Mining in Canada stands as one of the most energy-intensive sectors, playing a pivotal role as a significant provider of copper, nickel, and cobalt to the international market. Anticipated growth in the global population, coupled with the transition of several low-income economies to middle-income status, is poised to escalate the demand for essential raw materials. This surge in demand is expected to drive an increase in energy consumption across various stages of the Canadian mining industry, encompassing exploration, extraction, processing, and refining. Due to their geographical constraints, most Canadian mining operations rely heavily on fossil fuels such as diesel and heavy fuel. Considering the global shift towards decarbonization and the pursuit of net-zero emission targets, exploring avenues for adopting electrification solutions and integrating renewable energy technologies, particularly in sizable surface mines, is imperative.

- mining decarbonization

- mining electrification

- renewable energy

- clean-energy technologies

1. Introduction

23. Current Active Projects Related to Renewable Energy Development in Canadian Mining

The Research Centre for Energy Resources and Consumption foresees a significant surge in primary energy demand for the global Canadian mining industry over the next decade, specifically in the extraction of copper ores for the renewable energy sector, rare earth for the semiconductor industry, and lithium and nickel ores for the manufacture of electric car batteries. This demand is projected to escalate from 8% of primary energy consumption to 15–20% by 2035 [8][19]. This growth prompts the expectation that Canadian renewable energy technologies, the semiconductor industry, and electric vehicle and battery developers will play a pivotal role in delivering adaptable, proven, and low-carbon energy solutions to meet the escalating energy requirements of the mining sector [9][20]. However, in this context, it is crucial to assess the potential environmental impact of these mining operations. In essence, Canadian mining operations have the potential to reduce their energy consumption and greenhouse gas emissions based on diesel fuel consumption through the implementation of energy recovery systems (ERS) [10][21], integration of renewable energy (RE) sources [11][22], transport electrification, and adoption of carbon capture (CC) technologies [12][23]. Additionally, Canadian mines are positioning themselves to cut expenses by curbing diesel usage and carbon emissions, especially as Canada is a pioneer as the first significant mining jurisdiction to enforce a national carbon pricing strategy [13][24]. Addressing the energy-related challenges in the mining industry will necessitate a blend of renewable energy solutions and electrification. To facilitate this, the Canadian government has committed CAD 2.3 billion to establish a research and development (R&D) framework, propelling Canada into a leadership role in renewable energy solutions. This framework includes targeted funding initiatives to bolster renewable energy within the mining sector [14][25]. Despite the harsh winter conditions in Canada’s northern regions, integrating renewable energy sources has demonstrated compelling cost savings at remote sites. The Raglan Mine project, undertaken by Glencore, stands out as a notable example. This pioneering initiative, led by TUGLIQ Energy, features the world’s first wind project incorporating various energy storage technologies. The project integrates two wind turbines with a total capacity of 6 MW (Figure 12) alongside diverse storage systems such as hydrogen fuel cells, lithium-ion batteries, and a flywheel [15][26]. These two turbines contribute approximately 10% of the mine’s electricity demand, resulting in savings exceeding 4 million liters of diesel annually and a reduction of 12,000 tonnes in emissions such as carbon dioxide (CO2), nitrogen oxide (NOX), hydrocarbon (HC), and particulate matter (PM). By incorporating two additional wind turbines, the mine’s renewable energy capacity would scale to 12 MW, its energy storage capacity would increase to 6 MW/2 MWh, and its yearly diesel consumption would plummet by 6.6 million liters [16][27]. In addition to the Raglan wind-storage hybrid project, Rio Tinto’s Diavik Diamond Mine in Canada’s Northwest Territories has operated with four 2.3 MW wind turbines since 2012. These turbines collectively comprise a wind farm with a demonstrated capacity of 9.2 MW and an annual production of 17 GWh. This setup provides an average of 10% of the mine’s power needs and contributes to a reduction of up to 6% in GHG emissions [17][28].

