The Fourth Industrial Revolution, marked by transformative technological advancements, has ushered in a promising avenue for green economic growth. This transition towards a low-carbon, environmentally sustainable economy has gained momentum across both developed and developing nations, driven by the urgent need to address impending climate change and its far-reaching consequences. Amid this context, the synergy between financial technology (FinTech) and the green economy emerges as a potential solution to the ecological challenge.

The convergence of green economic growth and FinTech is the focus of this study, which employs a systematic bibliometric analysis of Scopus-published papers. The primary objectives encompass exploring the potential of green FinTech as a catalyst for transitioning African countries towards sustainable green economic growth and identifying gaps in knowledge and policy. Results underscore an increasing research trend towards the interface of green FinTech, green economic growth, climate change, and environmental regulations. Five key research trajectories have emerged, encompassing digital finance technology and instruments, regulatory frameworks, climate risk mitigation, environmental quality enhancement through FinTech, and the intersection of green finance and climate change mitigation.

Based on these insights, an integrated framework is proposed. This framework aims to facilitate green economic growth in African countries by leveraging FinTech as a vehicle for transition. By uncovering the opportunities and challenges at the crossroads of technology and sustainability, this study contributes to the ongoing discourse on fostering environmentally responsible economic development in an increasingly interconnected global landscape.

1. Introduction

The recent worldwide disjuncture, moving from COVID-19 to the current global warming, has exacerbated the socioeconomic structure of many developing countries, even developed nations, and efforts to transition to a green economy have now become a socioeconomic imperative. The world is facing the risk of increasing temperatures and environmental degradation. This necessitates a united global front in mitigating global risks. One such collaborative effort was the Paris Agreement of December 2015 that aims to keep the increase in global temperatures under 2 °C and to fix it to 1.5 °C

[1]. However, a key question arises and points to whether economic growth can be sustained while dealing with adverse climate change. This question has raised an ongoing contentious debate that has not resulted in any consensus. Whilst some scholars, such as

[2,

3], argue that environmental limitations do not bind economic growth, other scholars have posited that economic growth is simply not compatible with environmental limitations (see, for example,

[4,5]).

A key challenge for the African continent is that its economy is closely tied to climate-related activities. It has a higher exposure to climate risks such as flooding, droughts, and low-adaptive capacity, further exacerbated by financial and technological limitations. Despite Africa’s relatively low contribution to carbon dioxide emissions on a global scale, African countries remain vulnerable to climate risks. The Germanwatch institute presented the Global Climate Risk Index

[6], which showed that Africa, Madagascar, Kenya, and Rwanda are among the top 10 most climate-vulnerable countries in the world, positioned at 4, 7, and 8, respectively.

The economic consequences of adverse climate risks affect the already fragile economies of African countries, making them vulnerable to shocks such as food security, rising crude oil prices, and social turmoil. This climate-change problem in Africa compounds the structural economic fragilities exposed by the COVID-19 outbreak. Achieving the Sustainable Development Goals (SDGs) alongside the goals of the Paris Agreement on Climate Change requires capital to fund measures that aim at alleviating climate risks and reducing carbon emissions so that green economic growth can be attainable in Africa. Unfortunately, there is a huge funding gap for climate investments in Africa since the demand exceeds the current investment inflows. This is despite the pledge made by developing countries to invest USD 100 billion in emerging economies to deal with climate risks

[7]. Part of the challenge is the low-credit-risk scores and high indebtedness of the African countries alongside alarming poverty and unemployment rates and recent post-COVID-19 disruptions. Various options can be considered in attaining low-carbon investments that alleviate climate change effects. The usual approach is government spending, which relies on shifting the burden to taxpayers. Private capital is an alternative to government spending in low-carbon investments. Another viable strategy is to consider blended finance, which involves private and public funding. Under blended finance, government spending budgets or grants are used to finance the initial stages of implementing carbon-financed projects, and private funding can be used to finance the remaining project lags after project risks associated with inception stages have been significantly reduced.

