In recent years, Artificial Intelligence (AI) has become widespread, driven by abundant daily data production and increased computing power. It finds applications across various sectors, including transportation, education, healthcare, banking, and finance. The financial industry, in particular, is rapidly adopting AI to achieve significant cost savings. AI has the potential to revolutionize financial services by offering tailored, faster, and more cost-effective solutions. Saudi Arabia is emerging as a growing market in this field, emphasizing technology-driven institutions. Despite gaining prominence and government support, AI has yet to play a crucial role in improving the efficiency of financial transactions. Limited research on AI adoption in the Saudi Arabian financial industry underscores the need for a comprehensive literature review. This study explores the benefits, limitations, and challenges of implementing AI in finance, emphasizing ethical and regulatory considerations. Findings indicate existing research on how AI enhances financial processes through tailored components and efficient algorithms. The study proposes a sequential framework for AI development and integration into the financial sector at both macro and micromanagement levels. The framework, drawing insights from existing literature, aims to provide a nuanced understanding of opportunities, challenges, and areas for improvement to maximize AI's potential in the Saudi Arabian financial sector.

- Artificial Intelligence

- financial industry

- Deep Learning

- machine learning

- finance

- AI in finance

- fintech

- financial regularity

- sustainable economic

- Saudi Arabia

1. Introduction

2. The Current State of Deploying AI in the Financial Industry in KSA

AI is revolutionizing the global financial sector by automating regular tasks, optimizing efficiency, and increasing our understanding of customer behavior. KSA has seen an impressive recent upsurge in AI adoption in its financial sector. The industry has been quick to adopt AI technology. Swain and Gochhait’s study [20][15] investigated AI’s effects on Middle Eastern financial institutions, they carried out a literature review that explored topics related to AI integration, blockchain, cloud computing, and data security in Islamic banking. Additionally, they sought potential solutions to tackle any challenges. The study’s results indicated that the use of cloud computing flourished during the pandemic in Islamic banking and is still growing. Cloud services provide updates to secure data capture, storage, and interpretation processes. Their research concluded that cloud computing could be hugely beneficial in fortifying the structure and networks within Islamic banking. SAMA launched a regulatory sandbox initiative in 2018 as an AI implementation, allowing fintech companies to test innovative products and services in a safe environment; this encourages innovation and broadens the use of AI in the financial sector. During COVID-19, it became apparent that AI and IoT were essential in the banking sector. This resulted in urban financial institutions transitioning to using robotics and AI to automate banking processes, along with many fintech companies [16][12]. The study highlighted that banks are less likely to experience cyberattacks when using AI technologies and improve compliance. Furthermore, Saudi banks have applied AI technology to improve their services, such as chatbots for customer service inquiries and fraud detection systems. For instance, Saudi National Bank (SNB) implemented chatbots that are accessible 24/7 to provide customers with quick responses and an AI-based fraud detection system to analyze customer behavior and transactions. Many financial organizations increasingly use AI-powered customer service chatbots to provide personalized assistance. However, Al-Ghamdi and Al-Shehri [22][16] illustrated a shortage of skilled AI professionals and expertise, hindering its full implementation within the industry. They also noted the need for regulatory frameworks to ensure AI’s ethical and responsible use within the finance domain.3. Leveraging AI in the Saudi Financial Industry

