You're using an outdated browser. Please upgrade to a modern browser for the best experience.

Please note this is a comparison between Version 1 by Marios Stanitsas and Version 2 by Sirius Huang.

Renewable energy strategies for sustainable development perform as best practices and strategic insights necessary to support large scale organizations’ approach to sustainability. Power Purchase Agreements (PPAs) enhance the value of such initiatives. A renewable PPA contract delivers green energy efficiently to organizations that seek sustainability benefits. Consequently, various approaches that define PPAs are utilized to motivate both interested parties to participate in such deals.

- PPAs

- sustainability

- indicators

- MCDA

- renewables

- construction

1. Introduction

Organizations are progressively attempting to lower their environmental impact and energy costs, which aligns with the global sustainability-oriented trend. As an approach to such an initiative, many organizations and corporates are sourcing energy from renewable generation sources (RES). Renewable energy is gradually being raised from operational and technical activity to a strategic and commercial focus in an organization’s energy strategy. Corporates may implement a renewable energy plan in a variety of ways, including renewable power, heat, and transportation, all of which have connected benefits [1][2][1,2].

Renewable electricity solutions involve either directly constructing an asset, or acquiring green power from a third party’s project, both of which make it possible to obtain renewable energy certificates [3][4][3,4]. Corporate power purchase agreements (PPAs) have been proven a fitting tool for addressing sustainable initiatives, development risks, and finance opportunities. They may, therefore, help considerably in enhancing and expediting the deployment of renewables [5].

The renewable corporate sourcing sector in Europe, which includes both PPAs and other kinds of corporate sourcing, has enormous potential. Long-term PPAs are used by renewable energy plant developers to ensure a project’s future revenue and provide lenders with assurance that loans will be returned; in other words, to improve a project’s bankability in the absence of predictable income from government assistance programs [6][7][6,7]. However, these PPAs come with a lot of risks that most corporates are not familiar with [8]. Traditionally, utilities with a strong grasp of the energy market and broad, diversified portfolios of projects and technology have managed to cope with the risks associated with long-term energy contracts in Europe. They have had to devise complex procedures in order to accommodate an increasing proportion of fluctuating renewable energy costs. Corporates are increasingly interested in signing long-term PPAs as renewables become the primary energy technology for big energy corporations and new renewable energy suppliers enter the market. It is crucial that they realize the risks to which they may be exposed. During the last few years, different pricing PPA mechanisms have been explored by counterparties. However, fixed-price structures have dominated amongst commercial pricing mechanisms for renewable PPAs. The unpredictability of the wholesale power prices across Europe and the probability of additional price cannibalization of wind and solar capture prices by means of increased renewable penetration in the system is of the essence for developing new PPA structures. A vast number of offtakers are becoming more interested in alternate PPA pricing scenarios [9][10][9,10].

PPAs can also be conducted through various energy storage management strategies, used to mitigate energy consumption. Organizations can acquire storage capacity to supplement their renewable energy purchases using battery PPAs. By incorporating batteries into a renewable project, surplus energy can be stored during periods of high production and low power prices and sold back to the grid during times of low production and high-power prices. There are two categories of battery storage power purchase agreements (PPAs): a combined PPA that covers both renewable energy (usually from solar) and energy storage, and a separate PPA contract that only focuses on battery storage. There are two major categories of battery storage PPAs, namely, a combined PPA that covers both renewable energy (usually from solar) and energy storage, and a separate PPA contract that only focuses on battery storage [11][12][11,12]. A battery storage PPA that is structured accurately to reflect both the RES producer’s and the offtaker’s needs can reap pricing benefits. The seller can secure a stable revenue stream to support project financing, while the buyer gains an effective hedge against battery storage price fluctuations. Additionally, there are advantages in terms of reduced need for balancing and shaping during unpredictable output periods, as the battery can take over. This will make power more environmentally friendly by reducing reliance on purchasing fossil-fuel-based electricity from the grid during low production periods. Sustainability-related strategies can also be formulated via the implementation of such schemes. Thus, there is further impetus for increased storage to ensure availability of green power at all times of day [13][14][13,14].

