2. Cassava Sector in Thailand

Thailand is the third largest cassava grower in the world, with a total production of more than 30 million tons per year, after Nigeria and Congo. Cassava production is mostly located in Northeastern Thailand. More than 90% of its production takes place on small family farms, averaging 2.56–3.2 ha per household. From 2021 to 2022, the number of cassava farmer families was 738,153 households, with a production cost of 52.24 USD/ton

[4]. The exchange rate used when converting the figures is 1 USD to 35.93 THB

[11]. Even though cassava can be planted and harvested throughout the year, the major harvesting season in Thailand typically spans from October to March. This leads to the common problem of oversupply in the cassava value chain, giving the lowest cassava prices over the harvesting seasons and farmers suffering from income uncertainty. Although a government policy (e.g., income guarantee and price support) was implemented to guarantee cassava prices and boost farmers’ income, these schemes do not provide sustainable solutions to the stakeholders, especially farmers

[12]. Value addition and circular practices can enhance market competitiveness and create additional revenue streams through sustainable development

[3][9][3,9]. The BCG economy in Thailand allows new product developments and emerging new production on a number of alternative materials from agricultural resources. The lack of collaboration among cassava industry stakeholders, limited value addition, and constraints in accessing finance and resources can restrict the ability to capture higher prices, increase profitability, and shift to high-value-based products.

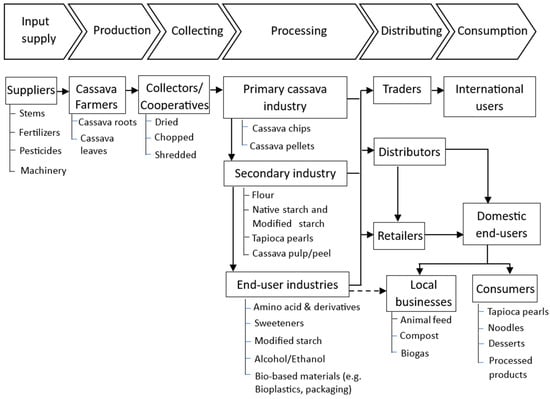

The cassava value chain refers to the sequence of activities and interactions among different actors involved in the value-added process, from production, processing, distribution, and the final market of cassava and its derived products

[7][13][14][15][7,13,14,15]. The cassava value chain in Thailand starts from input supply to consumption and includes various stakeholders and products, as shown in

Figure 1. The core actors include input suppliers, producers or farmers, processors, traders, distributors, and end-users

[7][16][7,16]. Suppliers provide inputs such as cassava stem cuttings, fertilizers, pesticides, and machinery to cassava farmers. Cassava farmers cultivate and manage cassava crops, including land preparation, planting, crop maintenance, and harvesting. Farmers face some agricultural risks, e.g., extreme temperatures and rainfalls leading to pests, plant diseases, and damage in some cassava production areas

[17]. These cause low crop yields, low flour content, and high production costs. Thus, some farmers turned to new varieties that contain greater starch content and gain higher prices

[7][17][7,17]. Farmers harvest the roots and distribute them to collectors or primary processors, who carry out activities such as cleaning, sorting, and packaging. After harvesting, the cassava roots must be processed immediately to prevent spoilage and preserve quality. Cassava cultivation practices can vary based on local conditions and infrastructures, climate, and farming systems. Additionally, a proper knowledge of pest and disease management, as well as good agricultural practices, is crucial to ensure successful cassava production and minimize post-harvest losses

[18][19][18,19].

Figure 1. Cassava value chain in Thailand. Source: adapted from [2][16]. Cassava value chain in Thailand. Source: adapted from [2,16].

