The development of digital techniques, including blockchain-based mechanisms, has meant that an increased interest in blockchain-based solutions is to be expected. Blockchain and similar approaches are characterised by decentralisation, so they are concurrent with the trends of the transforming power sector. Decentralised energy generation based on a high proportion of prosumer installations requires the implementation of a new settlement system for grid activities related to electricity use. The first projects of such systems based on a dedicated cryptocurrency have emerged. Based on these, the general concept of such a system with its own cryptocurrency called CCE is presented, including variants implementing net-metering and net-billing.

- cryptocurrency

- cryptocoin

- energy settlements

- energy market

- blockchain

- DLT

- prosumer

- smart grid

- smart contract

- electricity user

1. Introduction

-

reliance on cryptographic systems in the users’ network for storing account and balance information, authentication and verification of transactions, thus enabling management without a central authority,

-

the existence of accessible and verifiable open source code,

-

the availability of a project description (white paper).

2. Overlook

2.1. Evolution of Forms of Energy Use and Settlement

Technological developments are causing changes in energy use. New types of loads appear, on the one hand, more energy-efficient, but on the other hand, the energy demand is increasing [7]. The lockdown experience of 2020 has shown that some work activities can be carried out away from the workplace, so consumers’ energy use profiles are changing and will continue to change [8]. On the other hand, technology provides opportunities for RES power generation in distributed sources, which have their own specificities [9,10][9][10]. Users become prosumers who can exchange energy with each other. If the prosumer has the ability to transfer energy at the desired time (having, for example, their own energy storage), they become a so-called flexumer [11]. Sharing economy becomes a modern-day energy trading scheme based on dispatching the energy directly from prosumer (flexumer) to end-user depending on smart grid technical possibilities. With the proliferation of prosumer installations and the energy sharing model, the term “Transactive Energy” [12] has emerged as a term for conducting energy production and trading using automated control [13]. The pillars of this approach are decentralised energy nodes that address different energy production and consumption levels. These nodes can continuously communicate with each other. A natural feature of the structure is interoperability, understood as the ability to communicate and share energy data while maintaining operational and service constraints [14]. In this concept, both network operators and individual customers can act as a single layer and interact with each other to achieve the ultimate benefits of optimisation. The cited definition of Transactive Energy states that it consists of “techniques for managing the generation, consumption and flow of electricity in the power system that allow a dynamic balancing of demand and supply taking into account the constraints of the overall network” [15]. This approach in particular should be applied to isolated power systems. It is a systemic linkage of technical methods of controlling network traffic and ways of influencing users by means of economic-market mechanisms based on well-designed settlement methods for the energy used. Thus, structures and forms of settlement for energy use need to be adapted to the evolving energy paradigm. A settlement between users can take place directly in a peer-to-peer (P2P) system [12] or via a special entity—the “Community-based p2p market” (the function of a community manager can be fulfilled, for example, by a DSO) [16]. It is also possible to combine the possibility of settlement in both forms in one system (Hybrid P2P market) [14]. Increasingly, the creation of local energy markets is being considered as part of new operational models for the control of local (distributed) generation units [17], a solution that is predestined for isolated systems. Energy sharing within the smart grid, supported by modern communication and IT technologies (e.g., Internet of Things, machine learning, artificial intelligence, cloud computing, blockchains, payment interfaces), means that we are no longer dealing with a transformation towards a “smart grid”, but with an “Energy Internet” [18].2.2. Blockchain and DLT for Energy Settlement

Proposed transactive management platform architectures for such structures are typically based on blockchain technology [17,19][17][19]. However, blockchain is only the most popular implementation of structures, generally forming Distributed Ledger Technologies (DLTs). Although, other DLT technologies also exist, for example, Tangle, Hashgraph, Sidechain, Holochain, Plasma, solutions different from blockchain are based on the Direct Acyclic Graph (DAG) approach [5,6,20,21][5][6][20][21]. In the case of energy trading, adequate control of access to the registration and settlement platform is desirable, as false orders can lead to imbalances in the power system. In addition, here we are dealing with sensitive data, which must be made available to the relevant institutions and energy companies. In addition, the mechanism should provide sufficient capacity for transaction possibilities. Hence, at present, among DLTs it is blockchain that seems appropriate [22]. A decentralised approach to trading in the era of prosumption and distributed generation is much needed. Blockchain technology provides the basis for peer-to-peer energy transactions and eliminates the problems associated with centralisation [23]. Blockchain tokens can be used to represent both payments (units of currency) and units of transactable energy, possibly taking into account the source of origin (e.g., an energy certificate such as a Guarantee of Origin according to EU Directives [24]). Simulations of a marketplace using the blockchain where prosumers can sell tokenised origin certificates to users willing to subsidise renewable energy producers were presented in [25]. Issues related to blockchain-based energy trading, based on a literature review of research and implementation attempts, are grouped in the paper [26] into four areas: construction of the trading platform; economics, privacy and security of the trading mechanism; redundancy and scalability of the trading platform; and implementation of specific trading platform technology. These issues thus relate to the technical issues of conducting transactions. Among the identified areas, the issue of settlements using modern techniques was not singled out. It should be noted that the issue of settlement formulas is fundamental from the users’ point of view, as the entities for whom all these solutions are created. Settlements for energy use between the participants of such a system should provide clear incentives for appropriate activities and investments rationalising the use of infrastructure and available cheapest and ecological energy resources. Appropriate methods are still being sought to allow blockchain-based trading platforms for renewable energy to function, enabling the efficient processing of increasing ranks of information [27,28,29,30][27][28][29][30]. The trading platform should also be suitable for EV clearing, including in a V2G service [31,32][31][32]. In [33], a transaction platform for prosumers, electric vehicle owners and energy companies based on exchanges of six different types of tokens related to the fulfilment of different functionalities in the system was proposed, comparing their implementation in the form of FT (Fungible-Tokens) and NFT (Non-Fungible-Tokens) in blockchain technology. Energy assets can be granted additional attributes, such as Guarantees of Origin [24], which affects their exchangeability so that they can be implemented as NFTs. If energy assets are considered interchangeable, the tokens representing them can also be exchanged in parts and implemented as FTs. An NFT or FT implementation requires an algorithmic definition of the life cycle of tokens from issuance to redemption. The choice of implementation depends on the specific use case, and no absolute attributes are found to indicate an absolute advantage of one implementation over the other [33]. A comparison between FT and NFT is presented in Table 1.Features | FT | NFT | ||||||

|---|---|---|---|---|---|---|---|---|

Divisibility | Possible division of token value into smaller units | The value of a single token is indivisible | ||||||

Price differentiation for energy assets | Ensures uniformity between tokens of the same type, there should be a finite set of possible token types for possible activities | Allows different prices to be set for different tokens of the same type, possibility to set different reward conditions for a given activity (depending on the current situation) | ||||||

Access to information | The acquisition of all tokens for a customer can be performed on the chain | The acquisition of all NFTs may require off-chain operations | ||||||

The problem of token capacity | A single token accepts multiple bids and the size of the token increases, which may degrade network efficiency. | There is no need to set a maximum number of unprocessed offers that the token can have at any given time | ||||||