3.1. Benefits and Limitations

AI technologies can potentially revolutionize the financial sector by enhancing efficiency, cutting costs, and improving the customer experience. However, they also present new risks and drawbacks that must be carefully considered. One of AI’s primary advantages in finance is its ability to process massive volumes of data and furnish insights that humans might overlook. These data can train ML algorithms, which can then predict future actions. Another benefit is that AI can automate repetitive or routine tasks and processes. Chatbots and robo-advisors are examples of such tools, which can respond to customer inquiries quickly and accurately [24[17][18],25], freeing up human resources for more complex tasks. Additionally, AI technologies are useful for risk management and fraud detection because they analyze large amounts of data in real-time [24,25][17][18]. The earlier malicious activities are detected, the less likely financial institutions will suffer losses or damage to their reputation. In addition, customers’ experience can be improved with AI technologies. For example, chatbots and virtual assistants can give personalized recommendations according to individual needs and preferences [24[17][18],25], which could lead to increased customer satisfaction and loyalty. Nevertheless, some limitations must be considered when deploying AI technologies in financial services. The first is biased decision-making due to inappropriate data used to train algorithms. To avoid this, financing organizations must ensure their data are diverse [24,25][17][18]. Data privacy and security breaches must be avoided; measures should be taken to ensure that data are securely stored against cyber threats [20][15]. Nonetheless, research has suggested that AI offers solutions that would have been impossible without such technology [25][18].3.2. Challenges

Despite AI’s continuous evolution in the KSA financial sector, certain challenges must be tackled. One of the primary difficulties Saudi financial institutions face is the shortage of qualified AI specialists and experts. As reported by AlBarrak et al. [26][19] there is an insufficient number of AI professionals in KSA, which impedes the emergence and implementation of AI technologies in the financial sector. This lack of skilled professionals is exacerbated due to the high demand for AI expertise in other industries like healthcare and energy. Apart from this, the cost is another challenge financial institutions in KSA encounter when implementing AI technologies. AI technologies demand considerable investment in infrastructure, hardware, and software, which can be too costly for certain institutions, especially smaller ones [27][20]. Additionally, maintaining and upgrading AI systems can also be expensive. Data quality and availability are also major challenges financial institutions confront when applying AI technologies. Good-quality data are necessary for algorithms to be trained or developed; unfortunately, many financial entities struggle to obtain quality data because of data fragmentation, silos, and the absence of standardization [27,28][20][21]. Furthermore, financial institutions may need to establish regulatory frameworks that guarantee the ethical and responsible use of AI technologies within the sector. Insufficient clear directives and regulations create ambiguity and prohibit adoption and usage [28][21].4. Ethical and Regulatory Considerations

4.1. Ethical Considerations

Regarding AI applications in finance, several ethical issues must be considered. For instance, an AI algorithm’s accuracy is only as unbiased as the data on which it is trained; if the data are biased, the outcome will be biased [29,30][22][23]. This can potentially lead to unfair or discriminatory practices in lending, investments, or other monetary activities. Another ethical dilemma is how AI will affect job prospects. As technology advances, there are concerns that it could replace workers in data analyses and customer service roles. Organizations need to consider how these changes could negatively impact their employees and devise strategies to minimize such impacts as they could cause economic disruptions for displaced employees. Finally, there are concerns related to protecting customers’ personal information. AI models require substantial amounts of confidential financial data to work effectively, and these must be secure and comply with all related data privacy regulations. There is also the risk that an AI model could be hacked, leading to financial fraud or other illegal activities.4.2. Regulatory Considerations

While utilizing AI technologies, it is essential that financial institutions comply with data protection laws such as the Saudi Arabian Data Protection Law and the General Data Protection Regulation (GDPR) of the European Union [21,22,31][16][24][25]. Moreover, customer consent must be obtained prior to using personal data for AI-related activities. Accountability is a necessary consideration; financial institutions must be accountable for the decisions made by their AI systems, and customers must have access to redress mechanisms if they are adversely affected [21,22,31][16][24][25]5. Significant AI Components and Their Algorithms