-

PV System at Raglan Mine (Quebec): Commencing in July 2021, this study evaluates the efficacy of solar energy production in Canada’s northern regions. The installation, located near the wind turbines at Mine 2, incorporates 108 bifacial panels, generating 40 kilowatt-peak (kWp) energy [19][30]. This project is still considered a pilot project in the northern region of Quebec.

-

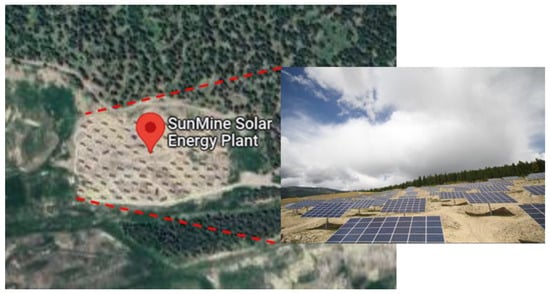

PV System at SunMine (British Columbia): Initiated in 2014, SunMine is a groundbreaking 2 MW solar field connected to the British Columbia grid. Remarkably, it is the first solar farm on a reclaimed abandoned mine site. Teck Resources invested CAD 70 million over five years to reclaim the site following the mine closure. The site continues to manage drainage water, as shown in Figure 23 [20][31[21],32].

-

PV System at Snowline Gold’s Forks Camp (Canada): An off-grid system at this remote gold mine encampment encompasses a lithium-ion battery bank, a power rack for equipment organization, and 64 bifacial modules on a ground mount (all rated at 27 kW). This configuration is expected to reduce carbon emissions by 90% and save an estimated 12,527 L of fuel annually by providing power to the 45-person exploration camp and recharging the battery bank [22][33].

34. Opportunities for Integrating RE into Off-Grid Mining Operations

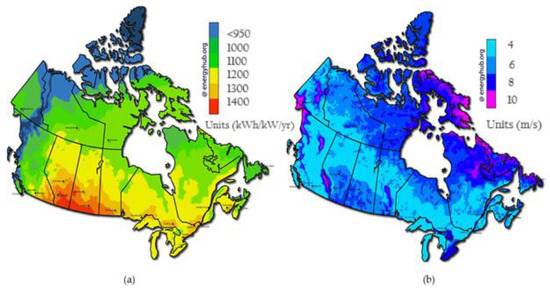

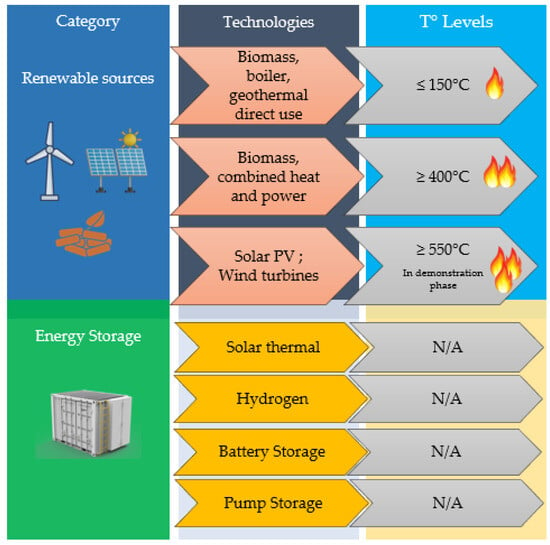

One of the foremost challenges in achieving sustainable development goals within off-grid mining operations stems from the pivotal shift from fossil fuel combustion to cleaner energy sources. Over the past decade, energy generation has witnessed remarkable technological advancements and cost reductions, particularly in wind and solar photovoltaic (PV) generation, thanks to widespread deployment. Recent insights into energy storage and renewable generation advancements suggest that the affordability of green energy is on the rise, attributed to climbing fossil fuel costs, the enforcement of climate change tax policies, and diminishing capital costs of eco-friendly generation and energy storage technology [24][25][26][39,40,41]. In Canada, the synergy of solar and wind resources presents an attractive solution for electrification and energy storage in remote areas. Notably, Canada’s prime wind resource lies predominantly in the northern regions, where many off-grid mines are located. The solar and wind source maps for Canada, as depicted in Figure 34 [27][28][29][42,43,44], underscore this distribution. Among the provinces, the prairie provinces emerge as solar energy production hotspots: Saskatchewan leads with 1330 kWh of energy per kW per year, followed by Alberta with 1276 kWh/kW/yr, and Manitoba with 1272 kWh/kW/yr. Comparatively, remote sites in Nunavut can generate around 1092 kWh/kW/yr, Quebec around 1183 kWh/kW/yr, and Ontario around 1166 kWh/kW/yr.