Problems for implementation |

|

| ||||||

Refers to | Replaceable objects | Unique objects | ||||||

| Popular contract standards | ERC20 | ERC721 |

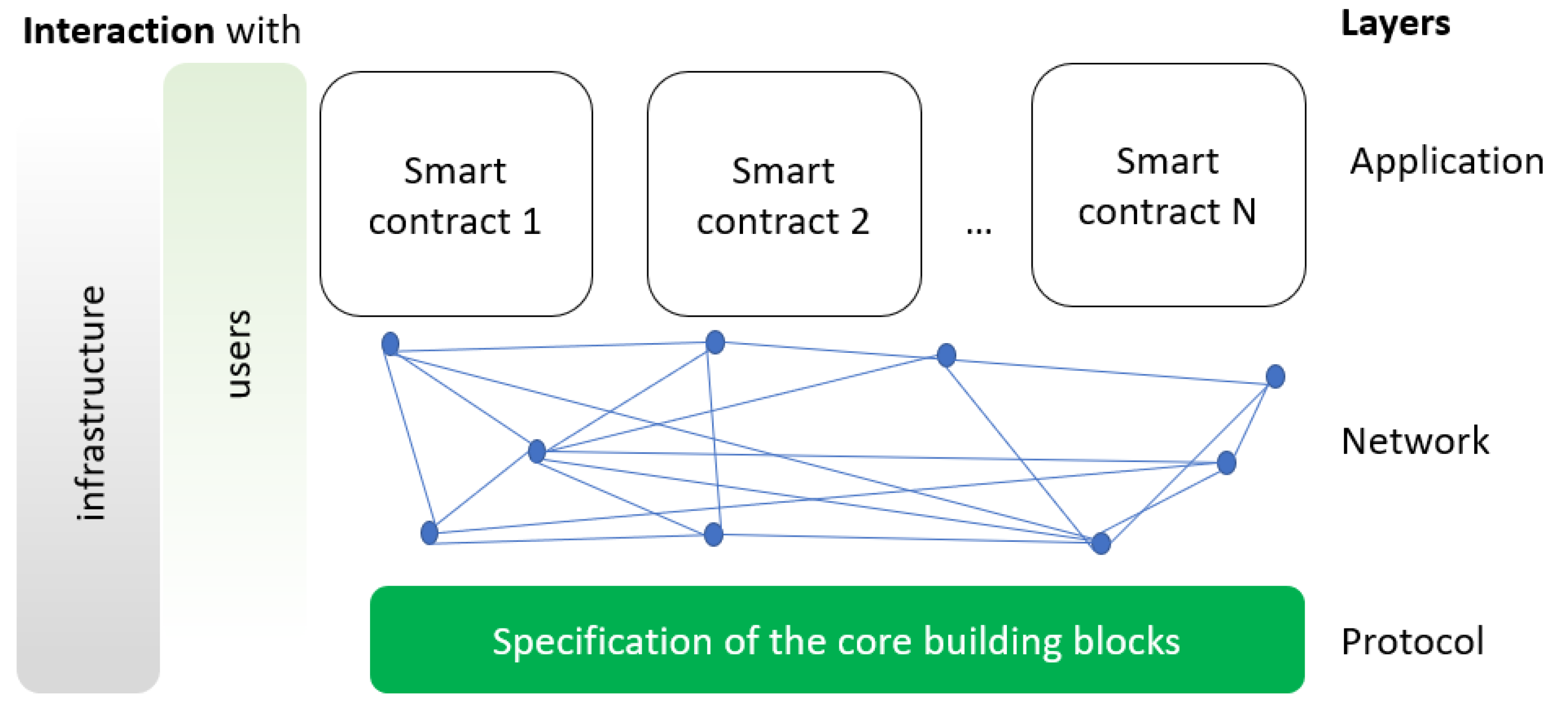

-

Protocol Layer—the software implementation with all rules that manage the energy market, and the protocol for the actual blockchain creation process (initialisation, configuration, evolution, etc.);

-

Network Layer—creating a peer-to-peer network of users (prosumers); and

-

Application Layer—energy trading smart contracts, providing the possibility of defining and implementing energy using specific business rules.

-

Simultaneous acquisition of information from energy meters with the execution of a settlement contract algorithm for energy use;

-

Integration of energy consumption and cost signals with other parameters as input signals to various smart contracts;

-

Integration of this activity with the automatic control of energy use processes at the level of:

- ○

-

Customer/end-user installations;

- ○

-

A structure that is a physical or virtual cooperative of users and/or prosumers/consumers (cooperatives, clusters, VPPs);

- ○

-

Cooperation of the user with different energy suppliers (e.g., in an island system, contracts triggered by specific characteristics of the consumption profile); and

- ○

-

Grid area.

-

Achieving a high degree of reliability in the collection of current consumption and settlement data;

-

Speeding up and automating the settlement execution process (blockchain-based currency can automatically transfer itself after each settlement time interval, e.g., every 15 min, with almost zero overhead);

-

Stability and a high degree of certainty in transactions—participants cannot change the smart contract formula;

-

The implementation of a settlement system based on a dedicated cryptocurrency to be exchanged for other units of value on a transparent basis; and

-

Increasing the accessibility of the service to the mass user.

2.3. Cryptocurrencies and Energy Assets

One of the most popular applications of blockchain is the operation of cryptocurrency. Indeed, the capabilities of blockchain have enabled the emergence of efficient, decentralised and independent cryptocurrency systems. However, attempts to create such non-independent and anonymous systems were made much earlier. These attempts were unsuccessful due to the lack of technology to enable decentralisation (e.g., the DigiCash System [56]). Often, the terms token, coin and cryptocurrency are used interchangeably, which can lead to confusion in interpretation. Although coins and tokens are considered to be forms of cryptocurrency, they provide different functions. Coins are built on their own blockchain and were originally intended as a form of currency. When developing a settlement system that is intended to promote and stimulate certain attitudes and activities, it is important to determine whether it is to use only reward utility tokens or whether it could be the beginnings of a new cryptocurrency system. A digital coin is created on its own blockchain and functions similarly to fiat (traditional money). It can be used to store value and as a medium of exchange between two parties. Tokens, on the other hand, are created on an existing blockchain and can function in many more ways than as currency (representing an exchange of value). They are programmable assets on which smart contracts can be executed. In particular, these smart contracts can establish ownership of assets outside the blockchain network. The issue of cryptocurrencies in relation to energy often comes up in the context of the increasing energy demand associated with the handling of cryptocurrency-based transactions, especially Bitcoin (BTC) [57] or carbon footprint analysis [58]. A positive correlation is observed between trading volumes of cryptocurrencies and energy consumption [59]. The reason for the energy intensity of handling BTC is related to the protocol of this cryptocurrency and the proof-of-work transaction consensus mechanism. However, other more energy-efficient solutions of consensus algorithms for use in handling cryptocurrencies are possible [60]. In addition, it is possible to create special utility tokens and cryptocurrencies, mainly dedicated to specific types of transactions handled via blockchain (or another DLT). This is the second area of thematic connection between cryptocurrency issues and energy, namely the creation of settlement systems for the use of different forms of energy using dedicated cryptocurrencies. Properly designed, such a system can reward specific energy user behaviours, promote specific generation technologies and desired investments, and accelerate settlement, thus developing the ideas mentioned above of “Transactive Energy” and the “Energy Internet”. The roles that a cryptocurrency can have involve not only settlement functions (medium of exchange), but also functions of verifying the transfer of assets and motivating the creation of new values (also social), supporting grassroots movements or desired activities. To a limited extent, a number of schemes to implement reward tokens have already been implemented, including cryptocurrencies related to energy settlements. Some of the projects cited are directly related to electromobility. However, the potential of the concept of a dedicated cryptocurrency system can be used to conduct settlements for user energy use on the electricity grid, primarily with prosumer sources. Examples of such solutions include NRGcoin [16] and SEB [71][61]. New units of currency (tokens) are generated when electricity is generated at a grid-connected energy source and they are transferred to the owner(s) of the generation source in proportion to the kWh generated (NRGcoin), or in proportion to the capacity of the source, taking into account the individual contribution made by the investor in the creation of the energy source (SEB). In the case of the NRGcoin project, the amount of NRGcoin a generator receives comes from two sources: from the DSO, as a network manager and transaction broker, and newly generated units awarded by the NRGcoin Protocol. (This is thus a direct analogy to the reward of a Bitcoin miner, who may be paid twice: for validating the transaction in the form of a commission on it, and additional units for mining a blockchain block with a record of the event). The user, to purchase energy, must pay a certain amount of NRGcoin to the DSO. The NRGcoin currency can be exchanged for other monetary units on the foreign exchange market. The algorithm causes the NRGcoin/kWh price to depend on the energy balance situation on the grid. As intended, NRGcoin, analogous to SolarCoin, is dedicated to settlements for energy from selected sources. In [16], the exact NRGcoin billing formulas related to one-unit energy generation are given. However, there is no in-depth discussion in the literature on the motivation for adopting the formulas and their parameter ranges defined there. Therefore, it seems advisable to carry out a more in-depth analysis and discussion of such formulas in terms of their impact on the (short- and long-term) objectives of the postulated settlement system, particularly the impact on the system’s stability, the development of the network and technical infrastructure and the promotion of desired attitudes and activities of users. Energy is an asset, allowing its possessor to achieve economic benefits (an indispensable activity factor), so it can be treated as a sub-carrier of value. Energy-related money can offer a means to improve the monetary system, also stimulating the low-carbon energy transition [91][62]. Thus, the concept of an energy-based currency made available to the grid or a selected DeKo user has been proposed [92][63]. The concept of replacing the existing gold-backed currency system with one based on an “energy currency” was proposed in 1921 by Henry Ford (“New York Tribune”, 4 December 1921) [93][64]. In the DeKo-based currency concept, its issuer must hold a portfolio of assets providing electricity. These assets can be claimed in the form of contracts for purchasing and delivering electricity from an energy producer. A practical mechanism implementing this concept to some extent is the SolarCoin project. The concept of P2P energy transactions using a blockchain model based on the digital currency SolarCoin in the smart grid was analysed in [23]. The idea behind SolarCoin is that a unit of 1 SolarCoin cryptocurrency (SLR) is credited for every MWh of electricity generated from the sun, regardless of where in the world this energy was produced. Here, there has been a change in the consensus mechanism of the transaction from “proof-of-work” to “proof of generation”. This approach to money is intended to offer a combination of stable value with economic utility and to be characterised by the social utility for a specific community. Finally, it is worth emphasising that money is constantly evolving, and its development is not straightforward. There is an informational component in the substance of money—it is tough to have a universal definition of money, just as it is challenging to have an ideal form of money [94][65]. Currency is a shared informational protocol for enabling and accelerating value flows across potential economic networks [95][66]. Whether cryptocurrencies linked to available units of energy will be an appropriate form of monetary units will depend on the details of the concept and social evaluation. A first test may be to open up new settlement systems for smart grid energy use based on cryptocurrencies or utility tokens.3. Settlement System Concept

