaser, P. Banking Goes ESG. How to Combine Sustainability with Profitability; Roland Berger GmbH: Munich, Germany, 2022.

- Albdiwy, F.; Ahmad, W.M.W.; Sukor, M.E.A. Does Bank Size Affect the Relationship between ESG Framework and Bank Stability? Evidence from the Global Banking Industry. J. Hunan Univ. 2022, 49, 396–411.

- Quang Trinh, V.; Duong Cao, N.; Li, T.; Elnahass, M. Social Capital, Trust, and Bank Tail Risk: The Value of ESG Rating and the Effects of Crisis Shocks. J. Int. Financ. Mark. Inst. Money 2023, 83, 101740.

- Gallo, P.J.; Christensen, L.J. Firm Size Matters: An Empirical Investigation of Organizational Size and Ownership on Sustainability-Related Behaviors. Bus. Soc. 2011, 50, 315–349.

- Chauhan, S. A Relational Study of Firm’s Characteristics and CSR Expenditure. Procedia Econ. Financ. 2014, 11, 23–32.

- Hörisch, J.; Johnson, M.P.; Schaltegger, S. Implementation of Sustainability Management and Company Size: A Knowledge-Based View. Bus. Strategy Environ. 2015, 24, 765–779.

- Gregory, R.P. The Influence of Firm Size on ESG Score Controlling for Ratings Agency and Industrial Sector. J. Sustain. Financ. Invest. 2022, 14, 86–99.

- Freeman, R.E.; Wicks, A.C.; Parmar, B. Stakeholder Theory as a Basis for Capitalism. In Corporate Social Responsibility and Corporate Governance; Palgrave Macmillan: London, UK, 2011; pp. 52–72.

- Deegan, C. Introduction: The Legitimising Effect of Social and Environmental Disclosures—A Theoretical Foundation. Account. Audit. Account. J. 2002, 15, 282–311.

- Adams, C.A.; Hill, W.-Y.; Roberts, C.B. Corportate Social Reporting Practices in Western Europe: Legitimating Corporate Behaviour? Br. Account. Rev. 1998, 30, 1–21.

- Baumann-Pauly, D.; Wickert, C.; Spence, L.J.; Scherer, A.G. Organizing Corporate Social Responsibility in Small and Large Firms: Size Matters. J. Bus. Ethics 2013, 115, 693–705.

- Granville, M.; Gez, M.; Gottlieb, D. A Survey of Sustainability Disclosures by Small and Mid-Cap Companies; Harvard Law School Forum on Corporate Governance; White & Case LPP: New York, NY, USA, 2021.

- Dobrick, J.; Klein, C.; Zwergel, B. Size Bias in Refinitiv ESG Data. Financ. Res. Lett. 2023, 55, 104014.

- Canback, S.; Samouel, P.; Price, D. Do Diseconomies of Scale Impact Firm Size and Performance? A Theoretical and Empirical Overview. ICFAI J. Manag. Econ. 2006, 4, 27–70.

- Aouadi, A.; Marsat, S. Do ESG Controversies Matter for Firm Value? Evidence from International Data. J. Bus. Ethics 2018, 151, 1027–1047.

- Barnea, A.; Rubin, A. Corporate Social Responsibility as a Conflict Between Shareholders. J. Bus. Ethics 2010, 97, 71–86.

- Akgun, O.T.; Mudge, T.J.; Townsend, B. How Company Size Bias in ESG Scores Impacts the Small Cap Investor. J. Impact ESG Invest. Summer JESG 2021, 1, 31–44.

- Udayasankar, K. Corporate Social Responsibility and Firm Size. J. Bus. Ethics 2008, 83, 167–175.