The Paris Agreement on Climate Change is also dedicated to “making finance flows consistent with a pathway toward low greenhouse gas emissions and climate-resilient development”

[1]. FinTech is a channel that can potentially stem the increasing climate effects and can be a tool to which policymakers have not given much attention for mitigating climate change effects, especially in developing countries. In the pursuit of minimising those effects, the opportunities provided by green FinTech can potentially be part of the levers that help developing countries implement the Paris Agreement on Climate Change of December 2015

[1] and promote the implementation of Sustainable Development Goals. As such, we ask, “As Africa is on a collision path with the devastating consequences of climate change, could fintech be part of the solution that transitions Africa to a green economy?” The authors in

[8] asserted that green FinTech might promote the progress of innovations and models that can support SDGs.

A key player in this domain is the United Nations Task Force on Digital Financing of the Sustainable Development Goals

[9]. In this regard, green FinTech, which is part of the advancements in digital and smart technologies, provides opportunities for firms and countries to minimise the gap between short-term and long-term climate risk goals, permitting green FinTech to be an enabler of transition towards green economies.

Green FinTech can assist firms and countries to decrease their climate impacts at different levels of the value chain through its technologies such as blockchain, smart contracts, and artificial intelligence. One important aspect to explore is the role that FinTech can play in evaluating the alignment of low-carbon emissions’ goals along the value chain, including consumers, tech companies and start-ups, service providers, banks, and insurance companies, as well as the providers of the regulatory environment. Moreover, the FinTech industry renders services to other crucial sectors of the economy, such as agriculture, energy, retailing, and manufacturing, which are at different stages of digitalisation; some already use digital payment processes, such as Mpesa in Kenya. FinTech offers an opportunity to enhance the technological infrastructure that contributes to defining different value chain players.

2. Financial Technologies and Their Integrated Ecosystem

The FinTech business model is recognised as one of the great breakthroughs in the financial industry and is growing rapidly. It is partially motivated by the sharing economy, favourable government rule, and digital information technology. The authors in

[13] highlighted that the FinTech industry holds the promise to revolutionise the financial industry by reducing costs, enhancing the financial service quality, and building a resilient financial system that absorbs a range of shocks of different types.

A study by the authors in

[14] stated that the structure of financial technologies enables growth opportunities in many related sectors, including software development, data-driven analytics, online payment platforms (e.g., peer-to-peer trading and lending), and asset management systems based on blockchain technology. Mapping a stable FinTech ecosystem will help to understand the competitive and collaborative dynamics in the FinTech industry. As suggested by the authors in

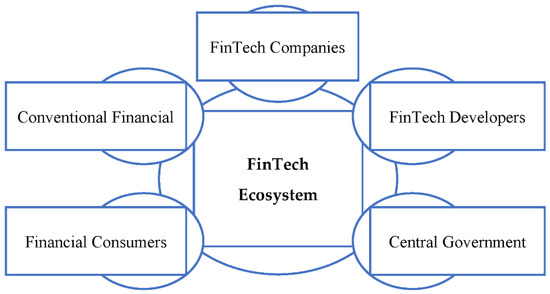

[15], there are five essential elements of the inter-correlated FinTech ecosystem:

-

FinTech Companies, including digital payment, asset management, trading, InsurTech, and crowdfunding.

-

FinTech Developers, including data-driven analytics, big data management, cloud computing, cryptocurrency, blockchain technology.

-

Central Government, including entities that create the financial rules and standards.

-

Financial Consumers, including individuals and institutions.

-

Conventional Financial entities, including banks, insurance, and trading companies.

These five interconnected elements cohesively stimulate innovation and promote economic growth in the long run.

Figure 1 shows the integrated ecosystem of the financial technologies industry based on the publications of the authors in

[13,15]:

Figure 1. The core contributors in the financial technology ecosystem.

The core element of the ecosystem is the FinTech companies. Most FinTech start-ups are innovating in areas such as digital payment, asset management, trading, InsurTech, and crowdfunding. They offer reduced costs compared with traditional operators and focus on all types of markets. In addition, they address global issues such as climate change and environmental degradation.