3.1. Motives

The unfolding climate catastrophe necessitates measures for the decarbonisation of the economy, particularly the power sector. This process, especially in regions heavily dependent on the fossil economy, should involve all actors and system users [96,97][67][68]. Popular RES generation technologies have reached sufficient maturity [98][69]. In order to achieve the suggested targets of reducing emissions and increasing the share of renewable generation, appropriate mechanisms should be used to promote specific behaviours and preferred generation technologies. An incentive of a financial nature appears to be one of the most effective. An appropriately designed settlement system should support sustainable development, in line with the postulates of an ecological approach to energy use. Maintaining the electricity system requires ongoing financial investment to ensure that efficient technologies and appropriate management methods can be invested in. Regardless of the financial flows between actors in the energy market, in the final calculation, the end-user pays for all activities related to the generation and supply of energy. These costs must be distributed among users in a way justified by their individual consumption share. The specifics of the traditional electricity grid structure categorise users by tariffs. New methods to track flows, decentralise the structure and bring generation closer to consumers should be reflected in the settlement system. The problem of covering network operation costs should be solved, with users with specific technologies, especially prosumers, being able to use their own potential in this process by providing specific system services (becoming flexumers). All users should be rewarded for their contribution to system balancing, reduction in energy distribution losses and improvement of power supply quality and reliability, considering the demands of sustainable development in proportion to their involvement. A DSR-type programme should also be universally addressed to smaller user groups and extended to the possibility of providing appropriately identified ancillary services to the grid. Research into the design of an appropriate settlement system between network users seems essential. The functionality of the settlement system should promote a balanced approach to the use of energy resources and ensure proper financing of the fulfilment of the functions assigned to electricity grids and systems. However, the available literature lacks an analysis of the concept of settlement for system services provided by energy users (flexibles) within a coherent energy settlement system, especially one based on a dedicated cryptocurrency. An appropriately designed settlement system can exploit the advantages of the opportunities offered by cryptocurrencies, with the system being based on its own cryptocurrency, not linked to others already in existence (such as Bitcoin). The expected advantages include that a dedicated cryptocurrency system makes the billing layer for energy use independent of the macroeconomic situation (the linking will only occur at exchanging this cryptocurrency for other monetary units, such as traditional fiat currency). Furthermore, this approach will show which activities are desirable for the sustainability of the electricity grid, regardless of the current economic situation. That is, from the user’s point of view, the difference will be clearly shown between the operation of the electricity system, whose operation will directly translate into the flows and deployment of cryptocurrency units, and the economy-wide situation affecting commodity prices and exposure to speculation. Another advantage is the transparency of currency flows. According to the blockchain principle, the users themselves can remain anonymous, but all the transactions carried out for energy will be visible to all participants. Furthermore, transaction information will be recorded on the subsequent blockchain. The visibility of the activities of individual users can motivate others to optimise and increase their own participation in the system, especially in terms of energy efficiency. Other possible advantages of the system are achieving transparency and simplifying the settlement form between energy users and the chance for additional profits from energy and currency exchange activities (new business niches). A settlement system covering various activities related to energy use, using the concept of a dedicated cryptocurrency, should be further investigated from the point of view of its impact on the development of the power sector, including the financial sector, particularly by identifying opportunities and threats and pointing to elements for achieving the intended development goals.3.2. Basic Assumptions

Among the emerging blockchain-based settlement concepts and energy trading platforms for systems with connected prosumer installations, one can distinguish between approaches proposing the use of dedicated cryptocurrencies (in the sense of coins), e.g., NRGcoin, SEB [70,71][61][70] or using a blockchain model based on an existing digital currency (such as SolarCoin [23,99][23][71]), and proposing the distribution of proprietary utility tokens (e.g., [33]). Cryptocurrency can be a convenient measure of value due to the elimination of the issuer. The guarantee of the authenticity of the unit is provided by blockchain technology. Moreover, there is an integration of the value of money with a programmable machine algorithm. The open nature of blockchain (as the most popular DLT) motivates participation in the system from the bottom up. The basic form of activity realisation according to the ideas of the system in question is smart contracts, which combine the logic of technical processes with a layer of civil law contracts. The information in the publicised libraries of smart contracts is publicly available and enables the creation of new business systems of the desired complexity. Smart contracts can be established between two or more parties, with contracts being able to influence each other during execution as they themselves have the ability to undertake and participate in transactions. The cryptocurrencies or certain utility tokens required for smart contract execution, as carriers of value, combine the characteristics of a convertible means of payment with those of a control signal. They thus integrate responsibility and financial obligations with process control automation. This results in a reduction in the effort and time required to create and operate individual relationships, both business and technical. The creation of complex multi-partner structures is possible here without the need for centralisation and mediator involvement [100][72]. Based on the descriptions in [16,70[16][61][70][72][73],71,72,100], a general concept of a settlement system for energy use in a designated electricity system using a proprietary cryptocurrency can be formulated. The basic elements of this system can be assigned to two layers:-

Physical—related to the flow and recording of energy in a specific electricity grid; and

-

Digital—related to the flow and recording of values stored on cryptocurrency tokens in the blockchain network.

-

Market participants in a broad sense: grid operators, metering operators, settlement intermediaries, generators, energy sales intermediaries (independent sellers), service aggregators, energy cooperatives, energy clusters, virtual power plants, users, additional grid service providers (including prosumers and flexumers);

-

Power grid infrastructure and IoT technology devices, also smart grid, smart building, smart city;

-

Financial institutions, including entities that allow the conversion of cryptocurrency into another monetary unit (exchange offices); and

-

State authorities (fulfilment of tax or other obligations arising from current legislation governing the power sector).