2. Sustainable Energy Strategies for Power Purchase Agreements

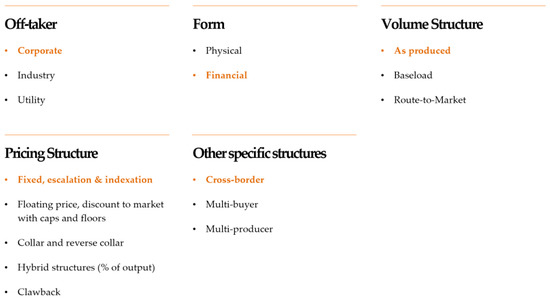

Recent studies and reports have highlighted the importance of conducting more PPA deals in order to attain a sustainable society [9][15][16][9,16,17]. The corporate sourcing business in Europe has exploded in recent years. During 2014, the European corporate PPA market developed to a total capacity of more than 8 GW for offsite projects. In 2018, contracts for commercial and industrial onsite renewables totaled 1.3 GW and 2.1 GW, respectively. Over 2.5 GW of offsite PPAs were signed in 2019 alone [17][18]. The need for sustainability, as expressed through renewable energy projects, arises from a shortage of natural resources, leading the whole PPA theme to new insights and scientific “green” solutions [6]. Corporates act on several motives for trying to obtain power from renewables, but the capability of stabilizing energy costs is crucial for PPA transactions. While decarbonization obligations are frequently highlighted as the initial impetus for considering renewable corporate sourcing, most corporates identify the capacity of a PPA to minimize energy cost volatility and provide long-term savings on energy bills as the critical business justification [18][19]. Long-term PPAs, the most common agreements, vary between 10 and 15 years, are used by RES developers to ensure the project’s future revenue, and provide lenders a guarantee that their loans will be refunded in order to enhance the project’s feasibility (bankability of the project) in the event of the absence of governmental funding [19][15]. Nevertheless, risks still exist (e.g., development, volume, performance, etc.), and PPAs can become problematic for both counterparties, as these kinds of deals are brand-new to practitioners [20]. PPAs can be introduced into a wide variety of schemes depending on the counterparties’ needs and purposes. The accounting aspect of this sort of transaction also may be complicated, causing the PPA signing procedure to be delayed. The impact on financial statements may be severe, depending on how the agreement is constructed. PPAs can be categorized depending on the offtaker, energy transmission, volume produced, the chosen price mechanism, number of counterparties, and location of markets. Figure 1 presents the most common types of PPAs and highlights in orange and bold printing the most used types in European markets as extracted from interviewees’ expertise along with relevant publicly available reports and articles [17][21][22][18,21,22].

Figure 1.

Main PPA types.

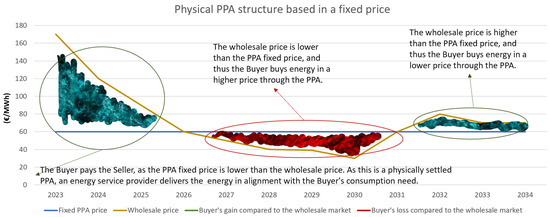

Figure 2.

Physical PPA following a fixed price scenario.

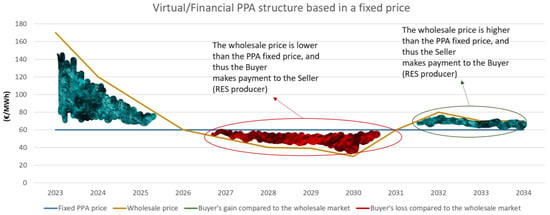

Figure 3.

Virtual/financial PPA following a fixed price scenario.

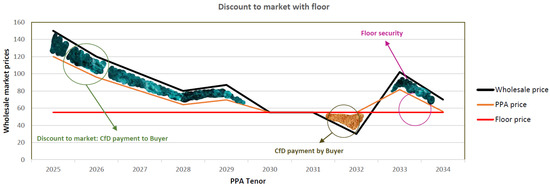

Figure 4.

PPA pricing structure: discount to market with floor.