3.1. Meeting Electricity and Heating through RE

4.1. Meeting Electricity and Heating through RE

3.2. Replacing Diesel with RE for Transportation

4.2. Replacing Diesel with RE for Transportation

To illustrate, a notable fraction of approximately 10% of the energy requisites for both iron ore and gold mining is allocated to transportation and hauling operations [34][52]. Since diesel fuel remains a prominent energy source for these functions, particularly in truck hauling, integrating renewables into material handling presents notable challenges. In Canada, employing biodiesel within mining encounters certain hurdles. High biodiesel blends, particularly those derived from non-soy substrates, may undergo gelation in cold weather conditions [35][53]. However, strategies that are employed to counteract cold-sensitive compounds can also be applied to circumvent gelling issues. Several biodiesel exporters currently employ this approach to warm personalized train carriages.3.3. Making Hydrogen with RE

4.3. Making Hydrogen with RE

Hydrogen plays a multifaceted role within the mining sector, serving various purposes such as high-temperature heat generation, electricity production, feedstock, fuel for vehicles and mining equipment, and energy storage. Currently, the dominant sources of hydrogen production are oil, coal, and natural gas [36][55]. Surplus energy can be efficiently transformed into hydrogen and stored for later utilization. Notably, excessive electricity can undergo conversion into hydrogen and be stockpiled for deployment in other mining operations that possess the capacity to integrate intermittent-output renewable energy technologies, such as solar and wind.3.4. Electrifying Communities Nearby

4.4. Electrifying Communities Nearby

Mining enterprises have historically erected essential infrastructure to cater to the needs of remote mining communities, including electricity supply for housing employees. By leveraging this existing infrastructure, mining companies possess the potential to significantly enhance electrification efforts by extending these services to nearby villages [37][57]. Capitalizing on economies of scale, mining entities can leverage their substantial power consumption and financial capabilities to establish larger-scale power plants than required for mining operations. This approach enables the extension of electricity access to adjacent communities at an economically viable rate. This endeavor could manifest as a novel micro-grid initiative, where electricity generation from renewable sources is designed to serve both the mine site and the neighboring populace.45. Electrification Alternatives in Canadian Mines

The shift towards electrification within the Canadian mining sector is already underway. Both ongoing and upcoming mining ventures in Canada are actively transitioning to renewable energy sources and incorporating battery energy storage to meet their electricity demands. Numerous forward-thinking Canadian enterprises are channeling investments into fully electric or hybrid electric vehicles to substitute diesel vehicles, curtail costs, diminish pollution, and embrace clean technologies for a more prosperous and ecological future [38][39][40][41][42][43][44][59,60,61,62,63,64,65]. However, this transition also ushers in infrastructure, maintenance, and operational challenges mine operators must contend with. Currently, a predominant focus within Canadian mining operations centers around electrifying their haulage systems. This initiative is highlighted by converting several heavy-duty truck prototypes into electrically powered alternatives actively integrated into service.4.1. Installation of a Trolley-Assist System for Diesel-Electric Trucks