3.3. Participants

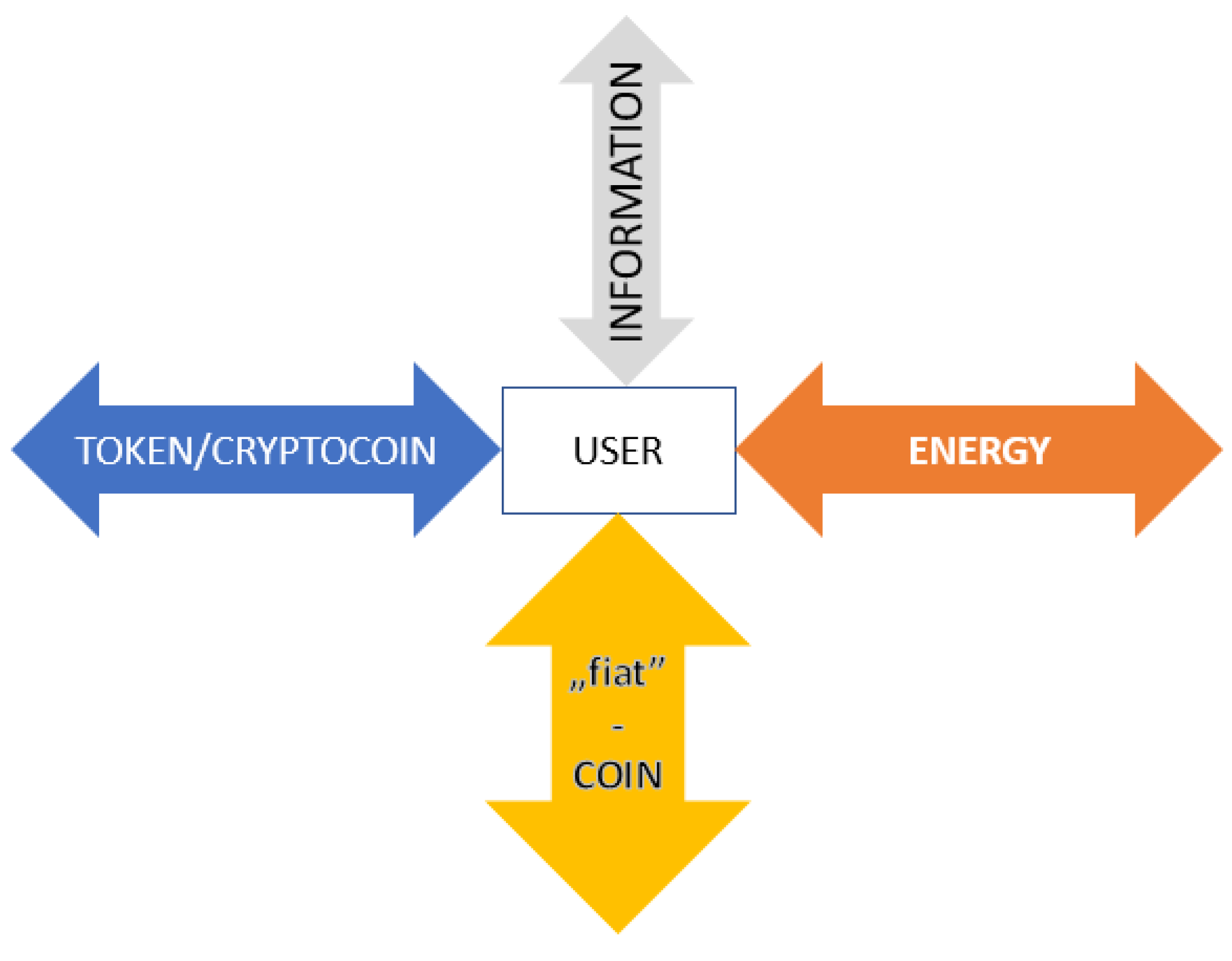

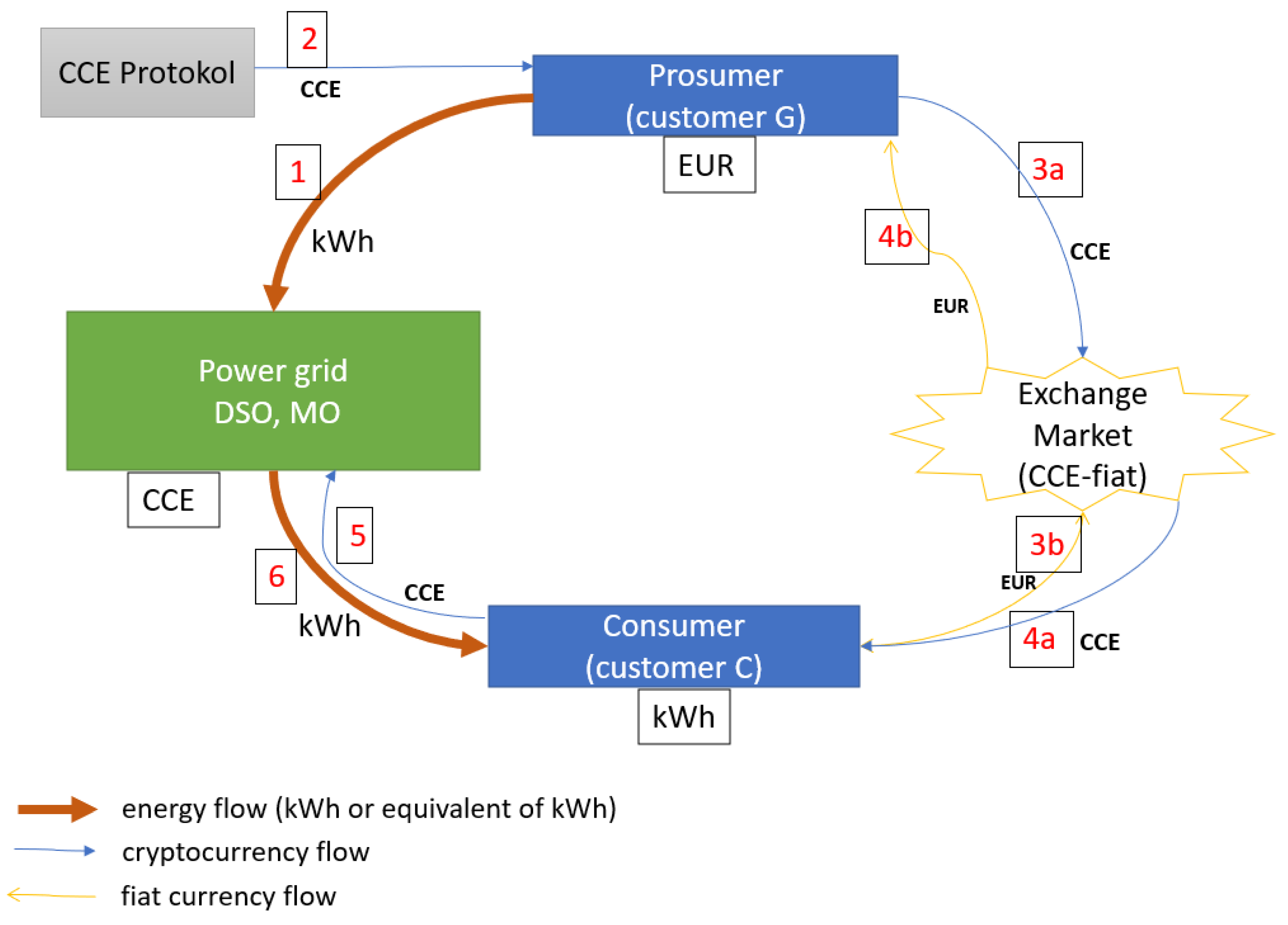

A participant in this conception can be presented as a node of a network to which four streams flow: electricity, fiat money and dedicated cryptocurrency, as well as measurement and control signals (information), while in general, these streams may come to the participant in both directions (depending on the role of the participant and the situation in the system—Figure 3).

- -

-

Customer group (entities)

-

-

Energy generators (G)—in addition to the typical generators, this group includes prosumers and flexumers ready to feed surplus electricity back into the grid, as well as facilities with the generation and storage (including, for example, electric vehicles).

-

Consumers (C)—typical (conservative) end-users, including prosumers who do not cover their entire demand themselves, including storage units used for arbitrage (stationary and mobile).

- -

-

Intermediaries

-

-

Distribution System Operator (DSO)—an entity that manages the technical operation of the power distribution grid, responsible in particular for infrastructure maintenance and grid operation.

-

Metering Operator (MO)—depending on legal requirements, a separate entity or one that is within the DSO structure, dealing with customer meter service issues and managing metering on the grid.

-

Platform for the exchange of cryptocurrency into other monetary units (exchange office)—a structure operating on a market basis allowing the exchange (purchase, sale) of cryptocurrency units into other currencies (including fiat currencies).