Cassava roots can be processed into various products, such as flour, starch, chips, foods, or bio-based materials, depending on the levels of industries and application uses

[2][7][2,7]. Primary cassava processors transform the harvested cassava roots into intermediate products, such as cassava chips or grated cassava. Secondary processors convert intermediate cassava products into value-added products, such as cassava flour, cassava starch and derivatives, ethanol, and by-products, including cassava pulp and peels. End-user industries (e.g., food and non-food industries such as paper and textiles) process cassava starch into tapioca pearls, modified starch, sweeteners, amino acids, and alcohols. Cassava wastes are processed as biogas, compost, and animal feeds. Processed cassava products are packaged and prepared for distribution and are supplied for both local and export markets.

A large portion of Thai cassava production (72.8%) is primarily supplied to export markets, while the remaining portion (27.2%) is allocated to the domestic market. In the domestic market, cassava is either consumed directly or utilized as a material for industries. The balance of production, domestic uses, and export indicate the opportunities in processing or value-added activities to utilize materials and waste from cassava in order to enhance the sustainability of the cassava value chain and generate higher value-added cassava products.

3. Bioplastic Industry

Conventional plastics, e.g., polyethylene (PE) and polypropylene (PP), are derived from petroleum resources or made from fossil fuels. These petroleum-based plastics are mostly non-biodegradable and always remain in the environment after use, causing harm to life and pollution and landscape problems. Although recycling is a suitable solution to reduce their environmental impact, less than 20% of these plastics are recycled nowadays

[20][21] due to the performance deterioration of the recycled plastics and low process and cost efficiencies. Biodegradable plastics are alternatives to non-biodegradable petroleum-based plastics and are suitable for some applications, particularly short-life, disposable, and single-use items. Biodegradable plastics are defined as plastics whose degradation takes place through the action of natural microorganisms and fall under the umbrella of bioplastics. Some of these biodegradable plastics are derived from bio-based feedstocks such as polylactic acid (PLA), polybutylene succinate (PBS), polybutylene succinate-

co-butylene adipate (PBSA), thermoplastic starch (TPS), and other starch blends, while the others are made from petroleum resources such as polybutylene adipate terephthalate (PBAT)

[21][22]. Nevertheless, the properties and characteristics of the abovementioned biodegradable plastics differ depending on their chemical and packing structures. PLA, the most widely used bioplastic, has high strength and stiffness and slow crystallization, making it suitable for rigid products. In contrast, PBAT is more flexible and tougher than PLA; it is thus used to produce films and bags or is sometimes blended with PLA to impart toughness. The outstanding heat resistance of PBS, which is more flexible than PLA but stiffer than PBAT, makes it practical for paper-container-coating applications for hot foods and drinks. Thailand is the 11th largest global exporter of plastic resins and products and ASEAN’s second largest exporter of plastics. The gross domestic product (GDP) of the plastic industry in 2019 accounts for 6.1% of the total GDP, with a growth rate per year of 2–3%

[22][23]. In 2019, plastic resins were domestically produced at about 9 million tons per year, and about 2 million tons were imported. About 44% of all plastic resins are used for domestic production, which is divided into packaging (36%), construction (16%), textile (14%), other (12%), consumer goods (10%), transportation (7%), and electronic parts (4%)

[22][23].

Recently, there have been growing concerns about the environmental impacts of plastics, especially single-use plastic products, awaking many industries invested in the research and development of new or innovative products to respond to shifting market demands and global trends. An increasing number of biodegradable plastic manufacturers from renewable resources (e.g., PLA derived from sugarcane or cassava and PBS) are located in Thailand, and current plastic converters are expanding the production lines of bioplastics. The process of converting resins to plastic products involves melting, molding, cooling the molded plastic, and finally processing it to the finished goods. Moving toward the BCG economy, the concept of the BCG economy will support changes in not only circular but also bio-based and green production and consumption and promote new ways of value creation

[23][24]. The Thai government has committed resources towards increased funding for research and development into bio-based products by partnering with a range of academic institutes, research centers, and the private sector. Thailand has positioned itself to become a global bioplastic hub because of an abundance of plant-based feedstocks, especially cassava and sugar cane. Thailand is the world’s largest cassava exporter (with 64 cassava starch factories). Bioplastics produced through the processing of cassava or sugar cane are cheaper than corn starch

[24][25]. However, only 1% of all cassava and sugar cane production is currently used for bioplastic materials. A significant role in the research and development of bio-based products (e.g., bioplastics and biofuels) and government actions would provide a potential opportunity for plastic converters and related industries to build a high-value economy.