5.1. Significant Components

Developing AI systems that meet the financial industry’s needs requires careful consideration of several critical components, including data quality, data security, explainability, and human oversight. Data quality: High-quality data is a critical component of any AI system, and financial institutions must ensure that their data are clean, accurate, and up-to-date [28,29][21][22]. Data quality is essential for building accurate machine learning models that can make informed decisions. Data security: Financial institutions must also consider the security of their data when developing AI systems. Data breaches can have severe consequences for financial institutions, including damage to their reputation, legal liability, and loss of customer trust. Financial institutions must ensure their AI systems are secure and comply with relevant regulations [32,33,34,35,36,37][26][27][28][29][30][31]. Explainability: It is a critical component of AI systems in the financial industry, where decisions can have significant consequences. Financial institutions must ensure that their AI systems can explain how decisions are made and provide insights into the factors that influence those decisions [32][26]. This AI component is necessary for building trust with customers and regulators and improving the accuracy of AI systems. Human oversight: AI systems in the financial industry must have human oversight to ensure they make fair, unbiased, and ethical decisions [29,30][22][23]. Financial institutions must ensure that their AI systems are aligned with their organizational values and have mechanisms in place to monitor and correct any biases that may arise. Financial institutions must invest in infrastructure and talent to ensure their AI systems are secure, reliable, and aligned with organizational values.5.2. Algorithms

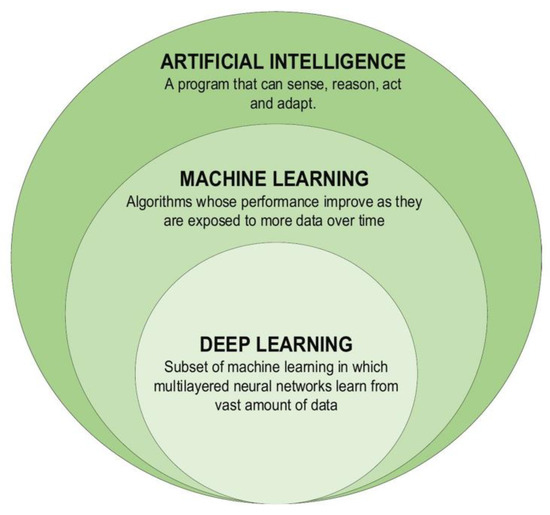

AI algorithms can help financial institutions enhance customer services, manage risks, detect fraud, and improve investment decisions. AI algorithms have become an integral part of the financial industry. Among the algorithms on which AI can be utilized in the finance industry and that are well-known are ML and Deep Learning (DL). Figure 21 below illustrates the relationship of AI with ML and ML with DL:

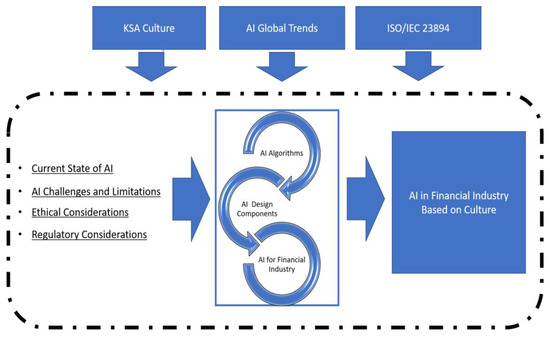

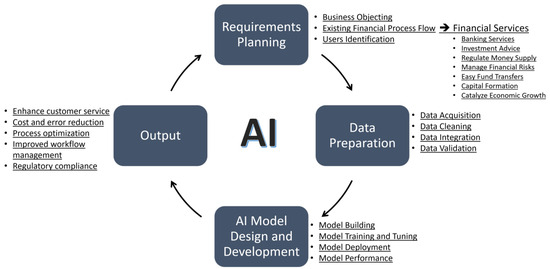

6. The Proposed Frameworks

7. Conclusions

References

- Singh, A.M.; Haju, W.B. Artificial Intelligence. Int. J. Res. Appl. Sci. Eng. Technol. 2022, 10, 1210–1220.

- Hentzen, J.K.; Hoffmann, A.; Dolan, R.; Pala, E. Artificial intelligence in customer-facing financial services: A systematic literature review and agenda for future research. Int. J. Bank. Mark. 2022, 40, 1299–1336.

- Buchanan, B.G. Artificial Intelligence in Finance; Zenodo: Geneva, Switzerland, 2019.