- -

-

Additional elements

-

-

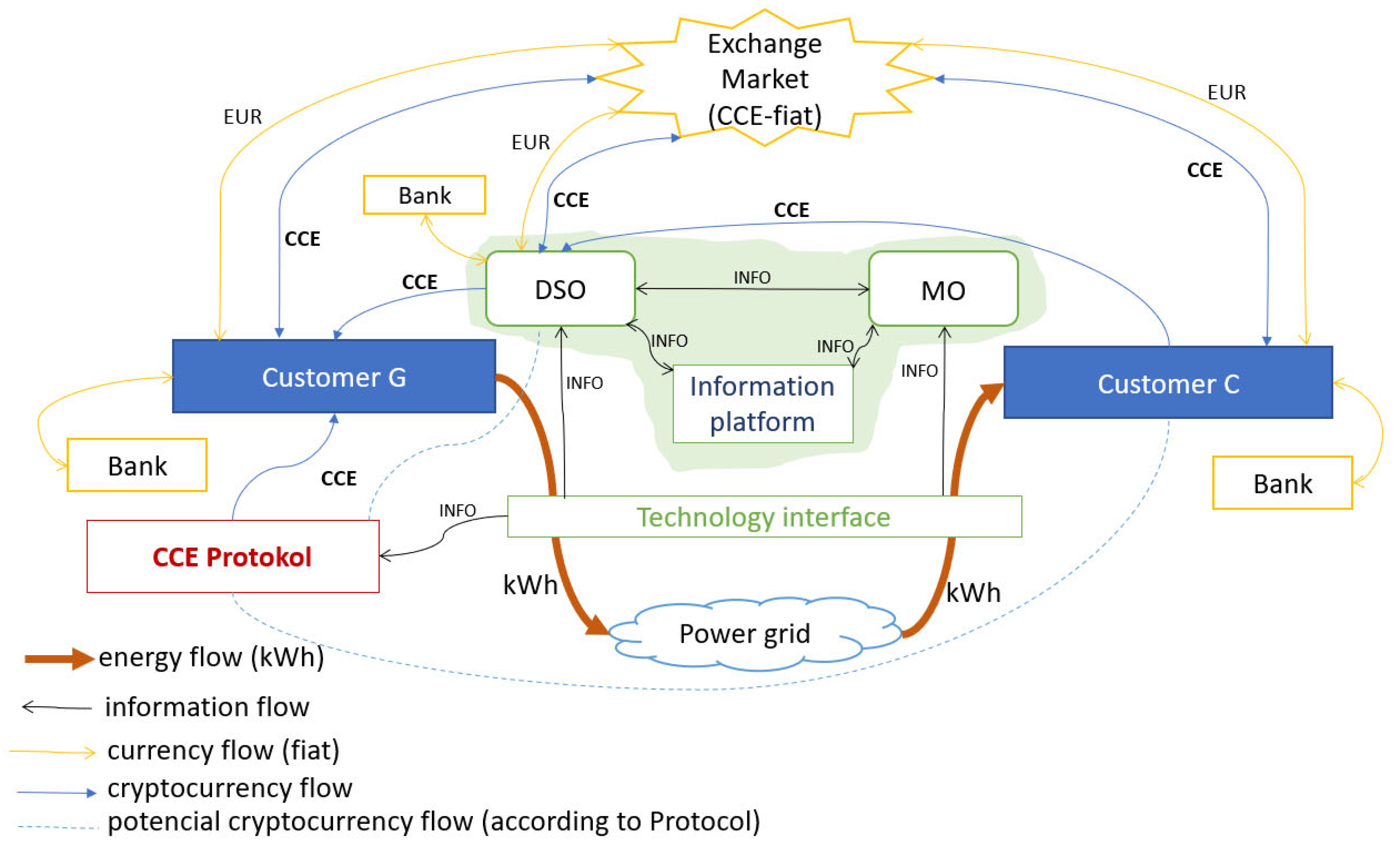

Cryptocurrency protocol—a set of rules and an algorithm for the generation (also possible redemption) of cryptocurrency units, and also the creation of records (blocks) according to the Distributed Ledger Technologies (DLT) blockchain.

-

Technological interface—providing connectivity between the physical layer (monitoring and recording of energy flows) and the digital informative layer (translation of energy use facts and events into the DLT settlement sphere, smart contract recording).

-

Flexible, i.e., able to adapt their energy use position (supply and off-take respectively) to a certain extent to the current situation (signals) on the power grid; and

- Information platform—an area for the exchange and collection of information on the state of the network and the power system, aggregating data on the current generation and energy demand in the grid area, taking into account the current constraints; a place used by the grid operator to form the demand for ancillary services to the grid.

-

The power grid as a medium for the transmission of energy between participants.

-

Rigid, i.e., enforcing certain states of grid operation due to the technology used—forced generation (RES units without direct cooperation with storage) and rigid off-take (e.g., critical loads).