4. Bioplastics from Cassava

Cassava, or tapioca, one of the Thai economic crops, consists mainly of starch, which can be used as a valuable feedstock to produce monomers via fermentation for various bioplastics such as PLA and PBS. However, many advanced technologies, including biotechnology, chemistry, and polymerization, are required to acquire those bioplastics with satisfactory performance, making them expensive. In some cases, cassava starch and flour

[25][26][27][28][26,27,28,29] and cassava pulp

[29][30][30,31] have been added as fillers into thermoplastic materials

[25][26][27][30][31][26,27,28,31,32] to reduce costs and increase the bulk of these plastics. However, only a limited amount of cassava has been filled into plastics to avoid significant performance deterioration.

On the other hand, cassava starch and flour can be directly converted to TPS by plasticization using the existing technologies and machines, e.g., extruders

[25][32][33][34][35][36][37][38][39][40][41][42][43][44][45][46][47][48][49][26,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50] and internal mixers

[50][51][52][53][51,52,53,54], which are commonly used for conventional plastics. TPS has been produced not only from native cassava starch but also from modified cassava starches

[31][38][46][48][49][50][54][55][32,39,47,49,50,51,55,56]. Although modified starch imparts hydrophobicity, its high cost and capability to improve the performance and processability of TPS should be optimized and considered. The performance of TPS was also tuned by varying plasticizer types and contents

[44][45] and other additives

[39][40]. However, TPS has high moisture absorption, which causes poor mechanical and barrier properties. Therefore, blending TPS with other plastics, either non-biodegradable petroleum-based plastics

[33][40][54][55][34,41,55,56] or biodegradable plastics such as PLA

[34][37][38][41][42][43][45][35,38,39,42,43,44,46], PBAT

[34][35][36][46][47][48][49][35,36,37,47,48,49,50], PBS

[37][38], and PBSA

[42][43], is an alternative to overcome the above limitations of TPS and meanwhile reduce the cost of the final blends. The biodegradability of biodegradable polyesters is retained or even better when they are blended with TPS.

To improve the compatibility between hydrophilic TPS and relatively more hydrophobic plastics and the performance of the TPS-based blends, various compatibilizers

[40][42][41,43] were added. The effects of agricultural wastes, such as duckweed biomass

[41][42], cassava pulp

[45][46], oil palm mesocarp fiber waste

[56][57], and rice husk

[57][58], and naturals fibers, such as jute fibers

[52][53], coir fibers

[43][44], kapok fibers

[52][53], cellulose fibers

[53][54], and bagasse fibers

[58][59], on the properties of TPS-based blends were recently investigated. Other additives, including inorganic compounds

[33][35][48][34,36,49] and bioactive substances

[47][49][50][54][55][48,50,51,55,56], were also incorporated into TPS-based blends to obtain functional properties such as antimicrobial and antioxidant activities.

Considering the converting processes of TPS and its blends, TPS itself could be blown into films

[39][44][40,45] for further producing bags and wrap films; nonetheless, its blends provide the blown films with better processibility and performance

[33][35][36][37][40][42][46][47][48][49][34,36,37,38,41,43,47,48,49,50]. In addition, TPS-based blends have been cast into sheets

[34][38][54][55][35,39,55,56] for producing food trays. Some of them were improved in terms of their toughness and barrier properties, particularly against oxygen gas, via biaxial stretching

[34][38][35,39]. Injection molding is one of the most popular techniques used to prepare specimens for rigid TPS-based composites

[41][43][45][42,44,46] such as tableware, cutlery, and pots.