5.1. Installation of a Trolley-Assist System for Diesel-Electric Trucks

Trolley-assist technology has been in existence for a considerable duration. During the energy crisis of the 1970s, sparked by events such as the Yom-Kippur War in 1973 and the Iranian Revolution in 1979, which disrupted oil supplies and led to scarcity and price surges for Western nations reliant on Middle Eastern energy exports, various mining companies explored trolley assist as a means to reduce their dependency on diesel fuel [45][66]. Although trolley assist offers advantages such as emission reduction, enhanced cycle times, and increased productivity, it failed to gain widespread traction. Multiple factors have contributed to the limited adoption of trolley assist, as outlined in [45][66]. Historically, diesel prices remained lower than today, and until recently, the mining industry lacked substantial incentives to mitigate its environmental impact. However, the landscape has shifted with Canada’s recent adoption of stringent climate change regulations and the implementation of carbon taxes. This has prompted the emergence of trolley-assist system installations in mines across the globe, including notable instances such as the Boliden Aitik mine in Sweden [46][67]. With the recent implementation of the trolley-assist system at the Copper Mountain mine, there are optimistic expectations regarding fuel savings and emissions reductions. The company anticipates that each truck will be able to displace approximately 400 L of diesel per hour or around a tonne of CO2 emissions. Despite the substantial CAD 40 million investment required for the integration of this innovative system into their operations, the company has identified compelling justifications for this endeavor:-

Increasing Carbon Taxes: Adopting trolley assist can substantially mitigate Copper Mountain’s carbon tax liabilities as these taxes continue to rise.

-

Escalating Diesel Costs: Using the trolley-assist system, each hybrid Komatsu haul truck consumes 400 L of diesel (equivalent to 1 ton of CO2) per hour. Additionally, transitioning to clean power sourced from BC Hydro offers a more predictable cost structure than diesel’s unpredictable availability and pricing fluctuations.

-

Enhanced Efficiency: Deploying hybrid trucks equipped with trolley assist translates to more efficient mineral transportation within shorter time frames.

-

Reduced Environmental Impact: With the support of the BC Government, Copper Mountain is aligning with efforts to bestow “responsible metals” credentials on their products as they traverse the supply chain. This designation positions these items for premium trading, ultimately augmenting their value.

4.2. Integration of In-Pit Crushing and Conveying Systems

5.2. Integration of In-Pit Crushing and Conveying Systems

In-Pit Crushing and Conveying (IPCC) systems consist of various components, including crushers, entirely mobile in-pit conveying systems, stationary conveyors, conveyor junctions, waste-spreading tripper cars, waste-spreading slewing spreaders, and mineralized material radial stackers [47][70]. Alternatives to the IPCC framework exhibit diverse configurations. There are three primary types of IPCC systems, each characterized by its distinct attributes. Compared to truck shovel (TS) options, IPCC systems offer a range of advantages supported by research reviews and real-world production experiences at mine sites [48][49][50][75,76,77]. The benefits of IPCC systems include:-

Energy Savings: Conveying minerals through conveyors inherently demands less energy per unit weight than transporting them via trucks [51][78]. Notably, only 39% of the energy utilized in a truck cycle is dedicated to moving the payload, with the remaining 61% allocated to moving the vehicle’s weight. Additionally, by relying on electricity-based methods, IPCC systems can reduce a mine’s reliance on diesel fuel.

-

Environmental Impact (Dust and Noise): Implementing IPCC systems can reduce noise pollution as conveyors generate less noise than conventional diesel-powered trucks. Moreover, reducing the number of trucks on the road can significantly diminish the dust emissions sources, positively impacting the environment [51][78].

-

CO2 Emissions: IPCC systems can substantially reduce CO2 emissions by facilitating fuel switching. A noteworthy example is found in a Brazilian iron ore mine that has integrated two fully mobile IPCC systems, collectively capable of handling 7800 t/h, resulting in an estimated reduction of 60 million liters of diesel consumption annually [52][79]. This approach aligns with utilizing renewable energy sources, such as hydroelectric, solar, and wind-based electricity, to transform IPCC into a decarbonized transport mining system.

-

Operational Costs: As mining activities escalate, waste dumps grow, and the pit becomes deeper. This progression leads to longer truck haul cycles and increased demand for additional trucks to meet production requirements. Truck hauling is frequently perceived as more costly than IPCC methods, particularly with increased distances and elevation [53][80]. Embracing an IPCC system over a truck haulage system can significantly reduce material transport operating expenses (OPEX), owing to potential savings from energy conservation, workforce reduction, enhanced weight efficiency, and lower maintenance costs.