While consumers have the option of choosing different sets of services from a variety of FinTech firms, a consumer may use his bank to transfer money ((PayPal, San Jose, CA, USA), (Skrill, London, UK), ( Payoneer, New York, NY, USA)), hold a cryptocurrency wallet (Coinbase Wallet (version 10.42.9), MetaMask (version 5.9.1), TrustWallet (version 7.21), Electrum (version 4.3.2)), or buy any digital currency from an online trading platform (e.g., Binance (version 2.56.0), Etoro (version 482.0.0), Coinbase (version 10.42.9)).

Rather than rely on a single financial institution for their needs, consumers are beginning to pick and choose services they would like from a variety of FinTech companies.

FinTech developers are the IT professionals who build the hardware and the software environment for FinTech firms to start their innovative projects. The government, as the neutral agent in this ecosystem, should provide a regulatory system for FinTech to evolve, but should keep it under observation to not repeat the financial crisis of 2007-08. Financial consumers are the main source of income for FinTech firms. Most traditional financial institutions start to re-evaluate their business models toward the FinTech industry after realising its competitiveness and future growth opportunities.

Recently FinTech businesses started to address global issues and to become the main actor in the green FinTech ecosystems. They enable economies to transition to green economic growth characterised by reduced climate risks and vulnerabilities for African countries. The publication by the authors in

[16] stated that green economic growth “promotes economic growth and development by balancing environmental hazards with long-term economic growth”. In the same frame of mind, the authors in

[17] asserted that “Blockchain, Big Data, the Internet of Things (IoT), smart contracts and other cutting-edge technologies hold out the promise of addressing the needs of new generation climate markets post-2020”. The author of

[18] noted that FinTech technologies can be used in the attainment of sustainable development: “the applications included: pay-as-you-go resource utilities; flexible energy supply and demand, peer-to-peer renewable energy, and community distributed generation”. Furthermore, the authors in

[18] posited that financial technologies that can be tapped into for green economic growth include blockchain for renewable energy, decentralization of electricity markets, and climate finance, as well as innovation of financial products such as green bonds.

The discussed FinTech’s businesses have been widely adopted in many vital sectors. FinTech still faces crucial challenges, since it has the potential to disrupt global financial stability. Consequently, the FinTech industry must handle challenging issues, such as regulatory restrictions, because the traditional financial systems have been under great regulatory restrictions since the financial crisis of 2007-08

[18]. Moreover, investors tend to leverage and shift to FinTech investments to overcome the traditional regulatory burden. Another challenging issue is data security, since FinTech carries sensitive data of its actors. In this regard, the authors in

[19] suggest a policy framework to secure FinTech services.

3. The Role of Financial Technologies in Ensuring Green Economic Growth

Recently, green economic growth has received great attention and is considered the new economic model (see, for example, the study by the authors in

[20]). Technology is the main driving force of green growth via CleanTech products. The nexus between green economy and technology in the financial sector has recently become a prevalent topic for policy making, as noted by the authors in

[21]. Accordingly, financial technologies become essential in stimulating the green economy through strengthened green finance products, which in fact has a higher significance for many countries (see, for example, the study by the authors in

[22]).

The authors in

[23] stated that the key to quality economic development and balancing green economic transformation is financial support for green economic development. The FinTech industry is well positioned to serve as an enabler of the new green economic model through the introduction of a set of new technologies such as artificial intelligence and big data mining in small and medium-sized businesses (SMEs)

[24]. The authors in

[23] noted that FinTech is the key for ensuring and balancing the process of transition. The FinTech business model is still in the early stages of development and suffers from many structural obstacles such as regulatory restrictions and personal data security. However, FinTech businesses play a major role in supporting green development projects by providing the necessary finance, ensuring global trust, and narrowing asymmetric information

[25].

While the current business model, including the traditional financial instruments, contributes to the environmental degradation and climate change, the authors in

[26] affirm that financial technologies are more inclusive and provide the necessary opportunities and can handle the constraints posed by the financial crisis of 2007-08.

FinTech plays a major role in developed countries compared with developing countries. The authors in

[27] noted that financial technologies can support start-ups and entrepreneurs in launching high-market-value firms and in creating significant job opportunities in developing countries, which helps in improving the socioeconomic development of certain marginalised populations. An empirical study by

[21] found a significant causality between green economy and financial technologies and CleanTech. Small businesses are also known to be a key part in developing countries and to contribute to economic growth and employment of less-skilled people

[28,29].