- Sahu, S.K.; Mokhade, A.; Bokde, N.D. An Overview of Machine Learning, Deep Learning, and Reinforcement Learning-Based Techniques in Quantitative Finance: Recent Progress and Challenges. Appl. Sci. 2023, 13, 1956.

- Gogas, P.; Papadimitriou, T. Machine Learning in Economics and Finance. Comput. Econ. 2021, 57, 1–4.

- Lakhchini, W.; Hassan, U. Artificial Intelligence & Machine Learning in Finance: A Literature Review; Zenodo: Geneva, Switzerland, 2022.

- Goodell, J.W.; Kumar, S.; Lim, W.M.; Pattnaik, D. Artificial intelligence and machine learning in finance: Identifying foundations, themes, and research clusters from bibliometric analysis. J. Behav. Exp. Financ. 2021, 32, 100577.

- Organisation for Economic Co-Operation and Development, Artificial Intelligence, Machine Learning and Big Data in Finance: Opportunities, Challenges, and Implications for Policy Makers. 2021. Available online: https://www.oecd.org/finance/artificial-intelligence-machine-learning-big-data-in-finance.htm (accessed on 20 March 2023).

- Munawwar, A.S. Artificial Intelligence in Saudi Arabia: Leveraging Entrepreneurship in the Arab Markets. In Proceedings of the 2019 Amity International Conference on Artificial Intelligence (AICAI), Dubai, United Arab Emirates, 4–6 February 2019; IEEE: Toulouse, France, 2019.

- Nasir, O.; Javed, R.T.; Gupta, S.; Vinuesa, R.; Qadir, J. Artificial intelligence and sustainable development goals nexus via four vantage points. Technol. Soc. 2022, 72, 102171.

- Alharbi, A.; Almazroi, O.; Alotaibi, N. The Impact of Artificial Intelligence on the Banking Sector in Saudi Arabia: Opportunities and Challenges. In Proceedings of the 2021 IEEE 11th Annual Computing and Communication Workshop and Conference (CCWC), Istanbul, Turkey, 19–20 March 2021; pp. 114–119.

- SAMA and the National Information Center Sign the Electronic Link Agreement. 2020. Available online: https://www.sama.gov.sa/en-US/News/pages/news-506.aspx (accessed on 6 June 2023).

- Clarity AI signs MoU with the Saudi Tadawul Group to Increase Access to Sustainability Assessment, Analysis and Reporting Capabilities for Companies in MENA. 2023. Available online: https://www.businesswire.com/news/home/20230212005014/en/Clarity-AI-signs-MoU-with-the-Saudi-Tadawul-Group-to-Increase-Access-to-Sustainability-Assessment-Analysis-and-Reporting-Capabilities-for-Companies-in-MENA (accessed on 6 June 2023).

- Yousif, F.; Anezi, A. Saudi Vision 2030: Sustainable Economic Development through IoT. In Proceedings of the 2021 10th IEEE International Conference on Communication Systems and Network Technologies (CSNT), Bhopal, India, 18–19 June 2021.

- Swain, S.; Gochhait, S. ABCD technology-AI, Blockchain, Cloud computing and Data security in Islamic banking sector. In Proceedings of the 2022 International Conference on Sustainable Islamic Business and Finance, SIBF 2022, Sakhir, Bahrain, 11–12 October 2022; Institute of Electrical and Electronics Engineers Inc.: New York, NY, USA, 2022; pp. 58–62.

- Al-Ghamdi, R.A.; Al-Shehri, M.T. The role of artificial intelligence in enhancing the quality of financial services: The case of Saudi Arabia. J. Financ. Serv. Mark. 2020, 25, 1–12.

- Mishra, P.; Guru Sant, T. Role of Artificial Intelligence and Internet of Things in Promoting Banking and Financial Services during COVID-19: Pre and Post Effect. In Proceedings of the 2021 5th International Conference on Information Systems and Computer Networks, ISCON 2021, Mathura, India, 22–23 October 2021; Institute of Electrical and Electronics Engineers Inc.: New York, NY, USA, 2021.