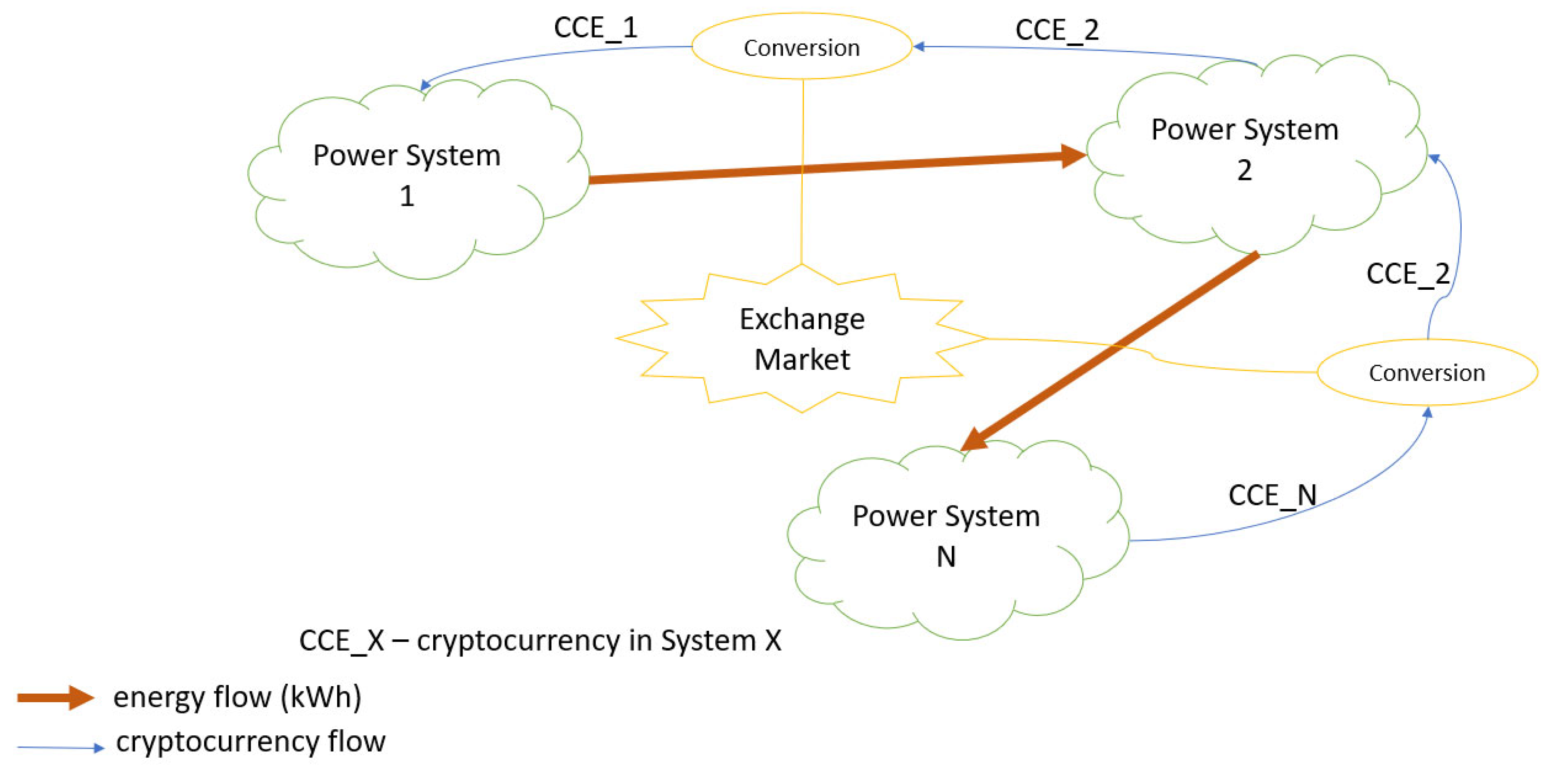

3.4. Outline of the General Concept of the CCE Cryptocurrency Settlement System

The researchers present a generalised concept, based on the idea of dedicated cryptocurrencies, for a settlement system for electricity use in the power grid. The concept developed is based on publications [16,70,71,72,74,100][16][61][70][72][73][75]. The schematic flow of signals, energy and value between potential participants and objects in the generalised version of the concept is depicted in Figure 4. The CCE and information flows are realised in the execution of the smart contract. CCE units can be accumulated by the participants (G and C energy users and the grid operator) in virtual accounts after smart contract execution. This information is stored in blockchain technology. CCE units can be exchanged for other values (fiat currency) via an exchange market (exchange office). Fiat currency, as a more universal store of value, can be held in an account at a bank. The CCE–fiat exchange market is a place of possible speculation, so appropriate mechanisms should be provided to safeguard CCE users. This issue is a separate research topic.The structure’s purpose is to dispatch the energy generated by the producer to the end-user on the grid via a kind of chain within the power system. In parallel, there is a reverse chain for the conversion of local cryptocurrencies (with any spreads covering the costs of subsequent contract stages). The flow of value of cryptocurrencies is thus opposite to the flow of energy along the path between the essential participants (generator and user). The identical direction is, of course, the case with traditional forms of settlement (fiat currency); however, there are other intermediaries in the path of the payment flow. Consumption of energy from the grid can be treated as an implementation of a smart contract in blockchain technology. A user searching for energy supply offers can use a mechanism to aggregate market information. In order to effectively integrate automatic search functions, the access point for such functionality should be the blockchain environment. The signing of a contract by the user takes place after market selection by calling the function of the selected contract. This call contains an attribute with the amount transferred from the orderer’s account to the contract account at the time of the call (i.e., not immediately to the producer’s or operator’s account). The funds deposited in the contract account are distributed between the participants in the contract, depending on the contract. Calling and transferring the monetary value are prerequisites for the performance of the contract. The parties to the contract can track and detect a change in its status. The system operator (or metering), in addition to the generator and user, should be a party to the contract, as it is responsible for the technical implementation of the delivery through the grid and should therefore have access to information about the transaction, retaining influence over its course. This operator can be considered as an intermediate link in the execution of the transaction. Each party is identified by its public address, which is its individual account number. It is, therefore, not possible to trigger anonymous activity [100][72]. The execution of the contract itself involves a chain of operations: matching–clearing–settlement–payment. In a smart contract, the individual phases of contract formation and exchange execution do not require the participation of a guarantor or the crediting of obligations and their subsequent enforcement, so there is no need for forward contacts. The smart contract code in the blockchain network defines the rules for the virtual coexistence of the commercial and technical layers. The role resulting from the capabilities of blockchain technology is to register an event and execute a programme in the virtual space of the contract (transaction). The settlement system in this model is primarily dedicated to isolated power systems capable of self-balancing with significant energy storage capacities and with a high proportion of prosumer installations, for which energy exchange with the grid would be a second-choice option (after self-consumption). Purchasing energy from the grid would practically have the characteristics of a spot market transaction through the CCE exchange market, organised on the principle of a CCE exchange (buying as close to the moment of demand as possible and selling at the moment of feeding energy into the grid, price depending on the current relationship between supply and demand, which brings the de facto settlement method closer to a time-varying pricing scheme [102][76]). Purchases analogous to the forward market in this model would be possible in the form of P2P transactions for CCE purchase options so that they would occur in the financial market, i.e., outside the structure of the relevant CCE-based settlement system for energy use. The initiation and progression of the basic settlement operation according to the presented concept would follow the following steps (Figure 5): Figure 4.General functional diagram of a CCE-based settlement system.

Figure 4.General functional diagram of a CCE-based settlement system. Figure 5.Flow chart of basic settlement operations in a CCE-based concept.

Figure 5.Flow chart of basic settlement operations in a CCE-based concept.-

Prosumer gives back to the grid the energy he/she has not consumed as a G generator (this is registered by the grid operator and/or metering operator, the technological interface initiates the start of the smart contract transaction).

-

Prosumer, as generator G, is allocated an appropriate number of CCE units according to the protocol (in the general warrant, there is the possibility to vary the rates of CCE units/kWh allocated depending on the generation technology, promoting specific RES solutions).

-

Prosumer, as generator G, puts the received CCE units up for sale on the CCE–fiat exchange market (in the form of a spot exchange or directly to another user in the form of a P2P); user C declares payment of a certain amount in the desired currency for the corresponding number of CCE units.

-

Prosumer G receives payment in the desired currency; user C receives the desired number of CCE units.

-

User C transfers the appropriate number of CCE units to the system operator.

-

The system operator enables the delivery of the appropriate amount of energy according to the amount paid in the CCE. The technological interface records the flow and allows the transaction to be closed.

-

-

-

-

-

-

References

- Schich, S. Do Fintech and Cryptocurrency Initiatives Make Banks Less Special? Bus. Econ. Res. Macrothink Inst. 2019, 9, 86–116.

- European Union. Proposal for a Regulation of the European Parliament and of the Council on Markets in Crypto-Assets, and Amending Directive (EU) 2019/1937 COM(2020) 593 Final—2020/0265 (COD). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52020AE4982&rid=1 (accessed on 2 September 2022).

- Gryshova, I.Y.; Shestakovska, T.L. FinTech Business and Prospects of Its Development in the Context of Legalizing the Cryptocurrency in Ukraine. Sci. Pap. Legis. Inst. Verkhovna Rada Ukr. 2018, 5, 77–78.

- Kopp, A.; Orlovskyi, D. Towards the Tokenization of Business Process Models Using the Blockchain Technology and Smart Contracts. CMIS 2022, 3137, 274–287.

- El Ioini, N.; Pahl, C. A Review of Distributed Ledger Technologies. In On the Move to Meaningful Internet Systems; Panetto, H., Debruyne, C., Proper, H., Ardagna, C., Roman, D., Meersman, R., Eds.; Springer: Berlin/Heidelberg, Germany, 2018; ISBN 9783030026714.

- Antal, C.; Cioara, T.; Anghel, I.; Antal, M.; Salomie, I. Distributed Ledger Technology Review and Decentralized Applications Development Guidelines. Future Internet 2021, 13, 62.

- Ahmad, T.; Zhang, D. A Critical Review of Comparative Global Historical Energy Consumption and Future Demand: The Story Told so Far. Energy Rep. 2020, 6, 1973–1991.

- Bielecki, S.; Skoczkowski, T.; Sobczak, L.; Buchoski, J.; Maciąg, Ł. Impact of the Lockdown during the COVID-19 Pandemic on Electricity Use by Residential Users. Energies 2021, 14, 980.

- Akorede, M.F.; Hizam, H.; Pouresmaeil, E. Distributed Energy Resources and Benefits to the Environment. Renew. Sustain. Energy Rev. 2010, 14, 724–734.

- Hatziargyriou, N.D.; Sakis Meliopoulos, A.P. Distributed Energy Sources: Technical Challenges. In Proceedings of the IEEE Power Engineering Society Winter Meeting, New York, NY, USA, 27–31 January 2002; pp. 1017–1022.

- Jee, Y.; Lee, E.; Baek, K.; Ko, W.; Kim, J. Data-Analytic Assessment for Flexumers Under Demand Diversification in a Power System. IEEE Access 2022, 10, 33313–33319.

- Pipattanasomporn, M.; Kuzlu, M.; Rahman, S. A Blockchain-Based Platform for Exchange of Solar Energy: Laboratory-Scale Implementation. In Proceedings of the 2018 International Conference and Utility Exhibition on Green Energy for Sustainable Development (ICUE), Phuket, Thailand, 24–26 October 2018; pp. 1–8.

- Olken, M. Transactive Energy. IEEE Power Energy Mag. 2016, 14, 4.

- Huang, Q.; Amin, W.; Umer, K.; Gooi, H.B.; Eddy, F.Y.S.; Afzal, M.; Shahzadi, M.; Khan, A.A.; Ahmad, S.A. A Review of Transactive Energy Systems: Concept and Implementation. Energy Rep. 2021, 7, 7804–7824.

- The GridWise Architecture. GridWise Transactive Energy Framework Version 1.0; Pacific Northwest National Laboratory: Richland, WA, USA, 2015.

- Mihaylov, M.; Jurado, S.; Avellana, N.; Van Moffaert, K.; de Abril, I.M.; Nowé, A.; Van Moffaert, K.; De Abril, I.M. NRGcoin: Virtual Currency for Trading of Renewable Energy in Smart Grids. In Proceedings of the 11th International Conference on the European Energy Market (EEM14), Krakow, Poland, 28–30 May 2014; pp. 1–6.

- Hosseinnezhad, V.; Hayes, B.; Member, S.; Regan, B.O. Practical Insights to Design a Blockchain-Based Energy Trading Platform. IEEE Access 2021, 9, 154827–154844.

- Joseph, A.; Balachandra, P. Smart Grid to Energy Internet: A Systematic Review of Transitioning Electricity Systems. IEEE Access 2020, 8, 215787–215805.

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; Mccallum, P.; Peacock, A. Blockchain Technology in the Energy Sector: A Systematic Review of Challenges and Opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174.

- Karaarslan, E.; Konacakli, E. Chapter 3: Data Storage in the Decentralized World: Blockchain and Derivatives. In Who Runs the World: DATA; Gulsecen, S., Sharma, S., Akadal, E., Eds.; Istanbul University Press: Istanbul, Turkiye, 2020; pp. 37–69.

- Bellaj, B.; Ouaddah, A.; Bertin, E.; Crespi, N.; Mezrioui, A.; Crespi, N. SOK: A Compre-Hensive Survey on Distributed Ledger Technologies. In Proceedings of the ICBC 2022: IEEE International Conference on Blockchain and Cryptocurrency, Shanghai, China, 2–5 May 2022; pp. 1–16.

- Hrga, A.; Capuder, T.; Zarko, I.P. Demystifying Distributed Ledger Technologies: Limits, Challenges, and Potentials in the Energy Sector. IEEE Access 2020, 8, 126149–126163.

- Rehman, S.; Khan, B.; Arif, J.; Ullah, Z.; Aljuhani, A.J.; Alhindi, A.; Ali, S.M. Bi-Directional Mutual Energy Trade between Smart Grid and Energy Districts Using Renewable Energy Credits. Sensors 2021, 21, 3088.

- Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC; European Union: Maastricht, The Netherlands, 2009.

- Castellanos, J.A.F.; Coll-Mayor, D.; Notholt, J.A. Cryptocurrency as Guarantees of Origin: Simulating a Green Certificate Market with the Ethereum Blockchain. In Proceedings of the 5th IEEE International Conference on Smart Energy Grid Engineering Cryptocurrency, Oshawa, ON, Canada, 14–17 August 2017.

- Li, H.; Xiao, F.; Yin, L.; Wu, F. Application of Blockchain Technology in Energy Trading: A Review. Front. Energy Res. 2021, 9, 671133.

- Miyamae, T.; Kozakura, F.; Nakamura, M.; Zhang, S.; Hua, S.; Pi, B.; Morinaga, M. ZGridBC: Zero-Knowledge Proof Based Scalable and Private Blockchain Platform for Smart Grid. In Proceedings of the IEEE International Conference on Blockchain and Cryptocurrency (ICBC), Sydney, Australia, 3–6 May 2021; pp. 2021–2023.

- Chen, R.; Zhao, W.; Bao, J.; Zhang, J.; Kuang, L.; Zhan, S. A Power Market Transaction Management System Based on Blockchain. In Proceedings of the IEEE 2nd International Conference on Power, Electronics and Computer Applications (ICPECA), Shenyang, China, 21–23 January 2022; pp. 1235–1239.

- Ren, Y.; Zhao, Q.; Guan, H.; Lin, Z. A Novel Authentication Scheme Based on Edge Computing for Blockchain-Based Distributed Energy Trading System. EURASIP J. Wirel. Commun. Netw. 2020, 2020, 152.

- Yahaya, A.S.; Javaid, N.; Member, S.; Gulfam, S.M.; Radwan, A.; Member, S. A Two-Stage Privacy Preservation and Secure Peer-to-Peer Energy Trading Model Using Blockchain and Cloud-Based Aggregator. IEEE Access 2021, 9, 143121–143137.

- Singla, S.; Dua, A.; Kumar, N.; Tanwar, S. Blockchain-Based Efficient Energy Trading Scheme for Smart-Grid Systems. In Proceedings of the IEEE Globecom Workshops (GC Wkshps), Taipei, Taiwan, 7–11 December 2020.

- Long, Y.; Chen, Y.; Ren, W.; Dou, H.; Xiong, N.N. DePET: A Decentralized Privacy-Preserving Energy Trading Scheme for Vehicular Energy Network via Blockchain and K—Anonymity. IEEE Access 2020, 8, 192587–192596.

- Karandikar, N.; Chakravorty, A.; Rong, C. Blockchain Based Transaction System with Fungible and Non-Fungible Tokens for a Community-Based Energy Infrastructure. Sensors 2021, 21, 3822.

- Wang, G.; Nixon, M. SoK: Tokenization on Blockchain. In Proceedings of the IEEE/ACM 14th International Conference on Utility and Cloud Computing (UCC ’21), Leicester, UK, 6–9 December 2021; pp. 1–9.

- Bao, H.; Roubaud, D. Non-Fungible Token: A Systematic Review and Research Agenda. J. Risk Financ. Manag. 2022, 15, 215.

- Sharma, P.; Senapati, R.; Swetapadma, A. Review of Blockchain-Based Energy Trading Models. In Proceedings of the IEEE International Conference in Advances in Power, Signal, and Information Technology (APSIT), Bhubaneswar, India, 8–10 October 2021.

- Foti, M.; Vavalis, M. What Blockchain Can Do for Power Grids? Blockchain Res. Appl. 2021, 2, 100008.

- Mollah, M.B.; Zhao, J.; Niyato, D.; Lam, K.; Member, S.; Zhang, X.; Ghias, A.M.Y.M. Blockchain for Future Smart Grid: A Comprehensive Survey. IEEE Internet Things J. 2021, 8, 18–43.

- Wang, X.; Yao, F.; Wen, F. Applications of Blockchain Technology in Modern Power Systems: A Brief Survey. Energies 2022, 15, 4516.

- Wu, J.; Tran, N.K. Application of Blockchain Technology in Sustainable Energy Systems: An Overview. Sustainability 2018, 10, 3067.

- Ahmed, M.; Farooq, M.S.; Ibrar-ul-Haque, M.; Ahmed, M.; Maqbool, H.; Yousaf, A. Application of Blockchain in Green Energy for Sustainable Future. In Proceedings of the 7th International Conference on Engineering and Emerging Technologies (ICEET), Istanbul, Turkey, 27–28 October 2021.

- Yapa, C.; Alwis, C.D.; Liyanage, M.; Ekanayake, J. Survey on Blockchain for Future Smart Grids: Technical Aspects, Applications, Integration Challenges and Future Research. Energy Rep. 2021, 7, 6530–6564.

- Wang, N.; Zhou, X.; Lu, X.; Guan, Z.; Wu, L.; Du, X. When Energy Trading Meets Blockchain in Electrical Power System: The State of the Art. Appl. Sci. 2019, 9, 1561.

- Jindal, A.; Aujla, G.S.; Kumar, N.; Villari, M. Blockchain-Based Secure Demand Response Management in Smart Grid System. IEEE Trans. Serv. Comput. 2019, 13, 613–624.