- Fares, O.H.; Butt, I.; Lee, S.H.M. Utilization of artificial intelligence in the banking sector: A systematic literature review. J. Financ. Serv. Mark. 2022, 1–18.

- AlBarrak, M.A.; Altwaijri, N.T.; Alghamdi, S.A. Artificial Intelligence in the Financial Sector: A Review of Saudi Arabia. In Proceedings of the 2020 IEEE/ACS 17th International Conference on Computer Systems and Applications (AICCSA), Antalya, Turkey, 2–5 November 2020; pp. 1–6.

- Alotaibi, N.S.; Alshehri, A.H. Prospers and Obstacles in Using Artificial Intelligence in Saudi Arabia Higher Education Institutions—The Potential of AI-Based Learning Outcomes. Sustainability 2023, 15, 10723.

- Kshetri, N. The Role of Artificial Intelligence in Promoting Financial Inclusion in Developing Countries. J. Glob. Inf. Technol. Manag. 2021, 24, 1–6.

- Alfityani, A.; Al-Lozi, E.; Abadalmajeed Alsmadi, A.; Hazimeh, A.; Al-Gasawneh, J.A. The Role of Big Data in Financial Sector: A Review Paper. Int. J. Data Netw. Sci. 2022, 6, 2–13.

- Rahman, R.; Islam, R.; Muhammed, F.U.S. Enhancing Big Data Security in Financial Sector Using Artificial Intelligence. In Proceedings of the 2020 23rd International Conference on Computer and Information Technology (ICCIT), Dhaka, Bangladesh, 19–21 December 2020; pp. 1–6.

- AlQudah, Z.; Shaalan, K. The adoption of artificial intelligence in the banking sector in Saudi Arabia: An exploratory study. J. Financ. Serv. Mark. 2020, 25, 145–156.

- Kshetri, S.; Nguyen, P.H.; Vo, V.A. Building Trust in Financial Artificial Intelligence: A Research Agenda. J. Bus. Res. 2021, 136, 56–68.

- Ali, A.; Razak, S.A.; Othman, S.H.; Eisa, T.A.E.; Al-Dhaqm, A.; Elhassan, T.; Elshafie, H.; Saif, A. Financial Fraud Detection Based on Machine Learning: A Systematic Literature Review. Appl. Sci. 2022, 12, 9637.

- Mishra, S. Exploring the Impact of AI-Based Cybersecurity Financial Sector Management. Appl. Sci. 2023, 13, 5875.

- Ileberi, E.; Sun, Y.; Wang, Z. A machine learning based credit card fraud detection using the GA algorithm for feature selection. J. Big Data 2022, 9, 24.

- Yasir, A.; Ahmad, A.; Abbas, S.; Inairat, M.; Al-Kassem, A.H.; Rasool, A. How Artificial Intelligence Is Promoting Financial Inclusion? A Study on Barriers of Financial Inclusion. In Proceedings of the 2022 International Conference on Business Analytics for Technology and Security, ICBATS 2022, Dubai, United Arab Emirates, 16–17 February 2022; Institute of Electrical and Electronics Engineers Inc.: New York, NY, USA, 2022.

- Chan, C.; Chow, C.; Wong, J.; Dimakis, N.; Nayler, D.; Bermudes, J.; Raman, J.; Lam, R.; Baker, M. Artificial Intelligence Applications in Financial Services; Asset management and insurance; Oliver Wyman: New York, NY, USA, 2019.

- Li, Y.; Huang, Y.; Zhang, Y. Big Data Quality Assessment for Artificial Intelligence in Finance. J. Financ. Data Sci. 2019, 5, 277–290.

- Biswal, A. Stock Price Prediction using Machine Learning and Deep Learning. In Proceedings of the 2021 IEEE Mysore Sub Section International Conference (MysuruCon), Hassan, India, 24–25 October 2021; pp. 660–664.