- Sciumè, G.; Palacios-García, E.J.; Gallo, P.; Sanseverino, E.R.; Vasquez, J.C.; Guerrero, J.M. Demand Response Service Certification and Customer Baseline Evaluation Using Blockchain Technology. IEEE Access 2020, 8, 139313–139331.

- Zhuang, P.; Zamir, T.; Liang, H. Blockchain for Cybersecurity in Smart Grid: A Comprehensive Survey. IEEE Trans. Ind. Inform. 2021, 17, 3–19.

- Aitzhan, N.Z.; Svetinovic, D. Security and Privacy in Decentralized Energy Trading through Multi-Signatures, Blockchain and Anonymous Messaging Streams. IEEE Trans. Dependable Secur. Comput. 2016, 15, 840–852.

- Szabo, N. Smart Contracts: Building Blocks for Digital Markets. EXTROPY J. Transhumanist Thought 1996, 18, 28.

- Kirli, D.; Couraud, B.; Robu, V.; Salgado-bravo, M.; Norbu, S.; Andoni, M.; Antonopoulos, I.; Negrete-pincetic, M.; Flynn, D. Smart Contracts in Energy Systems: A Systematic Review of Fundamental Approaches and Implementations. Renew. Sustain. Energy Rev. 2022, 158, 112013.

- Kemmoe, V.Y.; Stone, W.; Kim, J.; Kim, D.; Son, J. Recent Advances in Smart Contracts: A Technical Overview and State of the Art. IEEE Access 2020, 8, 117782–117801.

- Zheng, Z.; Xie, S.; Dai, H.; Chen, W.; Chen, X.; Weng, J.; Imran, M. An Overview on Smart Contracts: Challenges, Advances and Platforms. Futur. Gener. Comput. Syst. 2020, 105, 475–491.

- Vieira, G.; Zhang, J. Peer-to-Peer Energy Trading in a Microgrid Leveraged by Smart Contracts. Renew. Sustain. Energy Rev. 2021, 143, 110900.

- Abdelwahed, M.A.; Boghdady, T.A.; Madian, A.; Shalaby, R. Energy Trading Based on Smart Contract Blockchain Application. In Proceedings of the International Conference on Innovation and Intelligence for Informatics, Computing and Technologies (3ICT), Sakheer, Bahrain, 20–21 December 2020.

- Seven, S.; Yao, G.; Soran, A.; Onen, A.; Muyeen, S.M. Peer-to-Peer Energy Trading in Virtual Power PlantBased on Blockchain Smart Contracts. IEEE Access 2020, 8, 175713–175726.

- Pop, C.; Antal, M.; Cioara, T.; Anghel, I. Trading Energy as a Digital Asset: A Blockchain based Energy Market. In Cryptocurrencies and Blockchain Technology Applications; Shrivastava, G., Le, D.-N., Sharma, K., Eds.; Wiley: Hoboken, NJ, USA, 2020; ISBN 9781119621201.

- Kutler, J. Digicash to Test Live Internet Cash System with Mo.Bank. Am. Bank. 1995, 160, 1–3.

- de Vries, A. Bitcoin’s Energy Consumption Is Underestimated: A Market Dynamics Approach. Energy Res. Soc. Sci. 2020, 70, 101721.

- Sarkodie, S.A.; Owusu, P.A. Dataset on Bitcoin Carbon Footprint and Energy Consumption. Data Br. 2022, 42, 108252.

- Schinckus, C.; Nguyen, C.P.; Hui Ling, F.C. Crypto-Currencies Trading and Energy Consumption. Int. J. Energy Econ. Policy 2020, 10, 355–364.

- Milunovich, G. Assessing the Connectedness between Proof of Work and Proof of Stake/Other Digital Coins. Econ. Lett. 2022, 211, 110243.

- Gabrich, Y.B.; Coelho, I.M.; Coelho, V.N. Sharing Electricity in Brazil: A Crypto-Currency for Micro/Mini-Grid Transactive Energy. In Proceedings of the 6th IEEE International Energy Conference (ENERGYCON) Sharing, Gammarth, Tunisia, 28 September–1 October 2020; pp. 973–978.

- Ryan Collins, J.; Schuster, L.; Greenham, T. Energising Money. An Introduction to Energy Currencies and Accounting; Report commissioned by The 40 Foundation; New Economics Foundation: London, UK, 2013.

- Gogerty, N.; Zitoli, J. DeKo—Currency Proposal Using a Portfolio of Electricity Linked Assets. SSRN Electron. J. 2011, 7, 37–72.

- The Library of Congress Chronicling America. Available online: https://chroniclingamerica.loc.gov/lccn/sn83030214/1921-12-04/ed-1/seq-1/ (accessed on 30 December 2021).

- Hovorushko, T.; Sytnyk, I.; Rozvaga, L. Features of Money Origin and Its Evolution. Ukr. Food J. 2014, 3, 26–31.

- Gogerty, N.; Johnson, P. Network Capital Disclaimer: Value of Currency Protocols Bitcoin & Solar Coin Cases in Context; Columbia Business School Research Paper No. 19-2; SSRN: Amsterdam, The Netherlands, 2018.

- Skoczkowski, T.; Bielecki, S.; Kochański, M.; Korczak, K. Climate-Change Induced Uncertainties, Risks and Opportunities for the Coal-Based Region of Silesia: Stakeholders’ Perspectives. Environ. Innov. Soc. Transit. 2020, 35, 460–481.

- Skoczkowski, T.; Bielecki, S.; Węglarz, A.; Włodarczak, M.; Gutowski, P. Impact Assessment of Climate Policy on Poland’s Power Sector. Mitig. Adapt. Strateg. Glob. Chang. 2018, 23, 1303–1349.

- Skoczkowski, T.; Bielecki, S.; Wojtyńska, J. Long-Term Projection of Renewable Energy Technology Diffusion. Energies 2019, 12, 4261.

- Mihaylov, M.; Razo-Zapata, I.; Nowé, A. NRGcoin—A Blockchain-based Reward Mechanism for Both Production and Consumption of Renewable Energy. In Transforming Climate Finance and Green Investment with Blockchains; Elsevier: Amsterdam, The Netherlands, 2018; ISBN 978-0128144473.

- Enescu, F.M.; Bizon, N.; Onu, A.; Raboaca, M.S.; Thounthong, P.; Mazare, A.G.; Serban, G. Implementing Blockchain Technology in Irrigation Systems That Integrate Photovoltaic Energy Generation Systems. Sustainability 2020, 12, 1540.

- Kiluk, S. Klaster 3 × 20. Potencjalne Zastosowania Technologii Blockchain Na Rynku Energii Elektrycznej. (In Polish). 2019. Available online: http://klaster3x20.pl/cykl-raportow-bzep/ (accessed on 1 September 2022).

- Gabrich, Y.B. A Blockchain Application to Pave the Way for Transactive Energy at Brazilian Micro/Mini-Grids. Universidade do Estado do Rio de Janeiro: Rio de Janeiro, Brasil, 2019.

- Kubát, M. Virtual Currency Bitcoin in the Scope of Money Definition and Store of Value. Procedia Econ. Financ. 2015, 30, 409–416.

- SolarCoin.org. SolarCoin. A Blockchain-Based Solar Energy Incentive. 2015. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwjTw-7z0Kr6AhUihv0HHSzFAK0QFnoECAcQAQ&url=http%3A%2F%2Fwww.smallake.kr%2Fwp-content%2Fuploads%2F2018%2F06%2FSolarCoin_Policy_Paper_FINAL.pdf&usg=AOvVaw0SgKj1Pi65V0gk4vwFEK3B (accessed on 18 August 2022).

- Ruan, J.; Liu, G.; Qiu, J.; Liang, G.; Zhao, J.; He, B.; Wen, F. Time-Varying Price Elasticity of Demand Estimation for Demand-Side Smart Dynamic Pricing. Appl. Energy 2022, 322, 119520.

- Net Metering vs. Net Billing. Midwest Electric Local Pages; 20F-20G; Ohio Cooperative Living: St. Marys, OH, USA, February 2021.

- Trela, M.; Dubel, A. Perspective—Impacts of Changes in RES Financing in Poland on the Profitability of a Joint Photovoltaic Panels and Heat Pump System. Energies 2022, 15, 227.